-

Posts

14,797 -

Joined

-

Last visited

-

Days Won

37

Content Type

Profiles

Forums

Events

Everything posted by Spekulatius

-

And the rest goes broke doing the same thing.

-

I believe the commodity side of inflation is transitory, the labor side will not be. If you read the transcript of Biden‘s speech in the Twitter thread I linked in above, they are actually trying to create labor inflation. That would be the end of trickle down economics and probably not good for most equities. Thats a total regime change from the economical framework we have been seeing for 40 years, if it indeed occurs.

-

@CastanzaSome of the above is transitory. I have not noticed much inflation with groceries. Restaurants are getting more pensive for sure, but it seems to be more in the 5-10% range than 50% range. The long term driver for inflation will be wages, not lumber or other commodities. I think we are done with trickle down economics if this thinking goes into action:

-

ABNB certainly has the potential to be a great business, but it hasn’t proven itself yet to generate earnings. I am always amazed by the stuff these IPO‘s are spending on for what seems like pretty mature products/ platforms. I have never used ABNB. This is mostly because the cost is too high - we typically spent just a few days in each location and then when we add it up, the various fees makes using ABNB fairly uneconomic compared to Hotels. We have used VRBO several years ago to rent a skiing lodge NAND two years ago, we rented an apartment in downtown Montreal via Hotel.com that was hosted like ABNB. What I liked about Hotel.com is that the fees were included so you could directly compare it to Hotels vs ABNB tagging all sorts of fees on it after you made your choice ( I suspect they do This buy design and it is not customer friendly at all). ( ABNB rant over). Anyways, i keep my valuation discipline. I watch these new IPO and from time to time, I see some where subsequent drops bring the valuation into a range where it makes sense and then I buy a few shares. I haven’t really seen fat pitches from my perspective, but I have seen some where you don’t need 20 years of 20%+ growth and heroic margin assumption to see value.

-

It should absolutely get investigated what happens in this Wuhan lab at that one and the US should apply pressure tomorrow the Chinese to open the Sarong so to speak. If it want in the lab, we should be able to find the animal host and transfer chain. it should be evident for everyone that after hundred thousands of dead and trillion $ in economic damages throughout the world economy, we need to find out exactly what happened and to prevent this from occurring again. In the meantime, assume Occam’s razor is correct 80-90% of the time. I also think we should support Taiwan and give them the 23M/46Mdoses of a vaccine they need to get most of the population vaccinated. That would send a nice signal to allies and a big middle finger to the Chinese who want to sell their lousy vaccine to countries that don’t have any other options.

-

The bigger question is why would you want to deal with a stablecoin cryptocurrency at all? It seems like you take counterparts/ collateral risk and inflation risk at this same time. Why not stick with USD? Seems to work perfectly as a means to exchange goods and services.

-

I agree that ABNB ‘s valuation looks rich here north of 20x revenues. I can make the math work at the IPO price and maybe a bit more, but the math looks challenging around $120 or more.

-

-

Seems like a game of musical chairs with not enough chairs. Fed buying treasuries (in exchange for reserves) then repo'ing reserves in exchange for treasuries. I guess it all makes sense, but does it accomplish anything? I doubt it. I guess someone somewhere grabs a few pennies in front of some sort of steamroller.

-

When will the Fed stop QE and raise rates?

Spekulatius replied to muscleman's topic in General Discussion

Why is that? We never tried UBI. We did sent out the first round of stimulus checks for everyone (similar to UBI) but most of the stimulus was sent explicitly to people not working ( enhanced unemployment benefits). This is not UBI. UBI would be sent to everyone, including those that are working, so it would not deter people from working than the current system. -

The Chinese SinoPec vaccine doesn’t seem to work (efficacy is very low) so that partly explains why it was developed so quickly. The mRNA tech was there, but it was obscure and not a single vaccine was approved using this tech. A lot of people were sceptic, but it really proved that it was superior both in terms of development speed ,as well as efficacy. I am certain that this will be used for other use cases too, including very good initial results in Malaria (which has long been an elusive target for vaccines). Malaria is a curse for many countries in the tropics and having a vaccine available would be an absolute game changer.

