-

Posts

2,636 -

Joined

-

Days Won

15

Content Type

Profiles

Forums

Events

Everything posted by UK

-

Merry Christmas!:)

-

Dinar, thanks for your kind words. I am sure though, that at the time of your visit, not many here felt that different from the rest of the Union:). And then, since almost right after your visit, but especially over the last 20 years, the change was really big and thankfully for the better.

-

John, nice to know you! No problem, I am from Vilnius, Lithuania. It is some 180 km from Minsk, Belarus and only some 40 km from their new nuclear power plant in Astravets. My mother tongue is Lithuanian, but I also understand and speak Russian well, since my generation was probably one of the last, which still had Russian language on the full schedule at school (and on tv). Actually I love Russian classic literature etc. In my previous job, some 10+ years ago, I also worked on a project in Ukraine (in a town somewhere near Odessa), and my former employer was working on some other projects in a country, including in Mariupol, right until this February. Btw this summer we were visiting Billund, not that far from a place you live, very nice place for a fans of Lego:)

-

I realise than not everyone here speaks russian, but for those, who can understand, very entertaining interview with former insider: https://www.youtube.com/watch?v=isg4wArJJ28

-

https://www.wsj.com/articles/putin-russia-ukraine-war-advisers-11671815184?mod=hp_lead_pos7 Russian troops were losing the battle for Lyman, a small city in eastern Ukraine, in late September when a call came in for the commanding officer on the front line, over an encrypted line from Moscow. It was Vladimir Putin, ordering them not to retreat. The president seemed to have limited understanding of the reality of the situation, according to current and former U.S. and European officials and a former senior Russian intelligence officer briefed on the exchange. His poorly equipped front-line troops were being encircled by a Ukrainian advance backed by artillery provided by the West. Mr. Putin rebuffed his own generals’ commands and told the troops to hold firm, they said. The Ukrainian ambushes continued, and on Oct. 1, Russian soldiers hastily withdrew, leaving behind dozens of dead bodies and supplies of artillery to restock Ukraine’s weapons caches. Through the summer, delegations of military experts and arms manufacturers emerged from presidential meetings questioning whether Mr. Putin understood the reality on the battleground, according to people familiar with the situation. And while Mr. Putin has since then gone to lengths to get a clearer picture of the war, they say, the president remains surrounded by an administration that caters to his conviction that Russia will succeed, despite the mounting human and economic sacrifices. “The people around Putin protect themselves,” said Ekaterina Vinokurova, a member of his handpicked human-rights council until Mr. Putin removed her in November. “They have this deep belief that they shouldn’t upset the president.” The resulting mistakes have shaped Russia’s disastrous invasion of Ukraine—from the initial days, when Mr. Putin thought his soldiers would be met with flowers, to recent humiliating withdrawals in the northeast and south. Over time, Mr. Putin, who has never served in the military, has become so wary of his own command structure that he has issued orders directly to the front line. For months, a trickle of Russian officials, pro-government journalists and analysts tried to bring word in person to their president about how his invasion was floundering, according to people familiar with the matter. When one longtime pollster reached out to Mr. Putin’s office about a survey showing lower-than-expected public support soon after the invasion, his office responded, using Mr. Putin’s first name and his patronymic middle name, “Vladimir Vladimirovich doesn’t need to be upset right now,” according to a person familiar with the exchange. In July, as American-supplied, satellite-guided Himars rockets began to strike Russian army logistics depots, Mr. Putin summoned about 30 business leaders from defense companies to his Novo-Ogaryovo residence outside Moscow, according to people familiar with the meeting. After three days of quarantine and three PCR tests, the executives sat at the end of a long wooden table, listening as Mr. Putin described a war effort he considered a success. Ukrainians were only motivated to fight, he told them, because their army was shooting deserters, according to the people. Then Mr. Putin turned to Chief of General Staff for the Russian Armed Forces Valery Gerasimov, who said Russian weapons were successfully hitting their targets and the invasion was going