All Activity

- Past hour

-

I converted more of my Ethereum to Bitcoin yesterday. Not a straight conversion. I bought Bitcoin with about 65% of it. I’m holding back 20% for taxes and 15% which I plan to buy MSTR with tomorrow.

-

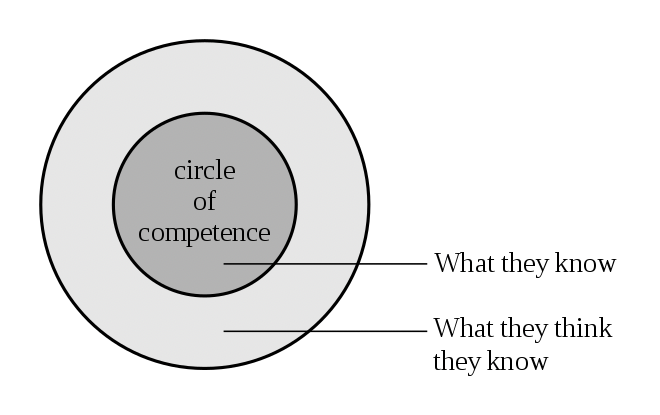

Capital allocation - Circle of Competence - Margin of Safety - Concentration In this section we are going to explore the topic of capital allocation. Capital allocation is the most important responsibility of a management team. Why? Capital allocation decisions are what drive the long-term performance of a company and important metrics like reported earnings, growth in book value and return on equity. In turn, these metrics drive the multiple given to the stock by Mr. Market - and finally the share price and investment returns for shareholders. When done well, capital allocation does two important things: Delivers a solid return. Improves the quality of the company. Therefore, the fundamental task of an investor is to determine if management, over time, is making intelligent decisions regarding capital allocation. How to be a good investor / capital allocator Being a good investor is the same thing as being a good capital allocator. Warren Buffett is a great teacher. In his 1996 shareholder letter, Buffett succinctly lays out what an investor needs to do to be successful. This is the same approach that Berkshire Hathaway has followed - quite successfully - for decades. We have included Buffett’s full quote below. In his framework, Buffett introduces the concept of ‘circle of competence.’ Given its importance, we will explore it more fully in the next section. Warren Buffett - Berkshire Hathaway 1996AR “Let me add a few thoughts about your own investments. Most investors, both institutional and individual, will find that the best way to own common stocks is through an index fund that charges minimal fees. Those following this path are sure to beat the net results (after fees and expenses) delivered by the great majority of investment professionals. “Should you choose, however, to construct your own portfolio, there are a few thoughts worth remembering. Intelligent investing is not complex, though that is far from saying that it is easy. What an investor needs is the ability to correctly evaluate selected businesses. Note that word "selected": You don't have to be an expert on every company, or even many. You only have to be able to evaluate companies within your circle of competence. The size of that circle is not very important; knowing its boundaries, however, is vital. “To invest successfully, you need not understand beta, efficient markets, modern portfolio theory, option pricing or emerging markets. You may, in fact, be better off knowing nothing of these. That, of course, is not the prevailing view at most business schools, whose finance curriculum tends to be dominated by such subjects. In our view, though, investment students need only two well-taught courses - How to Value a Business, and How to Think About Market Prices. “Your goal as an investor should simply be to purchase, at a rational price, a part interest in an easily-understandable business whose earnings are virtually certain to be materially higher five, ten and twenty years from now. Over time, you will find only a few companies that meet these standards - so when you see one that qualifies, you should buy a meaningful amount of stock. You must also resist the temptation to stray from your guidelines: If you aren't willing to own a stock for ten years, don't even think about owning it for ten minutes. Put together a portfolio of companies whose aggregate earnings march upward over the years, and so also will the portfolio's market value. “Though it's seldom recognized, this is the exact approach that has produced gains for Berkshire shareholders: Our look-through earnings have grown at a good clip over the years, and our stock price has risen correspondingly. Had those gains in earnings not materialized, there would have been little increase in Berkshire's value.” ————— Mental model: circle of competence A mental model is simply a framework that helps us understand how something works. Mental models guide our behaviour and they help us solve problems. “The more models we have, the better able we are to solve problems. But if we don't have the models, we become the proverbial man with a hammer. To the man with a hammer, everything looks like a nail. If you only have one model, you will fit whatever problem you face to the model you have” Charlie Munger To guide investors, Warren Buffett introduces the concept of ‘circle of competence’ as a foundational mental model. What is it? ‘Circle of competence’ is a subject area when you have an edge. It is a match with your skills and experiences. To be successful at investing, stick to areas where you know more than other people. This might sound obvious. Few actually do it. It allows you to answer the 3 fundamental questions: Do you understand the business? Is it run by competent management? Does it sell for a price that is attractive? Let’s revisit Buffett’s quote: “You only have to be able to evaluate companies within your circle of competence. The size of that circle is not very important; knowing its boundaries, however, is vital.” Warren Buffett 1996 Shareholder Letter Buffett highlights a number of important points: Self awareness: You have to know what your circle of competence is. The size of the circle is not very important. Importantly, it can be expanded over time. Knowing the boundaries is ‘vital’. This is knowing what to avoid. In the HBO documentary linked below, Buffett expands on ‘circle of competence’ and provides additional insight: Patience: wait for the right opportunity - one that is in your ‘sweet spot.’ Think independently: don’t let the mood of Mr. Market influence what you are doing. HBO Documentary: Becoming Warren Buffett (30:30 minute mark) https://youtu.be/2Q5zhl4YVo8?si=A5RY0o3ivBfbPHYz “I was genetically blessed with a certain wiring that is very useful in a highly developed market system that has lots of chips on the table where I happen to be good at that game “Ted Williams wrote a book called the science hitting. In it he has a picture of himself at bat and the strike zone broken into 77 squares. He said if he waited for the pitch that was really in his sweet spot he would bat 400 and if he had to swing at something in the lower corner he would probably bat 235. “In investing I’m in a no-called strike business, which is the best business you can be in. I can look at 1000 different companies and I don’t have to be right on every one of them or even 50 of them. So I can pick the ball i want to hit. “The trick with investing is to sit there and watch pitch after pitch go by and wait for the one that is right in your sweet spot. If people are yelling ‘swing you bum!’ Just ignore them. “There is a temptation for people to act far too frequently in stocks simply because they’re so liquid. “Over the years you develop a lot of filters. I do know what is called my circle of competence. So i stay within that circle. I don’t worry about things that are outside of that circle. Defining what your game is… where you’re going to have an edge… is enormously important.” ————— Margin of safety “If you were to distil the secret of sound investment into three words we venture the motto, margin of safety.” Ben Graham The Intelligent Investor - Chapter 20 Margin of safety is one of the most important principles/concepts in investing. It is defined as the difference between a stock’s price and its intrinsic value. Buying a stock with a large margin of safety does two things at the same time: Limits the downside risk. Provides a high return opportunity. Circle of competence and margin of safety Only invest in opportunities that: fall within your circle of competence. can be purchased at prices that provide a margin of safety "If you understood a business perfectly — the future of a business — you would need very little in the way of a margin of safety," Warren Buffett - 1997 Berkshire Hathaway Annual Meeting ————— Concentration "Diversification may preserve wealth, but concentration builds wealth." Warren Buffett “If you can identify six wonderful businesses, that is all the diversification you need. And you will make a lot of money. And I can guarantee that going into a seventh one instead of putting more money into your first one is gotta be a terrible mistake. Very few people have gotten rich on their seventh best idea. But a lot of people have gotten rich with their best idea. So I would say for anyone working with normal capital who really knows the businesses they have gone into, six is plenty…” Warren Buffett - Talk at Florida University 1998 (1:05:30 mark) - https://youtu.be/2MHIcabnjrA (great 90 minute video) A key part of Berkshire Hathaway’s long term success has been holding a concentrated portfolio of investments. Circle of competence and concentration Only investing in his ‘circle of competence’ gives Buffett conviction - and allows him to concentrate in his best ideas. This further improves Berkshire Hathaway’s long term returns. ————— Circle of competence, margin of safety and concentration Circle of competence, margin of safety and concentration are concepts that are inter-related and synergistic. Combined, they provide results that are far more powerful than those that could be achieved on their own. (1 + 1 + 1 = 5) Circle of competence = good returns Circle of competence + margin of safety = better returns Circle of competence + margin of safety + concentration in best ideas = best returns Key take-away: of the three, circle of competence is perhaps the most important component. It is the lynchpin. It is what allows the other two components to work their magic. ————— As he told us earlier, this has been the approach that Buffett has been using with great success to grow Berkshire Hathaway for decades. This also gives investors a blueprint to evaluate the capital allocation skills of management teams at other companies. Let’s now apply what we have learned. Let’s look at the capital allocation decisions of Fairfax Financial. We are also going to explore something Charlie Munger called ‘cannibal investing.’ Part 2 should be out in there next couple of days.

