Viking

Member-

Posts

4,936 -

Joined

-

Last visited

-

Days Won

44

Content Type

Profiles

Forums

Events

Everything posted by Viking

-

I am addressing your points. We just disagree. I am trying to simplify the discussion. Zero interest rates (negative interest rates in Europe and Japan) are the central issue. You think they are great. I think they are terrible. So we reach different conclusions about what is appropriate today. In terms of investing strategy, i love all the different perspectives on the board. I hope EVERYONE makes a shit load of money in the coming years. What i also know is there is no one way. Each investor needs to figure out what works for them. As Druckenmiller says… be inquisitive… and be open minded… Especially important given the current set up.

-

Your baseline is a fiction. The ‘prosperity’ you imagine that was created the past +2 years was an illusion. Yes i know, reality sucks.

-

Bubble returns are not reality. Investing is not a Disney movie. When interest rates went to zero the returns from bonds went to the moon. With the 10 year bond near zero (the discount rate) returns from stocks also went to the moon. With mortgage rates crazy low house prices spiked (up 50% in Canada over 2 years). Investment portfolios and paper value of net worth spiked. But it was an illusion (unless you liquidated and moved to cash… but we all know what a dumb decision that is…). Interest rates are normalizing. Bond values are getting torched. 10 year bond is over 3%, stock values are getting torched. Mortgage rates have popped higher; in Canada a chill is in the air of the housing market. It appears US housing market is slowing. Easy come… easy go.

-

How is the ‘average family’ feeling these days? Terrible. Why? High inflation. Not rocket science… The crazy thing is the inflation story is still in the early innings. If people think things are bad right now just wait another 3 or 4 months $150 oil will help… food shortages too… And this is all good for the ‘average family’? Nuts. ————— The Michigan consumer sentiment in the US fell sharply to a record low of 50.2 in June of 2022, well below market forecasts of 58, preliminary figures showed. The current economic conditions subindex sank to an all-time low of 55.4 (vs 63.3 in May) and the expectations gauge plunged to 46.8, the lowest since May of 1980. Consumers' assessments of their personal financial situation worsened about 20%. 46% of consumers attributed their negative views to inflation, the biggest share since 1981, during the Great Recession. Inflation expectations for the year ahead went up to 5.4% from 5.3% and the 5-year outlook to 3.3%, the highest since June of 2008. Consumers expect gas prices to continue to rise a median of 25 cents over the next year, more than double the May reading. - https://tradingeconomics.com/united-states/consumer-confidence

-

I have been saying for years that crazy low interest rates resulted in asset bubbles in stocks, bonds and real estate (in Canada for this last one). Anyone who owns assets have made out like bandits. Anyone who does’t own assets is screwed (falling much, much further behind). Who wins in this scenario? The rich. Big time. The problem with bubbles is they ALWAYS pop. And when they do pop it usually gets very ugly. Think economic recession. Not good for ‘average workers’. Inflation is also a big problem. And IF it gets entrenched into the economy and you get a wage/price spiral then we are screwed. There is one solution for that: Volker type increase in interest rates. And a brutal recession(s). Except THIS TIME the world is swimming in debt. Once again ‘average workers’ get screwed. High inflation/asset bubbles are a terrible set up for ‘average families’.

-

Inflation is good for ‘average workers’? Seriously? Inflation is a hidden tax. Taxing workers with a tax they can’t see is now good for workers? George Orwell (Animal Farm) couldn’t have written it any better.

-

Lots of super interesting things going on in China today as they attempt to deleverage and pivot their economy away from a real estate/infrastructure investment model to one driven more by personal consumption. For years Michael Pettis has been one of my sources in trying to understand China. The 30 minute interview below lays out Michael’s thesis. Bottom line he is thinking GDP growth in China will be coming way down to something closer to 3% moving forward and that this could be too optimistic.

