-

Posts

15,105 -

Joined

-

Last visited

-

Days Won

38

Content Type

Profiles

Forums

Events

Everything posted by Spekulatius

-

Ok, you changed the explanation, but not the outcome. People on Ozempic want a healthier lifestyle and either because of inflation or less cravings that lets them to eat less which lets them to buy less food. Same outcome. This looks a shift in consumer behavior that is likely to be long lasting and will continue to accelerate, imo.

-

Same here in my area, supply and demand determines prices, but I think those are more short term. LT, it's affordability. For example, when prices start to fall, buyers immediately get more cautious and pull back. There is a lot of reflexivity in buyers and sellers behavior.

-

I don't think you are correct. WMT has CC data from both food and drug purchases (from their pharmacy) and can compare nonGPT-1 users with GPT-1 users. 2% is a huge dataset in terms of statistical sampling if you are as large as WMT. Also- think first order principles. We know that GPT-1 users eat less and drink less soda etc, that's why they are losing weight after all. Whey shouldn't they buy less? It makes perfect sense. Maybe some users will trade up to more expensive food. I think there is an opportunity here for premiumization.

-

I am curious why the WSJ think that only commercial RE will be affected. We all know that the higher interest rates has removed sellers from the market because they have low cost mortgages but that's not a lasting effect. At some point, residential RE will have to come down with higher mortgages because the key metric affordability is a multi decade low. There simply won't be buyers at current prices and with current mortgage rates.

-

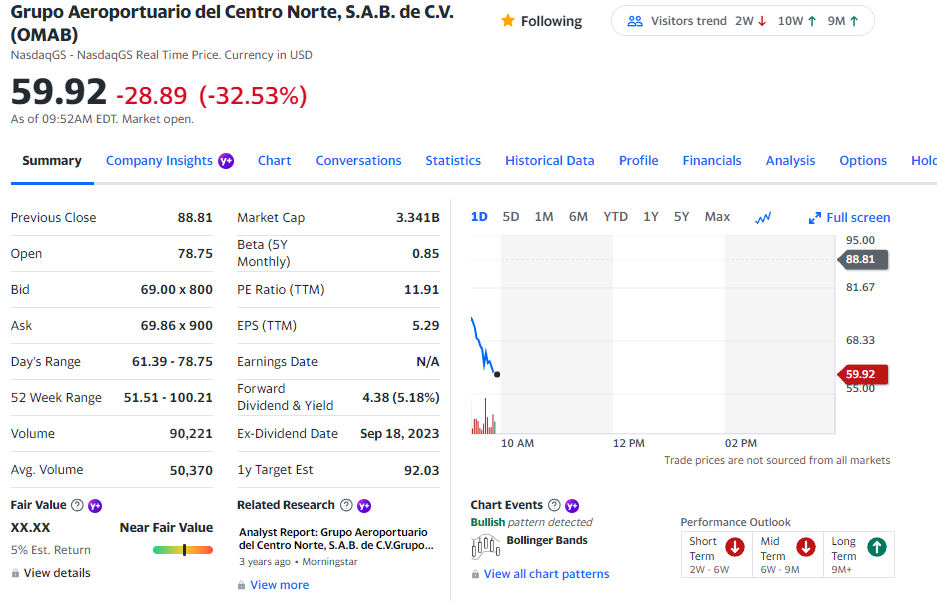

OMAB bounced of ~30% from the lows (~$50). Daytrading bonanza. FWIW, the fees that these airport charge should make mexican drug cartels jealous.

-

If these drugs work as well as expected, I am taking the over on 7%. For once, some of the second Gen GPT-1 should be generic by 2035 (Ozempic should go generic by 2032), which means they become much cheaper and that should open the floodgates to widespread use.

-

I do think that what @SharperDingaan wrote is well prosed non-sense. The bodies of overweight and people with diabetes are piling up right now. it looks like the GPT-1 is a drug that fight both an the synergistic benefits from reducing both are huge for health going from better cardio health, less hospitalization, less cancer, higher labor participation and probably many other things. Munger call this a Lollapalooza. Truly gamechanger if these benefits work for a long time. It’s quite a stretch to think that people will overdose until it becomes toxic or they starve themselves to death. I am sure some idiots will do it , but that does not mean that millions can’t benefit from them using them responsibly.

-

MLAB does look interesting on a quick look. They do seem to grow massively with acquisitions and have put some debt on. I will have a closer look. Thanks for sharing. One I like is $CRL which has the largest market share in contract pre-clinical and safety research for Pharma. They are sort of the shovel makers for Biotech and Pharma. Even big Pharma who used to do this internally, more and more outsources this part of their work. Aran up with COVID he the bio funding boom , but the business is quite resilient and valuation is back to earth. I have been buying some shares as a LT hold. Trades at less than 19x earnings, but there is some leverage as well.

-

@Castanza I am not stating what I think should happen, but what I think will happen. By 2035, you probably won’t be able to buy an ICE car any more in Europe or the US. You can tell by the tech roadmaps of the automobile companies which for the most part have stopped development of ICE car engines for example (except minor tweaks). Europe pretty much enacted legislation to this goal as well. It’s not going to take 50 years until ICE engines are phased out for sure.

-

I like Hybrids too, but you are looking only at a ~20% improvement in fuel efficiency with current models compared to ICE. I guess emissions scale with fuel efficiency (Co2 for sure). Compare for example the Honda CRV - ICE 28/34 MPG Honda CRV hybrid 43/36 MPG. Pretty good improvement for City driving but very little for HWY driving.

