MMM20

Member-

Posts

1,870 -

Joined

-

Last visited

-

Days Won

10

Content Type

Profiles

Forums

Events

Everything posted by MMM20

-

Maybe now Mr Market starts paying more attention to the structurally higher earnings power.

-

This is a better question for the MKL board FFH goes for it with some big positions, even if they're not everyone's cup of tea. I believe roughly a half dozen investments (across everything) add up to roughly half the NAV. The same is roughly true for BRK. I don't think it's anywhere close to that for MKL nowadays, but please correct me if I'm wrong. Also, I ask myself a similar question about short selling. Why bother with a few insignificant short positions if they're just another thing to track and never move the needle? I think the answer is it makes you better as a long investor to be able to adopt the mindset and framework of a short seller. The same is probably true of Fairfax with their big positions, even something like the GFC big short, the Digit investment, or maybe even the mid 2010s insurance acquisitions. Would they have pulled these things off if they simply indexed? Maybe not! So you take the good with the bad and focus on where it all nets out. And the result has been pretty damn good over a pretty damn long time period.

-

You can argue that earnings in the out years would be lower (I'm skeptical) but don't forget that the fair multiple of those earnings would be higher - holding ERP constant at least.

-

Just thinking though downside scenarios. Does anyone know if the KW vehicles are set up in such a way that, worst case, Fairfax can hold indefinitely? If I’m an insurance company I might want to just go team #neversell on some quality real estate anyway. Of course there are opportunity costs and let’s hope we don’t end up with real estate broadly cut in half but better not to be forced sellers in such a scenario.

-

In a downside case where cap rates double or whatever, can't KW/Fairfax foreclose and just hold the properties?

-

Does anyone here have a view on whether this should matter much to Fairfax investors? https://lindynewsletter.beehiiv.com/p/borders-lindy The Canada Experiment In a bold and unprecedented move, Canada is embarking on an audacious experiment, opening its doors to millions of high-skilled immigrants in a bid to outpace the economic might of its southern neighbor, America. This strategy is anchored in the belief that an infusion of skilled talent can catalyze innovation, boost productivity, and propel Canada to new economic heights, potentially surpassing the United States in wealth and technological advancement. In 2023, Canada is on track to welcome nearly 500,000 new permanent residents, marking a significant increase from previous years and surpassing its annual target. The plan is to keep this going, adding millions every 2 years and turning Canada into a 20-40 percent high-skilled immigrant country. However, this gamble carries with it the risk of significant societal upheaval. If the policy fails to integrate these new immigrants smoothly, or if it inadvertently exacerbates economic disparities and cultural tensions, Canada could find itself grappling with deep internal divisions. In the worst-case scenario, such tensions could escalate into widespread civil unrest or states seceding from the union like Quebec or Alberta. What if it’s successful? In a successful scenario of Canada's immigration strategy, the country actively transforms into an economic superpower, surpassing even the United States. By welcoming millions of high-skilled immigrants, Canada ignites an innovation and productivity renaissance. Cities like Toronto, Vancouver, and Montreal rapidly develop into global tech hubs, challenging Silicon Valley's dominance. Canadian companies, driven by a diverse and talented workforce, lead groundbreaking advancements in fields like AI, renewable energy, and biotechnology, attracting worldwide investments. This is a high stakes gamble. If Canada’s plan works. If you can just import high-skilled immigrants and create an economic superpower, than America may copy it. A lot of people want to move to America. Billions. We are all waiting and watching the Canadian experiment.

-

Ring true for you too @Viking? “The best ideas are usually the ones most people find unappealing, even if the investment thesis is articulated well. This is why you may have found it frustrating to share your best ideas, even if - or maybe *especially* if - those ideas went on to be big winners.” -John Mihaljevic

-

Are global scale economies not a moat in the insurance business? I think we’ve increasingly seen that in Fairfax’s results. And could a deep pocketed investor replicate Fairfax’s footprint and well managed operation today? How much capital and how many years and missteps would that take? I think that’s real now. Also, what are the best private businesses in Canada? Would those owners see Prem as someone who would take good care of their babies and so consider selling to FFH at lower prices than some random private equity firms? If not, well, that seems like a missed opportunity. I think of that as the secret sauce for BRK, a reputation well and hard earned over many decades of doing what they say as permanent owners. So to the degree Fairfax is moving in that direction, they are gradually widening the moat and incremental returns should remain high (if volatile/chunky) for a long time.

