-

Posts

2,636 -

Joined

-

Days Won

15

Content Type

Profiles

Forums

Events

Everything posted by UK

-

Sorry, my bad. Inflation resistant growth industry with ever growing TAM:))

-

So does this suggest, that insurance is quite a growth industry with a continuously expanding TAM:)?

-

https://www.ft.com/content/af04c395-393f-4acf-abe3-ea87bdad9260

-

https://www.reuters.com/world/us-close-agreeing-long-range-missiles-ukraine-delivery-take-months-2024-09-03/

-

'I want more, impossible to ignore Impossible to ignore'

-

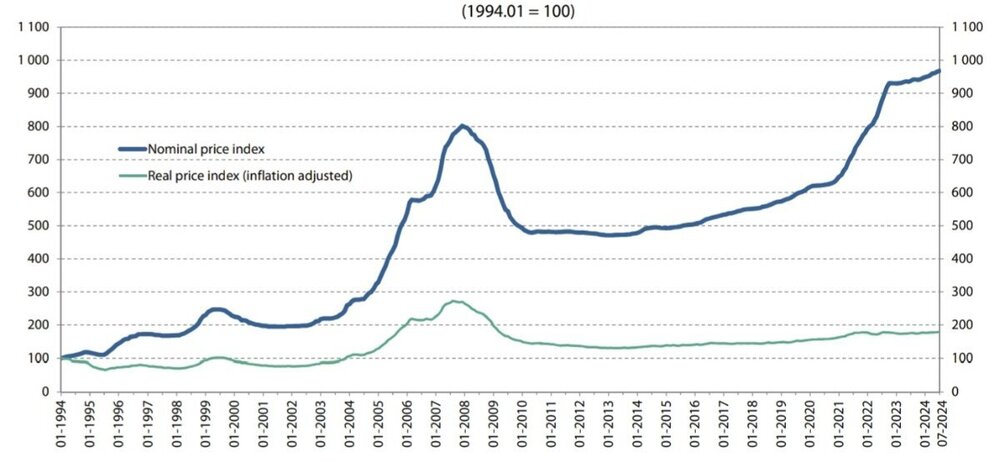

I am in the process of selling my main (non listed) real estate investment which was bought in 2018 and its price has ~ followed this index since. Some dry powder is coming, if the deal closes as expected soon:)

-

Does being full-time investors help you getting better return?

UK replied to alertmeipp's topic in General Discussion

+1. This is basically my plan as well. -

Does being full-time investors help you getting better return?

UK replied to alertmeipp's topic in General Discussion

-

Does being full-time investors help you getting better return?

UK replied to alertmeipp's topic in General Discussion

It is a lonely job and that is why I like it:). Working in office, but especially in a team and all these meetings were starting to drive me mad, so I moved to work from home in 2012 (later my wife followed, so for 5+ years we both can basically work from wherever there is a good internet), I could not be more happy about this aspect since. And I was not even driving to the office at the time, since I lived close and could reach it by walking. But still way more free time, less loss of energy. And you can always sociolize by meeting a person you like or just by going outside, but only if/when you also want it. Same as here at COBF:). But not like giving up your energy to some random jerk, who think he can bother you whenever he wants, you wish you have never seen in the first place:). But as with the other things, perhaps this is also very personal and lots of people enjoy and thrive in the office. -

Does being full-time investors help you getting better return?

UK replied to alertmeipp's topic in General Discussion

I have a very similar view and experience! Only I have started investing as a main job a bit earlier, with a more ambitious goals (min 10 percent, while beating the benchmark, but aiming at 15 percent CAGR over time), but ended up with lower results than yours (still confidently above my minimum though), which perhaps shows, that I am much more lazier, than you, as input on FFH analysis perfectly illustrates:). I think the crux is to find/know what fits you and not too full for to long yourself if it is not! -

Does being full-time investors help you getting better return?