according to plan. The arms makers left the meeting with a sense that Mr. Putin lacked a clear picture of the conflict, the people said. Since March, when Mr. Putin’s invasion began to clearly falter, Western leaders have been puzzled by how a leader so singularly occupied with the status of Ukraine and the restoration of Russia’s military greatness managed to so badly underrate Ukraine’s strength and misread his own. Some of Mr. Putin’s allies concede that information reaching the president was flawed and attribute military failures to poor planning by government officials. Konstantin Zatulin, a senior lawmaker from the ruling United Russia party who supports the war, said in an interview that the president “proceeded from an incomplete understanding of the situation and in some ways not fully correct.” The war planners, he said, “clearly underestimated the strength of the enemy and overestimated their own.” Mr. Putin needed only days to roll through more than a fifth of Georgia in 2008, and weeks to take Ukraine’s peninsula of Crimea in 2014—an operation that his defense minister, Sergei Shoigu, and Mr. Gerasimov, along with Russia’s SVR foreign intelligence agency and others, had advised against. The SVR declined to comment. The Russian president came to see the Crimea operation as a personal triumph. His inner circle gradually shrank down to his most hawkish advisers, who assured Mr. Putin Russian forces would seize Kyiv within days. “He probably forgot that when he was a KGB operative he was lying to his boss,” said Indrek Kannik, a former head of analysis for Estonian foreign intelligence. From inside Ukraine, a Kremlin-connected businessman was telling Mr. Putin what he wanted to hear. Viktor Medvedchuk, a Russia-funded politician, had made Mr. Putin godfather to his daughter Darya. For years, Mr. Medvedchuk had a dedicated line to reach the president—a phone with a Russian number and a secure calling app the Ukrainians called Kremlyovka, in reference to the Kremlin, according to Yuriy Lutsenko, the former head of the Ukrainian prosecutor’s office, which had tapped the phones of people linked to the Kremlin in an investigation into the 2014 downing of a Malaysian airplane above Ukraine. Mr. Medvedchuk assured Mr. Putin that Ukrainians saw themselves as Russian, and would welcome the invading soldiers with flowers, said two people close to the Kremlin. Mr. Medvedchuk, who had been arrested in Ukraine and then released to Russia as part of a prisoner swap in September, couldn’t be reached for comment. Meanwhile, the FSB was tweaking polling data to convince Mr. Putin that Ukrainians would welcome Russian soldiers, according to Ukrainian Security Council Secretary Oleksiy Danilov and a person close to the Kremlin. Other opinion surveys appeared to be entirely fabricated, said Mr. Danilov. War planning fell to the FSB more than the military, according to the former Russian intelligence officer and a person close to the defense ministry. The ministry kept normal working hours in the weeks leading up to the invasion, with little sense of the urgency. Mr. Putin’s spokesman, Mr. Peskov; his foreign minister, Sergei Lavrov ; chief of staff, Anton Vaino; and Mr. Kirienko, the domestic policy chief, weren’t aware of the plans, according to people familiar with the matter. Fifteen days into the war, after his quick strike on Kyiv failed, Mr. Putin scowled in a gold-embroidered armchair as his defense minister briefed him over a video link in a televised meeting. “Vladimir Vladimirovich, everything is going to plan,” said Mr. Shoigu. “We report this to you every day.”

-

https://www.barrons.com/articles/warren-buffett-investment-aides-stock-market-performance-51671746676

-

https://www.barrons.com/articles/bill-miller-interview-bullish-on-bitcoin-amazon-51671661918 Some old and new ideas.

-

https://edition.cnn.com/videos/world/2022/12/22/zelensky-us-congress-speech-full-sot-vpx.cnn

-

https://www.investing.com/news/stock-market-news/third-points-loeb-says-cathie-wood-has-stonk-hodlers-mentality-432SI-2968787

-

https://www.bloomberg.com/news/articles/2022-12-21/us-farmland-escapes-real-estate-slump-as-prices-soar-to-record?srnd=premium-europe In the long term, a growing global population coupled with a changing climate makes productive land in the Midwest integral to global food production. Interest from outside investors is also on the rise. Farmland is considered a great hedge against inflation because the commodities it produces usually gain in value when overall prices rise. “Land is a real asset,” Gary Schnitkey, professor at the University of Illinois, said at a conference in Champaign. “Do you want to own a piece of dirt or cryptocurrency? It’s a good way to diversify your asset pool.”

