-

Posts

2,634 -

Joined

-

Days Won

15

Content Type

Profiles

Forums

Events

Everything posted by UK

-

It will be interesting to watch, how this plays out. Also it is really strange how (including all crackdowns) much anticyclical policy they run at this point in time, especially comparing to the rest of the world: https://www.bloomberg.com/news/articles/2021-09-09/china-could-be-heading-for-first-balanced-budget-since-1985

-

https://www.bloomberg.com/opinion/articles/2021-09-08/it-s-a-lehman-moment-not-volcker-that-china-should-fear-in-its-real-estate-boom https://www.wsj.com/articles/what-if-chinas-property-crackdown-goes-overboard-too-11631017035 A crackdown on runaway housing prices jibes with other recent initiatives like President Xi Jinping’s populist call for “common prosperity.” Unaffordable homes are a major cause of inequality and an obstacle to child-rearing. A huge amount of capital has also been channeled into housing that could be put to more productive uses. Previous research has linked China’s housing boom to falling productivity. The problem, of course, is that property is already so entwined with China’s economy that a sudden stop could be extraordinarily dangerous. Real estate is the biggest asset of Chinese households—who recognize that the political sensitivity of the market, and its outsize economic footprint, make sustained price falls risky for Beijing. A lack of investment options and the preference of banks for mortgage loans has exacerbated that concentration. The wealth impact from a housing crash could seriously affect already-weak consumption.

-

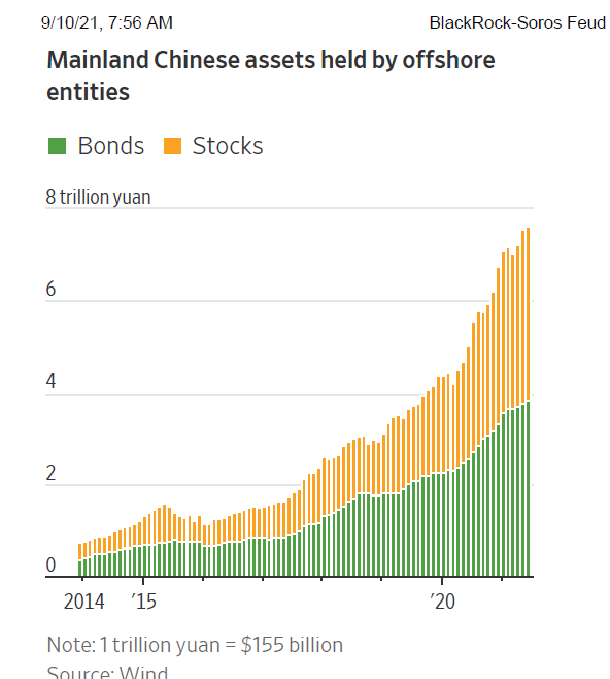

As part of the 2020 trade deal with the U.S., China has been opening up its financial industry. Earlier this year, JP Morgan got permission to take full control of its securities business there. Previously, foreign brokers had been required to operate through joint ventures. If you are scratching your head wondering why Beijing is welcoming American securities firms while relations with the U.S. are plumbing new depths, the answer is simple: The move is in China’s interest, too. Beijing has long wanted capital markets to play a larger role in China. Chinese companies rely mostly on bank loans and retained profit for investment, which is quite different from many other major economies. Around 60% of outstanding total social financing, a broad measure of credit in the economy, comes from bank loans, according to data provider Wind, while corporate bonds and equity for non financial companies make up around 12%. In the U.S., equities and bonds provide 73% of funding for non financial corporations. The stranglehold of state-owned banks on the financial system makes it harder for small businesses without good connections to secure long-term funding to grow—even if they have an innovative, well-run business model. And with Beijing more wary of dependence on U.S. stock markets, the problem has become more urgent. The involvement of names like Black Rock could help gain the trust of domestic investors and redirect Chinese household savings out of real estate, which Beijing wants to shift the economy away from. Apart from opening up finance to foreign players, China has rolled out the welcome mat for investors outside mainland China. Off shore investors, including those based in Hong Kong, now hold 7.6 trillion yuan, the equivalent of $1.2 trillion, of Chinese domestic stock sand bonds as of June, according to data from China’s central bank via Wind. That has quadrupled the amount four years ago but is still a drop in the ocean of the country’s $19 trillion bond and $13 trillion stock markets. Such inflows could also help off set capital outflows from China-based investors and bring discipline to the market.

