-

Posts

15,184 -

Joined

-

Last visited

-

Days Won

38

Content Type

Profiles

Forums

Events

Everything posted by Spekulatius

-

Sold $CVS. Lost confidence after they were rumored to circling $CANO

-

US / Blinken‘sview on Taiwan:

-

This cartoon is actually pretty good:

-

I would argue that the FANG are too large to be Nifty Fifties. Xerox etc never were that large relative to the economy back in the 1960's than the FANG are right now. it's the law of large numbers more than anything else that is a problem for the FANGS, not so much the valuation (valuation was the main issue with the Nifty Fifties back then).

-

Where Does the Global Economy Go From Here?

Spekulatius replied to Viking's topic in General Discussion

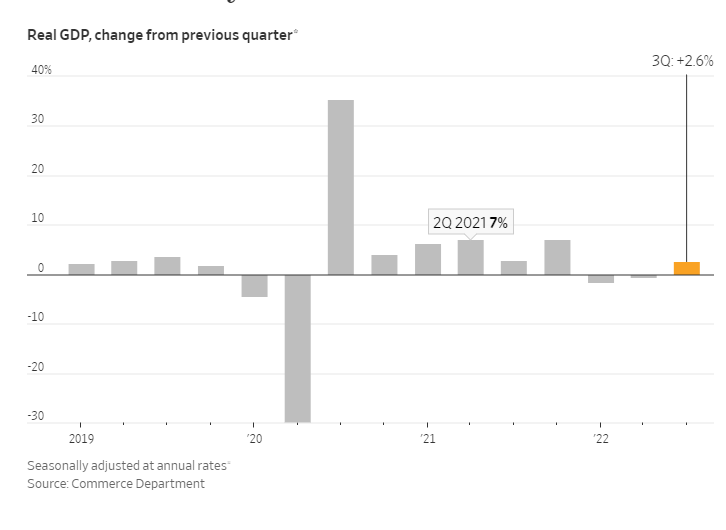

Economy seems fine. 2.6% growthin Q3 2-2022. The last two quarters contraction was clearly a result of lapping tough comps (6-7% growth in 2021): -

China is likely complicit and knew about the impending attack. Putin met Xi on February 4 supposedly for the Olympic games when Putin was already amassing his army on the Ukraine border. I am guessing Xi told Putin to wait until the Olympic games are over (20 February) and then Russia attacked on February 24. I don't believe in coincidences on these matters. Now, I am not sure if Xi Jinping approved of this war, but he sure didn't do anything to prevent it either. I think they liked the idea that Putin tries his luck first and then decided to let him hang dry when things went sour and claimed to have nothing to do with the matter whatsoever.

-

Russia and China are linked. First of all, they are allies (even though it may be more like the Stalin Rippentropp pact) and second China is surely watching how Russia is doing in Ukraine and even more so how the West responds to it. I would bet that nobody gave a damn about Ukraine, China would get their preparations for an invasion of Taiwan into overdrive -in fact they may have done it already. China was just a bit smarter to let the Russians go first.

-

It‘s a war. Russians do what they always have done. Give Ukraine weapons to eliminate the threat - defense system, but also long range weapons to take out the launch sites wherever they are (Crimea). Get back to the Iran regime responsible for the drones and Republican guard as well with targeted sanctions as well. I didn’t really know that the Republican guard is not just elite army (and terror organization ) but sort of works like commercial and industrial organization woven deep into the Iranian economy. Sounds a bit like Putins Oligarch cleptocracy/oligarchy system.

-

The next step is China sanctioning the US in retaliation to the US semiconductor sanctions enacted right before the CCP Congress.

-

I think Peter Zeihan's view is correct, except I don't think the US (or any other nation) can go it alone. In the future, you have to pick sides. The US is going to be a huge trade block with North America (CA, Mexico, US), Europe, Australia and Japan, Taiwan etc) and then there is the "Axis" with China, Russia, North Korean, Cuba Venezuela (?) and Iran trying to lure some more in via Belt and Road. there will be iron curtains between the "Axis" and the Western block. Not sure where Saudi Arabia,. India, Brazil & South America, and others like South east Asia and Africa will go. Trade between these blocks will still continue, but is purely opportunistic and rules can change or trade in parts could be shut down on a moments notice. This will not globalism's in terms of trade and market access as we know it any more.

-

U.S. Retail Investors Down 44% YTD Ending October 18th

Spekulatius replied to Parsad's topic in General Discussion

The average retail investor account probably has (or had) $1500 in meme stocks, tesla call, crypto s etc. I think the median return is much more meaningful and probably close to the index returns. -

I don t think the Fed is looking at the stock market at all at this point. They are looking at credit markets (as they are obviously tightening), but as long as credit risk spreads are relatively moderate, I don't see much of an issue. The bigger issue is international and especially EM's as indicated by the USD rising against pretty much any currency. Looks at this: https://www.etftrends.com/disruptive-technology-channel/arkk-takes-in-nearly-half-billion-in-september-flows/ I don't think private &retail investors are panicking, the stock market selling is probably from institutional investors rebalancing.