-

Has anyone here made a big investment that didn’t work out? And have you still made good returns on your overall portfolio? I’ll be the first to raise my hand. I’ve owned an EM value fund for the last ~15 years and still compounded at mid-high teens. Do I get no credit for the overall result because I got one big decision wrong? For that matter I also missed the easy money in big tech. Should that define me as an investor? This is what I think about whenever anyone writes more than one sentence about BB nowadays. I get the baggage and it’s painful to think about the opportunity cost of owning Brazilian crap for the last ~15 years too. But doesn’t that clearly miss the forest for one single tree? It is almost like writing a 10 page report about how Berkshire is uninvestable because of Precision Castparts or, like, Snowflake, I don’t know. I’m sure there’s a better comparison, but why not focus on Fairfax’s insurance acquisitions that were brilliantly timed in retrospect, or any of the investments that actually move the needle for Fairfax today? I’m not sure I’ve seen a bigger disconnect between spilled ink and what actually matters to a company now and looking forward. It is a bit exasperating.

-

Yeah it doesn't make sense to me either, but I always have these sorts of tensions with these "someone else's fund" sort of investments. I want them doing things that I wouldn't do myself, eg Fairfax with Digit, Berkshire with Apple, Exor with Ferrari/Stellantis, and all technology/biotech venture capital for that matter. I guess the question is just whether there is an ethical issue - if the critics have a valid point that they're taking advantage the public with overhyped expensive IPOs and/or minority shareholders with take privates at obviously depressed pricing. Why not just inject capital and take the public for the ride to redemption and burnish your reputation that way? Maybe because it's just too expensive to be a tiny public company nowadays? There is no way I would even take a look at Farmers Edge personally... but that's part of why I own Fairfax. I just want to know I'm going to be treated fairly as a partner and that they aren't bailing out their friends. So if nothing else, maybe this sort of thing just puts a lid on multiple expansion?

-

I don’t get it either, but we are talking about one day of cash flow for this.

-

~15% ish should be sustainable for a pretty long time if we're in a more normal interest rate environment... really for as long as small and mid cap equities can move the needle. The issue for Buffett now is that a $5B home run investment in the Japanese trading companies adds what, like 100-200 bps to BRK intrinsic value? Things like that are barely worth his time so he goes elephant hunting in mega caps, right? By contrast, Eurobank and Digit could each add 1000-2000+ bps to FFH IVPS over a few years if things cut a certain way.

