thepupil

Member-

Posts

4,299 -

Joined

-

Days Won

4

Content Type

Profiles

Forums

Events

Everything posted by thepupil

-

Does being full-time investors help you getting better return?

thepupil replied to alertmeipp's topic in General Discussion

the difference in cost of living for young-ish people living in urban areas, particularly dual income households paying for childcare/education, versus older people elsewhere (assuming they don't have other familial funding obligations) is....massive. relatedly.... https://www.washingtonpost.com/opinions/2023/01/29/400000-a-year-rich-feeling-poor/ -

Does being full-time investors help you getting better return?

thepupil replied to alertmeipp's topic in General Discussion

this is logical, but if one values relationships / ties to area where that isn’t the case then you gotta pay up / save more. i actually don’t really know many boomers who actually move to a cheaper area where they have no ties. Most want to move to either be wherever grandkids are or (more likely) stay in same house/neighborhood where they built their lives. Plenty of empty nesters out there in 3K, 4K, 6K sf houses. an alien looking down would conclude insanity but I understand the emotion behind it. -

Does being full-time investors help you getting better return?

thepupil replied to alertmeipp's topic in General Discussion

perhaps to rephrase, I think I could do a lot of things but none that pay me nearly as well per unit of effort than the current niche. on the actual topic, I think about this a LOT. The answer is "I don't know". there are situations where I know that I would take more risk and bigger positions IF I had more time to answer various questions or do more work. To do the on the ground diligence that some people do here, or pore over years of filings and just generally be more comprehensive about diligence AND turning over rocks; I think the biggest difference if doing this full time is I'd try to expand the sandbox more and look at a wider variety of companies to always keep the portfolio fresh. maybe I wouldn't hold JBGS for 4 years or TFG for 11 and let those suck wind...maybe. But not doing this full time keeps me humble regarding my level of knowledge versus others, which I think may actually be a decent way to avoid impairing capital. -

Does being full-time investors help you getting better return?

thepupil replied to alertmeipp's topic in General Discussion

I'm 98% certain I'll oversave and also inherit a fair bit (hopefully in like 30 years at which point I won't need any of it), but...if I run out of money because I retired 5 years earlier than I should have, then I let down 2 generations before me who set me up well and the next generation down for whom i become a burden. people live a long time now... I don't really see how I'd be employable after leaving the workforce. I have no real skills (beyond my niche). lacking money you're subject to the government; public healthcare, public education, public senior living facility. you become a ward of the state and subject to whatever the state offers you which I think you have to think is only declining with time. retiring w/some other low number is a bet on the benevolence and efficacy of the government whereas a bigger nut offers some escape hatches / alternative options to dying a state run facility. rightly or wrongly, people (including me), probably overweight the downside risks of running out of dough, but it is quite difficult to contemplate not having dough...I'm trying to balance the here and now a bit with the tomorrowmight spend about 2%-3% of muh net worth on a boat for next season....yea that's a market top -

You pretty much know what I own…I’ve been taking a hard (and skeptical) look at DEA. I think the divvy is sustainable and that if the stock goes up they can accretively issue and then f those assumptions are correct you have an 8% yield from long duration government guaranteed cash flows. they’re empire builders so lots of path dependency on stock price and cost of capital etc. id they can’t make it work and cut the divvy by a 1/3 or something and the stock went down a lot, I’d be all over it. It’s kind of in this purgatory where it needs to go up or down 30% for me to like it.