UK replied to alertmeipp's topic in General Discussion

I think it really depends on your day job and other circumstances. If you like your job, I think the best of two worlds would be to keep it and just start working way less/part time. Otherwise you need to plan for a some alternative to investing activity anyway, since it could become really boring because you just have nothing exciting to do for a long time sometimes. Perhaps parenting could fit this quite nicely, but it is not totally stress free either, so sometimes you become overwhelmed, but I think it would still be better vs only investing, at least for me personally. Too much time may not necesarilly lead to a better outcome quickly, but you could feel too accountable for this to happen if investing was the sole activity. But I think all this is very personal and the best way to know is just to try:) -

This sounds like a serious and nice plan! In such case, adding a few days for Jurmala or Nida (this is perhaps a nicest coast you can get in LT/LV) would not be bad, I was just sceptical of chosing them as the only place to visit/staying for long here:). Krakow is really nice, perhaps would be my top single city of Poland to visit, if I had to chose one (also Auschwitz is near, as is Energylandia). There are plenty of cheap flights or even overnight ferries from Stockholm to Riga (or perhaps also Tallin or Klaipeda), so personally I would include Stockholm or Copenhagen (or maybe even place such as Gotland), especially if in the middle of summer. Most of Scandinavia is very nice and summer, maybe +- one month, is really the only time to visit it, since it could be to cold in other time (same for Baltics:)). https://www.bloomberg.com/news/features/2024-07-03/norway-sweden-and-denmark-tourism-boosted-by-coolcation-trend

-

If strictly in summer, for me it would be easy to answer: I avoid Baltic coast in our country in peak months (June-August), because it is very crowdy and expensive at this time, and I am afraid same would be true for Jurmala. The other part of Latvian Baltic coast is way less crowdy, even in summer, but also with way less infrastructure, perhaps good only if you are ok with enjoying the nature with less people and much else to do (still the better option for me personally). The best time to visit Jurmala (as our Palanga) I think is early September, because the weather is still nice (or even like in the summer as currently is), but all bad things disappear right with the back to school season, not an option if you travel with kids though. Italy/Spain/Greece of course would be my choice, but the problem with recent summers, it could be really too hot, there is even a new word/trend, 'coolcation' I think, to describe this phenomena. Again late spring or early autumn perhaps would be a safer bet. So I have never been in German Baltic coast (or only from the side of Denmark:)), but I would chose this over other options (perhaps even adding some places in Poland, especially if you will use car), or even Scandinavia, depending on the circumstances, for the summer. E.g. Stockholm is very nice in the summer, you can be in the city, many things to do, and go to swim in the sea basically using public transport and for me it is same price/as easy to reach (thank you Ryanair) as Jurmala, so really no brainer vs our/Latvian Baltic Coast. But if you really want to visit Yurmala, maybe you can add Riga as well. I think it is also easy to reach from Yurmala by train or vice versa.

-

No problem John:). IIRC, you already had asked once and I answered, but still the same today, I live in Vilnius, Lithuania. So EU and NATO, but at the same time it is like only 36 km to our border with Belarus or only some 40 km from the new Astravets Nuclear Power Plant, which Belarusians have built here for not totally clear reasons:)

-

True, but I did not said that, only that we got lucky big time (some more post ago) and I would be happy to see this situation to continue. Btw we got lucky big time not once, e.g.: https://en.wikipedia.org/wiki/1991_Soviet_coup_attempt I am rooting for this stroke of luck not to end.