-

The economic impacts from covid continue. Phase 1 was consumers staying home and dramatically increasing goods purchases at the expense of services. Phase 2 is consumers shifting purchases to services (like travel) and away from goods. Phase 3? And then Phase 4? Who knows. Good luck forecasting consumer demand for goods or services over the next 12-24 months. Well, these are the phases in some of the world. China, kind of important, is still locked in Phase 1. Bottom line, the learning is pandemics take years to play out… ————— Goods producers are a hot mess right now. Airlines too. Target will take a profit hit to clear out inventory that shoppers don’t want. Target plans to cut prices and cancel orders to clear out unwanted inventory, announcing a series of steps on Tuesday to combat rising prices and supply chain disruptions. The actions would cut its profit in the current quarter, the company said, pushing its shares down 7 percent in premarket trading. It is the latest move by a major retailer revealing how inflation and shifts in consumer habits are swiftly changing the outlook for business. Just three weeks ago, Target shocked investors with earnings that were much worse than expected, leading its shares to fall nearly 25 percent. It cut its forecast for profit then, and lowered it even further on Tuesday. - https://www.nytimes.com/live/2022/06/07/business/economy-news-russia-inflation#target-profit-inflation

-

Given where Fairfax India is trading today (big discount) hard to see how a buyer of the stock at todays price could have their investment ‘blow up’. Probably the bigger risk is the stock goes largely sideways for many more years (continuation of the current trend) - Fairfax India continuing to be a value trap like it has been for many years. ————— Discount to BV widens: One issue specific to Fairfax India is the chronic and large discount to BV. Why does it exist? Why has it persisted for so long? Why can’t the discount widen? Fairfax: There is also the risk that Fairfax buys Fairfax India back at a big discount to BV. Fairfax has been VERY opportunistic in this regard in the past - at the expense of minority shareholders. One scenario: Fairfax India drops to 0.50 X BV and then Fairfax swoops in and offers to pay a ‘big premium’ to the price it is trading… of 0.65 X BV. Fairfax also is a big winner if the stock price of Fairfax India stays crazy low (Fairfax can keep increasing its ownership at very attractive prices). Incentives can be a powerful thing. Global bear market: One immediate risk is if we get a multi-year bear market like the 1970’s. Global in nature. Cause? Persistently high inflation. And growth disappearing. Resulting in stagflation. I wonder how super high energy costs combined with famine (or much higher food costs) will play out over time in India - especially if they stretch into multiple years. Social unrest = populism = political change. The recent demonstration by farmers was pretty widespread and caused Modi to pivot. But i am a complete novice when it comes to politics in India. Much stronger US$ leading to severe multi-year sell off in emerging markets. ————— Having said all the above, my guess is Fairfax India will spike much higher at some point in the next couple of years and we will all look like idiots for not buying more at todays prices given it is obviously cheap and super well managed. I do own a small position (2.5% of my portfolio) as a long term hold.

-

Pretty much every government has completely messed up with their solutions to climate change and for many years. The big problem is ESG is now the accepted wisdom/paradigm that CANNOT be questioned. “It ain’t what you don’t know that gets you into trouble. It’s what you know for sure that just ain’t so. “ – Mark Twain The bigger problem is climate change is real. So we will stumble along some more until some event(s) happen that provide the proper clarity. But this will likely be some time away… and most people won’t give a shit until it hits them square between the eyes (and for some even that won’t do the trick :-). —————- tobacco is a great parallel… look how it took for the general public to ‘believe’ the science and for politicians to do the right thing… and it is still a work in progress… —————- Dr. Peter Venkman : This city is headed for a disaster of biblical proportions. Mayor : What do you mean, "biblical"? Dr. Raymond Stantz : What he means is Old Testament, Mr. Mayor, real wrath of God type stuff. Dr. Peter Venkman : Exactly. Dr. Raymond Stantz : Fire and brimstone coming down from the skies! Rivers and seas boiling! Dr. Egon Spengler : Forty years of darkness! Earthquakes, volcanoes... Winston Zeddemore : The dead rising from the grave! Dr. Peter Venkman : Human sacrifice, dogs and cats living together... MASS HYSTERIA! Mayor : All right, all right! I get the point!