-

Does being full-time investors help you getting better return?

thepupil replied to alertmeipp's topic in General Discussion

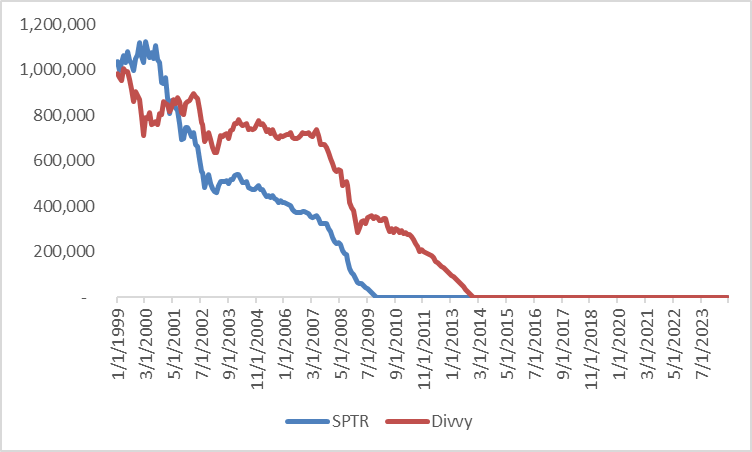

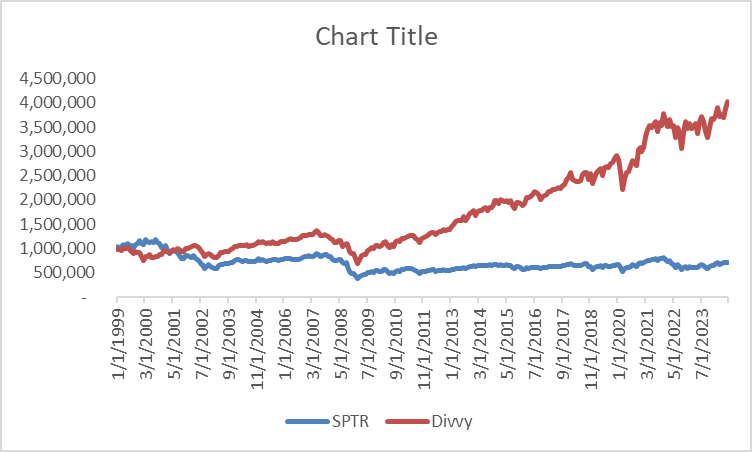

I mean we are discussing a real world example where one’s capital is clearly impaired only 25 years later. Starting with $1mm and ending with $400k $700k, or $1mm (different asset allocations) 25 years later is failure in my book… -

Does being full-time investors help you getting better return?

thepupil replied to alertmeipp's topic in General Discussion

fair point. differences are less dramatic if doing this. still higher but more like $720K 100% stocks $812K 87% stocks 13% cash, bonds are depleted in 3 year bear market $888K 87% stocks 13% cash, the "use cash after negative month method". the bottom line is a 4% WR is simply too high if you retire at the absolute peak of a bubble and stocks do nothing for a decade after that. -

Does being full-time investors help you getting better return?

thepupil replied to alertmeipp's topic in General Discussion

On this, I actually got curious last night about this (yea I'm weird) and ran two "retire at the top scenarios" to modify this. In one you make no withdrawals for 2000,2001,2002 in that you know those will be bad years and you deplete a 3 year cash reserve over that time frame. This results (in my spreadsheet) in an ending total of $1.7mm, a full $1mm difference than the $720K of the all equities approach even though it starts with $130K / 13% more. Since one would not have known in real time that those three years would be bad, I also did a different scenario where you start with $1mm in S&P 500 and $130K in cash making 4%. If SPX is positive for a month, you withdraw from that. If negative, you take from the cash pile. This could theoretically have been done without any knowledge of the future. This ended with $1.85mm (the cash is depleted in 2007 though). I was surprised this did better than the first which knows the down years. In both cases keeping some cushion led ending values approximately 2.5x more than the $1mm w/ all stocks. $1mm of S&P 500 + $130K of cash is 2.5x better than $1mm of S&P 500 starting in Jan 1999. It's one time frame, but I think the scenario should make anyone who is 100% or 130%+ long of equities while withdrawing from a portfolio think twice about such a stance. -

Does being full-time investors help you getting better return?

thepupil replied to alertmeipp's topic in General Discussion

just to add on to my earlier post, an 8% withdrawal rate goes bust in 8-15 years from that (cherrypicked) data point of Jan 1999 A 6% withdrawal rate goes to zero in 2013 for S&P 500 and changes the ending amount for the divvy aristocrats from $4mm to $587K... using Jan 1999 as a starting point is enough to make one want to work forever -

