Gregmal

Member-

Posts

14,973 -

Joined

-

Last visited

-

Days Won

18

Content Type

Profiles

Forums

Events

Everything posted by Gregmal

-

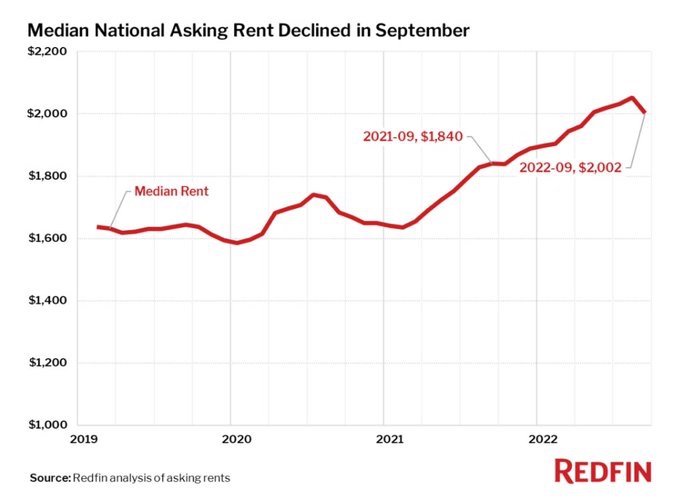

What’s the Fed paying attention to in CPI? Last year or this year? Just curious. Anyone paying attention to rentals could see this beginning in August. All those COVID boost rolls have finally been brought to market and now stabilize or modestly regress as supply comes to market.

-

Idk but even with a poor report you have to wonder what kind of jackass is bidding down Berkshire to $250? Someone with a 2 week time horizon? At some point this stuff is absurd and overdone. Is there anyone who really thinks next summer we re printing 5-10% CPIs?

-

More on the topic So as Sanjeev mentioned, no this is nothing at all like 2008. The only way it ever even gets there is if they recklessly jack up rates too high. But I guess this is what the hedge fund bro trade is….scream inflation is too high and that they MUST raise to stop it, while being positioned for them blowing up the economy by doing so…..

-

Although again noteworthy and perhaps on the day to day obsessing for folks, the VIX was a pretty big tell. Even at the lows to open, VIX was down 2%

-

Well, 1) does the market need to go down 3-5% every CPI or job report? This is like the bogus shit we saw in March 2020 where every new case of the sniffles gave people an excuse to sell off stocks another 500-1000 points. This is almost impossible to justify using any sort of long term model. 2) Biden said inflation has gotten to the 2% level!-sarcasm of course(the same day he raised SS benefits 8%) 3) maybe too many people are just unhealthily focused on day to day bs and things just got oversold? It is possible to have earnings with 5% inflation. So much of the number is still influenced by lagging housing data, especially OER. Or maybe it’s just a bounce and tomorrow gives it all back and next week is new lows? Who cares? This guy cleans up the analysis.

-

Yup. Same here. Great stuff.

-

It’s been such an obvious effort to manipulate the market(especially oil) and when it can’t be manipulated anymore it’s gonna be fun.

-

https://nypost.com/2022/10/13/cnbcs-jim-cramer-rips-clowns-who-bought-stocks-before-inflation-report/ I’ll just quota Sanjeev. Monkeys pick bottoms. The ramification of ONE CPI report on one’s lifetime investing decisions is absurdly meaningless. Irrelevant. What they did today or tomorrow or next week is pretty meaningless too. Fuck this guy fostering all these fake WS money scheme narratives.

-

https://www.cnbc.com/2022/10/13/biden-admin-asked-saudi-arabia-to-postpone-opec-cut-by-a-month-saudis-say.html Sounds like we need to have impeachment proceedings

-

Wabuffo sees what’s happening.

-

That’s a totally separate and interesting dynamic. So on one end you have the White House fighting tooth and nail to avoid the recession, while apparently the Fed is trying to create one. White House is trying to create more jobs, the Fed wants to see them disappear. Fed wants to curtail spending, the White House doubles down on spending. Who will win?

-

1929 was a bubble and also a depression in between wars. The popular thing to do right now is to revisit the “valuation short” neighborhood but I think the tea leaves have already said that’s bullshit and stupid same as it has been. Pepsi showed some inflation resilience and is trading not far from highs at 25x. Costco too. WM too. AAPL as well. Premium world class businesses still demand premiums. So even if we look at FANG, which I hate and have since January, what’s the argument? 10x trough earnings? There’s enough marginal businesses with cracks showing and poor metrics, like airlines/cruises/automakers, Tesla, that worrying about index multiples and valuation shorts I think is pointless. Market will still pay up for quality businesses and those are fairly valued especially the ones that don’t mind inflation. Bag of Cheetos or Doritos at Shop rite just went from $3.99-$5.49 last week. Looks like we need to hike another 150 bps so people with pre diabetes can afford the whole enchilada.

