kevin4u2

Member-

Posts

341 -

Joined

-

Last visited

Content Type

Profiles

Forums

Events

Everything posted by kevin4u2

-

Alberta elects NDP (socialist) government

kevin4u2 replied to bizaro86's topic in General Discussion

You just can't help yourself can you? Please do yourself a favor and click on your own elections link. Then expand the results for Wildrose party, PC's and UCP. Who is the leader for the three parties? https://www.elections.ab.ca/parties-and-candidates/parties/ The WRP and PC's voted to merged into UNITED Conservative Party. 95% of both parties agreed to the merger. How much tighter do you want? 3.5% of the entire population of Alberta are card carrying UCP members. It is the largest provincial political party in Canada. Some former WRP members have started Alberta Advantage Party (AAP). https://edmontonjournal.com/news/politics/party-founded-by-former-wildrose-members-officially-registered-with-elections-alberta The Alberta party (AP) is a bunch of former leftest, who now claim they are centrist. Tell us again how many conservative parties there are in AB? And since you don't think it looks promising for conservatives in AB? Here is some polling info. 100% odds of UCP winning. http://alberta.338canada.com/ I think I'll stop now. -

Alberta elects NDP (socialist) government

kevin4u2 replied to bizaro86's topic in General Discussion

I don't think you understand Alberta (AB) politics very well. AB had a progressive conservative government for 44 continuous years from 1971-2015. The NDP won the 2015 election due to a split in the right wing vote between the PC's and the Wildrose party. Those two parties have since come together under the UCP banner (united conservative party) since the last election. They are currently polling 2x the NDP and it appears they will win in a landslide. Since 1993 the NDP had only garnered maximum of 4 of the 83 seats in AB and in the 80's they had a max of 16 seats. Even before 1971, the AB government was a right wing populist party called the Social Credit party that governed for 36 continuous years. So basically AB has had a right leaning government for 80 continuous years before 2015. A remarkable feat. The AB election must take place on or before May 31st of this year. I would say the implications could be far reaching. AB will turn to being very pro-business and regain it's economic growth again. Alberta, if it was it's own country, would rank 9th in the world for GDP per capita. If the Trudeau Liberals win the Canada election this fall, there will likely be more rumblings from this group. https://www.cbc.ca/news/canada/saskatchewan/brad-wall-buffalo-project-1.4987354 -

Manufacturing

-

Radical transparency has nothing to do with stress. We share many of the same principles in the company that I work for and we also study Ray's Principles. There is so much misconception in the comments above it's hard to even start to unwind it. I would suggest that most people live in an "ideal" world within their head. Everyone's precious ego gets offended if people question what they believe. To really understand the topic it requires a deeper understanding of psychology and philosophy. People of high self esteem, who want to learn, thrive in such an environment, while those who are externally validated (98% of population) can't handle it. Dalio is a realist, along the lines of Aristotle. He understands that our brain (amygdala) have different reactions to sensory input causing a flight or flight reaction that isn't necessary rational (cortex). When you feel a threat it can flood the brain with chemicals that renders the cortex useless. In the past this helped with physical threats, but today most threats are psychological. This explains why facebook is so popular. The users are addicted to the dopamine hit it gives them daily. Dalio doesn't give them the fake like button, but the opposite. So if your self worth is determined by others, which is 98% of the population, you will not enjoy radical transparency. And what is stress anyway? Stress is a disconnect between our thinking and reality. Your brain thinks the world "should be" this way but in reality it isn't. When you lock your keys in your car it causes you to stress out because what we want in our head doesn't match the physical world. Most people are "stressed" out by other people, as crazy as that seems to some (as if you can control them). All you can control is yourself and your reaction to any circumstance life throws at you. If you disagree, read "man's search for meaning" by victor frankl. A psychologist who self admitted himself into a Nazi concentration camp to test the hypothesis. Quote, "Everything can be taken from a man but one thing; the last of the human freedoms — to choose one's attitude in any given set of circumstances, to choose one's own way." Personal responsibility is the path least chosen. So, radical transparency is either a dream or a dread depending on your viewpoint and your level of psychological dependence. For those who want to know the truth and learn about the world and themselves, they will enjoy it. If you prefer to live in a delusional state where people say things just to make you feel good, you obviously won't enjoy it. Cheers.

