glider3834

Member-

Posts

978 -

Joined

-

Last visited

-

Days Won

3

Content Type

Profiles

Forums

Events

Everything posted by glider3834

-

GIG is included in investments in associates - on B/S in brackets Fairfax shows fair value of all associates 6772 vs 6091 carrying value - this includes both insurance associates and non-insurance associates. The excess of fair value number that Fairfax reports is for non-insurance associates and non-insurance subs. So it appears to exclude insurance associates like GIG or Digit.

-

-

At current mkt cap of around $1.3B USD - Fairfax stake in GIG looks to have increased to 573M currently from 425M (31 Dec-22) https://www.zawya.com/en/press-release/companies-news/gulf-insurance-group-announces-a-net-profit-of-kd-382mln-us-1247mln-for-the-year-2022-iim2lbrw

-

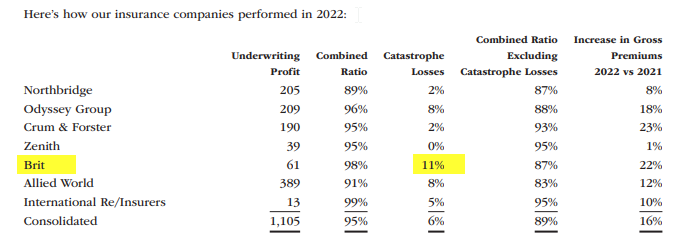

Fairfax's avg interest rate is 4.4% on its holdco debt & its mostly fixed and long term with staggered maturities and looks like no '23 maturities- it looks attractive from a funding/cost of capital standpoint at the moment considering the current Fed funds rate is around 4.5%. I think Fairfax should continue buying back shares held by minorities at Allied -they are paying an 8% preferred div to Allied minorities, so it makes sense to me to eliminate this plus they have a time limit - the option to buyout minorities expires Sep-24. Apart from debt, Fairfax can also target & reduce cat exposure as it is currently doing at Brit. 'Catastrophe losses continued to take their toll on Brit’s loss ratio, adding almost 11 points in 2022. Under new CEO Martin Thompson, actions are being taken to reduce the catastrophe exposure in the future.' (AR 2022) 'Only Brit has had a combined ratio greater than 100% since our purchase – due to larger than expected catastrophe losses. We expect this not to be repeated as Brit is reducing its catastrophe exposure significantly.' (AR 2022) (I have highlighted in bold)

-

https://www.hollywoodreporter.com/business/business-news/antenna-plus-stream-investment-fairfax-greece-expansion-1235357456/

-

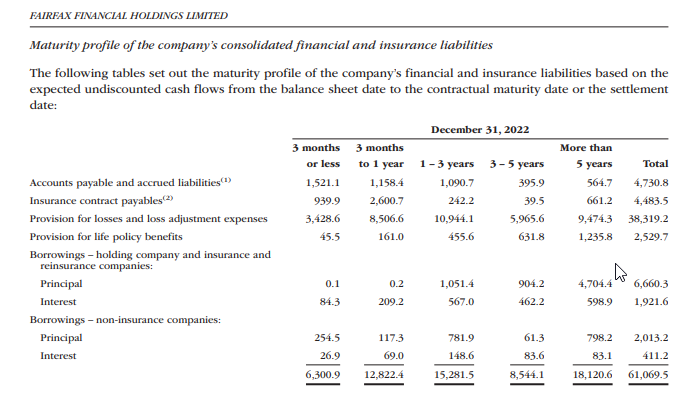

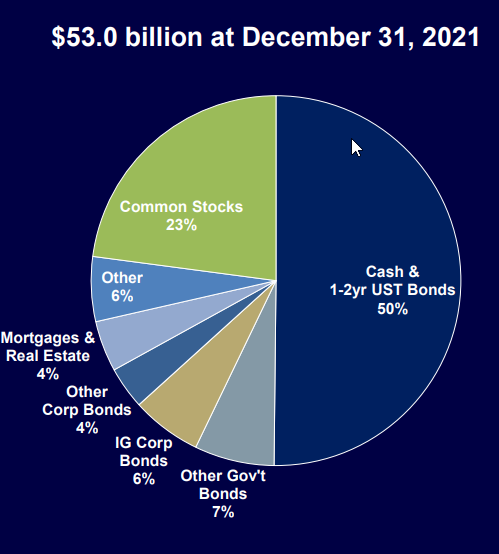

looking at their portfolio slide from last years AGM, I suspect that the common stock positions, real estate etc are being used to match the longer duration, 5 yr plus maturing liabilities

