-

Posts

2,636 -

Joined

-

Days Won

15

Content Type

Profiles

Forums

Events

Everything posted by UK

-

https://www.bloomberg.com/news/articles/2024-09-09/esg-rules-draw-backlash-from-unilever-totalenergies-and-other-eu-businesses?srnd=homepage-europe

-

Calsberg's Baltika (Russian subsidiary) was once one of their best and most profitable division accounting for some 40 percent of total EBIT (>10 years ago). And now it is zero, but this was already of lesser importance for them lately. IIRC they still own Slavutych, their Ukrainian subsidiary, though. Btw today this preparedness material was also announced here. At first I thought this maybe happened because of the upcoming elections:), but it seems this is some kind of EU wide mater:)

-

https://www.bloomberg.com/news/articles/2024-09-09/draghi-says-eu-in-danger-without-massive-spending-and-joint-debt?srnd=homepage-europe

-

https://www.reuters.com/world/europe/romania-searching-possible-drone-fragments-after-russian-attack-ukraine-2024-09-08/ https://www.reuters.com/business/aerospace-defense/drone-sightings-prompt-temporary-air-traffic-halt-stockholm-arlanda-airport-2024-09-09/ https://www.reuters.com/world/middle-east/iran-denies-reports-missile-transfer-russia-2024-09-09/ Same direction.

-

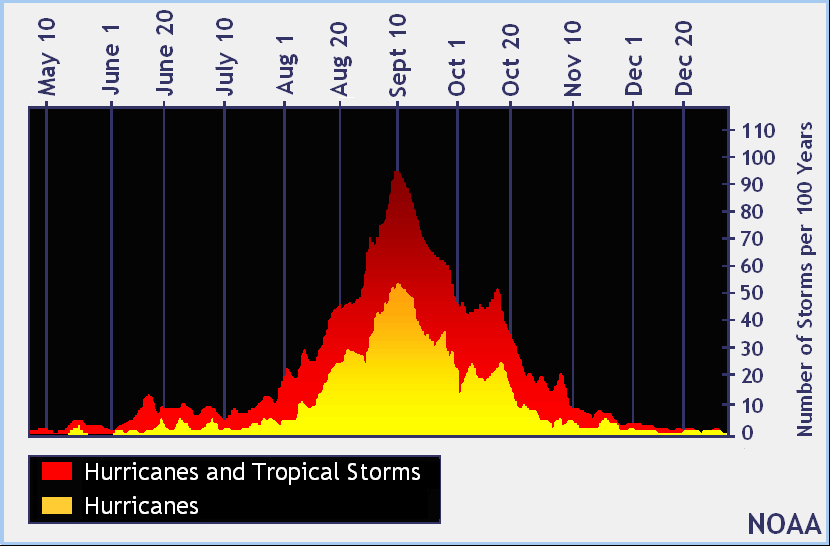

Some of the lines sound like almost a disapointment that this season may be major event free:)

-

https://davisfunds.com/funds/nyventure-fund/pm-review Pessimism Never Goes Out of Fashion Recently our friend and author Shane Parrish shared a striking quote that seems to capture the current mood of our country: “It is a gloomy moment in the history of our country. Not in the lifetime of most men has there been so much grave and deep apprehension; never has the future seemed so incalculable as at this time. The domestic economic situation is in chaos…Prices are so high as to be utterly impossible. The political cauldron seethes and bubbles with uncertainly. Russia hangs, as usual, like a cloud, dark and silent, upon the horizon. It is a solemn moment. Of our troubles, no man can see the end.” What makes this description so striking is that it was written in Harper’s Weekly in 1857. Pessimism, fear and uncertainty are nothing new. And yet we live far better lives today than ever before. For long-term investors, it has always been a mistake to bet against humanity in general and the United States in particular. While it is true that we currently face significant challenges, it is equally true that we are living through a period of enormous global progress. Technology and innovation have contributed enormously to human progress, and with breakthroughs like GenAI, genomics and alternative energy (including compact nuclear reactors) still in their infancy, we see no reason to believe that the record of the last 2,000 years should not continue. At a time when many feel the world has been getting worse, the data tells a different story (see Figures 7 and 8).

-

Does being full-time investors help you getting better return?

UK replied to alertmeipp's topic in General Discussion

Very good post! Nothing to add:) -

For what it is worth, I like him doing a reasonably good and detailed estimate of BRK earnings power (or look throught earnings), which you can find every year by searching this 100+ pages document (searh for 'Net Income Basis'). You can then adjust it if you wish and use for PE calculation, instead of this nonsensical gaap only PE, used by some. It seems it is ~17x for BRK vs ~23 for the market as of today on a F24 basis.