-

Mr. Francis Chou's 2016 annual report is out

kevin4u2 replied to Cigarbutt's topic in General Discussion

Wrong, Buffett has had two 50% drawdowns, peak to trough with Berkshire, I believe. He has also had many other investments that have done terrible, losing nearly everything. He has discussed these in his annual reports, take a look. Don't lose money is a relative term, not a short term temporary term. -

it would allow trump to say that mexico is paying for it. which, i think, is all that he cares about. I think you will see some serious inflation either over the next four years, or in the ensuing years as a result of some of the policies that are going to be implemented. Alot of cash is going to flow into assets over the next few years from reduced taxes, repatriation, etc. Combine this with tariffs on imported goods, increasing national debt due to a lack of tax revenue and increased infrastructure expenditure, and you could see hyper-inflation at some point. Cheers! How does it result in inflation? How are Trumps policies different from Japan's. If inflation can be controlled through fiscal policy then why is the global economy stuck in the current funk. Trumps policies will strengthen the USD but I fail to see how inflation occurs. Thoughts?

-

Passive will crush active over the long term because of fees. It is simple mathematics. Market returns are a zero sum game. If the market returns 8% and you return 10%, someone will have to earn 6%, so the net market return is always the average market return. When you pay 1-2% for active management then you are guaranteed to have low returns relative to the market. Due to career risk, fund managers don't see outperformance but relative performance. How many active managers beat the index over 30 years? The answer is less than you have fingers on your left hand.

-

Look, I'm not saying Trump is a nice guy. All the allegations of hurting the small guy in contract disputes should be easy to take to court. The problem in America is the entitlement attitude. The other guy is responsible for your happiness, whether that is big business, CEOs, the government etc. If you have something and someone else has a need you are responsible for meeting that need. Don't you think that there are people who don't have contract disputes with Berkshire? I have spoken with some who do with PCP. This stuff happens. To assume the "little guy" is always the victim is not being intellectually honest. The same can be said for the landlord situation, and the hiring of immigrant workers. Now, do you really think Trump did all the hiring? Would Buffett be responsible if one of his companies hired illegal workers? Come on, be realistic. You make it sound like he goes around doing this all the time and just happened to get away with it for years and built a successful business in the process. The Clinton's are lifelong politicians and are now worth 300 million, hmmm, only in America... and perhaps China. It's so painfully obvious that Hillary is a crook, it isn't even funny. The cattle futures stuff is clear as day. Do you really think she is the most successful cattle trader of all time? By the way. I would recommend all American vote anyone other than the two clowns at the top.

-

Who said it was insider trading? It doesn't look like insider trading to me but straight up theft. The broker was taking both sides of the trade and sweeping the winning side of the trade into Hillary's account and the losing side of the trade into another person's account. This was common back in the 70's. LC, the question is whether Donald has done anything illegal? Donald might be a _____ (fill in the blank), but hasn't done anything illegal like Hillary as far as I know. Don't get me wrong, I'm not for Donald because he utterly fails to understand the economics of trade, but Hillary is a repeat offender. She has repeatedly conducted criminal activity and has gotten away with it. Donald is a tough jerk but he isn't a criminal. If you have any sense of integrity within yourself you will be able to see the difference.

-

Aubrey McClendon (July 14, 1959 - March 2, 2016)

kevin4u2 replied to formthirteen's topic in General Discussion

The corporate governance at CHK was the absolute worst. No doubt some bad stuff was going to come out. All one has to do is read the proxy materials. The best example was in December 2008 when the company purchased an extensive collection of historical maps of the southwest from McClendon for $12.1 million. Why the company would purchase these from him is an interesting question and an even bigger question is how was the purchase price determined. Ironically the sale of the "maps" was applied as a credit against costs incurred by McClendon for participating in the "Founders Well Participation Program", a program that allowed the founders (Ward and McClendon) to participate in a 2-1/2% working interest in every well drilled by CHK. Behavior like this gives capitalism a bad name. I was especially surprised when Lou Simpson joined the BOD in 2011. I was not, however, surprised to hear of his resignation less than two years later. He likely didn't agree with the business ethics of the extremely well paid BOD's. -

+1. If you ask most people why deflation is bad they give you the same look as if you asked them why they believe in dinosaurs. I do agree with Cardboard that low oil prices are beginning to be have deeper negative effects. While there's a fair argument that $65 oil is better for the economy than $100 dollar, $33 oil presents a lot of difficulties around the world. At the least, it seems like a good time to cap off the strategic petroleum reserves. I would love to hear the argument that $65 oil is better for the economy than $33 oil. Personally, I would prefer $2 oil and so would every other consumer out there, particularly those in the third world. Would our standard of living increase or decrease with $2 oil? Implementing price controls?.... hmmm beside not having the faintest clue as to how a central bank would do this, I wonder if that would make the problem better or worse. Do we have any other Soviet/Chinese methods to prop up falling oil prices?

