-

Posts

2,636 -

Joined

-

Days Won

15

Content Type

Profiles

Forums

Events

Everything posted by UK

-

Yes, I generally agree with that and (except for some adventures with china tech) has been waiting for that from like 2020 summer, and still at this point my exposure is mainly BRK, but I also think that some of those long duration stocks have already come down a good part of way, and also, that you should look further than 3-6-9 month in terms what could happen with economy/inflation/rates. These business (not only FANGs, but long duration-quality in general) not so long ago were valued at 30-35 PE. They generally are well diversified globally (no need to worry about currencies so much), have strong pricing power and low capital requirements, so are inflation proof business wise (like Sees candy from WB letters on infliation), also usually are debt free or net cash and recession resilient. The only problem from perhaps until now was valuation but this problem is getting fixed as we speak. A lot of them come from 30+ PE to <20, some even to 10+. No need to look at questionable former darlings with questionable business models. And I agree It could be still premature, but if I can easily see >10 return from such businesses long term, I think they are starting to be attractive, at least for me. 15 percent would be even better. but generally I think we are not there yet. Also re inflation, I really like to discus about it but do not like to have strong opinion on it. Because like just 3 years ago everyone was afraid of high debts, automation, robots taking jobs from people (where are those robots now?) and permanent disinflation. Now everyone are talking about labor shortages and sees permanent high inflation, deglobalization etc. Meanwhile Japan still lives happily in a 0 rates world. So who knows for sure how future or even Autumn 2023 will look like? If after 12 month from now we are back at no growth and disinflation, growth will come back in favor. As for Google, sure it could have temporary problems, but big picture, Google and Meta are still global online advertising duopoly, there are few real alternatives at this point from advertisers point of view, sure they are big at this point so recession could be more pronounce for them, than in 2009, but economy will come back at some point (*at least if nukes will not start to fly) and than it is like tollbooth on global growth. Not to mention still fast growing Cloud, AI and other bets in case of Google. Also this digitization, which was turbocharged during pandemic, I think it is far from over, Microsoft talks about just getting started, cloud based businesses seems still supporting this claim. Than again if one is afraid of technology changes, companies like UMG or LVHM or similar story maybe less growth but more visibility. How much cheaper then 18 PE you expect them to become? 15x so another -10 percent from there? I remember KO trading at some 12x F PE in 2009 spring, but not sure if probability of such scenario is high? UK

-

Yes, although I did not realized that until it was a reference to Berkshire:)

-

Well: a. google is still growing 10+ percent after last years covid boom of like 40+ percent (and cloud is growing almost 40 per cent). b. what multiple you would give to a capex lite, global business growing at 10 per cent? c. even if economy will slow drastically, how much value of a business one or two subpar (not even loss making in googl case) years constitutes? Of course it could get even cheaper and perhaps assumptions about business perspectives are even more important, but it is like first time from the years you mentioned (except for a brief period in 2020), when some of these really wonderful businesses (not only Google) are finally getting reasonably priced?

-

Googles 3q cc sales +11 on +39 last year. Wouldnt called it terrible:)

-

https://www.wsj.com/articles/bullish-energy-stocks-esg-strive-asset-inflation-oil-gas-drilling-opec-technology-interest-rates-risk-underinvestment-warren-buffett-11666611839?mod=hp_opin_pos_6

-

https://www.bloomberg.com/features/2022-the-crypto-story/?srnd=premium&leadSource=uverify wall

-

Not good: https://www.bloomberg.com/news/articles/2022-10-23/xi-stacks-china-leadership-body-with-allies-cementing-control?leadSource=uverify wall President Xi Jinping stacked China’s most powerful body with his allies, giving him unfettered control over the world’s second-largest economy. Xi, 69, put six close associates with him on the Politburo Standing Committee, including former Shanghai chief Li Qiang, who appears set to become the next premier after Li Keqiang retires. The move effectively puts all of Xi’s men in key positions responsible for running the government, tearing down divisions between party and state instituted following Mao Zedong’s chaotic rule that ended with his death in 1976. The new lineup signals a greater emphasis on ideology over pragmatism in policy making for China, which now has fewer voices at the top to question Xi’s policies of Covid Zero, tighter control over the private sector and a more assertive foreign policy. In opening the party congress last week, a defiant Xi offered China up as an alternative to the US and it allies while calling for self-sufficiency in advanced technology.

-

This is interesting view: https://www.wsj.com/articles/the-u-k-market-meltdown-prime-minister-uk-borrowing-tax-cuts-energy-subsidies-truss-resign-kwarteng-boe-11666273710?mod=hp_opin_pos_4 Economic growth, which brings with it higher interest rates, might now be viewed by many in the market as a bug rather than a feature. It’s terrible news if so. Britain has shown over the past month that it cowers in the shadow of a financial system that can no longer tolerate productive economic growth or the policies necessary to achieve it. Will other countries find the same to be true for them?