-

-

Does being full-time investors help you getting better return?

UK replied to alertmeipp's topic in General Discussion

Thanks for sharing! -

Thanks!

-

https://www.bloomberg.com/news/features/2024-09-05/china-s-banks-build-100-billion-short-on-us-dollar-to-prop-up-yuan-cny-usd?srnd=homepage-europe

-

I just hope FFH will have opportunity to participate in the next Kestenbaum's venture:)

-

Do you expect him to stop just under 10 percent or sell it all?

-

Movies and TV shows (general recommendation thread)

UK replied to Liberty's topic in General Discussion

https://www.reuters.com/lifestyle/why-house-dragon-separated-older-younger-actors-alicent-rhaenyra-2022-09-22/ It is interesting, but I always do not like this (also when they did it for the first Daario Naharis) despite the fact that both new actresses objectivelly are no less or perhaps even better and this totaly makes sense after 10 year gap in the timeline. But it must be something about getting used to someone and not liking changes in general:) -

Does being full-time investors help you getting better return?

UK replied to alertmeipp's topic in General Discussion

'The Chains of Habit Are Too Light To Be Felt Until They Are Too Heavy To Be Broken' Between me and my wife we have three parents (and than some other close people) who are living alone and separatedly in an oversized too big home for each of them at this stage, which cost them dearly (and not only financially), but they do not want or are afraid to change anything, so I am jokingly almost consider them becoming some kind of a prisoners of their home's. Seeing this I am almost afraid to own a house for myself at this point:). Better to remain free and enjoy more sun somwhere, while you can, than to shovel snow all dark winter alone, in my opinion:)) This 'you live as if you were destined to live forever' or 'saving sex for the old age' is another very important thing to remember and to balance, while considering early retirement, or parenting, or whatever. And finding not what is necessarily right or super optimal, but what works for YOU is more important than anything. -

Does being full-time investors help you getting better return?

UK replied to alertmeipp's topic in General Discussion

And after realising this, you may even reconsider quitting:). I was basically working as a freelancer at the time anyway, so there was no need to be a `bad employee' or anything like that. Just not saying yes to all projects/assignments and no to a few was almost enought for a start:) -

Does being full-time investors help you getting better return?

UK replied to alertmeipp's topic in General Discussion

Again, especially in the very begining, or if you just want to try out if things works for you, the best way I think this semi aproach of not going all in/out: just keep you current job, while reducing workloads or hours to a minimum, if possible, start working the same job partime or few days a week. I think Mohnish said, that when he decided to start his own business, he began working at 'just not to be fired' level:). Less to lose this way. If everything is awesome with investing, you will always can quit you job for good later, but with more confidence and less stress. Perhaps a year or two should be enought to decide. personaly I do not need or like office job, but retrospectively I think I harpd felt better, for many other reasons, if I had quitted it more slowly, with some 2-3 more years of 'transitory period':) -

https://www.bloomberg.com/news/articles/2024-09-04/jpmorgan-abandons-bullish-china-call-as-us-election-stirs-angst?srnd=homepage-europe But: https://www.bloomberg.com/news/articles/2024-09-04/china-stocks-listed-in-us-near-cheapest-ever-versus-nasdaq-peers?srnd=homepage-europe But: https://www.bloomberg.com/news/articles/2024-09-04/china-s-earnings-setback-sows-fresh-doubts-about-stock-rebound?srnd=homepage-europe

-

-

https://www.reuters.com/world/lavrov-warns-us-not-mock-russias-red-lines-2024-09-04/ A new day, a new warning on red lines.

-

No problem John and btw: https://en.wikipedia.org/wiki/Denmark–Lithuania_relations#Modern_relations Since Lithuanian independence, Denmark has taken a leading role in supporting Lithuania with international recognition and military and internal reforms. Denmark also played a significant role in Lithuania's accession to the EU and maintains a military presence in the country.

-

Perhaps not so impossible: https://www.reuters.com/world/asia-pacific/if-china-wants-taiwan-it-should-also-take-back-land-russia-president-says-2024-09-02/

-

If the AI bubble like the Internet, in what year are we now?

UK replied to james22's topic in General Discussion

https://www.bloomberg.com/news/articles/2024-09-03/shorts-are-circling-some-of-the-ai-boom-s-biggest-question-marks