Does being full-time investors help you getting better return?

thepupil replied to alertmeipp's topic in General Discussion

This isn't about CAGR, but rather sequence of returns risk. From Jan 1999 to August 2024, S&P 500 has CAGR'd at 8.1%/year. From Jan 1999 to August 2024, Divvy Aristocrat CAGR'd at 9.7%/ year With 308 months of data (25.6 years), one might think the ending values would be different by something like this: 1.081^26=7.57 1.097^26=11.1 7.57 / 11.1 = 68%, but I calculate that with $1mm starting out $40K annual withdrawals and 3% inflation of withdrawals that the S&P 500 investor ends with $720K and the divvy aristocrat investor ends with $4.0mm. My numbers are different than that post but are directionally in line with his. Why does the divvy aristorcrat do so much better and end w/ 5.7x as much? It's because from 1999-2008 the S&P 500 index lost a cumulative 13% and the aristocrats made a cumulative 40%, including the first 4 years where SPX lost 25% and Aristocrats eked out 4%. This is the S&P 500's infamous "lost decade", so you impair the capital by withdrawing money from a declining portfolio When people say volatility or drawdowns don't matter, I strongly disagree if one is making regular withdrawals from a portfolio. there's a HUGE difference between CAGR and withdrawal rate. the withdrawal rate is much lower than CAGR and there's also sequence of returns risk. SPY Aristocrat 1999 21.0% -5.37% 2000 -9.1% 10.13% 2001 -11.9% 10.82% 2002 -22.1% -9.87% 2003 28.7% 25.37% 2004 10.9% 15.46% 2005 4.9% 3.69% 2006 15.8% 17.30% 2007 5.5% -2.07% 2008 -37.0% -21.88% 2009 26.5% 26.56% 2010 15.1% 19.35% 2011 2.1% 8.33% 2012 16.0% 16.94% 2013 32.4% 32.27% 2014 13.7% 15.76% 2015 1.4% 0.93% 2016 12.0% 11.83% 2017 21.8% 21.73% 2018 -4.4% -2.73% 2019 31.5% 27.97% 2020 18.4% 8.68% 2021 28.7% 25.99% 2022 -18.1% -6.21% 2023 26.3% 8.44% 2024 19.5% 11.44% -

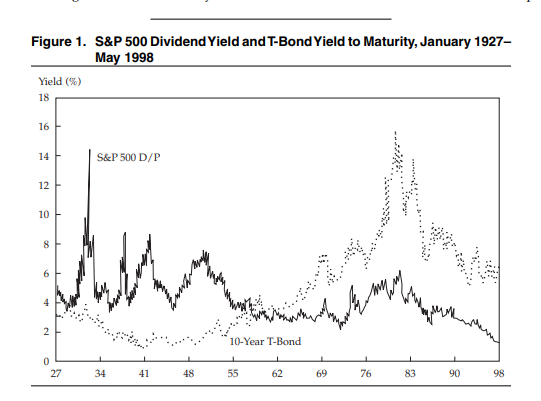

i think most assets with the exception of cash, short term TIPS are terrible inflation hedges in the short to intermediate term, but good over the long-term. But the short term becomes the long term in an unpredictable fashion. outside of inflation, being out of the market just leaves you open to your valuation framework being wrong and therefore being permanently left behind. Stocks used to yield more than bonds. that was the frameowrk. more risk = more income to compensate. If you waited for that to come back, y ou'd have gotten left behind. We think stocks should be at lower multiples, but maybe they shouldn't. being 70% cash you miss ever returning to whatever metric you're waiting for.

