Viking

Member-

Posts

4,936 -

Joined

-

Last visited

-

Days Won

44

Content Type

Profiles

Forums

Events

Everything posted by Viking

-

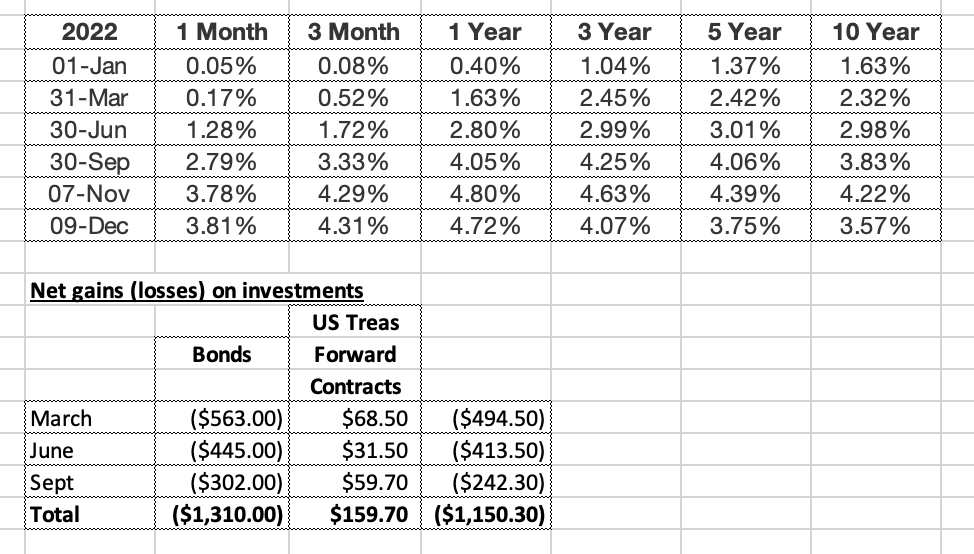

@StubbleJumper great question. When Fairfax reported Q3 I was surprised the net loss from bonds was only $240 million (after hedge). It was $150 million lower than Q2 - even though the absolute interest rate moves in Q3 were larger than Q2 across the curve. So I wonder if we are not now seeing - as bonds held shrink in duration and get closer to maturity - a small unwind each quarter in the unrealized loss bucket. Which is what Fairfax told us would happen (the unrealized $1 billion loss in bonds would reverse as they are held to maturity). After doing more of a deep dive this morning I think my $250 million number for bond gains in Q4 is too high. I was overestimating the gains (further out on the curve) versus the losses (on the shorter end). My new guess is something closer to zero. Fairfax will see gains in Q4 from their longer term bond holdings. In Q3 they were very aggressive adding $4.1 billion with a 3-5 year duration. Their total bond exposure of 3 years and longer went from $2.5 billion to $6.9 billion = + $4.4 billion. My guess is Fairfax likely continued to add bonds of 3 year or more duration in Oct and Nov. Yields on longer term treasuries peaked around Nov 7. If Fairfax continued to be aggressive adding to duration in Q4 then the gains from falling bond yields will be even larger in Q4. Offsetting the gains on longer term bonds will be unrealized losses on shorter duration bonds as short term rates continue to march higher. The bottom line, Fairfax's bond portfolio is in very good shape and they are positioned very well for the current environment (lots of unknowns). My guess is big unrealized bond losses are a thing of the past. And now Fairfax shareholders will enjoy much higher interest and dividend income. So it was 9 months of pain (and $1.1 billion net loss on their bond portfolio). Moving forward, Fairfax shareholders will now reap the gain of higher interest rates.

-

As of today, it looks to me like Fairfax is set to report Net Gains on Investments of around $2 billion in Q4 = $450 (equities) + $1,300 (pet insurance) + $250 (bonds). Over the first 9 months of 2022, Fairfax had booked a $2.3 billion loss in the 'Net gains (losses) on investments' line item. If Fairfax comes in around $2 billion in Q4 they would reverse most of the YTD loss. That would be amazing, given we have just had bear markets in both bond and stock markets. Importantly, the investment portfolio at Fairfax looks well positioned and should deliver better than average returns moving forward. ---------- As of Dec 9, Fairfax is sitting on about $1.14 billion in gains on its equity holdings (that I track... I attached my Excel spreadsheet below). Here is the split by 'bucket': 1.) mark to market = +$450 million (incudes TRS, warrants etc) 2.) associates = +$500 million 3.) consolidated = +$190 million Big movers? - Eurobank = +$299 - FFH TRS = +$226 - Fairfax India = +$181 - Atlas = +$180 - Quess = - $109 - Stelco = +$105 Fairfax Equity Holdings Dec 9 2022.xlsx