-

I agree. I was talking about Finland re F35 (they will receive 64) and Baltics re Himars. There will be 20 Himars in Baltics in two years including long range capabilities. It is more than currently are deployed in Ukraine. Finland already owns some 20+ larger versions. And Poland is in the league of its own: https://www.thedefensepost.com/2022/06/07/poland-himars-us/

-

JOE, AMZN.

-

https://www.barrons.com/articles/berkshire-hathaway-warren-buffett-board-member-51671476915 Earlier this year, investment research firm MSCI criticized Berkshire’s board composition. “Berkshire Hathaway continues to lag peers in corporate governance. The concerns include board entrenchment (over 42% board members are over 70 years old and 57% have served on the board for over 15 years), lack of board independence and diversity (57% not independent of management and less than 30% women on the board), combined CEO-chairman functions, and high voting power of the controlling shareholder.” Some of the qualities that MSCI criticized, such as “entrenchment,” are viewed favorably by many Berkshire shareholders who like that the board has considerable knowledge of the company and that Buffett wields enormous power. Buffett has suggested that if the board decided to rein him in, he would no longer want to be CEO. Buffett and Vice Chairman Charlie Munger have scoffed at the independence issue, saying board members care deeply about the company whether they are characterized as independent or not. Buffett has criticized corporate directors outside Berkshire who are deemed independent, but garner much of their income from director fees, compromising their willingness to buck management. Buffett noted there were big investors who withheld support for him about 15 years ago when he was on the board of Coca Cola , in which Berkshire held a big stake now worth about $25 billion. At Berkshire’s annual meeting in late April, Buffett said of the Coke episode that the opponents said he wasn’t independent because Dairy Queen, which is owned by Berkshire, “bought some Coca-Cola … I mean, do they think I can add things and if we’ve got billions and billions and billions of dollars (invested) that I’m going to be compromised, but it’s just nutty.” Added Munger: “Well, they don’t want them just independent. Now they want 1 horse, 1 rabbit, 1 cow, 1 whatever.”

-

John, thanks for your comment. Yes, looking one or two years out, as soon as new Himars, F35s and other stuff will arrive (which will be very plenty) and Sweden with Finland join NATO (foregone conclusion) I am too starting to become optimistic on the ability of the region to stand on its own, even against Russia. https://www.bloomberg.com/news/features/2022-12-18/ukraine-conflict-brings-finland-s-troops-and-tanks-in-from-the-cold-war https://www.defensenews.com/pentagon/2022/12/16/lithuania-signs-495-million-deal-to-buy-himars-atacms/ https://www.bloomberg.com/news/articles/2022-08-30/poland-will-double-military-spending-as-war-in-ukraine-rages?leadSource=uverify wall https://www.reuters.com/world/europe/poland-expected-buy-skorean-rocket-launchers-after-tank-howitzer-sales-2022-10-19/

-

https://www.bloomberg.com/news/articles/2022-12-18/europe-s-1-trillion-energy-bill-only-marks-start-of-the-crisis?srnd=premium-europe Europe got hit by roughly $1 trillion from surging energy costs in the fallout of Russia’s war in Ukraine, and the deepest crisis in decades is only getting started. After this winter, the region will have to refill gas reserves with little to no deliveries from Russia, intensifying competition for tankers of the fuel. Even with more facilities to import liquefied natural gas coming online, the market is expected to remain tight until 2026, when additional production capacity from the US to Qatar becomes available. That means no respite from high prices. While governments were able to help companies and consumers absorb much of the blow with more than $700 billion in aid, according to the Brussels-based think tank Bruegel, a state of emergency could last for years. With interest rates rising and economies likely already in recession, the support that cushioned the blow for millions of households and businesses is looking increasingly unaffordable. “Once you add everything up — bailouts, subsidies — it is a ridiculously large amount of money,” said Martin Devenish, a director at consultancy S-RM. “It’s going to be a lot harder for governments to manage this crisis next year.”