-

https://www.bloomberg.com/opinion/articles/2021-09-12/china-equities-a-cfa-analysis-of-three-scenarios-and-going-with-your-gut?srnd=premium-europe "You Don't Need a CFA to Value Chinese Equities"

-

Also, again, I am biggest fan of US (and very greatfull from prospective of my countries geopolitical situation:)), majority of my portfolio is still invested there and I am rooting for its success far in the future. but, despite this all common prosperity scare in China (which is by name a socialist country), have you noticed what is going on in US (EU is far ahead already)? Like: https://www.wsj.com/articles/transforming-america-in-17-days-democrats-spending-bill-entitlements-nancy-pelosi-11631221827?mod=hp_opin_pos_1 "Now with merely 50 Democrats in the Senate and a five-member House majority, Democrats are planning to rush through the biggest tax and spending increase in half a century. We’ll do our best to report and dissect the details in the coming days, but here’s a taste from the text that the two House committees deigned to release: • A universal paid leave mandate administered by Treasury that provides up to 12 weeks of family and medical leave for all workers including those self-employed at up to 85% of their weekly pay. It’s unclear how the new entitlement would interact with existing state paid leave and employer programs. The federal bureaucracy will iron out the complications later. • A new employer 401(k) mandate—that is, a tax. Employers would be required to automatically enroll their employees in IRAs or 401(k)-type plans or pay an excise tax. Employee 401(k) payroll contributions would be set at 6% and increase to 10%. There are myriad other legal changes on employer-sponsored retirements accounts that would be land mines for businesses. • The bill creates new civil penalties up to $50,000 per violation for unfair labor practices (ULPs), which would now include misclassifying workers as independent contractors. Business executives and directors could be held personally liable for alleged ULPs. As a gift to the plaintiff bar, employee arbitration agreements would also be effectively banned. • Medicare would expand to cover dental, vision and hearing benefits. Health and Human Services would be charged with standing up these expansions, including setting provider payment rates. Cost estimates for this and other entitlements have yet to be announced, but they’re likely to be fictitious anyway. One credible estimate is that the Medicare increase alone would cost $360 billion over a decade. *** There is much more spending to come, and next week come the tax increases that will also be marked up on a day or so notice. It’s important to understand how extraordinary this is. The Democratic bill would fundamentally alter the relationship between government and individual Americans. Entitlements, once created, will be all but impossible to repeal. Even if they start small, they will inexorably expand." Or all these new green regulations in US, but especially in EU? Banning ICE etc or nuclear power in Germany? Is it not some grand state planing/intervention? And who and how will pay for that? Or what does such things tells about future: https://www.wsws.org/en/articles/2020/10/23/soci-o23.html

-

Oh, thanks for reminding these "10 baggers", though I would argue, that they have fucked themselves up well before government came, of course by wonderfully payed "stewards of capital". I was burned so much times (of course self inflicted, in pursuit of "value", usually deep:), so not any governments fault, sometimes they do what they do) by such situations, that I almost forgot some (or maybe do not want to remember?). A lot of situations with utility companies also, especially in EU, water tariffs were changed over night (to a almost no profit), one was nationalized back in my own country (price was calculated based on maybe book value or something:)), or some onerous regulations was introduced on whole sector. If I was forced to name "risk free" (not only from regulations, but also from disruption) company list today, like I said, am not sure I would even put KO in it, surely not V/MA types, but maybe Nestle, Nike and similar. But all of them today trades at least at 25x forward earnings, most more like at 30-40x.

-

It would be very interesting to know what are those companies? Are they commodity companies or something else?