-

My guess is one of the reasons for the divergence is the significant stock buybacks that are happening. They will be increasing as more debt targets are getting achieved. ————— In the near term, i have no idea where the price of oil will trade. I continue to love the set up for oil looking out a couple of years. Constrained supply. And increasing demand. With more and more cash flow being returned to shareholders.

-

At the end of the day what we learn is an investor has to find a strategy that works (beats the averages) and fits with how they are wired: intellectually and emotionally. There is no one right way. Very interesting to think about all the different intellectual models that work. When looking at an investment I never think 20-25 years into the future. I usually focus my efforts on understanding 1-3 years out and that is pretty much it. Good short term decisions = good long term outcome. That has been my experience. (By short term I mean 1 to 3 years.) In my personal life I KNOW what I am doing the next 12 months. I have a pretty good idea looking out 12-24 months. 36 months out the view is starting to get a little blurry. That's as far as I get (right now). But I love change. Our youngest will be done university in 3 years. After that no need for a 4 bedroom house. Also no need to live full time in Vancouver. Lots of great options. (I should note that when my 3 kids were in elementary & especially high school we were locked and loaded in our house and neighbourhood - not going anywhere.)

-

Does this not kind of suggest an index fund / ETF (i.e. S&P500) approach is indeed a solid strategy for most people. They will be invested in most of the right (surviving) companies looking out 25 or even 50 years. And over time the companies that disappear (bought out, merged, broken up or gone bankrupt) from the index/ETF are replaced by the best of the rest. Over time you end up with the best companies and you pay virtually no fees for that expertise.

-

What a crazy year it has been; not just for energy but for all asset classes. Regarding energy, i follow the large Canadian producers the closest. Cash flow in 2022 has been amazing. Most of the cash flow has gone to debt repayment. Net debt levels in the Canadian oil patch have got to be at historically low levels. Balance sheets have largely been de-levered over the past 2 years which is a significant achievement. The interest expense savings for all companies will also be material moving forward (lowering their per barrel break even cost). As we end 2022, we are seeing more and more producers shift more and more of their free cash flow to investors. In Q4 MEG moved to 50% to share buybacks (was 100% debt reduction). In January 2023, CVE will be 100% to dividends, special dividends and share buybacks (with net debt at their $4 billion mark). Every company is materially increasing the % of free cash flow that is being returned to investors. All Canadian oil patch companies will likely hit their final net debt targets in 2023. The amount of money that will be returned to investors will be massive. My guess is the amount of stock buybacks that will be done moving forward will start to provide a floor for share prices of energy companies. If share prices get too high… energy companies will shift to special dividends. So how does and investor value a company that has little debt, solid free cash flow and is committed to returning an increasing % of free cash flow to investors? i ask because it is pretty clear no one is actually doing the math on Canadian oil companies. We learn that a stock is worth the discounted value of future cash flows. This does not apply to the Canadian oils (perhaps the US too… i just don’t follow them). So what is an investor to do? Wait. Give it time. Mr Market will eventually get it right. And patient shareholders will make out like bandits. ————— Even if oil sticks at US$70, the Canadian producers will still be gushing cash. And it their shares get pummelled (likely), with debt targets largely hit, they will be able to buy back meaningful amounts of shares a rock bottom prices. It really is a crazy set up. Regardless of where oil prices go in the short term, oil investors should do very well looking out a couple of years. I wonder if we do not see the next wave of consolidation happen in the Canadian oil patch over the next year. European and Chinese producers desperately want out. Canadian producers may get their ‘buy low’ opportunity.