-

https://www.bloomberg.com/news/articles/2022-12-19/san-francisco-s-feeling-the-pain-of-big-tech-s-troubles-remote-work?srnd=premium-europe Covid changed all that, as many of the young workers who fueled the city's surging wealth decamped to cheaper places such as Lake Tahoe or Austin, Texas, during lockdowns. From July 2020 to July 2021, San Francisco lost the most residents by share among major US cities. And even as vaccines brought some return to normalcy, tech companies, competing for in-demand workers, had little inclination to force reluctant employees back to offices. Earlier this year, when Karen Chapple led a group of researchers examining major economic hubs, she was surprised to see that San Francisco was seemingly “frozen in time.” Its downtown activity had recovered the least of 31 large US and Canadian cities. “San Francisco really suffered from kind of doubling down on commercial office towers,” said Chapple, a regional planning academic at UC Berkeley and the University of Toronto. “They made a big bet and it failed.” “As people leave, as firms leave, that’ll ease up some of these price pressures and that will in turn check some of this out-migration that we’ve been seeing,” Ratz said, noting that the latest figures showed inflation less heated in San Francisco than elsewhere. But a new paradigm for San Francisco will take years to take effect, if it does at all. And as time goes by, the problem may less be people moving out, but fewer moving in. Liz Giorgi thought she had to move to San Francisco to launch Soona, a virtual photoshoot platform for brands. But she was able to raise about $51 million while in Colorado, and it struck her: Nobody was telling her she needed to relocate. In fact, she said, investors begged her to organize board meetings in Vail, the Rocky Mountain resort town. San Francisco “didn’t seem as powerful or as attractive to me,” Giorgi said.

-

https://www.bloomberg.com/news/articles/2022-12-18/fed-zooms-in-on-american-paychecks-as-it-takes-inflation-battle-into-2023 As for the non-housing services that Powell has been highlighting, Omair Sharif — the founder of Inflation Insights LLC — sees plenty of evidence that wage growth hasn’t been the primary driver of inflation there. Prices in that category were mainly driven by increases in transportation and medical care in the first half of the year, which have now reversed, he says. There were a variety of causes, from a sudden surge in the demand for travel to quirks in how health insurance costs are calculated. Wages weren’t a big part of the story, Sharif says. “It’s just ingrained in everybody’s minds somehow that this is how things work.”