-

I am not sure to what extent 10 year Treasuries are an option for Fairfax if you look at their maturities table, appears around 56% of insurance and financial liabilities mature within 0-3 years, 14% in 3-5 years & remaining 30% after 5 years. For those longer duration liabilities like 10 yrs or more, & looks like Fairfax doesn't break out insurance liabilities after 5 yrs, wouldn't inflation hedge like investments, such as real estate, be preferable because rents can be increased whereas 10 year treasury rate are fixed

-

Eurobank recorded significant hedging gains in 2022 helping to offset increase in interest rates & Atlas has now fixed around 70% of its debt maturity interest cost - I just wonder how closely does Fairfax get involved/influence investees in asset liability strategy management because both Eurobank & Atlas appear to have handled higher rates - SVB has been a big casualty of higher rates and IMHO it would make sense for Fairfax to use their fixed income expertise to protect their equity investments in investees - I just wonder if that might be one reason why for some of their largest positions in financial services type businesses they would want control/influence at a board level...just a thought?

-

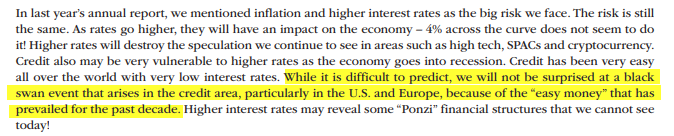

their high weighting in treasuries no surprise given PW's view - recent SVB failure definitely casualty of higher rates - impact on credit market is a wait & see

-

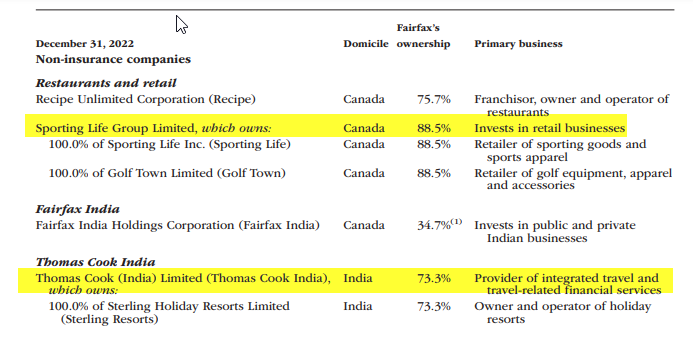

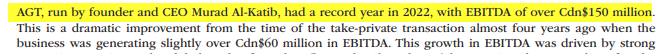

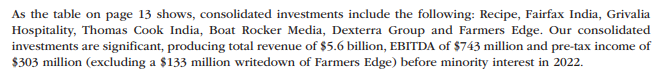

A few snippets that caught my eye - the increase in FFH's ownership of Sporting Life & Thomas Cook (India) - the $650M Increase in subs dividend capacity from $2B to 2.65B - if they achieve their $3B Op income target over next few years this could increase meaningfully. - their private mortgages investment with Kennedy Wilson look to be on a $190M annualised interest run-rate 'we have $2.4 billion invested through Kennedy Wilson in well-secured first mortgages, primarily on high quality residential apartment buildings, at a floating rate (currently 7.9%).' (2022 AR) compared to '$1.6 billion in first mortgages with Kennedy Wilson at an average rate of 4.5%, with an average term of three years.' (2021 AR.) - Atlas take private idea came from David Sokol - interesting ... - AGT had meaningful jump in EBITDA in 2022 - non-insurance subs are achieving meaningful EBITDA & pre-tax income of close to $300M

-

Just a reminder 'the company's annual 2022 annual report, which will include the Chairman's letter to shareholders will be posted on the company's website after 05:00 P.M. on March 10, 2023.'

-

'The bank initially planned to distribute a dividend this year. "The amount earmarked for dividend distribution (in 2023) will be used in an optimal way to bid for the 1.4% HFSF stake through a share buyback scheme," said Eurobank's Chief Executive Fokion Karavias.' (Reuters)

-

https://www.reuters.com/markets/europe/greeces-eurobank-posts-big-jump-2022-profit-2023-03-09/

