-

Posts

15,151 -

Joined

-

Last visited

-

Days Won

38

Content Type

Profiles

Forums

Events

Everything posted by Spekulatius

-

@Cigarbutt The deposit to cash ratio is meaningless. In the past, banks have used MBS and treasuries as cash substitute, but that‘s not valid any more because the MTM on debt securities make them essentially an asset that the banks can’t touch (until they are close to par again). So in my opinion, you need to look at loans plus longer dated securities and if you do that, the liquidity is far less impressive. Pretty much all the longer term security on the bank balance sheet are now immobilized : Deposits made a Huge jump in 2020 but are now shrinking https://fred.stlouisfed.org/series/DPSACBW027SBOG Looks like there are $4.4T of treasuries and MBS on the banks balance sheet, which are mostly “under water”, so they are basically immobilized and can’t be sold , since it would lead to loss of regulatory capital. Those $4.4T represent basically quantitative tightening. I guess some of it is shorter dated paper, but I think most of it is longer dated. https://fred.stlouisfed.org/series/USGSECNSA

-

For cash return junkies, PBR-A is hard to beat. Nothing comes even close.

-

@KJP Signature bank had a liquidity issue, not a solvency issue. Their deposits were fleeting and they had $31B in MM accounts and others in short term savings. there was relatively little in transactional account. Ad for 12/31/2022 they had already drawn ~$12B from FHLB, but they have not borrowed from the discount window (I think they can do so by using MBS or treasures as collateral.) At 12/31/2022, their liquidity didn’t look that great, but not that bad either. They had ~$6B in cash and I think a total of $12B in cash and ST securities. My guess is that the situation must have deteriorated from 12/31/2022 and Barney Frank said, that they were OK until the last hours of Friday. the withdrawals must have been huge , I guess in excess of $30B so they exhausted cash, FHLB capacity and discount t window capacity. Either that or the treasury / FHLB don’t let them draw down their credit line. Ny concern is that similar things can repeat. Maybe we get Meme inspired deposit runs on instructions started on Reddit. the Fed and regulators should take the potential for those serious because a few failures will cause a banking meltdown. I think extension of deposit insurance (higher limits or no limits at all) may be necessary. I think you are also correct that there is less friction. Social media was around in 2008, but we have seen the herding being much more pronounced as is evident by the GameStop /Meme crowd, Then there is easer transfer capability which formerly needed to do in the branch. Now I can do it Friday afternoon at 3Pm to get my money back the same day. Again, removing friction is great for the customer , but it also can get things moving much faster and pot. destabilize a bank. I would love to see a post mortem of a Signature bank case much more so than the Silicon Valley bank, because the former was mich more like a plain vanilla Bank than the latter. anyways, the risk as different than what the regulators have considered so far, which were mostly due to economic distress, loan losses, counter party failure. I don’t recall seeing losses on securities due to higher interest rates and sudden bank runs accounted for in stress tests.

-

If you take Book, you should at least tangible book. FWIW, I took a look at Signature bank. The bank was rated BBB+ / A- when it was seized. The banks want insolvent either - they had $7.2B in equity, ~$700M in preferred and the bond losses were about $3.2B total. So there was quite a bit of equity left. There are many banks still standing that look worse. What SBNY didn’t have was a stable deposit base. They also had the crypto connection against them. So there was a bank run and instead of saving them, the bank was seized, despite reasonably solvency. I think the point can be made, that it was probably the crypto connection , that did them in. I think the regulator were probably out to get them. It’s interesting and somewhat alarming because I don’t think I have ever seen a bank with those metrics that SBNY had fail. At the end of the day, while numbers matter, it’s really only two things that matter - the trust of the regulators and the trust or the banking customers. If one of these is lost, your tangible book value will not save you. I think balance sheet and earnings wise, FRC is in a way worse condition, yet is still limping around. Although, I think they may become part of JP Morgan wealth management soon. It can’t really be that great to cater to HNW clients when your stock trades like a penny stock on steroids.