- Today

-

John Hjorth started following Ted and Todd Results

-

To me, there isen't anywhere near sufficient public available data and facts to say something fact- and databased about Ted and Todds results. So why even try to guess them on that basis, to have an opinion about them [<- the results]. It's to me more a feature than a bug. Mr. Buffett has for many years now had the attitude towards to practice what in his own mind should be disclosed to investors and shareholders, as long as it's going on inside the borders af being legal in accordance with existing rules and regulation. Here, why not give Ted and Todd the rights and advantages of operating below the radar in the first place, where there are no specific requirements for public records of these results separately.

-

Both of those were Warren's positions. It turns out he's not perfect.

-

I feel one of the reasons for WEB not talking about them anymore may be to tamp down the demand that T&T are made available to field investor questions.

-

I intend to mean nothing. I came across the NYT article, thought that painted another side of recent India, and felt others might be interested in reading it.

-

Stupid post. They've also helped Berkshire with the Apple position which was $100B profit. Plus, Todd is running GEICO now, and Ted is doing a lot of M&A type of deals. Honestly these two are great assets for Berkshire. They dont need to beat the S&P.

-

78% of Americans live paycheck to paycheck

Hektor replied to blakehampton's topic in General Discussion

Why paycheck to paycheck may be expected to continue? https://www.wsj.com/personal-finance/money-discipline-downsides-delayed-gratification-5770e346 The Downside of Delayed Gratification We’re all told that it pays to be disciplined in our spending and consumption. But the advice can backfire. -

I think what is more depressing than missing the big winners listed above were the investments in vz and hpq.

-

To the money-manager-pickers on the forum: start your own insurance/investment companies. I will move our family’s money over and we will become rich! In the meantime I’m going to stick with the greatest that has ever lived… and his hand-picked successors.

-

Well you can criticize Todd all you want but I wouldn't accuse him of "missing" Visa or Mastercard. He also boldly told both Charlie and Warren that Progressive was the better business vs. their beloved GEICO. Warren has said for many years that MSFT was on the 'do not invest' list because of this close friendship with Gates. Maybe that has changed more recently. Warren and Charlie met a lot of investors over their lifetimes. It was very hard to impress them. I can only think of 6 or so that they ever let touch any of their capital. Everything is going to be OK.

-

With all due respect, where do you get the idea that Todd delivered outsized returns before Berkshire? As for size being an impediment to their performance, first of all, they clearly missed: MSFT, Alphabet, Meta, LVMH, Hermes, Costco, Chipotle, Progressive, Visa, MasterCard, and the list goes on and on. Also, somehow large size did not prevent sir Christopher Hohn from putting damn good numbers.

-

You mean the Muslims in India are treated the way Muslims treat Christians and other minorities in Muslim majority countries? Actually, Christians and other minorities in Muslim majority countries can't even dream of being treated the same way that Muslims are treated in India. How are Christians and Zoroastrians and Bahai of Iran treated? Christians of Iraq? Christians of Lebanon and Egypt? You cannot build a church in Saudi Arabia. How are Christians treated in Chechnya?