-

I agree China is not the same as US and risks related to government are higher. But not sure if it is only black and white, especially re respect to individual property rights, they still have and produces a lot of billionaires, are they not? Also, while investing, usually you still accept bigger or lesser risk. So it is different, but is the risk is really lower if you invest today in Intel instead of Tencent? Or you invest in smaller companies (or even large) and are being screwed by a management (or majority owners) instead of CCP? Is that somehow better? Destruction of value by management in perfectly fine jurisdictions in largest companies is sometimes quite amazing, just look at things like Bayer's acquisition of Monsanto or Bank of America's of Countrywide. And do you remember circumstances under which BAC acquired Countrywide? It was called shotgun wedding if I recall correctly:), was forced by the government and almost killed the company. Was it uninvestable after that? Also I would like to ask: If Apple is good enough and safe then? Let say only 1/5 of their sales is China related, so no existential threat, but if you take that out while a company trades at like 40x earnings, I think you can go for a permanent loss of capital situation there also. And in a more nuclear scenarios, Apple is dependable on China for like 4/5 or 2/3 of its manufacturing. So is it investable or not? Also, because it is related to regulatory risks of a very strong and moaty company in a perfect jurisdiction, I like this example so much, that I will post it perhaps third time:). So forgive me but once again: "Archie McCardell was named president of the company in 1971. During his tenure, Xerox introduced the Xerox 6500, its first color copier. During McCardell's reign at Xerox, the company announced record revenues, earnings and profits in 1973, 1974, and 1975. John Carrol became a backer, later spreading the company throughout North America.[citation needed] In the mid-1970s, Xerox introduced the "Xerox 9200 Duplicating System". Originally designed to be sold to print shops to increase their productivity, it was twice a fast as the 3600 duplicator at two impressions per second (7200 per hour). It was followed by the 9400, which did auto-duplexing, and then by the 9500, which was which added variable zoom reduction and electronic lightness/darkness control. In a 1975 Super Bowl commercial for the 9200, Xerox debuted an advertising campaign featuring "Brother Dominic", a monk who used the 9200 system to save decades of manual copying. Before it was aired, there was some concern that the commercial would be denounced as blasphemous. However, when the commercial was screened for the Archbishop of New York, he found it amusing and gave it his blessing. Dominic, portrayed by Jack Eagle, became the face of Xerox into the 1980s. Following these years of record profits, in 1975, Xerox resolved an anti-trust suit with the United States Federal Trade Commission (FTC), which at the time was under the direction of Frederic M. Scherer. The Xerox consent decree resulted in the forced licensing of the company's entire patent portfolio, mainly to Japanese competitors. Within four years of the consent decree, Xerox's share of the U.S. copier market dropped from nearly 100% to less than 14%." It was one of those nifty fifty companies, very expensive at that time (like most US tech companies now) and as you can see, it was killed not even by technological disruption. It was done by a democratic government. How about Xerox shareholders property rights? Are you sure that similar risks today are "virtually non-existent" while investing in some western tech/payment/etc darlings? Also take for profit education, which is being exterminated now in China, but they were not treated much better in US: "As for-profit colleges began to falter, for-profit online program managers gained momentum. Under the Obama administration (2009–2017), for-profit colleges received greater scrutiny and negative attention from the U.S. government. State Attorneys General, the media, and scholars also investigated these schools. For-profit school enrollment reached its peak in 2009. Corinthian Colleges and Education Management Corporation (EDMC) faced enrollment declines and major financial trouble in 2014 and 2015. In 2015, Corinthian Colleges filed for bankruptcy. Enrollment at the University of Phoenix chain fell 70% from its peak In 2016, ITT Technical Institute closed, and the US Department of Education stripped ACICS of its accreditation powers. In 2017, the advocacy group the Debt Collective created its own, unofficial "Defense to Repayment App" allowing former students of schools accused of fraud to pursue debt cancellation. In 2017, Harvard Business School professor Clayton Christensen who developed the theory of disruptive innovation, predicted that “50 percent of the 4,000 colleges and universities in the U.S. will be bankrupt in 10 to 15 years.” So what is risk free? I would argue, that even Coca-cola is not, and its shareholders can be robbed by some kind of sugar tax in the future. But i think it is the wrong question, because the right one, as with all investments, is what risk is already priced in.