-

@Climacus oil is the new tobacco. It is hated and it will only get worse from here (climate change is real). Given that reality why would any oil and gas company put significant money into a new project with a payout more than 12 months out? ESG is firmly in the drivers seat - and it is a complete hot mess / terrible joke. Bottom line, high oil and gas prices are likely structural at this point. The interesting question is how high do they go? 10 years ago they went to $150. So +$200 looks like a reasonable and conservative estimate at some point over the next couple of years. Especially if inflation moderates and global economic growth picks up the next couple of years.

-

US 10 year bond yields are on the move again, up 25 basis points the past 10 days, and back up over 3% to 3.03% today. Recent 52 week high was 3.17%. The high over the past decade was around 3.2%. So we are approaching a technically very important level. Should the 10 year move and hold over 3.2% we could see the next leg higher in interest rates. And given all assets classes tend tend to be priced off the 10 year bond, higher yields will matter. The Fed needs financial conditions to tighten. What we have seen so far is not nearly enough. Just look at the most recent stellar jobs report. House prices in the US continue to rocket higher (the biggest investment by far for most Americans). Bottom line, Fed needs financial conditions to tighten much more than where they are today. This makes for a VERY interesting set up for investors over the next 3-6 months.

-

I like to follow Fairfax through three broad buckets: 1.) Underwriting 2.) Interest and dividend income 3.) Equity holdings How is bucket 1 looking 5 months into 2022? Perhaps the most important thing we learned from P&C insurers when they reported Q1 results was the hard market is continuing. WRB forecast the hard market likely continuing into 2024. What does this mean for Fairfax? Likely +20% top line growth in 2022. My current estimate is for Fairfax to grow net premiums earned by 25% in 2022 and another 10% in 2023. I think there is an outside chance Fairfax could hit US$20 billion in net premiums earned in 2022. What does this mean for underwriting results? Net Prem Earned CR Underwriting Profit 2023 Est $21.3 billion 94 $1.28 billion $57/share 2022 Est $19.4 billion 94 $1.16 billion $50 2021 $15.5 95 $801 million $31 2020 $13.86 97.8 $308 $12 2019 $12.54 96.9 $389 $15 2018 $11.91 97.3 $322 $12 Fairfax could see close to 60% growth in net premiums earned over the last 4 years. At the same time we are seeing a lower CR. And this is resulting in a much higher underwriting profit (up 4X the past 4 years) to $50/share in 2022. As a reminder, Fairfax shares are trading at US$535 today. ---------- One important input is hurricane activity. Sounds like the forecasts are for an above average hurricane season in 2022. Something to watch given we are just beginning hurricane season (June 1). The silver lining is a bad year for catastrophe losses will likely extend the hard market… ---------- My numbers above do NOT include runoff. My guess is the cost of runoff will come in at about $200 million per year (about the average from the past couple of years).

