gfp

Member-

Posts

5,641 -

Joined

-

Last visited

-

Days Won

12

Content Type

Profiles

Forums

Events

Everything posted by gfp

-

Fairfax book value or share price will touch US $ 2000 before 2027 end.

gfp replied to Haryana's topic in Fairfax Financial

Ha! Well, something happened - assigning causation accurately isn't quite that simple. How do excess bank reserves impact the real economy when bank lending is not even close to being constrained by the level of bank reserves? Neutered money only useful as tokens between the largest mega banks. And QE removes highly useful, interest paying, pristine collateral that can be transformed into virtually anything and/or leveraged! -

Fairfax book value or share price will touch US $ 2000 before 2027 end.

gfp replied to Haryana's topic in Fairfax Financial

We'll just have to agree to disagree on the effectiveness of QE / QT. I couldn't disagree more! -

-

Poor Berkshire only owns 70 shares of BHE! Imagine calling the family with the other 6 shares and asking them to pony up their share.

-

It may be one reason they are selling BYD but definitely not Apple. BHE can bankrupt Pacificorp in a worst case. I don’t expect that at all. I expect methodical settlements and plenty of liquidity to pay them. BHE itself is not at risk of bankruptcy. Berkshire not even close

-

I don't know if they sold it right then, but I did just check their NAIC portfolio and MKL doesn't own any Fairfax shares as of 12/31/2023. 13F filings do not require disclosure of over-the-counter (non-exchange listed) stocks or foreign stocks. I don't know why they included it previously but maybe they owned the NYSE-listed Fairfax shares until 2009 and somehow that became FRFHF and they kept up the disclosure out of habit. I will list MKL's foreign stock holdings in case anybody has interest in that - Diageo Pernod Ricard Sony Group ADR AON Accenture Brookfield Reinsurance Ferguson Linde RennaissanceRe Willis Towers Watson Spotify

-

It's hard to tell whether they just stopped listing it on their 13F on that date or actually sold 100% of the position in one quarter.

-

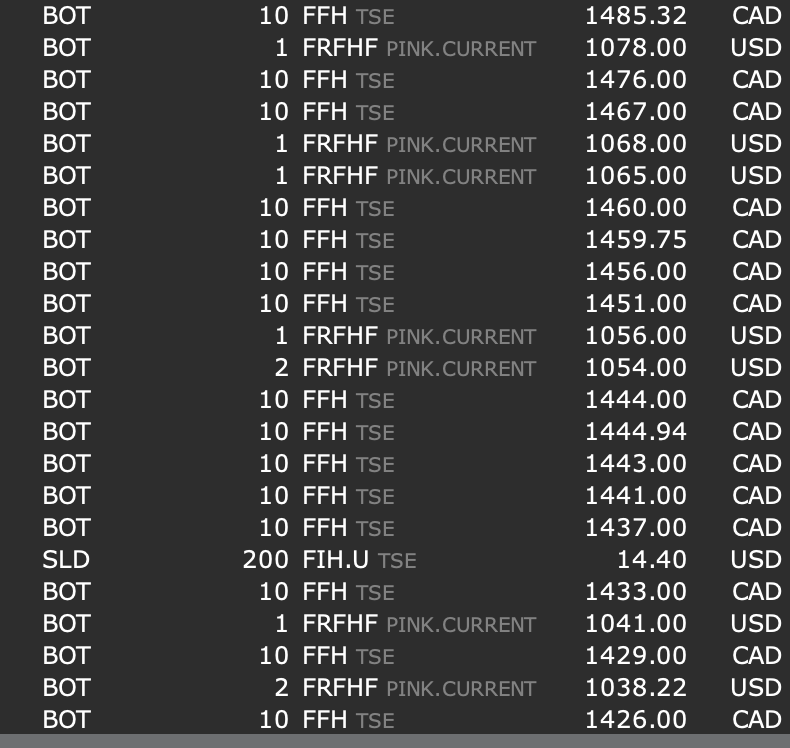

I just had some orders filled at 1064 USD and 1468 CAD. Happy to have it continue lower

-

Berkshire doesn't own any Fairfax stock. I've never checked if Markel does - it wouldn't be on the 13F so you would have to check the NAIC filings for several of MKL's insurance subs to find out. Watsa family has been pretty clear that Fairfax is not for sale. They are painting their own painting.