-

i think the stock market really disliked the Neo Maoist vibes from this Congress. Then there was the selection of leadership for each Politburo: https://www.scmp.com/business/china-business/article/3196994/hong-kong-stock-index-slumps-below-16000-mark-new-13-year-low-chinas-leadership-reshuffle-leaves-no?module=live&pgtype=homepage They keep on saying the right things from time to time (also stronger action against monopolies may not be that great for Alibaba and the likes )to calm things down, but the signaling toward a new Maoist era isn’t really bullish for equity investors by any stretch of imagination. The simple message from the CCP Congress is that expect more of the same of what you have been seeing lately as long as Xi is around (at least).

-

I agree on declaring them a terrorist state. De facto they are already. Trying to hit civilian infrastructure has a poor record of changing war outcome as well. The Russians will most likely lose Kherson and a significant part of their army very soon. A countermeasure against the drone swarm will be found as well, possibly by jamming GPS signals or something like cannon based defense systems. The Iranians don’t do themselves any favors either. What little they gain by helping Russia will be absolutely overshadowed by increasing sanctions and getting deeper in the terrorist state stigma and international isolation. Really stupid from their perspective. The mobilization brings through war from something to watch on TV to something that starts to affect lots of families and I think quite soon , almost everyone will know someone who get killed or injured in the Ukraine. How much this changes Public opinion, we do not know, but I think it will change the perception for some people about their government.

-

@Dinar Sorry for leading the thread OT (college admission) it was just a point I was interested In personally. I think adding racial criteria rather than objective measures to school and college admission criteria leads to rabbit holes that should be avoided. I absolutely think that being a black or Hispanic gives you better chances than being white or even more Asian at the same level of qualification currently. My son is half white and half Asian technically and we for sure won’t identify him as Asian in his college application process. I wrote this just to debate your numbers for Harvard (22% black admissions when it‘s in reality 15.2%). I do agree that even these numbers could indicate racial preference to the admission process. On the other hand does anyone really think that Chinese Colleges are better than US ones ? Does anyone know of a Chinese American sending their kids back to a Chinese college?

-

The Harvard freshman‘s are 15.2% black, not 22%. So slightly over represented. I am sort of interested because my son will apply for next year. https://college.harvard.edu/admissions/admissions-statistics

-

Yes, indeed. I am happy to see this as well. People say I lot about the stupidity of the Europeans here, but the same negligence is going on here in NE with respect to obstructing NG pipeline builds. It is literally possible that NG need to be rationed here in a really cold winter and with a bit bad luck while having basically the Saudi Arabia of NG right around the corner just 200 miles from here (Marcellus field). I guess nobody believes it until it actually happens.

-

I think earnings could look better then people think, because the inflationary costs to input costs for a lot of companies have started to abate. Of course this differs from business to business and energy costs are still high and probably remain so, but for a lot of others things, input costs (which have been pressuring margins) have started to revert and some may end up recovering margins that has been lost during a cost surge. For tech companies, While I agree that growth may slow, there is a lot of fat in salaries. Both in terms of high salaries being paid as well as the numbers of positions and perks they may be able to cut, once competition for talent from upstarts and hot areas like crypto starts to abate.

-

This sounds good. If indeed LNG starts to flow from the floating terminals in a few weeks from now, then I think it will go a long way to alleviate issues in winter:

-

Looking for Advice / Stories from Older folks

Spekulatius replied to randomep's topic in General Discussion

Yes, the vast majority technical people leave by choice, not because they have to. The, "let's fire the older guys and hire cheaper college grads" was happening in the 90's and maybe for a short time after the GFC (when college grads were scraping for jobs) but it hasn't been happening for quite some time. The reason are the high boomer retiring rates (which means persistent losses in tech experience) and the college grads are just not showing up. College grads are not cheap either... -

Maybe $STIPS might work as well. it's a 0-5 years duration TIPS ETF.

-

I think the biggest risk is that you are forced to sell it because it is a state controlled entity like what happened to CHL and CNOOC. Similar idea is PBR-A. It has paid out more than 20% of my investment in just a couple of month. it's interesting to hold these dividend monsters in tax deferred accounts. You really want to get your investment back very quickly with these sort of iffy entities. 10% return is not enough, imo

-

Looking for Advice / Stories from Older folks

Spekulatius replied to randomep's topic in General Discussion

The replacing depends on the job. In my area of expertise (loosely related optics) engineers are hard to get - to niche and those that are working tend to be specialized. I bet ASICS and Chip design is the same thing. So if you hire a different engineer, it takes years until they know their way around. In my area, the talent drag from older folks retiring is very real. Then the company hires new engineers from college and while some decide to hang around, I see more than half changing the job after 2 years and the whole training thing starts from scratch. There are many engineering disciples like this. Try material science, chemical engineering, automobile and many others areas that are not flashy but keep the world moving. These areas pay decently but not enough to really attract new young engineers or scientists who are more interest in "tech" or get rich doing something crypto or something along the lines. I can't blame them either. -

@thepupil thx, i don't have a clue either. However the fact that "risk free" rates are blowing up means that perhaps they are not considered risk free any more. Perhaps the Quantitative tightening is the reason as you stated. I would agree it is an indication that something somewhere is blowing up. Perhaps we are seeing a repeat of the pension fund disaster in the UK.

-

Anyone knows why the ^TYX (30 year treasury) is going parabolic? This is an insane movement since August.