-

@KFS nice to hear FFH has worked out well for you. Individual stock weighting is an interesting topic. I like to flex positions of stocks i have high conviction in. Add (sometimes aggressively) when they sell off for no apparent reason. And also lighten up when they pop aggressively and lock in some nice short term gains. I am lucky because most of my holdings are in tax free accounts (so i am not taxed on gains when i sell). Regarding Fairfax specifically, aggressively flexing my position has been a very good strategy the past 2 years. The stock just keeps selling off +20% - even as the story continues to get better each quarter. Eventually Mr Market figures it out and the stock hits higher highs. That will continue to be my strategy moving forward. I do expect Fairfax to be very aggressive on the share buyback front moving forward and this could mean the stock just keeps powering higher over the next year (with less downside volatility). Given how good to story currently is my plan today is to keep a large core position. Another factor for me is what the overall market is doing. My guess is investors will get another wonderful opportunity to buy great companies at wicked low prices at some point in the next 3 months. So i have been slowly building my cash position. It has been a great year and i am happy to lock in some of my gains. And sit in the weeds and patiently wait for Mr Market to serve up some more fat pitches.

-

@whatstheofficerproblem when you get your answer please let me know. I continue to think that interest rates are one of the keys. If the Bank of Canada keeps raising rates then i think more pain is ahead. The spring market (gets going in Feb) will be key - and it is not far away. If the economy also slows in 2023 that will probably be a hit to housing. ————— Prices are coming down pretty hard in the areas that were most frothy. I looked at my old neighbourhood (Langley) and house prices look to be back (perhaps even lower) to where they were back in March of 2021.

-

Well time to get the bubbly out this weekend for Fairfax shareholders. Why? Christmas has come early. Fairfax’s stock price has hit a new all time high today in Canadian dollar terms of $791.93 (markets haven’t closed). The previous all time high had been C788.88 on June 15, 2018. Congratulations to shareholders… it is always nice when a plan comes together! A few of us backed up the truck late in Oct/Nov of 2020 at under C$400 which has been a double in a little over 2 years. Not too shabby. But the story gets even better. Trading today around C$790, Fairfax is still wicked cheap. My guess is ‘normalized’ earnings for Fairfax is north of US$100/share, or C$135/share. So the stock is trading at PE multiple of less than 6. Moving forward i think Fairfax should be able to deliver 20% to 25% returns per year for at least the next couple of years driven primarily by earnings growth and also a little multiple expansion. (I also expect the stock to continue to have lots of volatility… as per usual.) The quality of my estimated C$135/share in earnings is very high: primarily coming from Interest and dividend income and underwriting profit. I also expect Fairfax to be very aggressive on the stock buyback front over the next year, taking out at least 1 million shares (perhaps 2 million) and this is NOT built into my earnings estimate. Other catalysts would be a Digit IPO or more asset monetizations like we saw in 2022 with pet insurance and Resolute Forest Products. We can be very hard on Fairfax and their management team. Today i tip my hat to them. They appear to have learned from past mistakes. Largely corrected past mistakes. And have been executing well for the past 5 years. As a result of all their hard work, today both the insurance and investment operations at Fairfax are positioned exceptionally well at the same time. That is a big deal for Fairfax investors. Bottom line, Fairfax’s future has never looked brighter. So my guess is the shares will power even higher in the coming years. Prem and company have got their mojo back! Well done! ————— I am not a big technical guy. But i do think Fairfax stock hitting new all time highs is a big deal. We can officially call an end to the 8 year bear market in Fairfax’s stock. It is also impressive to see Fairfax starting to dramatically outperform the market averages (one year and two year). ————— In US$ terms it looks like the all time high was US$593.99 in Oct 3, 2016. Shares hit US$588.50 today so we are within striking distance of this mark as well.

-

This purchase builds on Eurobank’s initial investment in Hellenic Bank last year and now makes Eurobank the largest shareholder of the second largest bank in Cypress. Eurobank also has its own operations in Cypress. It is clear Eurobank has aspirations to grow in size. One strategy it is executing is to slowly build out its presence into adjacent countries. Chug, chug, chug. My guess is Eurobanks’s strong financial position is going to allow them ample opportunity to continue to expand over time. In a weak environment, the strong get stronger. The stellar work the past 5 years of the management team at Eurobank is beginning to really shine through. Here is another article discussing the acquisition in a little more detail: - https://cyprus-mail.com/2022/12/01/eurobank-to-become-hellenic-bank-majority-shareholder/ Eurobank on Thursday said that it has increased its stake in Hellenic Bank to 26 per cent, having now made an agreement for the acquisition of a 13.4 per cent share that currently belongs to video game company Wargaming, with the agreement pending regulatory approval. Following the acquisition, Eurobank has now become Hellenic Bank’s majority shareholder, further expanding the bank’s involvement in the Cypriot banking sector. Eurobank also operates its own wholly-owned subsidiary on the island.