-

https://en.wikipedia.org/wiki/Keep_Calm_and_Carry_On

-

https://www.ft.com/content/17f16071-87e0-4675-a152-6d6285b97fd5 Y Combinator, the San Francisco start-up incubator that launched Airbnb, Reddit, Stripe and Coinbase, is backing a weapons company for the first time, entering a sector it has previously shunned. Ares Industries, which launched last week, has pitched its “low-cost cruise missiles” as suited for use in a potential war between the US and China in the Taiwan Strait. The start-up claims that US weapons stockpiles would be exhausted within weeks in such a conflict, and that “recent conflicts in the Middle East and Ukraine have shown that our weapons are too large, too expensive for the wars of today”. Ares’s founders, Alex Tseng and Devan Plantamura, say their $300,000 anti-ship cruise missiles “will be 10x smaller and 10x cheaper” than today’s alternatives. On the YC website, Tseng’s biography consists of a single sentence: “Missiles are cool.” ... The US defence industry is dominated by an oligopoly of contractors such as Raytheon and Boeing that receive an overwhelming majority of government contracts. Anduril Industries, the most prominent defence tech start-up, raised $1.5bn this month to accelerate the production of autonomous weapons for the US military and its allies. That investment was led by Peter Thiel’s Founders Fund, one of the first big venture capital firms to embrace defence technology. Since then, venture investment has flooded in from mainstream companies such as Andreessen Horowitz and General Catalyst. In the past year, Sequoia Capital, one of Silicon Valley’s pre-eminent firms, made its first investments in defence and weapons. It backed Mach Industries, which makes hydrogen weapons, and Neros, a drone-maker aiming to boost the supply of quadcopters to Ukraine for use in data gathering, mine clearing and offensive missions. ... Rather than building massive, complex weapons systems, the start-ups are focused on cheaper weapons and drones that can be produced quickly at scale. Anduril’s new funds will go towards a network of weapons factories which the company says will adopt the manufacturing techniques used by Tesla to boost production. Jared Friedman, a partner at YC, said the company started actively encouraging defence tech start-ups to apply earlier this year. “Why now? It’s not that we wouldn’t have funded this earlier, but simply that this is the first time that a great company like this applied,” he said.

-

I would consider your are far enough, at least for a 'boots on the ground' type risk, but of course, the closer you are, the sronger this mind occupation...and empathy perhaps. Oh and btw, few days ago it was 31 year anniversary of a situation I hope (but not sure) will continue for at least anoter 30 years. Article from a year ago: https://www.lrt.lt/en/news-in-english/19/2066608/red-army-go-home-how-lithuania-expelled-russian-troops-30-years-ago

-

No doubt. And no one from the plenty hawks has yet articulated what winning even means in this case.

-

https://www.bloomberg.com/news/articles/2024-08-31/ukraine-must-be-allowed-to-use-f-16s-inside-russia-denmark-says

-

I have listened to a few of a very long interviews of his and I liked them very much and I agree with a many things he is saying. Also the whole thing is way above my paygrade, very difficult and complicated, to have any clear conclusions on some things or on their long term consequencies, and there are many biases etc involved. On a few things my mind (perhaps because of fear) is on the oposite position where the heart (or gut) is. Or just to point out some incredible contradictions of this situation, and I am not even sure if it is 100 percent true, but it seems that the current commander-in-chief of Ukraine armed forces was born in Russia while his parents and brother still live in Russia...one of a many things quite not so easy to understand. Long story short of how I see it, I have no idea how to solve this lets call it a 'Putin problem', but I am very sure I know how I feel about it/him and this is not uncommon of how majority of people around me are feeling, see the picture:). But also notice the red logo on the next building further. It it is the logo of Huawei:). Can not remember / not sure if it is still out there though:)

-

Nothing to add:)

-

-

https://www.bloomberg.com/news/articles/2024-08-30/once-in-lifetime-wall-street-rally-raises-soft-landing-stakes?srnd=homepage-europe "Levels of conviction are soaring across assets. In one example, exchange-traded funds tracking government debt, corporate credit and equities have now risen in unison for four straight months. It’s the longest stretch of correlated gains since at least 2007. Up 25% in the past 12 months, the S&P 500 has never climbed this much in the run-up to the first interest-rate cut of an easing cycle, seven decades of data compiled by Ned Davis Research and Bloomberg show." Dammit, my level of conviction is not going up or even staying the same...

-

Some good possible reasons. I would add one more, though I admit this is more likely >95 percent just a rationalisation and wishfull thinking, but perhaps this revaluation could be insurance related? After long 'ZIRP winter' insurance float is finally an asset and not an almost liability again, all this constant noise about global warming and end of the world catastrophes (which in reality is like good publicity for business, like for Coke participating in Olympics, only usualy for free:)), WB himself still buying insurance, while selling Apple/BAC? I would also appreciate this hypothesis, lets call it an 'insurance supercycle':), because it would also bode very well for one another good and even more purer insurance company:)