-

Posts

2,634 -

Joined

-

Days Won

15

Content Type

Profiles

Forums

Events

Everything posted by UK

-

Movies and TV shows (general recommendation thread)

UK replied to Liberty's topic in General Discussion

https://www.imdb.com/title/tt3553976/ Funny, serious, especially for those who have kids:) -

It was shamelessly copied (and tweaked a litttle bit) from: https://www.drwealth.com/invest-in-these-3-companies-and-you-pretty-much-own-the-world/

-

RE sentiment: https://www.wsj.com/articles/alibabas-u-s-shares-fall-to-lowest-since-2019-as-china-cracks-down-11629240410 Another factor pressuring U.S.-listed Chinese businesses is Afghanistan, said George Ball, chairman at the investment firm Sanders Morris Harris. He said traders worry that China’s potential growing influence might empower the Chinese government to enact even more stringent regulations. “The American inability to deal with the threats in Afghanistan is making traders think that China is going to be all the more stronger,” Mr. Ball said.

-

-

This is THE MOST DANGEROUS time regarding covid

UK replied to muscleman's topic in General Discussion

https://www.bloomberg.com/news/articles/2021-08-13/improving-covid-data-boosts-u-k-s-johnson-after-economy-reopens Coronavirus data suggest the U.K. is slowly emerging from the latest wave of the pandemic, even after the government pushed ahead with an almost full reopening of the economy last month. Virus reproduction numbers published on Friday indicate Covid-19 is in retreat in five of England’s seven regions and in the nation as a whole, while the national statistician’s weekly survey showed infection rates broadly stable in England, Wales and Northern Ireland and declining in Scotland. -

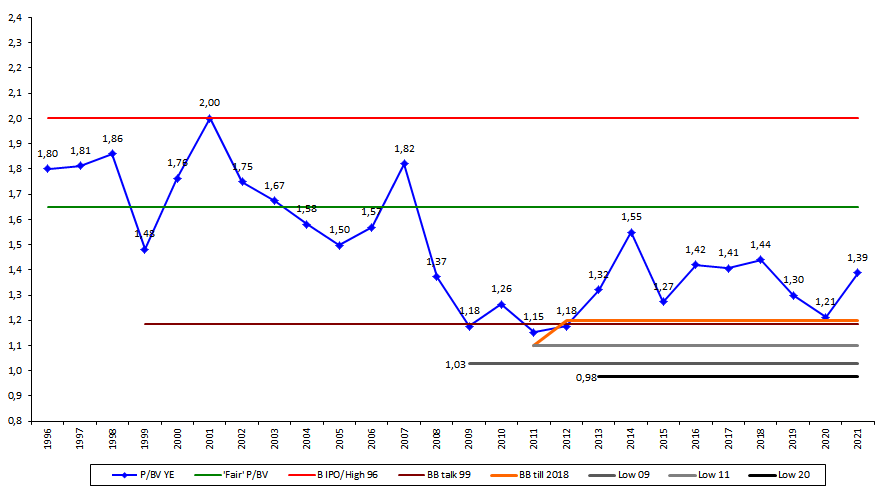

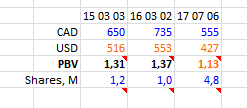

Yes, sure, BV era is ending:) and I look at BRK more via "normalised earnings" (which you can conveniently borrow and adjust as you like from say Semper Augustus) and PE, however I am to lazy yet to calculate normalised profit back to 1996:). If anybody knows, maybe such data is already available (kind of look through earnings or similar)? Because also it would be nice and possible to compare BRK to SNP in such way.

-

Movies and TV shows (general recommendation thread)

UK replied to Liberty's topic in General Discussion

I think this one can be recommended in advance:) -

Since from this years AGM it is official, I recently reread this article from 2019: https://www.theglobeandmail.com/business/article-the-oracle-of-edmonton-is-greg-abel-the-next-warren-buffett/ Nobody will change Warren Buffett, but new management could have its own strengths, from more hands on operational matters, to more freer hands on divestment, or, maybe even (why not to dream a little) to going semi hostile/activist in acquisitions/larger holdings. Abel's approach and Ted/Todd's involvement with companies they invest, participating in hot tech IPO's when that makes sense, indicates that this is a possibility and why not?

-

Returns also depend on starting and ending valuation (and finaly normal BB are very encouraging for the latter), but I remember him saying, that for 10 percent IV growth they would need "somewhat more normal rate environment". Also I think, that if recesion, or more importantly, some kind of market disllocation (but esspecially due to higher rates) comes in the next 5 or 10 years, BRK would be worth more at the end, then without any turbulences. Conservatively, from current valuation, I do not expect BRK to return more than 8-10 if rates and capital deployment oportunities stays as it is, but as WB said in last interview "sometimes conditions changes very very quickly in the market". So BRK even after recent run up stays quite atractive and defensive, given alternatives. Looking longer term I am almost starting to treat it as a place, instead of cash (or above certain max level of cash), to put capital if I dont have better ideas (depending on valuation ofcourse:)).