-

The bad news... https://inc42.com/buzz/ipo-bound-go-digit-gets-show-cause-notice-multiple-advisories-from-insurance-regulator/ IPO Bound Go Digit Gets Show Cause Notice, Multiple Advisories From Insurance Regulator 14 Nov'23 Insurtech major Go Digit General Insurance, which is gearing up for its initial public offering (IPO), has received a show cause notice and multiple advisories from the Insurance Regulatory and Development Authority of India (IRDAI) last month, the company said in a new addendum to its draft prospectus filed with the Securities And Exchange Board of India (SEBI). The development comes at a time when the company’s IPO is yet to receive final approval from the SEBI even after Go Digit refiled its draft red herring prospectus (DRHP) addressing certain concerns that the market regulator had raised earlier. Go Digit revealed that the show cause notice from IRDAI has alleged non-disclosure of change in the conversion ratio of the CCPS issued by Go Digit Infoworks Services (GDISPL), the parent of Go Digit General Insurance, to FAL Corporation. FAL Corporation is a part of Canada-based Fairfax Financial Holdings, which is one of the major investors in Go Digit. “In terms of the Notice, the change in the conversion ratio of 6,300,000 CCPS issued by GDISPL to FAL Corporation, from ‘1 CCPS for 2.324 equity shares’ to ‘2.324 CCPS for each equity share’, which was reflected by way of an amendment to the JV Agreement dated August 11, 2022, is a material change to the information furnished at the time of applying for registration to the IRDAI,” the company’s regulatory disclosure to SEBI said. As per the notice, Go Digit was expected to provide the details of such change to the IRDAI but it did not furnish the “full particulars”. Hence, IRDAI has also alleged that the startup is in violation of Section 26 of the Insurance Act. If an adverse order is passed against Go Digit and its officers responsible for the non-compliance, the insurtech unicorn would be slapped with a maximum penalty of INR 1 Lakh for each day during which such failure continues, or INR 1 Cr, whichever is lower, the addendum mentioned. Besides, IRDAI has also issued certain advisories and cautioned Go Digit on a few aspects. The advisory notice has been issued for failing to take the insurance regulator’s approval for the change in remuneration of its Chief Executive Officer (CEO) on the account of the change in ESAR 2018 (employee stock appreciation rights scheme) to ESOP 2018 (employee stock option plans) and for failing to inform IRDAI of the retrospective grant of ESARs prior to the date of grant of the company’s certificate of registration. “In the event the IRDAI is not satisfied with our responses or we fail to adhere to the advisories and cautions issued by the IRDAI, we may be subject to warnings, show-cause notices and/ or penalties in the future, which would, amongst other things, adversely impact our brand and reputation,” Go Digit said in its regulatory disclosure to SEBI. Meanwhile, the IRDAI has also cautioned the startup to ensure due care and correct disclosures in the offer documents, of the position in relation to the commission on long-term policies and that acquisition costs incurred in the year, among several other advisories issued. It is pertinent to note that Go Digit filed its DRHP with the SEBI in August last year. Within months, it also received the IRDAI’s approval to launch the IPO in November last year though SEBI had kept the IPO in ‘abeyance’. In March this year, the startup refiled the DRHP with the market regulator for its $440 Mn, addressing the latter’s concerns about its ESOPs. In the latest filing, Go Digit said its erstwhile Go Digit – Employee Stock Appreciation Rights Plan, 2018 has been amended and changed to ESOP 2018, pursuant to the resolutions passed by the board and shareholders on March 21, 2023 and March 27, 2023, respectively. Founded in 2017 by Kamesh Goyal, Go Digit offers insurance policies across verticals including motor vehicle, health, travel, and property. Besides Prem Watsa’s Fairfax, the startup is also backed by prominent names such as Sequoia, cricketer Virat Kohli, and actor Anushka Sharma. Go Digit’s IPO comprises a fresh issue of shares worth INR 1,250 Cr and an offer for sale (OFS) of 109.45 Mn shares.

-

The good news... https://www.apnnews.com/digit-insurance-wins-digital-insurer-of-the-year-award-at-asia-insurance-industry-awards-2023/ Digit Insurance wins Digital Insurer of the Year Award at Asia Insurance Industry Awards 2023 Published on November 14, 2023 Bengaluru: Go Digit General Insurance Limited, one of India’s leading digital full stack insurance companies, announced it has won the “Digital Insurer of the Year” Award at the prestigious 27th Asia Insurance Industry Awards 2023 held in Singapore. This is Digit’s fourth AIIA award in the last five years. The Asia Insurance Industry Awards, 2023 stated that “Digit’s technological innovations have enabled it to achieve efficient underwriting, which is its differentiator from other insurer.” Digit’s hybrid model of AI-enabled analytics and human assessment along with its partnership-based model has helped the company mitigate India’s geographic limitations. Hong Kong-based AIA Group and FWD Group were the other two finalists for the Digital Insurer of the Year category. Only two Indian companies won an award at this year’s edition. Digit Insurance is also the only Indian insurance company to have bagged the Digital Insurer of the Year award twice in the last five years. The company had bagged the General Insurance Company of the Year Award back-to-back in 2019 and 2020. Digit is also the only Indian company to be nominated this year for two organizational categories, the other being “Technology Initiative of the Year” award. Commenting on the win, Jasleen Kohli, MD & CEO, Digit Insurance, said, “We are extremely honoured and delighted to win the prestigious Asia Insurance Industry Award. Winning the ‘Digital Insurer of the Year’ is truly special as it is a testimony of our in-house tech capabilities that form the backbone of our company. Our advanced tech platform is surely one of our competitive strengths that has aided in our growth and helped us in delivering high quality customer experience.” The entries were judged by a panel of 26 expert judges from across the insurance industry and the winners were chosen from nearly 200 entries in 17 categories received from insurance companies all over Asia. The awards are well known for their stringent criteria and transparent selection process and is overseen by a panel of expert judges from across the insurance industry.