-

Also this. https://www.nytimes.com/2024/05/18/world/asia/muslims-india.html

- Yesterday

-

Random thoughts: - If you want to compare to Mr. Buffett (which it is a mistake) but if you want to, think about this. In 2000, Berkshire's "equity portfolio" was $37B total. $28B of the $37B (75%) were in 5 businesses: Amex, Coca Cola, Gillette, Washington Post, & Wells. Need to further unpack that $28B because it basically was permanently allocated - Amex/Cocoa Cola (still owned and untouched) makes up $20B of the $28B, Gillette turned into P&G which was turned into a tax free exchange for Duracell, Washington Post turned into cash, shares of Berkshire, and a TV station (tax efficient), Wells at $3B was added/trimmed and finally sold with sizable gain in 2022 - if not for a little scandal, arguably, he would still be holding today. That leaves $9B (25%) to allocate in 2000. Lets just say that again, $9B was a lot in 2000 but nothing today in relation to size of portfolio. - Ted/Todd manage roughly $15B each, that's 10% of Berkshires "investments in equity securities". Pittance in relation to Mr. Buffett's $300B+. - Traditional money managers/hedge funds may have $20B, $40B, $60B+. They employ 100's of people. Ted/Todd each have 1 assistant. - Size is the biggest thing holding them back from outsized returns, who knows what other funds actually manage and their are some lists out there but here is the point, they are tiny in comparison. Both Ted/Todd proved they could deliver outsized returns with small amounts of capital in previous life. Also previous market cycle. - Ted/Todd true value will only shine through once the loaming shadow of Mr. Buffett is gone - Finding a "stock picker" successor was not the task for Mr. Buffett in looking for replacement, it was about capital allocation for the next 10/15/20years. Giving Ted/Todd a traditional yardstick to compare performance is not the game although monthly reports are shown to CEO. - Trying to paint Ted/Todd as classical money managers is a mistake. They do many things for Berkshire. And just having them at the ready for future issues is important. I view them as the fire sprinkler alarm handle inside Berkshire. Rarely used but when needed incredibly important. - Ted/Todd are going to make some mistakes with hindsight, they will lose money. Mistakes are fine. Permanent loss of large amounts of capital is not fine and trusting someone to do that job as well as deliver "alpha" is yeoman's work - could prove to be difficult in coming years as capital amounts grow. - Ted/Todd have not had an opportunity, due to the "Fed Put" and other governmental intervention, to operate in a prolonged bear market. Everyone has made money for previous 12-15years - most glorious bull market in history coming off 2008-2009 financial crisis. - Ted/Todd will also have to replace themselves at the end of their tenure and finding someone who can replace themselves is not an easy job. I believe both Ted/Todd have the character traits to attract/find the right kind of replacement when that time comes. Final thought: - Berkshire today is not the same company as Berkshire in 2000. Different game. - Ted/Todd's value will be shown when they can allocate significant sums into situations - $50B-$100B+ and there be a significant margin of safety. - Mr. Buffett has repeatedly said Ted/Todd are Berkshire's intellectual property. Almost like the recipe for Coca Cola, you don't share the recipe hence the reason why they do not get on the mic and to cast their views on markets/businesses. I tend to agree. - Looking forward to watching them both grow as managers/allocators and be stewards of Berkshire's capital (our money).

-

78% of Americans live paycheck to paycheck

DooDiligence replied to blakehampton's topic in General Discussion

Nice. I'm going to see these guys in Birmingham tomorrow. -

78% of Americans live paycheck to paycheck

Dinar replied to blakehampton's topic in General Discussion

I was fortunate to hear Sonny Rollins live a couple of decades ago in Carnegie Hall. Still love to listen to Coltrane. You got to spend some time in NY for the music - we went an amazing Argentian music concert the other day - Pablo Ziegler. -

Except Paramount ..

-

The board gripe is just ignorant. Buffett has gone on record to say most boards are useless, but he says the board structure that seems to be most effective is the one where a family with controlling ownership governs a professional management team (meaning the managers aren't family, and the board isn't dominated by a single person). With that structure there is genuine interest in the best long term performance of the company for its owners.

-

Additionally, hundreds of private deals go across their desks each year, which they analyze. Todd says most of them are deals he wishes he could short. I'm sure the opportunities that do look promising end up getting outbid by private equity.

-

They meet every weekend and discuss any S&P 500 companies selling for less than 15x earnings that have long term growth prospects. It's not rocket science. My guess is there aren't many companies selling for 15x or less, and that there are even fewer for which long term growth can be predicted with any confidence (aka: too hard pile).

-

Office was never a great asset class and it was a joke to see 4-5 cap prints for the better part of 2014-2019. Meanwhile grade A grocery traded for 7-8 and warehouse near double digits. Both the Wall Street crowd, and the academics, just had no clue what they were doing because they were still living in the 1980s.

-

No question there is further pain, write-downs on property, defaults etc. However vacancy rates are not staggered consistently among properties, it’s the old commercial buildings that have highest vacancy rates, new ones less so. As ever quality will matter. This article highlights some of the differences and where the squeeze points are: https://www.brookfield.com/news-insights/insights/misunderstood-us-office-market This could be a slow car crash that continues for a couple of years. The refinancing of debt seems to be an average of 5-10 years and many of those loans will need refinanced at higher rates. So I get it. It’s not a slam dunk. However I suspect there is good money to be made at these prices. A 50% + drawdowns in any sector is rare and it’s worth considering whether the pervasive doom and gloom is justified. I mentioned above, some of these REITs are trading at 08/09 lows. Is it really that bad out there? My back of the envelope bull case: - office work is not dead even if wth is here to stay at some level - excess inventory will get wound down and the supply problem will fix itself in time - companies will default and fail but overall I think we will muddle through No position btw. Talking out loud.

-

I agree with the above. No one can say for sure but I think it would be silly not to give some credit to one of the 2 for the Apple investment.

.thumb.jpeg.b0384a4135d041bebd0e39ae144d51f4.jpeg)