-

https://www.bloomberg.com/news/articles/2022-10-20/treasury-yields-may-peak-before-end-of-the-year-gundlach-says

-

Yes, I do not have a strong view, but I agree with you om this. More importantly Buffett seems also on this side:). And these transitions are long and costly trends, so perhaps what happens to world economy or even China (if something happens) is much more important than that in the near/mid term. However if demand would collapsed in the short term due to one or another reason (I am not predicting it), do not be surprised those peak demand theories getting attention again:)

-

That is awesome post. I have seriously invested in bonds only once in my life, that is during GFC and Euro crisis, when you were able to get like >10 per cent yield from government bods shorter than 10 years duration. And since I try to look at least for 8-10 return in stocks, the same applies to bonds in my view. Only I still prefer shares, because i.e. if bonds is at 5 and shares of a good company at 20 PE, I much prefer the later, because it also includes growth and safety of not loosing complete/majority of purchasing power, in case inflation and currency would go Turkish style. I was not investing at the time, but was old enough to experience two currencies going to the toilet paper in my country:). I ques that shapes attitudes somehow:). But that framework of yours on looking at the 6 per cent of long term bond is very informative and a thing to think about!

-

I have no strong opinion on that myself, but in my investing lifetime there were probably allready two peak oil times and then two peak demand times. Perhaps reallity is somewhere in between. https://www.bloomberg.com/graphics/2022-clean-energy-electric-cars-tipping-points/?leadSource=uverify wall

-

I agree re index composition, more or less similar situation everywhere vs SNP500. RE UK: they have their currency, borders, language, top universites, positive demography via controlled skilled imigration (if they want) etc. I would not loose my sleep owning assets in UK in the long term and if I was forced to invest only in assets in Europe, UK definately would be on the top of the list.

-

https://www.yahoo.com/now/billionaire-investor-bill-ackman-joins-175616088.html

-

Despite all these missteps, I think UK is the closest thing to US, here in EU, and it will be fine in the long term or at least relatively will do better than rest of the Europe.

-

When phrases like "untouchable" and "valuation does not matter" are used (and they are not about Russia or even China or simillar country) I am pretty sure they are speaking so under srong influence of the recent price action:)

-

Not about small caps, but seems interesting: https://www.wsj.com/articles/u-k-markets-are-on-sale-nobody-wants-to-buy-11665996328 “It’s an untouchable market right now,” said Viraj Patel, a London-based global macro strategist at Vanda Research. “You could easily make a case where things get progressively worse from here.” “Those elements are completely incompatible,” Ms. Ielpo said, noting that while U.K. stocks trade at a large discount, he views few opportunities. “We don’t think valuations are a relevant indication” for U.K. equities.

-

Quite good writeup: https://seekingalpha.com/article/4546944-fairfax-financial-unfairly-punished-by-investors-significantly-undervalued?mailingid=29398128&messageid=2800&serial=293

-

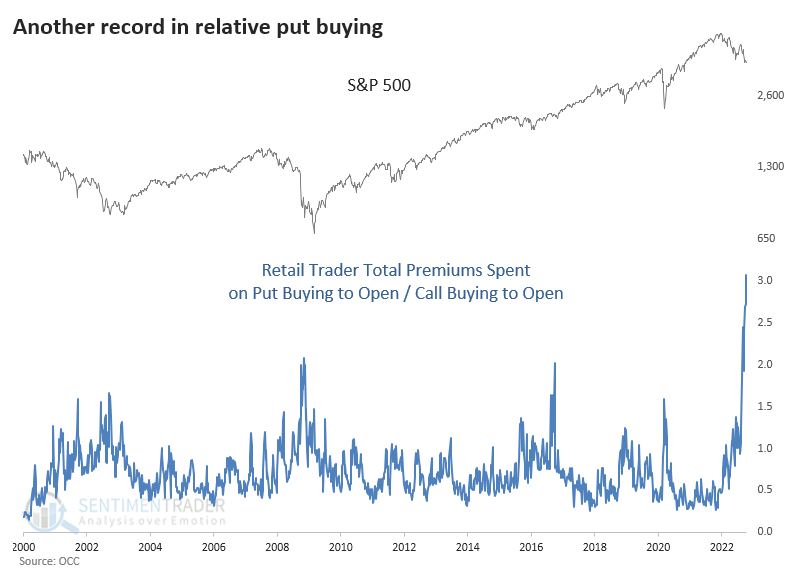

Another one on sentiment: https://www.bloomberg.com/news/articles/2022-10-17/small-time-options-traders-bet-big-on-us-stocks-falling-further?leadSource=uverify wall

-

Thanks. Yes, unfortunatelly I mostly agree with your sombre view. Probably just wishfull thinking on my part.

-

-

https://www.wsj.com/articles/whiplash-in-stock-market-shows-investors-are-still-on-edge-11665871144?mod=hp_lead_pos3

-

https://www.bloomberg.com/news/articles/2022-10-15/uk-fiscal-mess-becomes-butt-of-jokes-during-week-of-imf-meetings?srnd=premium-europe One joke circulating on Twitter went: “Apparently Kwarteng had to fly home first class, as no-one wanted him near business or economy.”