-

@EBITDAg , yes, thanks very much for posting. ————— The article you posted does a wonderful job of explaining why we are not seeing more aggressive drilling by oil and gas companies in the face of higher prices. And why this will continue - until Mr Market properly values the stock prices of oil and gas companies (at a much higher level than where they are at today). A big part of the valuation problem is most of the large investors CAN’T invest in oil and gas (because of ESG constraints)… and this suggests to me the valuation discount could persist for years. The end result of low stock prices is oil supply will also remain constrained. And this will keep oil prices elevated. We are in an oil boom where oil companies are generating record free cash flow. Which are being returned primarily to shareholders. And supply will remain constrained. So record free cash flow will be continuing, likely for years. It is such a good story that pretty much no one actually believes it! It’s got to be too good to be true, right? And that is why i love investing so much. Despite the run-up in prices, most oil and gas companies continue to trade at crazy cheap valuations. Investors look at a stock price chart (vertical the past 2 years) and think… ‘missed that one’. But what have oil and gas companies done with most of the record free cash flow they have earned the past 18 months? Primarily the free cash flow has gone to 3 activities: 1.) Debt reduction 2.) Dividends 3.) Share repurchases. Some has also gone to M&A. And, yes, a little has gone to growing production. The end result is supply growth has been much slower than expected (forcing the US to aggressively tap SPR). And this will support higher prices in the future. As an example, i posted an update on Suncor yesterday. RBC is estimating free cash flow in 2022 of C$14.6 billion and $13.6 billion in 2023 (at US$91 WTI). Market cap today is C$60 billion. Stock is trading at 4.4x free cash flow. That is wicked cheap (i also expect oil to average more than $91 in the coming years… if so, the story gets even better). And what is Suncor doing with its free cash flow? Debt repayment, dividend, share buybacks. Minimal investment in growing production; any investments made have very high IRR. ————— An investor in Suncor today is getting: 1.) dividend of almost 5%, growing at 10-15% per year moving forward 2.) annual share buybacks of around 8%; this will increase to around 12% end of Q1, 2023 3.) reminder going to debt reduction. Debt targets could be hit by the end of 2023; then 100% of free cash flow will becoming to investors. ————— Another oil-sands play, Cenovus, is just getting to 100% shareholder return (they have, or are very close to, hitting their net debt target)… it really is a crazy time for oil and gas investors. ————— Below is the conclusion from the article referenced at the start of my post WHY WON'T ENERGY COMPANIES DRILL? - https://4043042.fs1.hubspotusercontent-na1.net/hubfs/4043042/Content Offers/2022.Q3 Commentary/2022.Q3 GR Market Commentary.pdf “When you think about the challenges now being faced by the industry in these terms, you can easily see why oil company executives would keep the pace of development subdued. On the one hand, you could increase activity, risk attracting the ire of policymakers, have your stock price go down (investors want capital return NOT production growth), and deplete your irreplaceable asset. On the other hand, you could return capital to shareholders, stay under the radar of policymakers, have the market reward your capital discipline, and keep your Tier 1 assets for a later time when the market will better value them. Is it any wonder energy companies are not drilling? In past cycles, the “signal to drill” has often been determined by the oil and gas price. When oil prices fell from $100 to $27 between 2014 and 2016, the industry laid down rigs because they could not generate a return on drilling. As prices recovered in 2016 and into 2018, the rig count rebounded by 600 rigs. Because of record low valuations, this is the first time we can recall where the “signal to drill” is driven by valuation instead of oil price. As a result, higher prices have not incentivized increased activity. Until investors allocate capital to the space and valuation improves, we expect drilling activity to remain subdued and oil shale supply disappointments to continue.

