-

Posts

15,197 -

Joined

-

Last visited

-

Days Won

38

Content Type

Profiles

Forums

Events

Everything posted by Spekulatius

-

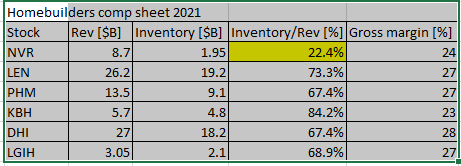

Yes, NVR sticks out. They are run way more capital efficient than the rest. I looked at a few financial metrics (pulled from tikr.com so may need to be adjusted a bit). the key number in terms of capital efficiency I am looking at is inventory/revenues. and NVR on that end looks far better than the rest. This is because they don't speculate on land. Amazingly enough, even though they don't speculate on land, their gross margins aren't much lower than peers. Worst of the bunch seems to be KBH. Best after NVR are LGIH, PHM and DHI. DHI and PHM right now generate a substantial FCF, LGIH operates around FCF break even.

-

My hunch is to stay away from controlled entities that are set up to lay of risk. For once, with controlled entities you can’t expect a buyout, except in a takeunder scenario and then there the general conflict of interest issue. it is interesting that DHI has been layi g of some risk, even though with a 63% majority, the assets and liabilities still remain on the consolidated balance sheet.

-

This is how it works, in the US more so than almost anywhere else. https://en.wikipedia.org/wiki/The_squeaky_wheel_gets_the_grease I always complain when I feel I am getting taken to the woodshed or when I feel I can get a better deal. Just remember , on the other end of the line or (email chain) there is just a lowly paid employee who wants to make to through the day without much hassle. It’s not their money. You personally just have to figure out, if it’s worth spending your time and effort on getting “justice”.

-

Buffett/Berkshire - general news

Spekulatius replied to fareastwarriors's topic in Berkshire Hathaway

If you believe that HPQ business mean reverts, since the pandemic is over, then he bought $4B in pre tax income for a ~$40B EV, which is not that attractive, since HPQ isn’t growing. High ROIC doesn’t really help if HOQ can’t invest incremental capital because it isn’t growing. Buffet must be seeing something else under the hood. -

Yes, what people forget about buying 18% long dated treasuries in 1980 is that inflation was 13% and rapidly rising. So buying long dated treasuries was a bet on normalization. If you had done the same thing in Weimar or Argentina before the hyperinflation, you would have gotten wiped out. In fact you can read up on Stinnes who borrowed all he could pre hyperinflation in Germany at what seamed to be high interest rates. He bought companies (partly private and partly public) and become the largest conglomerate for a short time in Germany from borrowed money that become worthless. So people who claim that buying treasuries in 1980 forget that there was risk in that as well. Buying treasuries is essentially a bet on political stability and fiscal responsibility. They are not really risk free in that sense.

-

What are you listening to ? (Music thread)

Spekulatius replied to Spekulatius's topic in General Discussion

Gordon Lightfoot. Nothing like this song to bring memories from the 70's back. I recall hearing this on in the radio. Never get's old: -

What are you listening to ? (Music thread)

Spekulatius replied to Spekulatius's topic in General Discussion

How to win a propaganda war: -

Where Does the Global Economy Go From Here?

Spekulatius replied to Viking's topic in General Discussion

@wabuffo While I agree the inflation will should recede, simply because the ripples in supply and demand from the pandemic would peter out, a new stone was thrown in the pond - the Ukraine invasion. My take is that we are at war already (even though it is a proxy war for us), but the Ukraine invasion alone screws already up things like some food items, energy etc as well as secondary effects on other items (automobile production etc). I think this will make this inflationary period last longer and it's not easy to foresee the duration. I guess this inflationary period that is now going to last 2 years is now really stretching the transitory moniker and that's why the Fed as well as Mr Market is getting antsy. -

Pretty good article. Thanks for posting.

-

Well, but that's Putin's problem and he has his Propaganda machinery to turn pretty much everything into a "victory".

-

Where Does the Global Economy Go From Here?

Spekulatius replied to Viking's topic in General Discussion

The fact that the treasury interest rates are negative (adjusted for inflation) doesn't say much about the expectations of the private sector. The shape of the yield curve does to some extend and that's why inversion can signal a recession. The private sector will merit any investments not on the Fed's interest rates at the current time, they typically have expectation on ROIC that are more or less independent on actual interest rates (mostly double digit for any Capex investment). This would change if interest rates go high single digits or double digits, but we are far from that. -

If you want to do something in the real world, you still need trust. You can do all the transaction you want in the blockchain without trust, but you somehow need to make sure whatever you have done in the blockchain, gets done in the real world. The block chain tech has no way to enforce it. I also fail to see how an anonymous (by design) blockchain network of individuals is social. I think this world would be dystopian with fraudsters pretty much everywhere. Image buying a house on the blockchain and when you ask for the keys the seller says, Oh you bought the NFT of a house, here are the digital keys. Sue me.

-

This guy seems delusional. Just because you need a victory doesn’t need doesn’t mean you get one. NATO Article 5 isn’t worthless either, hopefully they don’t think so at the Kremlin.