-

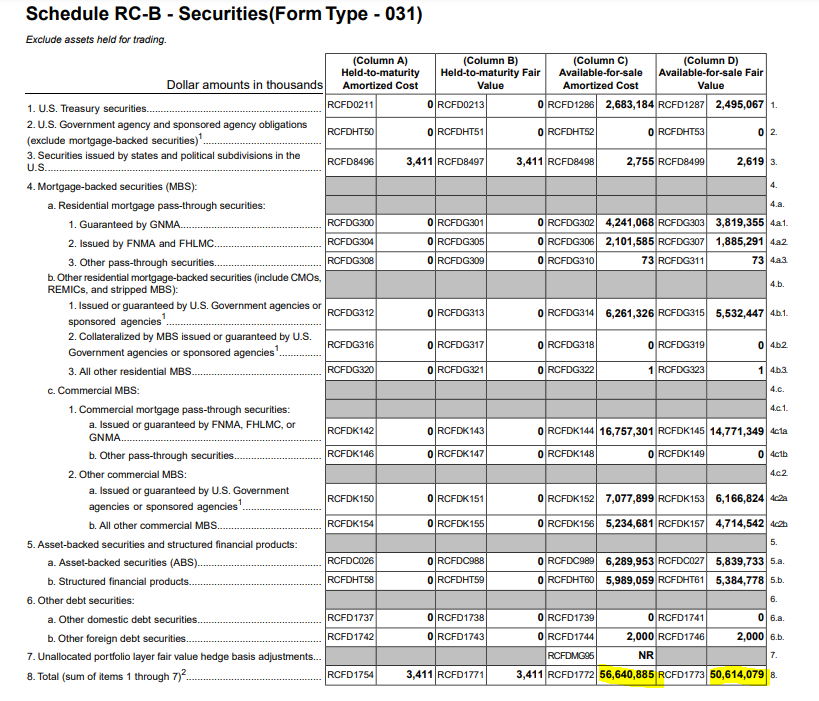

I actually think that banks can elect if they do let AOCI affect regulatory levels or not, but I am not sure. here is one Example. FFIEC report from Exchange bank in Santa Rosa. They hold a huge bucket of securities (~$1.5B) in AFS. MTM loss ~$150M Hence the fair value losses run to GAAP equity and reduce it from ~$350M to ~$200. However , despite th MTM losses reducing in GAAP book value, and the securities held AFS regulatory capital stills stands at $350M Second page below shows that Exchange bank has elected to opt out of AOCI. So I think the GAAP equity is $202M here and the regulatory capital is $355M. As far as I know any bank that I have looked at ops out of AOCI adjustments affective regulatory capital. I may have misinterpreted something Example ZOIN Bank - same form: I always imagine that if the CFO or his assistant one day makes a mistake and checks the box with a "0" instead of a "1" and sent this to the FDIC the bank could instantaneously implode with the Fed standing at the door on a Friday afternoon to shut the place down. Oops.

-

I think there are mistakes in this table or it's meaningless. Banks can elect if they put debt securities in the AFS or HTM bucket. If they put them in the AFS bucket, then they are taking a hit to book value (if the security loses value), in the HTM bucket, they do not. For regulatory capital purposes, both AFS and HTM get treated the same though and they do not take a hit to regulatory capital if they put it in either AFS or the HTM bucket (as long as it's not impaired or sold) . Regulatory capital is what should matter here. For example, BAC has $173B in tangible book value. Most of their securities are in the HTM bucket, so they have not taken a hit to book value on their HTM losses which are ~$115B. So tangible book would really be $173B -$115B = $58B which looks pretty bad in above table.

-

USB is an example of what happened. revenues went up ~40% in 10 years, share count down 20% ,earnings from $3/share to $5/share yet shares trade lower than they did in 2012. Just one example as there are many others. Maybe Mr Market is correct, but at some point, something has to give. And yes @LearningMachine is correct, that USB needs to rebuild their equity base that was reduced by the MUFG acquisition.

-

That's meaningless. Many energy co's destroyed value from 2015-2020. A lot of them went bankrupt as well, others diluted. If you look at those that did not dilute like XOM, they do indeed trade higher than in 2016.

-

I looked at it briefly, but felt that it's too risky to put much into it. I definitely wished i bought some around $8. it does not look like a bank that regulators would just shut down though. ZION, FITB and KEY are similar play , but in a bit better shape and I think they should be fine. They may be good candidates for "ambulance chasing".