-

Kuppy’s most recent post? Oil could go to $300 in the next couple of months. Good thing higher oil prices don’t impact inflation at all… Those who see much lower inflation in the coming months had better hope Kuppy didn’t nail it this time. ————— I like oil/gas as an investment. I think we could see $150 oil… likely when the next expansion gets started (12-18 months out). $300 oil over the next few months? I am not so sure. ————— - https://adventuresincapitalism.com/2022/11/04/the-fed-is-fuct-part-5/ “I know that I touched upon this in Part 2 of this “Fed is Fuct” series, but I just cannot let go of this topic. It is simply too important of a question—in fact, it seems to be the only question in my mind as we find an event-path for “Project Zimbabwe” to re-accelerate. Let’s try a thought experiment. Imagine that OPEC pulled back on their production and sent oil to $300. Given how tight the oil market currently is, it wouldn’t even be that hard for them to achieve this. Given how annoyed they are with Biden and Powell, it’s easy to see how they’d want to do this and prove a point. Meanwhile, the rapid spike in oil prices would dramatically increase OPEC’s revenue, even with fewer barrels sold—making you wonder why they haven’t already done this. At $300 oil, the US economy would collapse. Sure, inflation prints would go parabolic, but with the rest of the economy in freefall, the Fed would be forced to stop chasing the CPI higher. In fact, I’d wager a healthy sum that in such a scenario, the Fed would dramatically reduce interest rates and flood the market with liquidity. The Fed would effectively ignore their inflation mandate in order to save the global economy from OPEC’s oil price spike—much like when they were fighting germs during March of 2020. In this scenario, the Fed would be responding to an exogenous event that threatened to take down the economy. Now, what if oil didn’t go to $300 due to OPEC?? What if oil went there because our President has joined an end-of-days economic suicide cult, with a bizarre carbon obsession?? The oil price spike would be the same, yet the cause would be different. In this self-inflicted scenario, would the Fed chase oil higher and continue raising interest rates to fight inflation?? Or would the Fed bail out the economy?? Every investor needs to answer this question and answer it correctly as the range of outcomes is too extreme if you get it wrong. If the causes of the oil spikes are different, will the responses be different?? I think we’re about to play out this experiment in real time over the next few months as the SPR releases end, right as China re-opens. The investment choices in front of you are quite different in terms of how you answer this key question. Sure, you’re going to ride oil into the supernova, but when you switch investment horses, which one do you choose?? What will JPOW do when oil hits $300?? If you aren’t fixating on this conundrum, you’re going to be paralyzed when it happens.”

-

Well 70 million Americans will be getting an 8.7% increase. Starting in Jan 2023. Nice to see that inflation thing is in the rear view mirror. ————— “With the payment increase in 2023, Forbes said 8.7% more will equate to an average added monthly benefit of $144 for individuals and $240 extra for couples filing jointly.” - https://ca.sports.yahoo.com/news/social-security-cola-2023-benefits-160922091.html ————— Where will the government be getting the money from to fund the increase? Someone will be paying higher taxes next year. The tax payers will then need higher income (consumer) or higher prices (businesses) to pay the higher taxes. That will lead to higher inflation and so the COLA for 2024 will be elevated again… and we get to do it all over again. Kind of like a wage and price spiral…. But i thought this inflation thing was transitory? (Some people also believe in Santa Clause, the Easter Bunny and the Tooth Fairy…). ————— Latest COLA The latest COLA is 8.7 percent for Social Security benefits and SSI payments. Social Security benefits will increase by 8.7 percent beginning with the December 2022 benefits, which are payable in January 2023. Federal SSI payment levels will also increase by 8.7 percent effective for payments made for January 2023. Because the normal SSI payment date is the first of the month and January 1 is a holiday, the SSI payments for January are always made at the end of the previous December.