-

@glider3834 it is looking pretty likely that Fairfax’s next big investment(s) will be in India. 1.) Fairfax (and Fairfax India) has a pretty outstanding long term track record of investing in India. 2.) part of the strategy/secret sauce is partnering with outstanding entrepreneurs. 3.) i certainly am just starting to appreciate the enormous transformation happening in the Indian economy under Modi from Socialism to Capitalism. Sounds simple but it is exceptionally difficult to pull off (just look at the epic fail in Russia). These sorts of transformations take decades and it appears India is still in the early stages. 4.) the privatization drive in India has been going on for some time… perhaps in 2022 we see some large transactions. It looks like a lot of work at Fairfax has been going on in India for a couple of years on this front (delayed by covid). 5.) My guess is Fairfax will be looking to partner with the usual suspects (OMERS etc) and is including total partner contributions as part of the ‘$7 billion over 5 years’ forecast. Also, ‘5 years’ timeline will likely stretch out to 7 or 8 given the realities of how fast things like this move in India. 6.) where will the money come from for Fairfax? Proceeds from Digit IPO might be one source of funds. Perhaps Anchorage gets to its next phase of development later in 2022. 7.) India is exceptionally well positioned to benefit from geopolitical shift in the West away from China. Just another tailwind. ————— Below are the parts of the Q&A with Prem (from the article you linked to) that i found most interesting: Q: Now of course the other thing is about Fairfax and we were casually talking when you were in Delhi and you were talking about how much capital you have put in and how much you want to put in? Prem: Sure. So we have put in about $7 billion. We’ve put in about $5 billion through Fairfax India and in total we control about $7 billion of investments. And I’m thinking we’ll put in at least that much more in the next five years. India is the best place to invest. We have to invest in a way that’s good for everybody. Good for your employees, good for your customers, good for your shareholders. And you have to give back to the community here. Q: Any time frame in mind for the investment of another $7 billion? Prem: In the next five years. We think the opportunity is huge. Particularly when the government is welcoming business. Wherever business is welcome, business will come. Many businesses all over the world will invest in India. Q: Could this $7 billion go into companies that come up for privatization? Prem: It could be that. It could be some of the companies we bring from North America to India. There is privatization taking place in the railway stations and other sectors, we look at them all. Q: I read on the railway stations front that Fairfax is doing a pilot? Prem: I’d love to tell you but these are in early stages. We are looking at all the opportunities. Q: Any thoughts on the new logistics policy and Gati which has a focus to bring down logistics costs? Prem: Only thing on that is we are very close to Fedex and Fedex is looking at India and we are looking at it with them. Q: This could include warehousing and storage and all of that? Prem: Yes, in broad terms. India is a huge opportunity. So where does it make sense? We want to deal with high class entrepreneurs, such as Madhavan Menon (Thomas Cook Chairman), Kamesh Goyal who has built Digit from scratch, Hari Marar (CEO of Bangalore International Airport Limited), Ajit Isaac who heads Quess. These are people who have built institutions.

-

Here is a quick update of Fairfax's equity holdings. Please note, I have not updated the spreadsheet to capture any changes to positions that have happened the past couple of months. Regardless, my numbers should be directionally accurate. Since March 31 the equity portfolio has likely declined a little over $800 million = 5.7%. About $500 million of the total is mark to market = $20/share (pre-tax). S&P500 performance since March 31? - 9.3% Nasdaq performance since March 31? - 15.5% Fairfax's results are not unexpected given the equity market sell off in April and May morphed beyond Nasdaq to include all stocks. perhaps the biggest takeaway is Fairfax's equity portfolio is continuing to outperforming the broad averages which is nice to see. What does this mean for Fairfax and Q2 results? 1.) underwriting: tailwind (hard market) 2.) interest and dividend income: tailwind (rising interest rates) 3.) realized investment losses: headwind (from both equities and bonds) My guess is we will see Fairfax report a loss of $5 to $10/share share when they report Q2 results. It would be impressive if they are able to get through a bear market is stocks and bonds in 2022 with only a minor hit to BV. We will see. ----------- Big Movers (so far in Q2): 1.) Atlas - $170 2.) Blackberry - $166 3.) Stelco - $116 It looks to me like about 70% of their holdings are down which is likely representative of what is going on in the overall market. Fairfax Equity Holdings June 2 2022.xlsx