-

With their deposits, banks either do loans (their primary purpose) or buy bonds (MBS or treasuries). With securities I mean income securities (treasuries, MBS). Intentionally or not, the banks sucked up a lot of them in 2021, basically doing what the Fed has been doing with quantitative easing. They won't buy more of those long dated debt securities now and likely just run off the ones that they own as they amortize (MBS) or come due.

-

It really depends on the trajectory of the share prices. I always say that everything in my portfolio is for sale at any time for the right price. So if regional bank prices bounce back quickly by let's say 25%, I would likely sell. I do think we are looking at more long term issue, so my guess is that it's not going to be a quick trade. In any case, i wanted to create a thread to put the knowledge / input that posters here in one place. Generally speaking, I only buy bank stocks if there is a crisis of some sort and that seems to be the case right now. it's only then when the questions about balance sheet and quality of loans come up. The share price swings associated with these changes in sentiment can be huge, so there is a significant opportunity to make some real money.

-

Most E&P / energy companies have disconnected from the weak pricing of WTI recently, which is not something that will continue indefinitely.

-

I agree- the banking crash equals quantitative tightening. The banks are the main transmission mechanisms for credit and all of them collectively will increase the liquidity on their balance sheet somewhat. That means less security purchases and more importantly less lending.

-

The banking crash is basically quantitative tightening. Banks are one of the main transmission for the Fed because they lend to Main Street. Banks collectively will probably increase the liquidity on their balance sheet, which means they buy less securities and lend less. Thats basically monetary tightening. Now we have banking stocks crashing in Europe as well, caused by CS of course.

-

Consistent growth in the area they operate in is good, but the last thing you want to own is a bank in a real estate bubble. For a smaller bank,growth in the area isn’t the most important factor , it matter more how tough and smart competition is. I would rather own a bank in a slow and steady growing area than one growing in leaps and bounds. I have heard the name Seacost before and it might have been a bit after the GFC. I recall management being very promotional and also happy to make acquisitions which did not alway seem to pan out. I stopped tracking them back then, but they still seem to like acqusitions.

-

@Dalal.Holdings Thanks for the summary, i was aware of the insurance transaction. It is interesting that the insurance brokerage business is worth a substantial part of TFC market cap. I followed TFC when they were BBT for a while and never really liked management too much as I think they overpromised and underdelivered. That said, the shares seemed habe taken quite a beating for a bank with this quality and particular the demographic tailwind in their operating area.

-

@CorpRaider I felt the MTM losses were underreported at that time, but it’s now that it got everyone’s attention, it should not be the sole focus. I think the possibility to pledge securities with the Fed goes a long way to alleviate bank runs. If we indeed get more bank runs, I expect the limits on deposit insurance to get raised, because I think the Fed will do everything to protect banking from a meltdown because it would cause a meltdown of the economy with unthinkable consequences. As far as an ownership is concerned, I own (and added recently) to USB and started positions in TFC and PNC. I do think that PNC has better management than TFC, but TFC is nicely positioned in the sunbelt, which gives them an organic growth advantage. I believe the super- regionals should be able to handle any crisis just as well as the mega banks. One of my biggest concerns related to macro is commercial real estate, especially office and to a lesser degree retail. Smaller banks, but also larger banks have heavy exposure to real estate lending and the interest rate changes are going to lead to lower valuations here.

-

I think you can’t look at the asset side of a bank in isolation without looking at the liability side. The issue with mark to market aside, the simple fact remains that banks make more money at higher interest rates than with ZIRP, because NIM tends to go up, up to a certain point. That said, the deposit run is a risk, but we are not exactly in unchartered water with 4% interest rates either. Personally, I like the super- regional banks better than the merge banks with an investment bank attached (JPM, BAC , C) but I do think that at least JPM achieves some synergies having both, the rest I am not so sure about.

-

Who is black? I got to get myself tested.

-

I don’t think so. This would be quite a statement actually. I don't recall them putting out hard numbers on housing valuation.

-

So what fucks the poor (however you define it) more? a) 5% unemployment and 2 % inflation or b) 5% inflation and 2% unemployment? Quite frankly, it is not clear to me. I think the middle class is fucked more by b).

-

I think WFC is just too kneecapped plus their online banking still sucks. I would rather go with regionals like PNC or TFC or USB (bought a bit of all three today). I just don’t think it has much of a chance to perform very well.