thepupil

Member-

Posts

4,184 -

Joined

-

Days Won

4

Content Type

Profiles

Forums

Events

Everything posted by thepupil

-

this was a good trade. late October really sized into VCLT. now we're seeing bloomberg articles on pensions not being able to get enough long duration corporate paper. spreads have actually tightened to < the prior "free money" decade. been lightening up on spread risk and bonds generally, but still probably have more than 99% of people my age lol.

-

How Does the World’s Largest Hedge Fund Really Make Its Money?

thepupil replied to james22's topic in General Discussion

you seem to be interchanging "portable alpha" and "risk parity" my admittedly limited understanding is they are not the same. I think of "portable alpha" as the separation of alphas and betas. So for s simplified example, let's say I found an investor that i "know" can beat the Japanese stock index by 500 bps in yen terms, but I want neither the yen exposure nor the Japanese stock market beta. Instead I want US stocks. A "portable alpha" strategy would invest in the investment manager short the japanese index and go long US stocks. So you'd earn the beta of the US stock market and the alpha of the japanese manager, and achieve your goal of your desired beta plus alpha. "risk parity" is basically sizing of exposures based upon their "risk". so If bonds have 1/4 of the "risk" than stocks, but I want to have equal risk in both bonds and stocks, all else equal I own 4x as many bonds as stocks. PSLDX seems to be a fund which is managed in such a fashion w/ stocks and levered bonds. Pure Alpha, managed by Bridgewater, in my limited understanding is a macro fund that tries to generate "alpha" by taking views on various asset classes returns and generally not have too much beta (long Japanm equities, hedged of the yem, short US equities agains EM equities, short long term USD rates, long oil / short USD etc) All Weather, managed by Bridgewater, in my limited understanding, is a risk parity fund which tries to invest in diversified betas such that the fund makes money in all environments (2022 not so much). @TwoCitiesCapital would you agree / disagree with this? -

the market is basically offering you your mortgage at $382K / 84% of par / ~6% yield, not quite the 70% of par you seek, but basically you are saying you are a buyer of discounted fixed long term obligations.....which are...wait for it...bonds! The mortgage backed securities index

-

yes, buy bonds.

-

agree on rates, but on the direct negative wealth effect from bonds, I don't really think anyone has been particularly negatively affected and generally feels better off given a better return on savings. I think most losses have been borne by Fed, banks, duration matchers etc and that people don't really give a shit if their 0-30% in bonds are down 10% in nominal terms and that higher rates feel like stimmy to folks of means. i agree with you regarding higher rates, but the "more money has been lost on bonds than on stocks in GFC" implies that the bond losses have actually mattered to anyone other than banks with flighty deposit bases. I just don't see that. whereas RE and stock losses in the GFC were devastating to many

-

How Does the World’s Largest Hedge Fund Really Make Its Money?

thepupil replied to james22's topic in General Discussion

https://www.institutionalinvestor.com/article/2bstqfeujm1aoa2jaqkg0/corner-office/fifty-years-ago-rusty-olson-began-investing-kodaks-pension-thanks-to-tom-mucha-hes-reaping-the-rewards it worked for these guys at least, not so sure about other LP's. Bit of a fluff piece w/o quantification, but they do give them credit. -

How Does the World’s Largest Hedge Fund Really Make Its Money?

thepupil replied to james22's topic in General Discussion

agree w/ the facts regarding performance, but don't think anyone is investing in Pure Alpha to beat the stock market. -

how many people in your life are you aware of that have been directly and negatively affected by the bond sell-off?

-

the old lady’s house sold for $1.3mm, demonstrating that purposefully underpricing remains best way to drive competition and get top dollar.

-

interesting, I peaked at 45% ish long bonds and sold down to about 40% today, been a ripper of a rally in spreads and rates.... just lightening up a bit. 6.2%--->6.6%--->6.2% in span of like 2 weeks for Bloomberg 10+ Corporates (VCLT Benchmark)

-

I don't really regard it as important. They're all going to build their empires. Manage in slightly different ways, get paid handsomely. Chai Truct Co LLC (Zell [RIP] Family Office) owns $300m of stock, but not clear to me what that does and now that Sam's gone, it's just another company in terms of board composition. Mark Parell (CEO) owns like 240K shares ($12mm) which isn't really a lot of money relative to his comp. Bloomberg says he made $8.5mm in 2022. Proxy says $8.5-$11mm / year for last 3 years. Keeping job much more valuable than stake in company. Probably true for all blue chip REIT C Suite.