-

@glider3834 thanks very much for pulling this together and sharing with us. You have done a great job of providing historical trends for lots of important inputs. A 95CR estimate for 2023 is what I am using currently. I don't think it is aggressive and as you point out it could easily come in at 94 in 2023. That would be sweet. I have net premiums earned growing 15% in 2023 to $22.3 billion, so a 94CR would deliver about $1.34 billion in underwriting profit. I am estimating $970 million in 2022 so this would be a sizeable YOY increase (+38%). It will be interesting to see where Q4 CR comes in this year; last year Q4 came in at a CR = 88.1. This will be an important number. Some thoughts: - one key is where catastrophes come in. And this is unknowable, of course. Taking the average for the last few years makes sense as they have been high catastrophe years. Hard market in reinsurance should really help here. - one benefit of the hard market of the past couple of years can be seen with the fall in the expense ratio (outlined beautifully in your chart) - hopefully reserve releases can continue to come in around 1.9 CR points on average moving forward. - yes, the inflation trend will be important to monitor. The good news is if there is development for the industry then it will likely prolong the hard market. I would be more concerned about inflation if we were in a soft market. I think another important development this year has been the spiking in bond yields. This has hit the reported book value of all insurers hard. I am thinking this could extend the hard market. Most insurers will not see the benefit of higher rate in interest income for another couple of years (given the average duration for P&C insurers is close to 4 years) - and this assumes interest rates stay high for years to allow them to lock in higher rates. Add in the emerging risk of inflation running hot for the next couple of years (not saying this will happen), it makes sense to me insurers will need to be cautious and continue to get significant rate increases moving forward. The economy also continues to chug along and this should help insurers continue to push for rate increases. Putting it all together I don't think my estimate for top line growth of 15% (net premiums earned) is crazy high for 2023. ---------- There are others on this board that understand the inner workings of P&C underwriting far better than me. Perhaps they can chime in with their thoughts

-

Here is the math in Canada (Vancouver/Toronto) for an investor. Lose money on the carry (your purchase will be cash flow negative). Make a killing on price appreciation. Where is the math? Well, the math is not important. Because real estate ONLY GOES UP. ————— I am looking to buy where i live in Vancouver: 2 bedroom condo (800 sq feet) - purchase price: C$800,000 - down payment = $240,000 - mortgage = $560,000 Revenue - rent: $3,500/month = $42,000/year - importantly, rent increases are controlled by prov gov’t. 2021 = 0%. 2022 = 1.5%. 2023 = 2% = 3.5% total increase last 3 years. Expenses - interest = $30,000 (5.5% interest rate) - property taxes ==$2,500 - condo fee = $400/month = $5,000 - reno/misc costs = $2,500/year Total expenses = $40,000/year Opportunity cost of $240,000 down payment @8% (low) = $20,000/year Revenue - Expenses (incl opp cost) = lose $20,000 per year Conclusion: i can buy a condo and lose $20,000/year (including opportunity cost). And hope that future price appreciation will cover my loss and provide an acceptable return. ————— Alternative? Invest my $240,000 and earn 8% = $20,000 per year. Hassle free. - if i can earn more than 8% this option gets much better. (My long term average is a little over 15% = $36,000.) ————— So when i look at buying a condo where i live in Vancouver (through an investors eyes) it makes absolutely no sense for me. ————- Other considerations: - real estate offers diversification (from holding financial assets only) - the rental market in Vancouver is nuts (hard to find and expensive)… my 3 kids will need to live somewhere after they graduate from university…

-

In terms of capital return, Fairfax has been pretty clear what the priorities are: 1.) solid financial position 2.) grow insurance subsidiaries in hard market 3.) buy back stock We also know a US$10/share dividend is coming in January. So investors know what they are getting when they invest in Fairfax. ————— Personally, i like what Fairfax has been doing on the capital allocation front the past couple of years. 1.) debt levels are a little elevated… most recent $750 million increase was used to increase stake in Allied World. Solid move. 2.) top line has been growing at 20% the past couple of years. Love it. 3.) share count has been coming down aggressively the past few years. I am VERY interested to see what they are doing with proceeds from pet insurance sale that closed the end of October. I wonder if Fairfax is buying back stock as part of its NCIB… someone is buying a bunch of stock spiking shares higher. Love it! 4.) looking forward to $10 dividend payout in January. Very shareholder friendly.

-

Greg, what happened in Ottawa is an event that started as a protest and then eventually devolved into essentially what was close to a riot that ebbed and flowed for days. The issue is that the police did not get ‘the protest’ under control earlier. And as we know with riots, once they get out of control, there is no Disney solution to bringing law and order back in to play. Much of what happened was in/close to residential areas. How long would you and your family tolerate big rigs driving down the street where you live blowing their air horns all times of the day and night? Three, four, five, six, seven days in a row. At what point do you say to the police/government… deal with this shit? Because the ‘protesters’ were not leaving. I am all for protests. I also want law and order. I am NOT a Trudeau fan. And i also do not agree with the method used to bring this mess under control. The ‘protest’ never should have been able to get out of control like it did - in my mind that was the fundamental mistake made. Mobs cannot be controlled once they hit a critical mass.