-

GS in free fall? If anything they have been outperforming the other banks, imo. I am much more concerned about other commercial banks and even BAC. Also I think if the interest rates and 7%+ mortgages are here to stay, real estate will crack (both residential as well as commercial).

-

"Changing World Order" becomes much easier to understand if you just assume that he is talking his book. I have "Principles" as a PDF somewhere and it's confusing and badly written. I never got past 20 pages.

-

Mexican airports blowing up on tariff changes apparently: FWIW - those Mexican airports are concessions so the assets are leased technically, not fully owned. I am not be correct as i recall from memory. They also charge very high fees comparatively speaking. Another compounder stock that became a confounder.

-

Yes, I am sure the EV's dominate sales 10 years from now. The world wide vehicle market goes in this direction (China, Europe, US). I really don't think this is in question. The developing world may take a little longer. Trucks may take a little longer as well, especially commercial trucks. It will start with the last mile / LTL and then move to long distance.

-

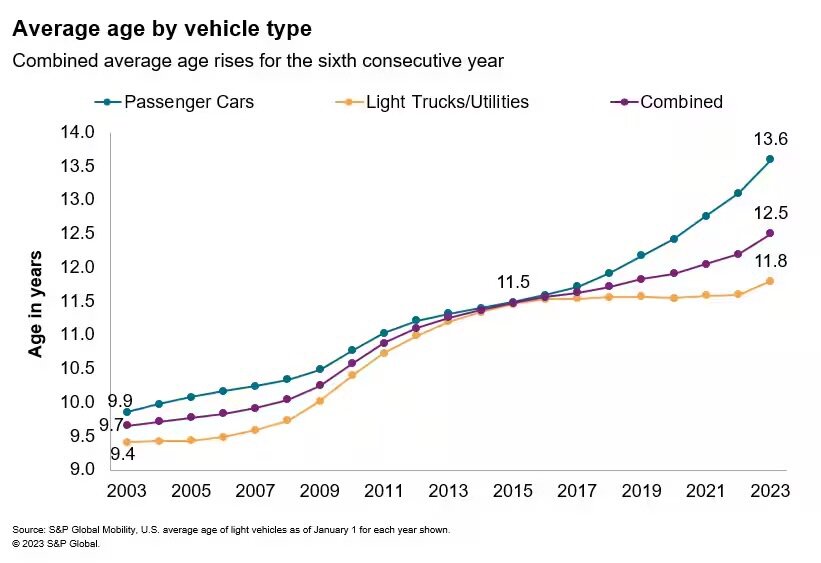

Isn’t that exactly what is happening ? The lifespan of cars keeps increasing as people keep them longer on the road -it’s now at 12.5 years. It has nothing to do with ESG either, just the fact that they last longer because they are build better: I actually think that EV’s may not last as long and will get scrapped quicker. For once there could be battery lifetime issues and then the tech changes quicker and repairs of older EV’s will be harder so a 10 year old EV may be more difficult to keep on the road. To your point, nobody proposes to keep ICE of the road, but at some point, we will have to start building new ones.

-

Risk premiums blowing out is something I would be concerned about. The bond risk premiums are right now fairly small. These moves in risk premium can dwarf any moves in underlying risk free rates. Then add to this the poor liquidity in the more junky paper that Howard Marks is talking about. The poor liquidity can exasperate the move in junk bonds preferred and the like. So I think the highly liquid treasures are probably the best buy right now.

-

Looks like the overdue correction in the energy markets is here. I don't think crude can really hold north of $90/brl for long periods of time. For example -petrochemicals have been very weak and that is one area that has quite a bit demand elasticity. The Saudi's have been creating a tight supply and high spot prices, but the future curve is a different story and predicts $70/brl a few years out. I have no idea who is correct here, but the shares of energy companies trade more based on longer term future prices than spot ( as they should). I own PBR-A and bit of SU and keep what I have, since they are great dividend payers.

-

India's press has become increasingly an extension of the government - Modi plays them like a fiddle. You can easily check this out watching WION etc on youtube. Lot's of disinformation going on with foreign politics topics.

-

What are you listening to ? (Music thread)

Spekulatius replied to Spekulatius's topic in General Discussion

Almost forgot how much fun Iggy Pop's "Lust of Live" record is. Punk rock never sounded as fun as it did on this record again: -

Could be fun for current home buyers to get trapped into a 7.5% + mortgage that they can't refinance because the equity melts away.

-

Well , it's clear that those people on GLP-1 drug lose weight because they are eating less (mostly). It does not seam that the weight loss is caused metabolic changes primarily. So the question is what will people on GLP-1 drugs be eating less? My guess fast food, snacks, candy and soda might be on the top of the list. Then add to this that those stocks (HSY, PEP etc) are very very expensive historically - seems to me that the risk reward is not great for those stocks, even if the GLP-1 threat is overhyped.

-

You can get equity like returns in credit taking equity like risk.

-

Sure he is, but he is hardly the norm. He certainly does more than 10k steps and eating 3 meals with two of them being junk food. Eating less than 2000 calories works too, but you would be surprised how little that is. For sure, you can forget any restaurant food or takeout. A pint of beer is about 200 calories. I think the average American eats more than 3200 calories daily.

-

Get back to us once you are over 50 and let us know how this works for you, especially with 2/3 meals being junk food.

-

YEN-USD is at a multi year low. The yen has absolutely gotten clobbered.