Castanza

Member-

Posts

4,135 -

Joined

-

Last visited

-

Days Won

6

Content Type

Profiles

Forums

Events

Everything posted by Castanza

-

The difference is Joe who gets laid off from the local bus garage making $16/hr with decant benefits isn't going to be picking from 6 other bus garages paying similar wages. No, he's going to be looking at the local salvage yard, two men and a truck, or a shelf stocking job at Petco. All those tech people are getting laid off from over inflated positions with overinflated salaries. They will ALL land on their feet just fine. Most of them (if smart) should have a decent savings and be able to afford living expenses for a few months while they figure it out. And if they don't that's on them. Meanwhile Joe from the bus garage is three weeks into finding a new job. Probably has less than 5k in his bank account at any given time. Joe doesn't have enough money to relocate to a new area with more jobs. Joe is one car breakdown or dentist/doctor visit from his kid to having to max his credit cards or worse pull from his 401k to make a payment. Just like a business FCF is king. Rich people make decision to be levered to the gills. Poor people are leverage by default. All I'm saying is, there is a lot less flexibility for the lower class than there is for us. When we make a choice between going to a steak house or Chipotle, there is someone else making the choice of putting money into a new muffler or paying their kids Little League initiation fee. I can see both arguments. I don't envy Powell and his position as it's not easy (dare I say impossible) to balance all that. there will always be unintended consequences.

-

Maybe the poor wouldn't need handouts if they weren't constantly getting fucked by the rich. I am against welfare and the expansion of it for 90% of people. But with all the meddling that has gone on for the past two decades and zero growth to show for it in terms of wages for the middle and lower middle class how can anyone continue to justify more economic planning? The rich get their cake, eat it, then just expand welfare to feel better about themselves. How many people making sub 50k a year were buying stocks the past two days? I do agree that many poor "fuck themselves". I agree with the IQ statement and have said the same thing on this board before. It's a real problem. 10% of the pop has IQ below 83 and we also have a 10% poverty rate. Coincidence? I think not. @RedLion Say the Fed cuts 2-3m jobs. Whos jobs? It will be mom and pop shops, service industry jobs, construction jobs, labor jobs. So you can say the poor fuck themselves (I agree, a lot of them do). But they are also the primary ones who get fucked in situations like this. I think what pisses me off most is all of these policies lead to more corporatocracy. Same thing during Covid...who got shut down? Not the big guys.

-

Banking vs Brokerage Question for Deposits or Stock Holdings

Castanza replied to Saluki's topic in General Discussion

Yup and I completely understand that perspective. You're probably right I'm taking future cash off the table. But nothing is certain in the future: "Bird in the hand is worth two in the bush". My risk appetite is more flexible than someone who has a subscription based lifestyle. My cashflow for investments is higher in the near term and gives me more flexibility for other investments. Jobs wise I feel way more flexible and less dependent on the place I work now. As I said, completely personal opinion and I know historically speaking I am probably losing out on some returns (should history repeat). There is also a life enjoyment aspect to this. I know plenty of people who own 500k+ houses at good rates but their housing costs to income ratios are off. So they are handicapped with investments, savings, and simply going and doing things; something that is often overlooked in my opinion. I don't want to only enjoy life when I'm 65. Most people invest to be rich but I invest and save to have peace of mind and generally live "free". -

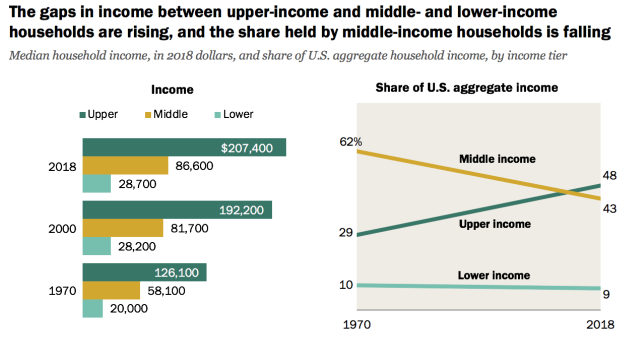

That answer depends entirely on where you fall on the socio-economic ladder. You widen the wealth gap doing this because you force poor families to cut back more on spending and wage growth at the bottom of the ladder also stagnates. Both of these reduce savings (less income) and economic mobility (fewer job opportunities). Who isn't affected? Those in the upper class. The middle class is affected as well, but they generally can absorb it and have more mobility. In the end Your always fucking the poor. I'm not a fan of all the meddling personally. I think what you read in textbooks doesn't work in the real world as it's intended. Frankly I don't think anyone knows what the fuck they are doing when it comes to managing complex economic systems. It's just guess work and dick swinging. Not a single policy between 1970 and 2018 has been a net positive for the middle and lower class individuals. US Unemployment Rate US Inflation Rate

-

Banking vs Brokerage Question for Deposits or Stock Holdings

Castanza replied to Saluki's topic in General Discussion

It's a tough thing to do as the culture the last decade has been "Why pay off loans or hold cash when you can get 7%+ in the market?". Nothing wrong with that thinking, but people miss the stress and fragility that can come with "high capex" lifestyles. Wife and I put investing 2nd to debt and had a goal of paying everything off by 30. Paid the house off this past year and live completely debt free. Feels great not being owned by anyone and not can focus completely on savings and investing moving forward. Did I sacrifice some solid returns but not going 100% in investing and making minimum payments on low interest debt? Yeah I sure did, but you can't put a price on peace of mind. Just my two cents. -

The thing about Wells is you're always waiting for another shoe to drop and leave you holding the bag. I've been in and out of it since 2017. I didn't pick up any when it was in the 20's during Covid. Everyone seemed to think the asset cap was going to be removed then due to market conditions as well....No Bueno Pretty much put this in the too hard pile along with Citi, CS, DB, for all of eternity. Wells is interesting though; they have some really unique assets (rail cars) but I think it will always underperform until that cap is lifted (if ever).

