-

Posts

5,482 -

Joined

-

Last visited

-

Days Won

14

Content Type

Profiles

Forums

Events

Everything posted by John Hjorth

-

John : Q : How do I invest succesfully for the long term? Bard : A : Here are some tips on how to invest successfully for the long term: Get your finances in order. Before you can invest for the long term, you need to know how much money you have to invest. You also need to make sure that you have enough money saved for your short-term goals, such as an emergency fund or a down payment on a house. Know your time horizon. How long do you plan to invest your money? If you're investing for the long term, you can afford to take on more risk. But if you need the money in the near future, you'll need to invest in more conservative assets. Pick a strategy and stick with it. There are many different investment strategies out there. Do some research to find one that's right for you and your risk tolerance. Then, stick with it, even when the market is volatile. Understand investing risks. No investment is without risk. But the long term is a long time, and over time, the risks of the stock market tend to average out. As long as you stay invested, you're likely to come out ahead. Diversify well. Don't put all your eggs in one basket. Spread your money across different asset classes, such as stocks, bonds, and real estate. This will help to reduce your risk. Rebalance your portfolio regularly. As your investments grow, you'll need to rebalance your portfolio to make sure that it still meets your risk tolerance and investment goals. Don't panic sell. When the market takes a downturn, it's tempting to sell your investments. But if you panic sell, you'll likely sell at a loss. Instead, stay calm and ride out the storm. Here are some examples of long-term investments: Stocks: Stocks are shares of ownership in a company. Over the long term, stocks have historically outperformed other asset classes. Bonds: Bonds are loans that you make to a company or government. Bonds are generally considered to be less risky than stocks, but they also offer lower returns. Real estate: Real estate can be a great long-term investment, but it's important to do your research and understand the risks involved. Mutual funds: Mutual funds are baskets of stocks or bonds that are managed by a professional. Mutual funds can be a good way to diversify your portfolio and reduce your risk. ETFs: ETFs are similar to mutual funds, but they trade on an exchange like stocks. ETFs can be a good way to get exposure to a particular asset class or index. Investing for the long term can be a great way to grow your wealth. But it's important to do your research and understand the risks involved. By following these tips, you can increase your chances of success.

-

Both parts are somewhat stuck in this warfare, generating desperation in the situation on both sides. Ukraine is desperate, because it would be run over if not for the support by the NATO and G7 countries. No need to complicate things here.

-

@Xerxes, Nothing you posted above was about your in casu skin in the game. Please let it go, as I will from here.

-

@Xerxes, You simply don't discuss in this topic, as if you have some skin in this game [, which is to you as a Canadian citizen as a fact at the most by now indirect and immaterial]. To me, the only thing to change this attitude of yours and wake you up would be an agression from the North from Russia, over the North Pole. I'm not going to spend time to comment on similar posts from you in this topic going forward. I'll leave it here.

-

So what, @Xerxes ? Like talking about running what into the ground? Putin is 71 years old. The stock that has already killed him has the ticker $RUSSIA.

-

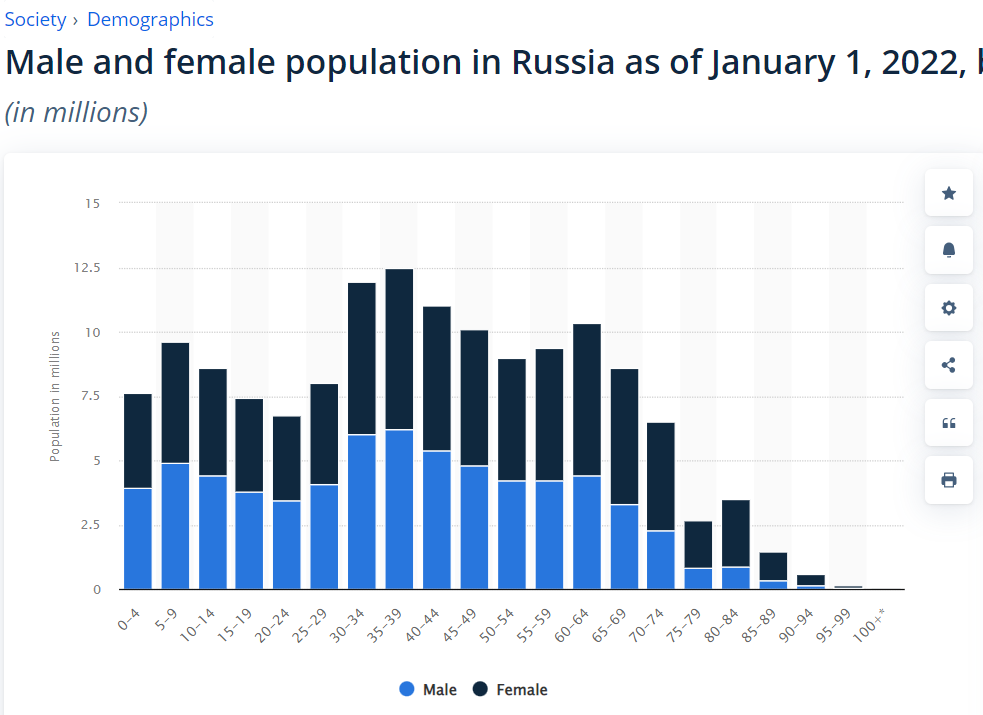

The ramifications for Russia in the future will become severe for its population, allmost beyond imagination, a melting icecube, gradually disintegrating and collapsing into a hellhole where noboday wants to stay or live, untill a material change in tracjectory for the future is set, based on demands for such changes by the incumbent population [by demands for societal reforms, uproar, revolution, coup d'état, civil war etc.] Statista [July 12th 2023] : Male and female population in Russia as of January 1, 2022, by age group (in millions) I don't think I have to explain anything to anyone a member here CoBF about how to interpret these statistics, related to @Vikings comments above, combined with thinking about what has happened to the graph since January 1st 2022. A turnaround, that is so far from even beginning to look like a turnaround, long way ahead just to begin looking like a turnaround, after which it actually has to become turnaround, that actually turns.