-

https://ca.movies.yahoo.com/ukraine-war-russia-enlists-singers-080018966.html

-

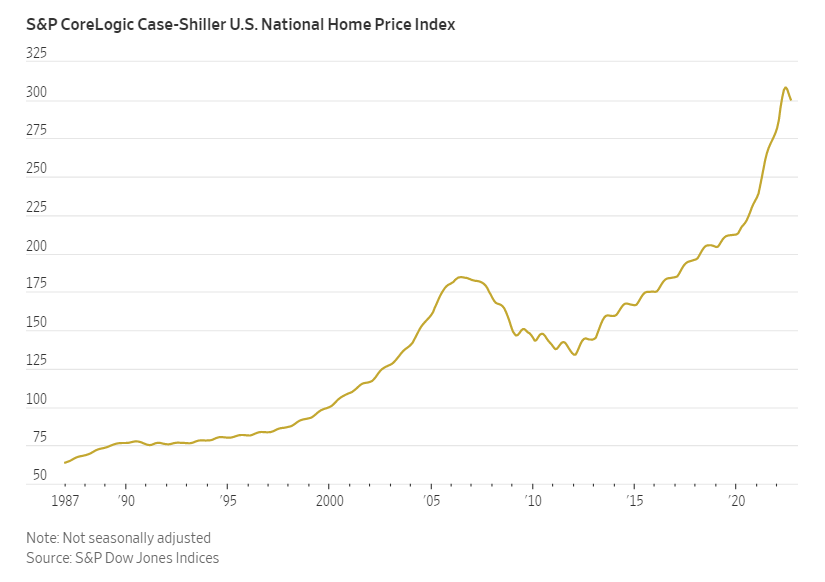

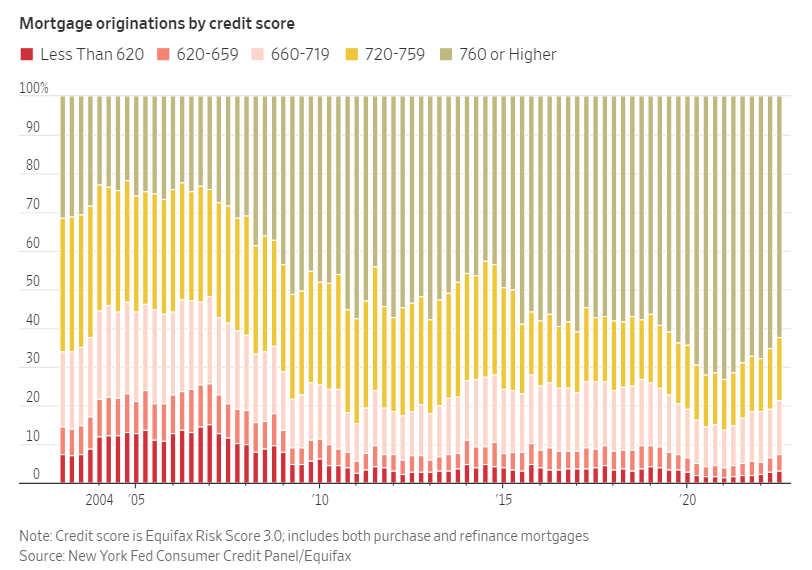

https://www.wsj.com/articles/why-this-housing-downturn-isnt-like-the-last-one-11671273004?mod=hp_lead_pos1

-

Interesting story and you can not say that the guy was not at least somewhat sensible: Another explanation for Murphy's lackluster results is that he's a market timer, constantly shifting from stocks to cash in hopes of exploiting seasonal patterns he believes he's spotted. In April, after the Nasdaq crashed, Murphy told investors to get fully invested, theorizing that the battered market would skip the traditional summer slump in tech stocks. In July he reversed course, telling subscribers he was selling all his stocks to avoid an imminent 25% drop in the Nasdaq. Didn't happen. Murphy's about-face prompted a wave of angry calls and e-mail from subscribers. "Customer service," he recalls, "came to me and said, 'Can you put something on the hotline about what a moron you are? Because a lot of people are calling and saying you're a moron.'" Murphy says he's considering halting the practice of giving his subscribers market-timing advice.

-

At this point BRK is also my only solution re energy/oil/utilities/etc too.

-

I think it was in 2011 and I already new at that time about WB and co quite well, but Berkowitz and his thesis was also part of the reason I finally decided to invest in BAC and other US large banks in the end of that year. Those were a very good investments for me and I was very thankful for him, for educating me and everyone else on the attractiveness of big banks at that time in very plain language. (I miss this with JOE:)). And you would not believe how many mistakes I made with banks before, mainly by wrongly focusing on European banks:). So Berkowitz is my hero for this episode:)