-

I generally think that people who are net savers who have jobs or businesses /unrelated sources of income that they can add to their portfolio should be relatively drawdown/volatility agnostic and I think those who are not those things should be drawdown aware and seek to mitigate volatility (to a degree). What I find difficult about that statement is as someone who is in between (nut = 13-18x+ spending, not 25+ but not just a few years either), I don't want to be set back by 3 or 5 or 10 years by a big drawdown so even though I'm a net saver, my stance has become more akin to a jobless rentier regarding desire to stomach a big drawdown. This will probably extend the working career a little because I'd probably have higher returns taking more risk/leverage/etc. but I don't really want to. Some folks take more risk as the nut get bigger. I'm definitely in the opposite camp. But I could never have <60-70% invested. That would basically frighten the hell out of me regarding the 1x irreversible inflation node.

-

Just what I have in my 401k, vanguard bond index, boring AF.

-

I, for one, am continuing to do what I did at start of thread. every $1 into my 401k goes into bond index. since 4/2022 the bond index has made 0.5%/yr while t-bills have made 4.1%/yr but starting from $0, $xK/month into bonds over that time period generates a +5.5% IRR and t-bills a +5.1% IRR. this is because bonds lost a fair bit of money relative to bills as yields rose and have started to come down, so the dollars invested when bonds yielded as high as 5.5% are now experiencing (small) capital gains as yields come down to the mid 4's. this is the appeal of bonds, it's damn near impossible to lose nominal money starting from a small amount and adding to them with flows and reinvestment of coupon. I was wrong on timing and started early in accumulating bonds, but have started to edge bills because of flows at higher yields and re-investment of coupon, even though bills still yield more than bonds (and have throughout this time) having something in toolkit that you know will make 4-5% on a 5-7 yr time horizon is nice. I just view it as slowly buying back my mortgage (technically buying everyone else's mortgage given MBS are big component of the AGG). none of it's very material but feeling slightly less stupid. of course, US stocks have tonned it, so should have just put it all in US stocks. the benefits from DCA'ing in more volatile stocks would be even more pronounced.

-

No, my excess liquidity is ~60% of my account. I could take out half my equity (and be 200% long) and still have a little breathing room. I would obviously not do this, but I definitely don't need to maintain the amount of margin you think. I mean really it's just that I have about 25% of my account in non-marginable securities. This makes sense as those are illiquid and trade OTC. they should be fully paid. I think IBKR is quite generous with margin, particularly portfolio margin. I recently had a 70% position in EQC in this same account, all of which borrowed. Hedging with options made the margin requirement equivalent to the non-put protected amount. I've taken a >100% position in PSTH in this account (once again protected with puts) to get a bunch of SPARC'ies one day. Just buy some 30% OTM puts on your stuff and watch the required margin collapes Test out what your margin does if you buy some January 2026 $90 PDD puts for $7 (5% of the current stock price) EDIT: FWIW i don't even see PDD as a high maint margin security. It's 20% for me.

-

35% isn’t that bad, I have no margin borrowed at this time and my maintainance margin is 40%. This is an aggregate of 3 100% margin positions that trade OTC and the rest being ~20%. Largest position is 15% and account owns 12 stocks. Ideally I should put the 100%ers in IRA’s, but don’t use enough mgn anymore for it to matter.

-

https://www.wsj.com/articles/SB898287577264756000 Buffett issued shares for Gen Re after a big run up in his stock and peak. Article mentions Berkshire running up to $80k, $37k 1998 BV, also note that the inputs to BV were expensive large cap stocks.

-

Awesome! I love it.

-

fair counterpoint, definitely know some folks who fit this narrative. real takeaway is that drinking a lot in college leads to strong professional outcomes