-

Great list, "Man's Search for Meaning" is an absolute must read. I would also highly recommend "The Six Pillars of Self Esteem" by Nathanial Branden. I wouldn't hesitate to say that book has had more impact on me that any other book I have ever read, period, full stop... and I read a lot of books every year. It is an absolute classic. Another great book is "Born to be Worthless" by Kevin Solomon. Solomon's book is easier to read and clearly shows how the natural dependency we all begin life with leads to low self esteem. Branden's book will definitely make you a better investor as well. "Often what people consider to be thinking is merely recycling the opinions of others" - Branden. That is just one quote that made me step back and do a lot of reflection of my own thinking.

-

What is the extent of the 'opportunity' in the oil market?

kevin4u2 replied to bmichaud's topic in General Discussion

Why do people assume that the oil market is going to behave any different since the gas shale revolution. Perhaps this is a paradigm shift and people are just not accepting the new reality. I know some consider me a perma bear on oil. That is not the case. I have been looking but there is are so few opportunities right now. Why do the bulls think an "eventual recovery" in prices is right on the horizon? The NG market has been in a tailspin since the shale gas revolution took over and today are at record lows. Why is oil going to be any different than the NG market? As I have written elsewhere, I was in total denial when the NG market tanked, not to recover for almost a decade. Until I see something compelling that oil is "different", I will be very, very skeptical. -

What is the extent of the 'opportunity' in the oil market?

kevin4u2 replied to bmichaud's topic in General Discussion

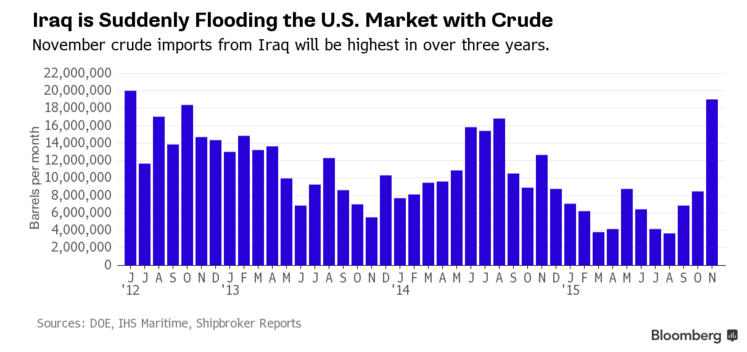

Well, good luck on his call but doing this with 100% of a portfolio is probably insane even if he turns out to be right. It's one thing if it's your own money, but managing on behalf of others is a different story. At least he's upfront about it so people who are uncomfortable can get out if they want. Huge gutsy move by this guy. Here are some facts that don't support his view of the world, particularly the supply situation. The world neither knows nor cares what we think or what we think "should" happen. 1) Iraq, the fastest-growing producer within the 12-nation group, loaded as many as 10 tankers in the past several weeks to deliver crude to U.S. ports in November, ship-tracking and charters compiled by Bloomberg show. Assuming they arrive as scheduled, the 19 million barrels being hauled would mark the biggest monthly influx from Iraq since June 2012, according to Energy Information Administration figures. (see Iraq crude import graph below) http://www.bloomberg.com/news/articles/2015-11-11/opec-challenges-shale-afresh-as-iraq-crude-floods-gulf-of-mexico 2) This will hit the market at a time when US storage is bulging and US production is no longer declining. Going long here, when a flood of supply is hitting the market is a gutsy move. (see graph below) 3) Supply is now cheap and plentiful. North Dakota has 1000 wells drilled but not frac'd ready to be turned on. New record. This will keep a hard ceiling on oil prices going forward. https://bakken.com/news/id/248095/north-dakota-oil-well-backlog-eclipses-1000-for-first-time/ -

You are exactly right.

-

Have you considered the possibility that the buyback level will march upward? What if it marches to 1.5x in 10 years? Berkshire paid close to 3x b/v for Precision castparts. A few more deals like that and I'd be willing to pay up to "only" 1.5x. The accounting doesn't work that way. Book values are not accretive. You don't "average up". While Berkshire paid 3x BV for precision castparts, that transaction will be carried on Berkshire's books at 1x book value, so in a sense it brings down the premium of how much you would be willing to pay for BRK in excess of book value, not the other way around. It will take years and billions in reinvestment for precision castparts to every be worth a multiple to what Berkshire paid for it. BRK's book value will only march upward to the extent that existing businesses retain earnings and earn a return in excess of the cost of capital on incremental capital employed.