-

https://www.bloomberg.com/news/articles/2022-12-16/binance-faces-too-big-to-fail-worry-as-ftx-collapse-boosts-dominance?srnd=premium-europe Even for those who ostensibly support CZ and his exchange, Binance’s market supremacy in the wake of FTX’s collapse doesn’t sit well in an industry that preaches decentralization. Weakness in crypto prices that followed headlines about CZ’s company this week reinforce concern that Binance has become a “too big to fail” player in a market where, unlike traditional finance, there’s no one to stop a potential failure, offer a bailout or soothe any contagion. “I don’t think Binance is trying to cause problems, but that organization is now a risk to all of us,” said Mark Lurie, the chief executive officer and co-founder of Shipyard Software, a developer of decentralized exchanges. “Anytime you have one player controlling substantial amount of volume, there’s a lot of systematic risks.” As Bankman-Fried’s FTX empire collapsed into bankruptcy and the 30-year-old former billionaire swapped a luxury penthouse for a Bahamas jail cell, Binance has increased its market share to 52.9%, its largest ever, and grown its share of derivatives trading to 67.2%, according to CryptoCompare. Binance’s dominance came up in a Senate committee hearing on FTX on Wednesday, with Tennessee Senator Bill Hagerty saying a hypothetical similar implosion by CZ’s exchange would prove “catastrophic for the cryptocurrency industry, and it would prove catastrophic to all of the consumers that utilize the industry.”

-

https://www.bloomberg.com/news/articles/2022-12-16/china-s-care-homes-rush-to-protect-elderly-from-covid-surge The same hunkering down is taking place across China, as its under-vaccinated elderly suddenly find themselves surrounded by infection after three years of little threat. In cities including Beijing, Shanghai and Nanjing, local governments are enforcing on care homes the same closed-loop system that factories adopted during earlier outbreaks. No one comes, and no one goes. Time is running out. Evidence from around the world shows that facilities for seniors often see the biggest waves of deaths, which is why countries prioritized vaccinating care home occupants first. That’s not been the case in China, where 38,000 homes provide beds for 8.2 million seniors according to 2020 data. Only 42% of those aged over 80 have had booster shots. That’s well below the levels seen in other countries that reopened after abandoning strict approaches toward the virus. “It’s just the start of a real tough time,” read a statement from Pudong Shinan Nursing Home in Shanghai explaining its new rules this week. “When the experts say 80-90% of the population will eventually get infected, we are scared!” National Health Commission officials last week gave rudimentary advice to care homes facing potential outbreaks of Covid. Minimize the risk of infection by improving ventilation, practicing hand hygiene, wearing masks and avoiding gatherings. They also urged the elderly to get vaccinated, without making shots mandatory. Persuading the elderly has proven to be a tough task. Many older Chinese are reluctant to get vaccinated, said Feng Wang, a sociology professor at the University of California, Irvine. Forcing them to get vaccinated risks creating a backlash in a society that traditionally has emphasized respecting seniors, he said. “It’s a tremendous gamble,” said Wang. “If an elderly person resists, I’m pretty sure there will be a lot of reluctance among the nurses, the local neighborhood committees and officials to force elderly people to take the vaccine.”

-

https://www.bloomberg.com/news/articles/2022-12-16/covid-unleashed-in-beijing-shows-rest-of-china-what-comes-next Beijing’s rapidly spreading Covid outbreak has turned the Chinese capital of 22 million people into a virtual ghost town as stores close and restaurants empty, underscoring the cost of President Xi Jinping’s sudden pivot away from Covid Zero. Bucking expectations for a managed and gradual transition, Xi’s government is now allowing the virus to run rampant. While officials have abandoned efforts to track case numbers, anecdotal evidence suggests entire families and offices in Beijing have become infected in the span of just days — a potential harbinger of worse things to come in other parts of China with less-developed health care systems. Beijing residents are hunkering down at home, either because they’re scared of catching the virus or because they already have it. While many grocery stores are still open to provide essentials, delivery services for food and other goods are facing delays with workers out sick. The retrenchment suggests China’s economy is likely to get worse before the benefits of exiting Covid Zero start to kick in next year. “My whole office is positive and down,” said one Beijing resident, a project manager named Emile, who asked not to identified by his full name. “It seems everyone in the city has a fever or headache. Beijing looks like a ghost town.” Infected or not, the abrupt change of policies has caught the country by surprise and many are frustrated after years of being told by China’s state media that Covid had to be stamped out by whatever means necessary. With the pathogen running rampant, the Communist Party is still insisting that Xi’s strategy will “stand the test of history” even as the president himself remains silent on the dramatic shift.