-

Buffett/Berkshire - general news

Spekulatius replied to fareastwarriors's topic in Berkshire Hathaway

Well, I used to like the podcast, until it became a de facto crypto podcast, then I stopped listening and following it. I think the split was a good idea as there are pretty different audiences. I will probably follow TIP again and see if it‘s back to it’s former self. -

What long term principles exactly did you forget buying DISCK? I can easily see pot. value as many others here as well. I just think there is way more risks here than those that put money in it.

-

It's a bit like this century version of the James Bond "Goldfinger" plot, if you replace gold with bitcoin.

-

I found this link interesting. How to kill Bitcoin: https://joekelly100.medium.com/how-to-kill-bitcoin-part-1-is-bitcoin-unstoppable-code-7a1b366f65ee Some of things proposed seem a bit far fetched as they requires world wide coordination, but the idea to that a nation state could slow the mining to a crawl and then launch a 51%+ attack seems interesting.

-

My biggest insight from all this is that QE <> money printing. QE at best creates an "unnatural" interest rate curve but it does not put money in anyone's pocket. Fiscal policy does print money and puts it directly into people's pocket (the stimulus checks are literally helicopter money), but seem to be easing up on QE at the same time. As far as monetary policy is concerned, we are living though a regime change.

-

It is the multiplier effect including asset value inflation at work. Many things are not bought from cash flow, they are bought via gains from asset inflation. If this reverses, the wealth effect and the Lambo’s (a classical douchebag / nouveau rich indicator ) will get scarcer too. 15 years ago was 2006 and we know what happened next. I don’t think we are close to some meltdown, but those are hard to predict and only obvious in hindsight.

-

Lower the rates by 50% or whatever the clearing rate is and see what happens. They need to reboot this starting from a lower basis.

-

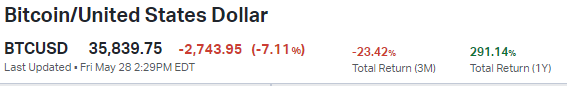

This is what a diversified portfolio of crypto looks like right now: 1) why are all crypto currencies so correlated? One would think that bad news for one crypto currency means it should create a tailwind for those that are “ sound “ but that’s not what is happening. 2) So Dogecoin, a crypto invented as a joke and with inflation build in is #4 by market cap and worth $38B. I guess Elon Musk is the answer?

-

That’s was not my intent. My question was does this matter for investing? With the financial pluming, it is probably just with home pluming, as long as everything works, it‘s all good, but when things are clogging up, it can get really messy very quickly. So far, I haven’t heard anybody expecting such a thing, except Raoul Pal who sees shadows of doom behind every corner and makes a living selling those stories.

-

LOL: https://webcache.googleusercontent.com/search?q=cache:5Z6siy-TQDUJ:https://defi100.org/+&cd=4&hl=en&ct=clnk&gl=au

-

It is interesting, but it would be way more interesting if something gets distressed for a while and opportunities in debt securities came up, or even distressed equities. Currently, we are getting the velvet glove treatment from the Fed and just about everyone can raise debt without a problem. Risk premiums across the spectrum seem to be almost at record lows.

-

BBB rated debt is not really going to move much, even if risk free interest rates go up 1/2 %. The last interesting opportunity in debt was in March 2020 (for a few days only) and with the energy meltdown in late 2015 , when solid MLP and even industrials showed increased risk premiums. Currently, the opportunities in debt are pitiful, even with non-investment grade.

-

This is all interesting, but why should the average investor care about this? It might cause a small compression in bank NIM, but that’s about it. I don’t see any relevancy for myself and probably the vast majority of investors, much less the average Joe or Joanne.