-

I went to a top 10 school. my fraternity brothers (all about 35 now) quant trader Restructuring lawyer VC *2 Equity research consultant dentist * 2 pain medicine doctor senior person at asset manager founder w/ decent exit to FAANG, started 2-3 companies so far wanderer (w/ varying degrees of employment) teacher don't know big law engineer @ defense company executive at railroad med tech executive CEO small software co non-profit stuff / development mgt consultant at MBB *2 now lots of these people would have been successful if they went to public school and plenty had lots of family connections / help, but it's tough for me to conclude the money our families spent on education was a waste. most of the above, except for the engineers have "useless" liberal arts degrees. I'd struggle to find someone making less than $400K (exception: teacher/nonprofit folks) and there are a few nice right tail outcomes as well. most are doing what they wanted to do or at the very least making a lot of $$$ in prep to do what they want to do. my school cost about $320K now for 4 years. we don't live in a meritocracy and the network / opportunities offered by elite education have significant value. maybe it won't always be like that, but it's hard to undo 300-400+ years of precedent. it's not necessary to succeed, but the base rate for success seems quite high based on my anecdata and objective rankings of schools w/ median income at 10 years after graduation. and it's practically free for families making <$100K at this point. <$150K at the best schools. so from my standpoint, most people who get in, should go. some edge cases (like say someone whose family makes $200K, but doesn't have a lot of savings and the person knows they want to be something where the network/branding/etc is of little value). but if family makes $700K or $100K, then I'd say that person should still go. pls excuse the poor writing/punctuation, wrote this quickly b/w stuff.

-

one reason to cover as an activist short is that you can find yourself overly successful in attracting other people shorting and risk borrow drying up, so if you got a portion of your profit in exchange for sharing your thesis, better to take the bird in hand.

-

yes, we agree here, he should not have lied about "staying long until X" and sold it that day. he should not have said he didn't take compensation from any HF's when in fact he did. he should not have said he managed external capital when he didn't (or implied it, unclear to me he actually said it). he definitely lied a few times, but much of the complaint seem very weak and has pretty big implications for anyone who speaks publicly about stocks with any kind of specificity.

-

it's not a question of ethics though is it? the law does not mandate ethics. it mandates following the law. what you or I consider distasteful doesn't matter, right? no one faces 20 years of jail time for cheating on one's spouse, even if it is unethical. I doubt that I'd like to spend any time with Left or have him marry my sister. lots of people do unethical things (some of what Left did I take issue with, some i do not), but not all of them are publicly charged by our government and facing up to 20 years in jail. e can't arbitrarily redefine what market manipulation is just because we don't like someone or don't like their investment strategy. that's what it feels like to me is happening here and that's why I hope he successfully defends himself. also I do agree with the critics that this will certainly silence potential short activists who are already the subject of enough persecution by companies and regulators. It feels the SEC is hollowing out a community that in aggregate likely does more to bring down bad companies than the SEC itself does.

-

yes. 2/26 = 7.6%. Making 7.6% in a day is a better IRR than making 3.5x in say 3-5 years...IF you have enough ideas to reinvest at similarly insane IRR's, perfectly reasonable to close out that day. Let's say Andrew's skill/podium were good for 7% every 2 months. in two years that's 125% return while only being exposed to one company on a fraction of trading days. he made a fair bit of money using only is own capital so it was effective, potentially even rational to monetize the short term moves in the stock. Saying something is worth $100 to the public does not carry any obligation to hold it to $100. one could certainly argue that it's 100% rational to do what he did and take the better risk adjusted returns particularly given the path dependency of shorting and degree tow which most ideas were shorts. that's what concerns me about this. the SEC seems to have made portfolio management a crime. if 5-10% in a day is too small a move, then what's the line? what about 20% in a week? a month? 3 months? to my knowledge the SEC has not mandated a holding period for a position on which you state an opinion of intrinsic value. nor should they. should one be penalized for effectively moving the market? no. if you say something false or just make shit up to try to then yes (which is my understanding of the law in place). the SEC seems to be shifting that with this case. I think SEC just doesn't like activist shortselling and needs something to show for their investigations these last three years. And there are clear instances where Left did lie...but not really about stocks, about stuff like not being compensated by HFs or implying that he managed external capital when he didn't. there I think it's more clear cut, but those don't strike me as serious as the other allegations. about the companies themselves, the SEC offers very little in their complaint regarding him saying untruthful things. as some bloggers and matt levinge have pointed out, he was often right (and sometimes wrong) in his analysis of companies, like any of us.

-

okay. just wanted to make sure we're looking at same thing. don't expect us to agree on this.