-

A pandemic hit the world back in 2020. Everyone was flying blind. We were very lucky in North America as we have about a 2-3 week head start as we could see what was happening in Asia and then Europe (and then here). I live somewhat close to one of the epicentres in the US in Kirkland, Washington State when it initially hit. Estimates are 35 deaths at this one facility were associated with covid. I remember watching the news reports in March 2020… this care home could have been on the moon. Covid was raging. People were dying. Care was non-existant. No one knew what to do. And the panic was real. No one wanted to be anywhere near this care home (given how little was known about the virus back then). Fast forward to today… yes, we know much more. Very good vaccines were developed. Most people in the West were vaccinated. And the virus has changed massively (to a much less dangerous strain). So the response in Western governments has changed from what we saw earlier in the pandemic. That is what should happen. China is the one outlier. They stuck with local vaccine’s that are not as good. They did not focus vaccinations on older people (those most at risk). They have not allowed the virus to run in a controlled way to get natural immunity. So if they open up now, even though Omicron is not that bad, the virus will still rip, hospitals will be overrun and a lot of old people will die. So their poor decision making the past 18 months is coming home to roost. They now have to choose between 2 bad outcomes. For now, they are sticking with lock-down. But it looks like the Chinese people are getting cranky. The problem in China is if you get cranky you likely end up in jail or worse.

-

As a follow up to my previous post, below is a fairly detailed build of what holdings are included in 'share of profit of associates' when Fairfax reports. The information by company is incomplete - but it is pretty complete for the larger holdings, which is what matters. I have gone through and pulled what information I could find in previous AR's. If we focus on the big rocks we can see the path to Fairfax getting to $1 billion (and higher) in 'share of profits of associates' in 2023 and future years. Four companies will likely drive 80% of the total: Eurobank, Altas, EXCO and Stelco. ---------- You can also reverse engineer the numbers below by looking at the reported results of the individual holdings. My understanding is the number Fairfax reports is roughly the pre-tax operating earnings less dividends paid - as reported by the individual holdings - adjusted for Fairfax's ownership percent ('Fairfax's share'). Please correct me if I am wrong. ---------- When companies were added/removed to this bucket of holdings is also relevant. I think Altas was added in 2018. Eurobank was added Jan 2020. Eurolife was removed in 2021. Stelco will be added in Q4, 2022, now that Fairfax owns over 20% (24%). Grivalia Hospitality will be removed in Q4, 2022 and will move to the 'consolidated' bucket given Fairfax's increase in ownership to 80%. Resolute will be removed in 1H 2023 when its sale closes. ---------- What a home run Eurolife has become. My guess is Fairfax has likely made enough money on this one purchase to offset all the losses from the poor investments listed below. --------- You can also see the fix for many of Fairfax's poor investments: - APR: sold to Atlas who is slowly turning that ship (lots of work left to do but Altas is way better positioned to execute on this) - Farmers Edge: moved to 'consolidated'; a big +$100 million write down this year. Likely on its way to zero (not far away now). - AGRFI/Atlas Mara/Other Africa: I think these have been sold or largely written down? Helios looks like the real deal... although it will take 5 years to likely see material progress (which is fine). Bottom line, most of the problem children holdings in this bucket have been dealt with. And the big dogs look like they will be barking loudly in 2023 and delivering good to very good results for Fairfax.

-

@Thrifty3000 good question. For 8.) Net Gains on Investments, I am assuming most of the $750 million gain in 2023 will be primarily from mark to market stocks/TRS. i am also assuming Fairfax will monetize at least a few assets and realize some sizeable gains on sale. The mark to market equities have been severely marked down in 2022… that will help future returns. The wild card is asset sales (leading to sizeable gains) and my guess is we will see more happening in 2023.

-

@returnonmycapital my guess is Bucket c.) will be a small good news story in 2023 with pre-tax earnings increasing to $250 million or so. Not earth shattering… but a solid improvement from the past 5 year average. What i am focussed on with all the line items on Fairfax’s income statement is the change: are each of the line items shrinking, staying the same or increasing in size (and how much). Recipe (hit hard by covid) is the biggest holding by far. I think it could deliver +$125 million in pre-tax earnings. Grivalia Hospitality just moved to bucket C.) and this should help. Fairfax India and Thomas Cook (hit hard by covid) should do well. Dexterra is fixing its modular business so its results should improve moving forward. Farmers Edge was written down (impacting 2022 results for the group), although we could see another write down here.