-

Last month looks interesting. brk bb.pdf

-

Movies and TV shows (general recommendation thread)

UK replied to Liberty's topic in General Discussion

Only recently I watched this one: https://www.imdb.com/title/tt6266538/ It was really entertaining and funny:) -

...has been described as "impenetrably ambiguous: either the answer is so obvious it is right in your face, or the answer is as intangible as the wind"

-

Not an investment idea, but interesting: https://asia.nikkei.com/Business/Markets/China-Telecom-raises-8.4bn-in-Shanghai-months-after-US-delisting State-run China Telecom is set to raise 54.2 billion yuan ($8.4 billion) in its maiden share sale in Shanghai, mere months after being forced to delist from the New York Stock Exchange. The offering by one of China's three state telecom groups will be the mainland's largest listing in a decade. China Telecom in a filing on Friday said it will issue up to 11.96 billion shares at 4.53 yuan apiece. The company's Hong Kong-listed shares ended the morning session 0.3% lower at 2.92 Hong Kong dollars (38 U.S. cents), trimming gains for the year to 40%. The offer price in Shanghai represents close to a 90% premium over the current trading price in Hong Kong. "The issue price was determined based on several factors including the fundamentals of the issuer, valuation of comparable companies [and] market conditions," the company said in the statement. Edison Lee, a telecom analyst at Jefferies, said on Friday following the IPO pricing that China Telecom remains to be "one of our top picks." "We believe China's industrial digitization in the next five years will be first led by state-run enterprises, and the Chinese telcos in general are strongly positioned to leverage that growth," he wrote in a note to clients. He sets his target price for Hong Kong-listed shares at HK$5.12, 75% higher than current levels.

-

Re delisting: I donnt know if it is high, maybe I am making a mistake here, but I donnt see delisting worries as material, at least comparing to other issues:). And if it is real, then why US listed Chineese company cannot list in HK, like Alibaba did? You are right, I didnot consider this, because I was talking from a different tax regime point of view:), but if you etf will perform better and after switching you have to pay some more taxes is it a big problem if in the end you still are left with larger profit?

-

I have no issues with going just with Alibaba and Tencent, especially for the long term, however, sometimes and when market dislocation is strong, it just makes sense to go for lower quality. Somebody very accurately has pointed in different topic, that simplest way to go in spring of 2020 (or 2009), was just by buing some small cap or small cap leveraged etf for US and not blue chip stuff. And perhaps later you can switch back. I am not sure this situation is the same, but simply by looking at price you can see, that KWEB is off more. Edutech is presumably toast but prices of those companies are like -90. I wouldnt touch any of them in meaningful way, but as a small diversified basket now comprising only few percent of that ETF, I donnt know. Also there are conflicting ideas who would benefit more (or better to say lose less?) from more regulations, presumably smaller companies would win, thought i am not sure.

-

https://www.bloomberg.com/news/videos/2021-08-05/kraneshares-cio-on-alibaba-tech-shares-video

-

If i am correct 2017 was done at about 1.1 BV. So, even if everything goes right, what is realistic upside/ceiling? Some 1.3?

-

"The chief losses to investors come from the purchase of low quality securities at times of favorable business conditions" This is a question I am asking re FFH, because at this stage of the cycle/markets, if something goes wrong a. lot of their investmens would suffer and b. they would not be able to take big advantage of that or do meaningfull buybacks. So you have to hope for things not to go wrong with FFH Vs it would be opportunity for say BRK (but yes, somewhat different valuation allready).

-

Market Disconnect is One of the Craziest I've Seen in 23 Years!

UK replied to Parsad's topic in Fairfax Financial

-

https://www.wsj.com/articles/biden-to-target-railroads-ocean-shipping-in-executive-order-11625736601?mod=hp_lead_pos12 In the case of the seven Class 1 freight railroads, consolidation has given railroads monopoly power over sections of the country where theirs are the only freight tracks, the person said. The executive order will encourage the STB to take up a longstanding proposed rule on so-called reciprocal or competitive switching, the practice whereby shippers served by a single railroad can request bids from a nearby competing railroad if service is available. The competitor railroad would pay access fees to the monopoly railroad, but could win the shipper’s business by offering a lower price, using the rival railroad’s tracks and property. The STB proposed a competitive switching rule in 2016 but hasn’t yet acted on it. “The consolidation brought about much-needed rationalization in the system 25 years ago, but the net result is a lot of shippers who are subject to a market-dominant railroad,” said a government official briefed on the White House’s proposal for the STB. But a move to mandate switching would guarantee a battle with the freights and the railroad trade association, the Association of American Railroads, which has long opposed the policy. “Competition remains fierce across freight providers, and any proposal mandating forced switching would put railroads—an environmentally friendly option that invests $25 billion annually in infrastructure—at an untold disadvantage,” Ian Jefferies, chief executive of the railroad association, said Thursday. “Such a rule would roll back the foundational market-driven principle that keeps the industry viable, reduce network fluidity, and ultimately undermine railroads’ ability to serve customers at a time when freight demands have dramatically increased.” In the rail industry, a wave of combinations in the 1990s left the U.S. with just seven Class 1 freight railroads. STB merger rules in place since the administration of President George W. Bush have effectively prevented further consolidation. Still, the White House argues that the current state of the industry leaves railroads with effective duopolies in much of the country, and monopolies at the local level, meaning customers have little leverage to negotiate prices. The White House will also encourage the STB to consider proposals that would compel railroads to offer rates that would better enable shippers to cobble together routes across competing rail networks to lower their costs, and to more readily bring cases to the STB to challenge railroads’ rates, this person said.

-

20210629 CNBC interview with Warren & Charlie?

UK replied to kiwing100's topic in Berkshire Hathaway

https://www.tunnelbear.com/ ? -

https://www.wsj.com/articles/what-it-would-take-for-herd-immunity-to-stop-the-coronavirus-pandemic-11600594201 "Reflecting these real-world effects in disease models can shift the estimated herd immunity boundary. One group of researchers estimated that threshold for Covid-19 could be as low as 10% to 20%, though many epidemiologists say that is unlikely. Other modelers have estimated it at around 40% to 50%. Christopher Murray, director of the Institute for Health Metrics and Evaluation at the University of Washington, said his group estimates the herd-immunity threshold at between 50% and 80%."

-

Very interesting discussions. Thank you all!