-

Maybe the goldilocks scenario is that but still with some big drawdowns so Prem can do a few more big auction buybacks. Buckle up?

-

Play around with the numbers yourself and decide what you think is fair, but this is one way to get to ~15%. Someone please tell me if I'm missing something stupid. Didn't sleep much last night. Investments ~$40B cash+fixed income @ ~5-6% yield ~$20B equities @ ~8-10% total return = ~$4-4.5B return on assets Financed in part by ~$30B float @ ~2-3% net margin (~97-98% combined) = negative $600-900mm ~$10B in debt+prefs @ 7-8% = ~$700-800mm = ~zero net financing cost minus opex and taxes ~$3-3.5B net income vs ~$20B equity = ~15%+ ROE Let's see if Prem follows through on his Teledyne inclinations and takes out enough stock over time to shrink book value to 0. If he does, I think some of our board members' heads might explode BTW even if we're looking at more like a ~10-12% ROE, that's enough for a ~15%+ per share return if they're using cash flow to buy back big chunks of stock at big discounts to IV (eg Dec '21).

-

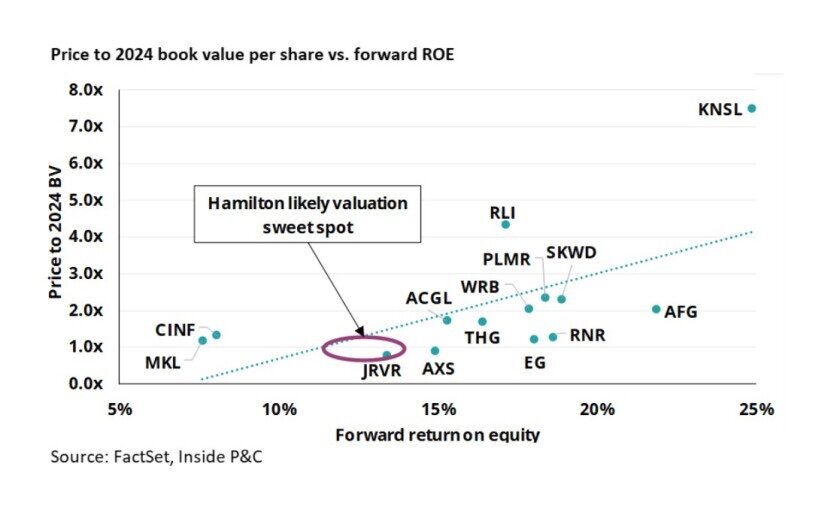

Maybe the catalyst for FFH to rerate to ~1.4x book (low teens normalized earnings) is the marginal MKL shareholder (re)discovering FFH. As a noted MKL hater, nothing would please me more.

-

I guess two things can be true. https://hiddenvaluegems.com/on-markets-investing/tpost/8v4518sn71-best-industry-for-building-wealth What industry is responsible for creating the most significant financial wealth? The most common answer would be Technology. At least, it appears so if you measure wealth by the number of millionaires or billionaires created in a particular sector. Definitely, in the past 30 years. However, if you add the number of people who have tried but failed in IT, the ratio becomes less favourable. If you also track the wealth of “investors” rather than the “founders”, I am afraid the results could be even more disappointing. I had a different sector in mind. It is the one that encourages long-term thinking and narrow expertise, is rather dull and is not growing at a double-digit rate. In fact, running this business was quite a tough job in the past decade. However, companies run by managers with skin in the game and excellent capital allocation skills have done phenomenally well over many decades. This sector is insurance. Considered a boring sector, it helped some shrewd operators amass wealth over many decades.