-

KAL cartoon [July 6th 2023] in The Economist. [Perhaps needless to say, but I like it [ ], especially on a day where there will be a solution for a roadmap for Swedens NATO membership, and thereby for the NATO members in Northern Europe in the Baltics and Nordics.]

-

@MMM20, I think, you'd better be careful such presumptions about the implications of such assumptions for an insurer - not much is static in that space of business for such a period. That does not change the fact that FFH looks really compellng right now.

-

I wish you good luck with it all, @RedLion! It reads interesting, with a lot of potential! Thank you for sharing.

-

Bloomberg [July 10th 2023] : Erdogan Links Sweden’s NATO Entry to Turkey’s EU Bid. The man is an intellectual pygmy. The legal framework for EU has nothing to do with the legal framework for NATO.

-

@RedLion, Are you simply shiftning a part of your invested capital to another [non-listed] asset class, or are you buying a new home? If it's the last alternative, congratulations!

-

Just some educational info here [without the intent to appear condecending towards fellow board members posting in this topic, or for that matter any CoBF member] : North Atlantic Treaty Organization - Press Release [July 7th 2023] : Defence Expenditures of NATO Countries (2014-2023). Full document in PDF with data tables and charts. Whose war is it : The war belongs Russia and Ukraine. Whose problem is the war? : To me, it's primairily a problem held and owned by Europe, because the war is going on in Europe and destabilizes Europe in a material way. ['Europe' here includes both Russia and Ukraine.] In the end it's an issue for every state in the western world, where societal values are based on democracy and freedom. I have no problem with understanding the stances of @cubsfan and @Castanza about USAs participation in the financing of the war. As a Dane, I'm actually embarrased by the Danish part of the data in the above mentioned material.

-

Please just give it a go. There is nothing as entertaining as a good libel trial, especially when your opponent is deceased. Up it Up!

-

"Russian National Interest" in casu? - Please give me a break. The man is runnning and ruling the country for his own personal benefit.

-

It's pretty striking to me, I would say, that not Browder, nor Kasparov, nor Khodorkovsky has much tangible to add here. Perhaps it's time to just settle with the Winston Churchil quote above posted by @Xerxes, and to shrug.

-

Add to that a priori low expectations, and you have a recipe for good life, if one combines it with living below or at your means. None of us need to be the next Warren Buffett to do good. - - - o 0 o - - - Perhaps one day, I'll tell the story about *F* here on CoBF [*F* will stay anonymous, unless he may chose to register here on CoBF.]

-

To get this calculation right pre tax, you have to include withheld dividend taxes as withdrawals to the calculation. Counterintutitive, but so it is.

-

Great one, @Xerxes!, What do you do to take down a man who takes him self too seriously? You troll him and pull pranks on him, so he looses face. Twitter : Phillips O'Brien : Ukrainians openly trolling Russian navy . Twitter : How to pull a prank, saying "Who owns whose a**" [Normally, this phenomen is about cats, not dogs.]

-

Two weeks today since what I have called the coup d'état. Still no *real* [tangible / solid] information about what's going on inside Russia. I'm puzzled.

-

It would be nice to getting back to sharing facts.

-

Bloomberg [July 6th 2023] : Russia Gas Giant Warns of Sanctions Risk for Ukraine Energy Firm. This has the potential to turn really bad - for both Europe and Russia. I have mentioned the gas pipelines in Ukraine before upstream in this topic and their importance, everyone seem to skip or disregard this matter / issue. Gazprom PJSC CEO Alexei Miller has for long now looked like something dragged inside the house by the cat, when he has been seen in videos. I think nobody envies him his job. Really bad, when international trade gets messed up with geopolitics. Personally I speculate that this could evolve and escalate into something worse than last autumn and winter in the European gas markets.

-

ICPA - Eurojust. Now, just wait patiently and see how this initiative is going to play out.

-

Has anybody seen any tangible / solid information about the whereabouts of Yevgeny Prigozhin recently [in the last week]?

-

Ian Fleming did not know, that what he was "inventing" - making up and thinking up with the use of his imagination and fantasy in 1961 while finishing the manus to Thunderball introducing SPECTRE would end up later to become quite similar to the playbook of Wagner PMC. All, from Russia with love. A tapeworm, but the logo is clearly an Octopus. It's deeply concerning.

-

Awesome, thank you for sharing, @Spekulatius, Purpose plausible deniability, and in this week we've got videos on Twitter, where Putin is putting numbers on the "chef" activities, and PMC activities, drowned somewhere in the Russian state budget. I only find it a bit amusing, because I've not been contributing to it. The man is simply loosing it.