-

For those that like more detail, here are the BHE and BNSF 10-Qs BHE: https://www.sec.gov/ix?doc=/Archives/edgar/data/1081316/000108131624000016/bhe-20240630.htm BNSF: https://www.sec.gov/ix?doc=/Archives/edgar/data/934612/000093461224000012/bni-20240630.htm

-

Don't worry about Mr. Buffett. He knows what he is doing. He has sold fixed rate corporate bonds in JPY. He has locked in the very low rates that he pays for the duration of each bond. The bonds serve as a natural currency hedge to the Japanese equities he bought. The Japanese equities yield more than the (tax deductible) interest on the JPY debt. This is "positive carry" so yes technically it is some version of the "Yen Carry Trade." But unlike most Yen borrowers, who want to borrow JPY to buy higher yielding assets in other countries and are exposed to swap spreads and changes in holding costs of their trade, Buffett is borrowing JPY fixed rate and investing the proceeds in Japan. Berkshire has no problem if refinancing JPY bonds becomes less attractive because Berkshire can just own the Japanese stocks funded with equity, or better yet, negative cost float. If he expands his insurance business in Japan, he could even conceivably fund the Japanese equities with JPY denominated negative cost float.

-

Remember the good old days, when news of Mars buying up Kellanova's Cheez-its would involve a call to Omaha and a nice bespoke preferred stock deal? What would the rate be on something like that today - 8% plus some redemption premium?

-

Great post @longterminvestor - thanks as always for the classroom time

-

Bets on whether BRK closes up on the day today?

-

I know when I'm panicking on the stock market a newly cashed-up Berkshire and a leveraged government bond portfolio in Fairfax are the first sell buttons I smash!

-

Question for the board - with Canadian stock markets being closed today, does anybody remember if US OTC ticker FRFHF trades today?

-

Hopefully everyone realizes that 1) of course they can do it, and 2) it won't help and never has so we should just shelve the whole QE / QT tool. Let's ask Japanese bankers how amazing it works.

-

Well don't get too worked up on the VIX - the market hasn't even opened yet. I'm buying in SPY shorts at 510 this morning. Huge drops like this are not how bear markets get started. Bear markets are more like boiling frog nobody notices we are getting so far from the highs. 5% drops are more like the end of bear markets. I just think it's funny that people think the Fed cutting interest rates is going to help. I have a commercial RE loan coming up for rate reset in May 2025 so I'm perfectly happy if they cut like crazy all of a sudden - but what the market has gone and priced in (multiple 50 bps cuts and inter-meeting cuts and all out panic) seems a bit of an over-reaction.

-

I was looking up BRK's taxable realized gains for the first six months and it was $73.7 Billion. Pencil in a 20% effective tax rate and it's around $15 Billion they will send in to the Treasury. T-bill interest on $300 Billion gets sent back over to BRK... $15 Billion (pre-tax, I know). Just liked the symmetry of it

-

-

What on earth in the Fed's toolkit would have made any difference at all in the type of inflation we experienced?

-

NYT has an article by Das out this morning about the Gates-Buffett relationship that I suppose is an excerpt from this book. Reading it now but don't have a link to send. I'm sure it is on the NYT website

-

What is your top 3 business/finance/investing books you've read?

gfp replied to schin's topic in General Discussion

All of my favorites are the biographies and autobiographies. Basically the case study method. Usually pretty entertaining. -

Don't think it is a sign of a top in Berkshire

-

Well it was 2.5% of Apple in a quarter. And I'll bet it corresponded with the period Apple went sideways for a long time. Then he probably stopped, at an even 400m shares (same as Coke!). And Apple was unburdened to break higher. Plus he told us ahead of time he was selling and would be selling some more and would have over $200 B in cash on the books. He probably already had the $200 B when he said that.