-

Also, like it or not: https://www.wsj.com/articles/china-nuclear-arsenal-deterrent-navy-new-start-proliferation-national-security-11630524535

-

https://www.theatlantic.com/international/archive/2017/05/what-china-wants/528561/ If China reaches the first goal— which it is on course to do—the IMF estimates that its economy will be 40 percent larger than that of the U.S. (measured in terms of purchasing power parity). If China meets the second target by 2049, its economy will be triple America's. What does China’s dramatic transformation mean for the United States and the global balance of power? Singapore’s Lee Kuan Yew, who before his death in 2015 was the world’s premier China-watcher, had a pointed answer about China’s stunning trajectory over the past 40 years: “The size of China’s displacement of the world balance is such that the world must find a new balance. It is not possible to pretend that this is just another big player. This is the biggest player in the history of the world.” Will Xi succeed in growing China sufficiently to displace the U.S. as the world’s top economy and most powerful actor in the Western Pacific? Can he make China great again? It is obvious that there are many ways things could go badly wrong, and these extraordinary ambitions engender skepticism among most observers. But, when the question was put to Lee Kuan Yew, he assessed the odds of success as four chances in five. Neither Lee nor I would bet against Xi. As Lee said, China’s “reawakened sense of destiny is an overpowering force.” Yet many Americans are still in denial about what China’s transformation from agrarian backwater to “the biggest player in the history of the world” means for the United States.

-

To one his own, I agree and also do not do like zillion things:), also did not owned or even looked at China stocks in the last 20 years before this debacle, except one stock in 2010, but it was a wash:)

-

And since question is specifically re CCP, I will repost this chart. Another day read somewhere "No matter how much I disagree with Brussels, I'd sure as rather trust EU over CCP". Now, I live in EU (and am one of the biggest fan on earth of US), but gee, in the last 10 years all EU managed to produce was crisis after crisis: Euro, Brexit, migration, energy policy, etc, while nurtured zero tech champions, now losing EV battery game. China meanwhile went from strength to strength every time and I still should trust EU more? Based on what? Only because it is democracy? Thanks god US has done better and I hope still will do in the future, but only because China's system is different, that does not mean it is necessarily inferior in every way and doomed to fail. It already successfully lasted 50 years. https://www.nytimes.com/interactive/2018/11/18/world/asia/china-rules.html

-

if you can't beat them, join them: https://www.youtube.com/watch?v=DpkCV2Hd62Y :))) Seriously thought, I think this is a major opportunity of one in a 10 year kind. I would also agree with Viking, that it is considerably more speculative than investing in similar US companies. But I would argue that a lot of US companies, especially smaller, are more speculative than China big tech companies. I would answer the question "what causes the fundamental change", that nothing (except maybe for education stocks:)) has changed in big picture in the first place, only valuations, because of this temporary "regulation noise":)

-

Kinda: https://www.bloomberg.com/opinion/articles/2021-09-07/goldilocks-low-rates-economy-has-stock-investors-in-a-headlock?sref=uN6cur8D "The rally is driven less by reflation prospects than a return to the pre-pandemic reality of low interest rates, which leaves no alternative to stocks" But I would not pay to much attention to such things, better I think, until some real shit hits the fan, just to stay with mostly win-win situations, like BRK:))

-

I would ques it is related to this value-growth rotation going on back and forth, which is mostly related to rate expectations, which is mostly related to economy expectations, which is somehow related to maybe delta scare and what not else, and it is only trying to explain past:) and still perhaps nobody on earth knows what will future be:). But I think BRK is quite well positioned, but they are regarded bu market as being more on the short duration side, so lower rate expectations is not as good for BRK valuation (as say for FANGS), but lower valuation is not so bad if BB are going on, so you cannot lose here and god bless BRK BB:)