-

Something I just picked up from Markel's Q4 results 'While these measures, considered independently of other factors, fall below our internal targets, we remain confident in the strong operating performance of our businesses. In addition, we give consideration to the following information in assessing our compound annual growth in book value per common share: Amortization expense - As we grow through acquisitions, our intangible assets grow. GAAP requires that we amortize a portion of these acquired intangible assets, which is a non-cash charge to net income. Amortization of acquired intangible assets for the five-year period ended December 31, 2022 totaled $763.2 million.' In 2021, Fairfax recorded an approx $97M non-cash amortization expense for customer & broker relationships. It has averaged around $100M for FFH over the last 4 years. This expense is largely included in corporate overhead & other and related to acquisitions of Allied World & Crum & Forster 'Conversely, the concept of recording charges against other intangibles, such as customer relationships, arises from purchase-accounting rules and clearly does not reflect economic reality.' ( Buffett) Given the significant growth in their insurance/reinsurance subs since acquisition, I think there is a strong case to argue this expense doesn't reflect economic reality or true 'owner earnings'. If we add back this expense for last 6 years (2016-21) , FFH's book value would increase by around US$500M and pre-tax earnings by around US$100M per year. Since 2009 to 2021, the total accumulated non-cash amortization expense for customer & broker relationships is US$577M. Cheers

-

Eurobank have agreed to sell their Serbian banking business Eurobank Direktna - I think boils down to they didn't have enough scale in Serbia - they own 70% should receive b/w 195-200M euro - ‘The sale was made at a premium , if it is calculated that it values the Serbian bank almost at its book value with a P/V of 0.98, i.e. higher than not only Greek, but even European banks trading at an average P/V of around 0.90.’ https://seenews.com/news/serbias-aik-banka-to-acquire-eurobank-direktna-for-280-mln-euro-816461 - 'The sale came as the Serbian bank had a small share of around 5.5%-6% in the local market and thus its size was a hindrance in an attempt to make Eurobank a strategic player in the market.' https://www.pagenews.gr/2023/03/04/nea-agoras/eurobank-giati-poulise-ti-thygatriki-sti-serbia-ta-epomena-bimata/ - according to Eurobank - this bank was not meeting their RoTBV target threshold 'is in line with Eurobank's strategy to direct capital to investments with higher return prospects (RoTBV) and further strengthen its presence in the main markets in which it operates, specifically in Greece, Bulgaria and Cyprus.' https://www.insider.gr/epiheiriseis/265761/eurobank-desmeytiki-symfonia-me-aik-banka-beograd-gia-tin-polisi-tis - will add 0.5 % point to Eurobank's CET1 capital ratio so on paper based on media reports above, looks like another decent capital allocation move

-

RFP transaction has closed https://resolutefp.mediaroom.com/2023-03-01-Paper-Excellence-Welcomes-Resolute-Into-Its-Family-of-Companies

-

not me lol but looks like now Mr Market is in weighing mode - also they have mooted a potential dividend in 2023 - lets see what happens

-

from an investment return perspective it will be better than a double - with total return they collect share price appreciation plus the dividend - I am not sure what their interest cost is(LIBOR/reference rate + spread) but lets say around 7% p.a to keep it the TRS open - the return could be 5-6x bagger over that 2 plus year time frame - again just speculating hopefully Prem will provide their all in cost

-

yes definitely - Hellenic Bank's mkt cap is around €800M & Hellenic expect pre-tax profit to exceed €200M in 2023 - so its trading at say 4x pre-tax profit but Eurobank look to have paid around 2.2x 2023 pre-tax profit

-

EUROB.AT - Eurobank look to have picked up around €107M or 83% return on their Hellenic Bank investment in just over 18 mths , assuming 13.4% acquisition approved

-

thanks for your work viking non-insurance ops - I think the AR should provide some detail hopefully we can dig into the numbers a bit more - I wonder how the investment team think about correlated risk in their investment portfolio - for example low natural gas 12mth strip prices are a headwind for Exco but for Stelco they are a tailwind as natural gas is key input cost for steel, similarly higher interest rates are a headwind for Atlas (although Atlas has fixed 70% or so of its borrowings) but work as a tailwind for FFH's insurance ops. interest & dividends - based on my calcs they are currently earning around 3.9% on their $38B fixed income portfolio - given US1,2,3y are all in mid to high 4s and mortgage bonds, corp bonds etc will be higher - I can see potential opportunity for them to raise bit more both yield & duration - so you have estimated 1.6B & I agree think thats possible they can push yield beyond 1.5B - each 0.5% of additional yield would be equal to an extra $190M

-

I was surprised viking when prem w on Q4 call said share profit from associates & non-insurance would conservatively be around $500M in 2023 - can we say he is possibly setting the bar low? In 2022, just Atlas & Eurobank provided $520M

-

I forgot to add for context that global insured losses from natural catastrophe in 2017 were around $130B & Aon has recently estimated a similar figure for 2022 https://www.reinsurancene.ws/natural-disasters-caused-over-130bn-global-insured-losses-in-2022-aon/ so Fairfax exposure looks to have remained around the same level - around 1% of global insured loss in both years