-

Mr Market expects inflation to be transitory (come down significantly over the next year to below 3%). If that happens current bond yields make sense (that is what is currently ‘priced in’). Mr Market thinks the Fed (and global central banks) are going to engineer a soft landing. I remain unconvinced. I think there is one way we get inflation under control in the next 12-18 months: we get a recession. Why does Mr Market think inflation will be much lower in 2H of 2023? 1.) HOPE. The Ukraine war will end. China will end zero covid policy. Oil will go back to $70. Food shortages don’t happen. Real estate prices/rent increases will stop. Workers will magically appear and flood back into the labour force. Etc, etc. Well good luck with that investing strategy. 2.) FAITH IN THE FED. Really? Seriously? My guess is inflation will remain stickier (higher) for longer. We will get head fakes - soon all we will be hearing about is ‘inflation has peaked’ - and financial markets will likely bounce higher and perhaps much higher. Until it becomes clear a few months later that persistently high inflation of 5 to 6% is still a bitch. So my number one trade idea is to expect lots of volatility over the next year - with financial markets hitting lower lows. UNTIL THE FED PIVOTS. Yes, i think it is highly likely we will get another Fed pivot. Caused by? Recession. Or something important breaking (that financial stability thing). I am also NOT all doom and gloom. The US economy continues to chug along. (Real) Interest rates remain highly accommodative. Deglobalization will be good for growth for North America. These (and other factors) are all likely going to help keep inflation stubbornly high. So bonds continue to be off limits for me.

-

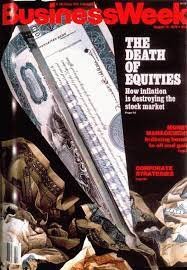

It is entertaining to read history. This article was written in 1979 (and NOT by Barry Ritholtz). Some lessons: 1.) The article was a great contrarian indicator - it actually called the bottom for stocks 2.) the persistent inflation of the 1970’s was terrible for most equity investors; bear markets can last a decade ========== BusinessWeek: The Death of Equities: How inflation is destroying the stock market https://ritholtz.com/1979/08/the-death-of-equities/ ————— The one rule whose demise did the stock market in could be summed up thus: By buying stocks, investors could beat inflation. Stocks were a reasonable hedge when inflation was low. But they proved helpless against the awesome inflation of the past decade. “People no longer think of stocks as an inflation hedge, and based on experience, that’s a reasonable conclusion for them to have reached,” says Richard Cohn, an associate professor of finance at the University of Illinois. Indeed, since 1968, according to a study by Salomon of Salomon Bros., stocks have appreciated by a disappointing compound annual rate of 3.1%, while the consumer price index has surged by 6.5%. By contrast, gold grew by an incredible 19.4%, diamonds by 11.8%, and single-family housing by 9.6%. ————— There are at least four good reasons why inflation is killing equities: • Stock prices reflect anticipated corporate profits. During periods of rapid inflation, however, profits fall because most businesses cannot raise prices quickly enough to keep up with costs. • Even gains in profits are largely illusory because inflation makes them look rosier than they actually are. And because plant and equipment are depreciated at historic cost rather than replacement price, money that should go into capital investing and inventory purchasing instead goes to the government in taxes. • Experience has taught investors that inflation will lead to an economic downturn that will wreck corporate profitability and stock prices. This happened in 1974, when the worst recession since the Depression followed the last burst of double-digit inflation. • Investors jump from stocks to bonds to nail down high rates. Inflation also promtps corporations to sell debt because it is tax-deductible and can be paid off in cheaper dollars—thereby reducing the flow of new stocks to market. Further, inflation makes investors very cautious. “We are coming down with the European disease,” says Thomas A. Martin, president of American Asset Management Co., pension managers with $127 million in assets. Indeed, European institutions have been putting up to 40% of their money into hard assets—especially real estate—for years. ————— Just about the only group no discouraged by such figures are U.S. corporations. Although generally unable to sell stocks themselves, companies have jumped on low stock prices to set off the biggest takeover binge in history. “The merger boom is essentially an attempt to invest in hard assets,” points out one investment banker, adding. “A buy rather than build decision makes excellent sense, since buying at these prices is cheaper than building.” Indeed, in the past few weeks alone, Mannesmann of West Germany has announced plans to take over Harnischfeger for $245 million, Britain’s Midland Bank to acquire Walter E. Heller International for $531 million, and McGraw-Edison to buy Studebaker-Worthington for a staggering $723.5 million. ————— Other corporations are following a slightly different strategy: Buying up their own shares. “The market is understating the real value of assets, and this does not encourage companies to add new assets but instead to use their cash to buy back their own stock,” says Salon Patterson, president of Montag & Caldwell Inc., an Atlanta investment adviser. Indeed, the average stock price is now about 60% of the replacement value of the underlying assets. Thus, a company can acquire $1 worth of assets by paying about 60~ for its shares. And despite soaring interest rates, borrowing to buy back stock makes sense because the debt will be paid off in ever-cheaper dollars that are tax-deductible to boot. Finally, by eliminating outstanding stock and the dividends on that stock, a company raises its earnings per share. ————— Housing, in fact, has become the most popular inflation hedge for most Americans. “For the past five years, real estate has been the equity market that stocks used to be,” points out Allen Sinai, a Vice-president of Data Resources Inc., a leading economic consulting firm. ————— Today, the old attitude of buying solid stocks as a cornerstone for one’s life savings and retirement has simply disappeared. Says a young U.S. executive: “Have you been to an American stockholders’ meeting lately? They’re all old fogies. The stock market is just not where the action’s at.”