-

iSavings bonds yielding 7.12% currently

thepupil replied to Spekulatius's topic in General Discussion

impressive! I thought my company's contribution was good, but you got me beat! -

I like all blue chip multifamily (I think he who has lowest basis, lowest leverage, and lowest g&a will preserve & grow capital over time). Don't take any of my individual purchases as "I love california vs southeast" or vice versa or "i think UDR's mgt team is better than CPT's". I try to be cute and buy them when mkt doesn't like because of impending negative earnings momentum or general fears (ESS has outperformed this year because it did worst in '22 because of tech downturn/west coast general fears, was buying in '22 haven't bought this year, sunbelt rents are rolling over and there's a supply overhang so CPT/MAA doing poorly, so I'm buying). It's nice to own a number of them (to extent owned in taxable) as you can swap comps to generate tax losses / maintain exposure. I'll probably sell my ie I'll probably sell my MAA in Nov to buy more CPT and then switch back to owning both... Maybe buy a little EQR today.

-

I doubled down on MAA and CPT yesterday, not by purchasing more, but by converting some holdings held in IRA to Roth, paying >40% taxes for the privilege. it's optimal to wait until low income years to do this, but I just want to build a ladder of liquidity/availability over time, try to do it with the more beaten down names.

-

High Quality Multi-family REITs - EQR, CPT, ESS, AVB

thepupil replied to thepupil's topic in General Discussion

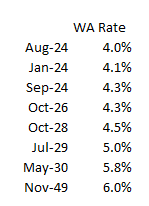

Camden raising $500mm of 3 year money at tsy+95 (5.85% ish), pay off floating rate revolver w/ rate of 6.2%. CPT had weighted average rate of 4.1% as of Q3. This will decrease that slightly, though it's shorter term $$$. Illustrates the ease with which these IG MF guys raise capital...$500mm at drop of a hat. If CPT had to refi its debt stack at 6%, here's how long it'd take to get there. Still at a quite reasonable 4.5% 5 years from now. They'd be able to pay 6% today because of their low leverage (3.5x ND/EBITDA), but wont' have to for 5+ years even if rates remain where are. -

some news from "Rich Men North of Richmond" land. House 1 is 2200 sq feet, 4BR lot w/ old shitty house on it bought for $1.1mm in 2022. Builder planned to get variance to slap a Mcmansion on it. Didn't succeed (#NIMBYISM). Opts to do gut reno on the small house. Looks beautiful, fancy AF, but small for px . Throws it on the market for a whopping $1.7 million. Sitting without any action for weeks. House 2 is 1900 sq feet. 3BR. Nice old European lady who loves my dog has to go to the nursing home . my neighbor realtor works with her for a month to make the house updated/clean, but nothing flashy. Throws in on market for $995K vs $1.2mm zestimat estimate. Flies off the shelf w/i 2 days, undoubtedly well above ask (don't know price), likely close to zestimate. these basically encapsulate what I'm seeing. the $2mm houses where someone's jumping from a $5K to $15K payment are moving slower than mollasses in winter. the more attainable there's near infinite demand and no supply.

-

https://institutional.vanguard.com/insights-and-research/perspective/rising-rates-beg-the-question-bonds-or-bond-funds.html vanguard answers this well in my view. Bond funds maintain a constant risk profile. bonds held to maturity dont magically avoid losses.that whole point is kind of a mental game. But it’s true that you can get more precise with initial risk profile with individual bonds. the more I’ve done it in practice though, the more I like funds/ETFs

-

Also the indices are cap weighted which means in corporate IG land you might end up lending to more banks than you want to, in bond index land you’re basically only in tsy’s and mtg’s with no credit. Starting the obvious, but it pays to look under hood for 10 mins to make sure you’re getting what you want

-

i realize a super quick and long response, caught me at end of my day on a slower friday and bonds are just so exciting right now.