-

So it looks like Finland may well join NATO , as was contemplated here. Sweden is much more hesitant, which is explainable given their location (no land borders with Russia). https://www.reuters.com/world/europe/why-putin-faces-more-nato-arctic-after-ukraine-invasion-2022-04-04/ Summary Finnish President asked NATO chief how to join; Sweden more hesitant NATO sees both countries as partners Living memories of war kept Finns on alert, Swedes less prepared Finnish politicians tour NATO capitals to gauge support Moscow has threatened "serious consequences" if countries join BARDUFOSS, Norway, April 4 (Reuters) - The sound of gunfire echoed around the Norwegian fjords as a row of Swedish and Finnish soldiers, positioned prone behind banks of snow, trained rifles and missile launchers on nearby hills ready for an enemy attack. The drill, in March, was the first time forces from Finland and Sweden have formed a combined brigade in a scheduled NATO exercise in Arctic Norway known as "Cold Response." Neither country is a member of the NATO alliance. The exercise was long planned, but Russia's invasion of Ukraine on Feb. 24 added intensity to the war game. This short video has more information This advertiser wants to share their trending video AD BY SPONSOR See More Report ad "We would be rather naive not to recognise that there is a threat," Swedish Major Stefan Nordstrom told Reuters. "The security situation in the whole of Europe has changed and we have to accept that, and we have to adapt." That sense of threat means President Vladimir Putin, who embarked on what he calls a "special operation" in Ukraine partly to counter the expansion of the NATO alliance, may soon have a new NATO neighbour. Report ad Finland has a 1,300 km (810 mile) border with Russia. In a March 28 phone call, the country's President Sauli Niinisto asked NATO Secretary-General Jens Stoltenberg for details on principles and steps for accepting new members, he wrote on Facebook. Finland's leaders have discussed possible membership with "almost all" NATO's 30 members, and will submit a review to parliament by mid-April, Foreign Minister Pekka Haavisto told Reuters.

-

Where Does the Global Economy Go From Here?

Spekulatius replied to Viking's topic in General Discussion

Well, Germany had Bafoeg, which was a loan as well. I had 45k DM ($22k in USD) Bafoeg debt in the 90's and paid it back in less than 2 years. With college degree in a subject where you can get a decent paying job, anything below $75K in debt should not really be a big deal. If you get a degree in something that makes you a Barista with a Masters degree, you probably should regard your college time as an long vacation -

Where Does the Global Economy Go From Here?

Spekulatius replied to Viking's topic in General Discussion

@maplevalue you can’t look at this from an homeowners perspective, you need to look at it from a first time homeowners perspective that’s trying to buy a house the first time. They don’t homeowners equity, they need to acquire the downpayment (or get it gifted from parents) and be able to shoulder the mortgage payment. For them it’s may become impossible to become homeowners unless something gives here - either prices or mortgage rates or both. -

Donbas is not a given for Putin. If it comes to a point where the people there can vote on this, overseen by the UN, I think they would vote to remain in Ukraine. It all depends on how the next stage of the war turns out. Crimean likely remains Russian, no matter what.

-

Where Does the Global Economy Go From Here?

Spekulatius replied to Viking's topic in General Discussion

@Viking Canada has a much higher population growth rate than the US. Canadas current growth rate is ~1.2%, US is basically static at +0.1%. This is mostly because Canada has kept immigration going while the US under Trump throttled it (which remained that way under Biden) and US birth rate have absolutely dropped. There does not seem to be pent up demand for babies either in the US because so far, the Birth rate remains stubbornly low in 2022. Anyways, these demographic trends don't have as much impact than people think , imo. -

Where Does the Global Economy Go From Here?

Spekulatius replied to Viking's topic in General Discussion

@wabuffo I would agree with your but on inflation receding, but the Ukraine war is inflationary too and we have not really seen the effects of this moving through the "snake" yet. As for housing demand, I believe there is always a lot of housing demand, it more a matter if people can pay for it. Housing space demand is highly elastic because people can live in 1000 SQFT or 2000 SQFT and it's more a matter what they can afford or not (especially in the US). That said, I do think the US economy overall will remain in good shape - I just don't think housing will be as strong as many here believe, because high prices and high interest rates will take their toll. Europe is in a much tougher spot because energy prices are absolutely exploding there. -

Where Does the Global Economy Go From Here?

Spekulatius replied to Viking's topic in General Discussion

Why wouldn't it be? If you can buy a productive asset (like a property) and finance it with a negative real interest rates, how can this not be bullish/ Some for any company trying to borrow. The non-bullish part is that this punch bowl is apparently being taken away right now. That will be the end of the housing boom, imo. -

I think the new Fang is going to make hardware, or at least there is a huge hardware component to what they do. AI, driverless car or augmented reality would be my guesses. Perhaps it's all three in one application or framework.

-

I like the (almost daily) reports from Michael Clark) on Sky news. Very concise and clear: Russia is going to move their focus to the South East and try a breakthrough. I think before this either succeeds or fails, all negotiations are moot, nothing will happen.

-

This also sent a signal to those that work with him and are involved in the war crimes as well. We do not know the exact inner workings, but each crime has more than person involved. I think starting this is the right thing to do, but there are going to be way more people implicated than just Putin. As for the War crimes Bucha, one should keep in mind that this is probably not just Putin's work. To me, it looks very much like the army of 2022 looks like the Russian army of WW2. The Russian army of WW2 did their fair share of raping, plundering and and random killing of civilians back then (my maternal family was on the receiving end of it in Berlin 1945). Probably more understandable given the circumstances back then, but again remember the army was told they are going on a de-nazification campaign in Ukraine. So what we are seeing here is a pattern of the Russian army that precedes Putin.

-

A company is a network of people essentially.