-

Yea we were talking about debt levels in the other thread and these are 100% an example of that but in a bad way. All the EV has been shifted to the debt. Dilution galore. Already capital intensive. The bull argument probably hinges on another market contradiction. The economy is too hot right? That’s the whole problem I suppose. So if that persists, they probably earn quite a bit more than what is currently in the share price. For me, these aren’t businesses I wanna hang around and find out whether the Fed actually destroys the economy with.

-

I also think just blanketing total debt figures lacks context. How much is fixed rate? Also why isnt it relative to EV? Business debt 10T to 19 over 15 years, so what? I have massively more debt than I did in 2007. I’m also 35 vs 20 then. But my debt/net worth ratio was way worse in 2007.

-

Oh yea also decided to test drive TSLS lol. See if it has autopilot mode

-

Little more Fairfax and few VIX 40 weeklies as insurance. Armageddon tomorrow!

-

100%. And 150% what @dealraker said too. That also doesn’t mean that these things aren’t real or impactful to folks. Which is why it makes sense for these guys to chill with the rhetoric and realize this issue needs to be managed properly. Some of the underlying rationale for rate hikes into oblivion are based on virtually nothing. Such as, inflation is going to be 5-10% in perpetuity unless something drastic is done. Huh? Based on what LOL? If I changed that number to 25% in perpetuity it would have just as much logical standing. Crusading for stock market crashes and job losses….which combined for those losing their jobs is devastating and shouldn’t be the baseline all over saving a few bucks on groceries.

-

I mean my wife the other day was like does it make sense to keep contributing to my retirement account? And I don’t follow any of her shit because she only works for health insurance and her earnings don’t really matter that much, but I asked what she meant and she said she started the year with ~$40k, put in $5k and had employer contributions of $3k. Current balance is $35k or something. So I was just like eh whatever it’s not meaningful money anyway, so don’t worry about it. But I’d hate to be her coworkers in their 50s or 60s, that’s for sure.

-

As earnings increase so does contributions. Money you put into a retirement account largely doesn’t matter in your 20s and 30s. Same type of stuff you’ve mentioned before about stage of the game being different for everyone. Outside of basically everyone who owned a house in 2008, who got set back the most? People on the back end of their work career(or so they thought I guess)

-

Sold for $19M.

-

“I learned, during this era of wealth destruction caused by corrosive effects of inflation, one could protect against ravaging inflation through investments in strong equities capable of growing their reported profits over time. I also learned, during this era, that investments in shares of companies which enjoyed powerful consumer brands had an ability to protect against inflation by virtue of the price inelastic demand their powerful brands enjoyed. Companies that possessed strong consumer brands were able to sustain their investments’ real values even in the face of rising cost pressures brought on due to inflation. Strong brands are supported by consumer perceptions that they do not have an adequate substitute for favored brands.” Interesting .

-

The thing is, why does it have to be equivalent to the 2009 system wide blow up. Raising rates to 3-4% isn’t really a big deal and 5% would probably be uncomfortable but pretty much in line with historic levels. There is so much revisionist bs the floating around. For instance, in March 2020 the Fed cut rates to 0 and said they’d buy more bonds. For weeks following this the market plummeted. None of the Fed cryers were screaming “buy!” Because of how obvious it was rates were going to be low or because of “all the liquidity in the system”. Even months later they were silent. Only significantly after the fact, did all this obvious jargon become apparent. So Im not sure why they’re given such wizard like forecasting credibility because in reality it’s been the same tune sung for a long time.

-

Art of The Deal

-

I should just tell my father in law and my tenants…hey you shoulda just bought preferred apartments and Pershing tontine you dumb fucks, right? If we re really concerned about “the most vulnerable” wouldn’t it be the ones who actually put effort in vs the ones who just always seem to fuck up? It’s pretty much impossible to be making $30k a year in the current job market. I went to pay my utility bill for my rentals at town hall the other day…help wanted signs up. $47k a year plus gold plated benefits to do 9:30-4 with an hour lunch and two half hour breaks and $88k a year to drive a truck at the DPW while on call 24/7 for snow plow. Like come the fuck on.