-

- ETF's maintain a maturity profile in line with the index rather than roll down to maturity which is what buying an individual bond would do. this can matter. If one wanted to offset a liability that's due in 2048, he/she might buy a 2048 maturing bond/TIP. In 5-10 years that individual bond/TIP will be the right duration for that liability, but if one bought an index that starts out at the right duration, the liability will get shorter while the index ETF maintain its duration. in actual practice, I don't think this matters much but it has implications i haven't FULLY thought through - ETF's price discovery and liqudiity is a function of supply and demand of the listed equity and the interplay between the market makers that create/redeem them / bonds price discovery and liqudiity is a function of the market makers of those bonds. in practice, in 98% of times, this won't matter, but I'm sure it could. - bond bid / ask even on treasuries kind of sucks. I probably ate a point or 2 in two months on my recent individual bond buying / selling spree. I'm perfectly fine doing that sloshing my book around in the greatest bond sell-off, but I don't want to do that once every eyar for the next 20. ETF's and mutual funds offer a diversifed portfolio w one click / low t-costs. this matters more where diversity actually matter.s if buying TIPS / treasuries you don't need to be diversified by issuer...it's all the same issuer. but if you want to diversify by maturity, even tsy's are kind of annoying, like do you want to buy 30 line items? - benefit of buying individual TIPS is you can target how seasoned / new you want the TIP to be. I like some of the old TIPS that were issued in '20 / '21 because they've declines so much in price, they can't lost money in deflation. the 0 1/8% of 2051 at $52 returns 1.8% nominal to maturity at huge deflation because you're guaranteed at least original principal. At 4% deflation it returns 6.5%. So that's a an instrument that literally can not lose money and is guaranteed to grow purchasing power by 2.5% /yr and if real rates fall can make 20-30-50-100%. EDIT Actually, you can't lose money in inflation if you buy a new TIP. the problem with buying a seasoned TIP that has lots of inflation built in but is still above original par value is you can lose money in deflation...but for new tips and extremely discounted ones it doesn't matter and most of the universe is either new or very discounted so maybe it really doesn't matter. maybe buying new actually better since principal won't adjust below....bottom line buying individual bonds let's you get into this degree of pointless minutiae i do both. i like ETFs. i go individual when I just can't get something in ETF form. Like there's a few illiquid college perpetuals that i love that I just slowly buy. I own some Cal Techs and Bowdoins right now. my parents own some stanford muni's. I have tried to buy Disney and Coke far aout paper but it's too illiquid. i wish there was a CEF that owned every high quality 100 year bond, but alas.

-

agreed, not gonna lend to a creditor unfriendly sponsor for 200 bps more than IG, particularly with low duration upside. if i want to lend to creditor unfriendly sponsors with low duration / upside, I'll buy CLO AAA and be structurally superior / diversified.

-

TDG 4 7/8% of '29 are at 350 over / 8.22% all-in. It's a high quality, cusp of IG/HY name. At this time sticking to IG, lower spread w/ more duration. if credit spreads widen, I'd be more interested in something like this. its 350 whn HY is 520. If HY got to 800 and htis was say $75 / 650 / 11%, I'd be more interested. it only has duration of 4. I've never been comfy with it as a business, I've followed it for a decade or so and watched it make people lots of $.

-

I sold almost all my individual 20 ish year individual corporate bonds today, having lost 5-10% in a relatively short time frame seemed like a liquid day with very tight bid/ask. I plowed all proceeds and more into VCLT w/ some $55 tail hedge puts. this move generated some tax losses, freed up lots of margin, and replaced that which i sold w/ diversified equivalent. eventually, I'll migrate these to tax free accounts but in the accumulation phase it's just easier to buy in taxable, short term returns dominated by price change whcih thus far is negative/loss generative. Long term Corporate Index: $76, 4.45% coupon, 22 yr wgt avg maturity, duration of 12, yield of 6.5%. I'm happy to be early to taking duration risk and am happy to lose money all the way down. Let's go!

-

I refuse to believe 5% / 2.5% real really can be the new normal. Doesn’t work with how indebted we are. Either need same nominal rates with higher inflation /lower rates rates, or lower nominal rates. Otherwise Interest as % of GDP/budget will force dramatic and undesirable societal change. basically my macro view is: lower rates or hell is coming. I’m an optimist so i’m more positioned for lower rates than hell. Even if hell is coming (massive taxation increase people say “we used to have 15% rates”…well we also used to have 30% debt to GDP. Can someone point me to errors in this “logic”/hope?

-

@TwoCitiesCapital, how do you square this view with the Fed data showing the largest ever REAL increase in HH net worth from 2019 to 20222, the largest percentage gains being from the young/levered. Do you think that's reversed in the 10 mo's since? Do you think it's "all housing"? Do you think something wrong w/ the data?