-

Fairfax has a number of significant tailwinds driving earnings higher. I have spent a fair bit of time posting on underwriting profit and interest and dividend income. There is a third item that is also spiking higher in 2022: share of profit of associates. Please note: I am not an accountant; I would appreciate it if other posters would point out any errors below (as I post to learn just like every else on this board… and I have thick skin!). I view this post as kind of a working paper... likely subject to lots of corrections/revisions. ---------- Over the 5 year period, from 2017-2021, ‘share of profit of associates’ averaged about $200 million per year for Fairfax. This year (2022) it should come in at around $1 billion for the full year. This surprised me. That is a big increase over the trend from the past few years. 2022 MUST BE an outlier and Fairfax should settle back to something closer to $200 million in 2023… right? Wrong. My guess is ‘share of profits of associates’ should be able to deliver around $1 billion again in 2023 and this number should actually grow nicely in the coming years. It’s like Fairfax in 2022 has magically found an incremental $35/share pre-tax ($800 million increase / 23.5 million shares). And this number could compound at +10% every year moving forward. That is a staggering increase in a very short period of time. What happened? Put simply, the earnings power of the equity holdings captured in the ‘associates-equity accounted’ bucket are beginning to shine through. The turnarounds have (finally) turned around (Eurobank). The fast growers are executing well (like Atlas). The commodity bull is running (Resolute, Stelco, EXCO). - Eurobank - Altas - Resolute Forest Products (will come out when sale closes in 1H 2023) - Stelco (will be added in Q4) - EXCO Resources - Bangalore Airport - Peak Achievement (Bauer hockey; 25% of Rawlings/Easton) - Quess - Kennedy Wilson Partnerships - Grivalia Hospitality (moved to ‘consolidated equities’ in Q4) - Other: Helios Fairfax, Astarta, IIFL Securities and more ————— What is ‘share of profits of associates’? Let’s start by looking at the big picture. Fairfax has an equity portfolio of about $15 billion. The accounting rules for these holdings can be confusing for investors to understand. From Fairfax’s 2020AR: “What we find useful in clarifying the accounting positions is to separate these common stockholdings into three buckets. Generally, for positions: A.) where we hold less than a 20% economic interest and no control, we mark to market B.) where we have an economic interest of 20% or more but no control (these holdings are called associates), we equity account C.) where we have control or an economic interest above 50%, we consolidate.” When Fairfax reports each quarter the specific results from each of their individual equity holdings will flow though the income statement and balance sheet in different ways depending on which bucket above the holding falls in to. Impact on income statement: A.) Mark to Market: Net gains (losses) on investments B.) Associates: Share of profit of associates C.) Consolidated: Other revenue & Other expenses Any dividends paid to Fairfax by any equity holding will show up in: Interest and dividends At Nov 23, roughly $5.6 billion, or 38%, of Fairfax’s $15 billion equity type holdings fall into the ‘Associates’ bucket. This $5.6 billion in equities will generate about $1 billion (pre-tax) in ‘share of profits of associates’ plus whatever is paid out over the year in dividends in the ‘interest and dividends’ bucket. ---------- Please note, in the table above, I have included the FFH total return swaps, debenture and warrant holdings in the ‘mark to market’ bucket. ————— From page 50, Fairfax 2021AR: Investments in associates Investments in associates are accounted for using the equity method and are comprised of investments in corporations, limited partnerships and trusts where the company has the ability to exercise significant influence but not control. An investment in associate is initially recognized at cost and adjusted thereafter for the post- acquisition change in the company’s share of net assets of the associate. The company’s share of profit (loss) and share of other comprehensive income (loss) of associates are reported in the corresponding lines in the consolidated statement of earnings and consolidated statement of comprehensive income, respectively.

-

-

@Gregmal you seem to be in the inflation is transitory camp. Please correct me if i am wrong. So where do you think inflation will be 6 months from now?

-

@dealraker good for you. Nice when a plan comes together Are you buying anything today? Anything (stocks or sectors) you think are cheap and exceptionally well positioned looking out a year or two?