-

https://www.wsj.com/articles/railroads-brace-as-regulator-signals-willingness-to-take-on-industry-11630584002?mod=business_lead_pos12 The obscure federal regulator that threw a wrench into a $30 billion railroad merger this week could have more in store for the nation’s freight railways—with implications for both business and consumers. Like other federal agencies, the five-member Surface Transportation Board has been tasked by President Biden to root out what it considers to be corporate monopolies that hurt smaller companies and consumers. In a closely watched action, the board in coming months is expected to consider a rule to mandate so-called reciprocal switching, the practice in which railroads can be compelled to share access to their tracks with competitors. That would allow shippers to seek competitive bids for moving freight, which in theory could lower shipping costs and the prices ultimately paid by consumers. Freight railroads oppose the plan, saying it would be detrimental to their operations and profits. Trucking already serves as a competitive counterweight, they argue. Freight railroads also warn that such a mandate could have unintended consequences, including lower capital investments in infrastructure they are forced to share with rivals. There are also threats beyond reciprocal shipping. Martin Oberman, who was appointed chairman of the STB by Mr. Biden earlier this year, has also mused about the possibility of the STB moving to regulate storage fees at so-called intermodal railroad terminals—which handle containers across multiple modes of transport, like rails, trucks and ships—to address clogs in the supply chain. Intermodal shipping is currently exempt from STB regulation. “This is an industry with very few entrants in it, and they tend to be very monopolistic or, at best, duopolistic,” Mr. Oberman said. ”So we just have to live with the existing limited entrants in the field, but at least build in competition where we can.” “The railroad industry is not just about maximizing profits for railroads, it’s also about the public interest in the economy, and the Congress has made that clear,” he said. Mr. Oberman’s focus on competition and skepticism of some of the railroad industry isn’t a departure from his predecessor, Ann Begeman —but his tone is, said Tony Hatch, a veteran railroad analyst. Mr. Oberman also established a new passenger rail working group that is preparing to begin enforcing new on-time performance standards beginning next year. Under those rules, which freights, Amtrak, and the government battled over for a decade, freight railroads could face penalties for delaying passenger trains, which run over freight-owned tracks across most of the country. Rulings favorable to passenger railroads in both matters could help make feasible Mr. Biden’s vision of vastly expanding train travel in the country. Mr. Oberman countered that many of the mergers that consolidated the rail industry 20 years ago included contracts for reciprocal switching among railroads, which have operated without major problems since. “The railroads would prefer that we do nothing ever, except pre-empt everybody else from regulating the railroads,” Mr. Oberman said. “I think the reaction, and I’ve told them, by the way, was way overdone and exaggerated.”

-

https://www.wsj.com/articles/how-mixing-hurricanes-with-low-rates-impacts-insurers-11630350607 But there is some rising pressure on recent positive pricing trends for reinsurers, according to industry reviews. A report by brokerage Willis Towers Watson in July said that in the reinsurance market “there are increasing signs of capacity supply outweighing demand. Worries about inflated costs had limited impact on recent renewal pricing, the report said. But the market for alternative capital is booming, with issuance of catastrophe bonds in the second quarter of 2021 outstripping new issuance in 2019, according to Willis. This market tends to be strong when interest rates are low, leading investors to search for alternative forms of yield. Historically this has hit reinsurance pricing through ample supply of funds.

-

I used to own old Honda or Nissan, but then changed my mind on this "cigar butt car ownership style" not least due to: https://en.m.wikipedia.org/wiki/Collision_avoidance_system I don't need or even like any assistance in driving (can even use manual gearbox:)), but this "automatic braking" is really important and it works (have "tried" several times). At night, or if you are distracted, sometimes it just sees and acts faster. It is usual feature for newer (soon will be mandatory for all new cars), but most older-cheaper just do not have it.

-

I am sure Q7 is very nice and good car! But what else is funny with Q8 is that it shares the same platform with Lamborghini Urus, so one could argue, that Q8 fanciest and most expensive version, which is Q8 RS, is actually cheapest:)). I think it should qualify then for value buy, with approx 50 per cent margin of safety:))) https://www.hotcars.com/heres-why-the-audi-rs-q8-is-a-better-buy-than-the-lamborghini-urus/

-

I think, that those issues were related to a very specific engines and years, also boxer diesel, which they already discontinued, but yes I also read that some of their cars from particular years had such issues. Otherwise they are made to be very practical and resilient, dirt proof, etc. But also noisy and very light on materials/fancy/comfort stuff. Probably it is hard not to find similar reliability problem stories with different manufacturers these days, but perhaps then Honda still has very good reputation?

-

Subaru Outback or Forester for value, Audi Q8 for growth/quality:)))

-

Movies and TV shows (general recommendation thread)

UK replied to Liberty's topic in General Discussion

Yes, watched this one twice:) -

This is THE MOST DANGEROUS time regarding covid

UK replied to muscleman's topic in General Discussion

https://www.bloomberg.com/news/articles/2021-08-20/delta-case-wave-in-u-s-northeast-may-be-nearing-its-peak