-

Damn completely forgot about that with Wells, has there been any discussion around the topic?

-

Haha good catch! Still significant and a bad day to leave!

-

Personally I don't know enough about the regionals to jump in. I think buying KRE and then some of the big boys is the less risky way to play this.

-

Truist CEO retired....today....

-

TFC, USB, BAC Call KRE 6/20/25 $50 at 5.50 Call TFC 1/17/25 $40 at 3.70

-

Hmm the more I think about this situation, the less I like it. As @changegonnacome said the metrics and guidance for all these banks is going to be jacked if there is any serious movement of capital. Index play on regionals might be the safest bet should it get low enough. Maybe a basket of the big boys….something tells me that opportunity might not be as sweet as we think. Either way, it will be interesting to see what happens! The Bank of Castanza does not need any runs of its own.

-

Opportunity might be gone pre-market

-

Guidance to New Members of the FORUM!!

Castanza replied to mr.anuj@gmail.com's topic in General Discussion

1.) Actionable is a personal choice. Do your own DD. Nobody’s suggestions should be considered financial advice. 2.) “Investment ideas” is for stock specific discussion. You can search for companies there. General Discussion is for anything else. Usually market or finance related but not alway. 3.) Historical info is best found in individual equity discussions. No great way to search, but you can page back to the timeframe you want to see. Welcome -

You’d have to dig into the holdings to see what they are and if they hedged. But I believe that is the general consensus. For the situation on hand it seems like deposits stickiness, size and diversity are more important.

-

-

How is this even responsible to say? There is no guarantee companies will do that. Fear stoking at its finest.

-

From my nosebleed seats, what I never understand about interest rate hikes is how everyone says it will take 12-18 months before we see the effects. Yet they continue to raise rates every quarter. Everything is just modeled out with textbook equations and they just hope that matches up with reality on the outcome side? Seems like a fools errand. Blunt tools indeed. It’s like baking a cake for 40 min and doing the toothpick test at 10 min, seeing the results and then upping the temp because it’s not done yet….Should you be surprised when the cake ends up burnt?

-

Not sure on the breakdown of the VC pool but SIVB was in both sectors; and I’m sure GOOGL and META would run ads for anyone willing to pay. To your payroll cuts….I guess that’s possible? Don’t really know . Either way VC funding was expected to decline and I’m sure both companies were acutely aware of the cash flow provided by them. Could be some short term pullbacks as they adjust and the numbers trickle through the next few quarters. More definitive numbers on ad spend would be great. I think someone posted a breakdown/estimation on one of the GOOGL or META threads a while ago.

-

Anyone else wondering how this will shake out for GOOGL and META in the ad department? Startups have been spending about half their cash on advertising between the two for some time. Many as high as 50% of cash. You had what 445B VC funding in 2022? Say 30% of that goes to ad spend so 133b and 50/50 split GOOGL and META....just napkin math without the nuance, but not immaterial when you consider GOOGL had 283b in ad rev 2022.

-

Liquor

-

On the Go, but here are a few topics highlighted. - Russia has largely failed and will never hold Ukraine - Russia is short on munitions and using most of what they make within a month. - Russia looks weak but can still make calculated pushes and capture territory. - Both armies are very different animals than when the war started. Both have greatly benefited from conscription/mobilization of additional forces. - Ukraine unlikely to re-capture major cities or hot spot locations (likely to lose Bakhmut) - War in general is at a relative stalemate - Ukraine wants more funding but US has 11B left in the tank. F16 don't make sense as 12 would eat that budget up. US production is bottlenecked and everything we give Ukraine is being taken away from current US missions. The "extra supply" is a myth. US debating future funding of resources based on our own risks as we deplete OUR supply. The benefit of a dozen F-16 to Ukraine would be negligible. - Some of the munitions very useful to Ukraine are not necessarily something we will continue to produce because they are not strategic to the US (speaker listed some shells and other munitions). US is Air dependent not Artillery. - Russia's nuclear declaration of use for Nuclear weapons is a much lower threshold than NATO nations. Putin is still irrational and the same people who said Russia wouldn't invade are the same ones saying Putin will never push that button. - Should the US supply cluster like munitions (cant remember specific name)? Maybe because they are already being used. - Ukraine will have to spend billions post war to de-mine the nation. It's going to be a massive problem that will hinder rebuilding. - Germany re-thinking the shipment of Leopard tanks as Ukraine may not be able to maintain them.

-

https://podcasts.apple.com/us/podcast/backing-ukraine-against-russia-with-colin-kahl-and/id682478916?i=1000601391447 Latest episode is worth a listen if you haven't. Covers the majority of the stuff you guys have been squabbling about the past few days.

-

I'm not lol added a bit more this morning

-

SNC (SNCAF) - new position