-

Cut my Recipe position in half. It was a ST trade; up @5%; time to sell some. Also selling other smaller position for quick mid single digit gains. I expect lots of volatility in the coming months. As long as inflation runs hot and the Fed continues to hike rates. QT begins next week I agree there is lots of opportunity in the stock market today. But my main investment strategy continues to be capital preservation. Until the Fed reverses course. Which will ONLY happen when financial conditions have tightened sufficiently; and we CLEARLY are not ‘there’ yet.

-

1.) by ESG, an immediate and obvious example is the move to electric vehicles. It IS happening. Tesla is a real company. And EVERY major automaker is accelerating their pivot to electric vehicles. The question is how fast it happens from here. The primary constraint will be material shortages… highly inflationary. The bottom line is climate change is real. How most governments are responding today is pretty idiotic; that does not mean massive change is not coming in the future in lots of verticals. 2.) covid is NOT over. China is kind of an important player in the global economy and they are ALL IN on their zero covid policy. Xi has staked his reputation on it and he is facing re-election shortly. Even the US still requires ALL foreign travellers coming into the US to show proof of a negative covid test (independent 3rd party verified) performed < 24 hours before flight time. Most importantly, we are not out of the woods yet in terms of how the virus will mutate from here. My understanding is the most likely outcome is future mutations will continue and be more contagious and likely less troublesome (in terms of hospitalizations and deaths). But there is also a small chance we good get a mutation that is more contagious AND more deadly than anything we have seen yet. 4.) deglobalization / on shoring IS happening. It is not theoretical. One example is all the chip factories getting built in the US. There are tens of billions of dollars requiring years of investment (just think of all the man hours of employment just to supply and build each plant). There are lots of other examples. Geopolitics will prevail. 5.) massive labour shortage: you say this is massively bullish for the average person. Ask the ‘average person’ who had a job in the 1970’s how happy they were with inflation. Inflation was/is horrific for the ‘average person’. For the simple reason wage increases for lots of people DO NOT come close to offsetting cost of living increases so real incomes fall and people get VERY ANGRY = lots of social unrest. Today the US has the tightest job market in history AND CONSUMER CONFIDENCE HAS TANKED. Bottom line, inflation is likely to remain much more sticky than Mr Market is currently thinking. And this means interest rates are likely to move higher that Mr Market expects today. We will see