-

I hope we can all agree that ~100-200x sales probably isn’t fair for Fairfax (maybe Digit )… but hey maybe ~16x normalized p/e or something like ~US$2000? My sense is many investors are reluctant to believe that can be true when the stock is already a ~3x in ~3 years or whatever it is exactly. We should stand to benefit.

-

Sovereign bonds were an all time bubble. Yields were insanely low - like at 5,000 year lows. You were not getting compensated for taking duration risk. Yes, this was obvious at the time. We just had no idea how long it would go on. In that sense, FFH’s short duration was just another old school mean reversion value investment - things were so stretched and historically insane at that time that if it wasn’t covid, it probably would’ve been something else within that rough sort of timeframe. There’s always something that people point to as the "trigger" to create an obvious and coherent narrative in retrospect, but we are really always dealing with probabilities of future states of the world - and I'll never be convinced that the probabilities weren't heavily skewed against rates being pinned to the zero bound for another decade. IMHO, the lucky ones were really the other guys who kept going hard into long duration in bonds and equities all the way up (down?) - that they haven’t gotten blown up even worse! 20 years sounds like a long time to base your historical analysis, but maybe not if more than half of those years were an all time crazy interest rate environment. The market is still anchored to that crazy environment in a bunch of ways, one of which is looking at Fairfax’s performance then and expecting reversion to that. So I think the big picture counterpoint is that maybe we are still bouncing off an all time insanely low point for fundamentals and sentiment. Maybe we are still less than halfway through the correction. I would also just point out that float has grown so much that IMHO we can expect through the cycle to make ~$70-90+/share pretax just from ~500-600 bps spread between fixed income and underwriting profitability (call it 4-5% vs ~99% combined). So IMHO we are at a fair ~10-12x pretax earnings on that piece alone, ie if you assume almost zero contribution (like a ~2% annualized return) from their ~$20B ish equity portfolio to offset overheads. That’s fair now? I would argue something like ~8% is reasonable if not conservative on their total equity portfolio now. And that puts us at high single digits normalized p/e, like ~8-9x - with zero credit from the "windfall" of ~1000 bps spreads between underwriting and fixed income returns, for however long that lasts. I personally would also expect them to pull another pet insurance rabbit out of their hat, I agree with Quincy Lee that Eurobank could easily be a ~2-3x over 3-5 years, and I wouldn’t be surprised if Digit is a ~$10-20B company in 3-5 years. So we’ve got those sorts of upside risks too - it's hard to be super bullish on FFH without being bullish those chunky investments, which are super additive to my own portfolio diversification. Again, I am probably too bullish, but I don’t think we should weight the ~2010-2020 experience very heavily at all looking forward, and every reasonable pushback on this one seems to be some version of that.

-

I’ll have more to add later but I think things like the pet insurance sale and digit investment are instructive.

-

Missing the trees for the forest

-

Hard to complain but the frustration is that I’ve been right on the fundamental inflection and the earnings power has ramped massively higher… and yet if you do the work you see that the valuation is basically the same depressed level as ~1-2 years ago. I think valuation on that earnings power easily would’ve doubled by now in most situations like this, and then FFH would already be a ~5x sort of investment to US$1500-2000 and everyone could transact at a fair enough price, which to Buffett’s point is what a company should really want for itself and its shareholders - yes, even if it means the company can’t buy back as many shares quite so cheap. And then I could then trim a bit to take advantage of lots of bargains elsewhere these days, which definitely wasn’t the case ~2 years back. I’d rather not cut the flowers yet when I’m quite convinced fair value is at least 100% higher and that leaves me very concentrated at a time when there are a lot of cheap stocks and I really should probably diversify so I'm a bit more robust. So yeah, there’s the cognitive dissonance. High class problem, fine, fair point. But maybe Mr Market is starting to catch on, and if buybacks really ramp, we should benefit in a major way from the cheapness, even though some Toronto widow is losing out if she needs to sell a share to pay for groceries and heat this month. We know the company understands and admires the Teledyne case and is now willing and able to take advantage of widows... the haters are right, Prem is a bad guy!