-

Where inflation goes from here is the million dollar question. 1.) ESG is highly inflationary - we need to build a completely new architecture while concurrently running the old one. 2.) covid has been highly inflationary. We are getting a second covid shock thanks to China’s zero covid policy. 3.) the Ukraine war is highly inflationary. Energy prices in Europe have spiked. Agriculture prices have spiked. Commodity prices have spiked. 4.) deglobalization / reshoring was a trend before covid / war in Ukraine - and these two events have accelerated this trend which is inflationary. 5.) the US has a massive shortage of workers. Power is shifting to workers… unions at Amazon and Starbucks. Wages are rising. This is highly inflationary. With each passing month we are getting closer to inflation expectations getting embedded and a wage - price spiral getting more firmly established. Many of the inflationary pressures look secular (will run for years) to me. This suggests to me that inflation could stay higher than most people expect - perhaps still running 5% mid 2023 (with lots of volatility). And this tells me the Fed could be forced to tighten MUCH MORE than Mr Market currently thinks. If the Fed is forced to take the Fed Funds rate to something closer to 4% in the next 9-12 months the bond and equity markets are screwed. Mr Market currently thinks inflation is transitory (and will drop big time in 2023). I am not convinced. ————— For inflation to come down in a big way, what of my 5 items above will reverse over the next year? What would cause inflation to drop precipitously? A recession. This outcome would also be terrible for equity markets.

-

@wabuffo interesting comments. Here is my read of how Fed / policy / financial markets have been going the past 5-6 months (since the Fed did their hard pivot). Fed talks more hawkish. Afterwards (over a few weeks) Financial markets then price it in. At the next meeting the Fed then executes (actual tightening) what the market has already priced in. In between meeting lots of Fed governors are floating different trial balloons - with the Fed getting a look at how financial markets respond. Rinse and repeat. So the market is front running (pricing in) the actual tightening the Fed does BEFORE each meeting. Bottom line, I am looking forward to seeing what happens to long term rates (among other things) when the Fed begins QT next week. Powell said during his last press conference that he (the Fed) really has no idea how QT will play out in financial markets over time. Other Fed officials have said they expect QT to affect the economy ‘like an additional rate hike’. i continue to think that the Fed is in a VERY tough position. Inflation is wicked high and looks reasonably sticky so the Fed will need to keep going with rate increases and QE. Parts of the economy are slowing and will slow further as financial conditions tighten more. How high can rates go before something breaks? My read is something will break BEFORE the Fed is ready to slow rate increases. The ‘breakage’ will give the Fed the cover (excuse) to slow/stop rate increases/QE even with inflation quite high (+5%). Where will the breakage occur? One or more of the following: 1.) The US Dollar: emerging markets? 2.) Corporate bond spreads: blow out? 3.) Equity market levels: bear market? 4.) The level of interest rates at different maturities: slow housing? Slow durable goods purchases? Slow business investment?

-

The podcast is an excellent overview of where the US and global economies are today and how things might play out over the next year. Bridgewater also expects core inflation to be @5% in May 2023. Mr Market expects core inflation to be @2.7% 12 months into the future. Big disconnect in the two views.

-

For those of you who like to get into the weeds of the impacts of Fed activities on the banking system and economy here is an interesting video. You might want to start at the 1 hour 8 minute mark… where they state their base case expectations of how things will play out in the coming months. They discuss the impact of QT, which begins in 8 days. Bottom line, they expect volatility to continue in the coming months. Until something breaks. At which time, the Fed will pivot. Joseph Wang is one smart dude. He is able to explain complicated things in a very understandable way. Jack Farley is a very good host. Forward Guidance is becoming one of my favourite YouTube channels.

-

With the severe sell off we have seen in stocks and bonds over the first 5 months of the year this is a good time to step back take stock. Most importantly, WHAT ARE THE BEST INVESTMENT IDEAS FOR 2022 as of today? There has been so much carnage in so many sectors i currently don’t have a single ‘best idea’ pick. Rather, i think this is likely a good time to be expanding equity exposure in a bunch of areas. Not ‘all in’. But a great time to buy companies and sectors that are getting killed. Example today? GOOG. Last week? US financials. CRM is back at 52 week lows. Lots of solid opportunities if someone has a 3-5 years holding period. As of today i am 40% stocks and 60% cash. I am in no hurry to get to 100% invested.

-

GOOG, AMZN, FB, CRM