-

How the Carl Icahns of the World Benefit Firms but Not Workers

kevin4u2 replied to giofranchi's topic in General Discussion

Lets allow Milton Friedman have a try with Jurgis. I'm not buying his philosophy of selflessness for one second. He claims the moral high ground but his philosophy at its root is morally bankrupt. I would like to know why he feels that he (or employees) have a mortgage on another persons life (and resources)? Why are business owners responsible for meeting their own needs while others are not responsible for meeting theirs? So, besides meeting the needs of employees, is it also our responsibility to meet the needs of everyone we know? Are business owners responsible for meeting their own needs or or is this someone else’s responsibility? What are the responsibilities of others, if any, in this regard? Who decides between those who get their needs met and those who have to do the providing? Jurgis, just like the pope, promote their philosophy because they believe nirvana is found through self sabotage and self sacrifice. In the pope's case he promotes it because that is how his needs are met. The pope would have to get a real job if he couldn't convince millions to sacrifice for him. Whenever someone (or country, or religion, or friend, or employee) expects you to sacrifice for them, just smile and realize you are looking at the truly selfish person. When you say no, the next thing out of their mouth will be, "Don't be so selfish"... Truly ironic and twisted logic. -

I have never heard that definition before. Do you think FFH is investing hundreds of millions based on your theory of deflation? Prices fall because of increasing supply or declining demand. The prices for every commodity around the world is falling. It appears that a lot of people have been putting off purchasing decisions. I don't see huge investments in O&G, steel mills, precious metals, mines, potash, etc. In fact, falling prices has caused a decline of incomes. The aggregate decline in incomes represents a further decline in demand. Rapidly increasing credit worldwide has kept demand robust, but that appears to be unwinding particularly in China. Keep in mind that what is required to reverse deflationary pressures is increasing credit, but banks tend to tighten credit when unemployment is rising and asset prices are falling. I can guarantee you there are a lot of O&G companies that don't want to talk with their banker this fall about the value of a their assets. Just as a side note. I was talking with someone from steel tubing company a couple weeks ago and he was telling me how many companies in Alberta have gone to 3-4 day work weeks, while some have kept 5 day work weeks but at a 50% decrease in pay. I wonder what the unemployment rate would be in Alberta if these partial layoffs were reported as full time equivalents. He also expects a lot more to come near the end of the year as people throw on the long awaited recovery. When I was there this summer, everyone was still in denial about how long the low oil prices would persist. So, when CNRL cuts wages 10% across the board, what is the effect on the unemployment rate? What is the effect on the economy? To answer your straw man, yes people will buy bread but why are grain prices at seven year lows, falling over 5% last month, if demand is so inelastic as you seem to think? Where is the demand response to falling prices? To QE infinity and beyond.

-

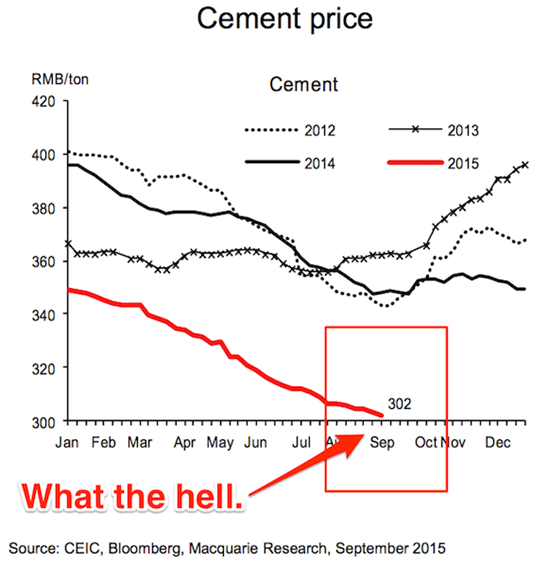

The graph has a truncated scale which gives the impressions that cement is almost zero. Actually cement is only about 75% of the peak of the last 4 years... I would not call this a free fall. BeerBaron You are quite right, but cement has been almost straight line down since the start of 2014. How much are steel prices down year over year? That isn't a rhetorical question. The CRU number from today saw HR coil fall 15/ton week over week, absolutely huge. New 52 week low. If it weren't for trade protectionism, there would be a US steel mill closing every week. You can pretend like this isn't a big deal, that's fine. http://news.yahoo.com/world-food-prices-plunge-seven-low-fao-084147343.html

-

Interesting graphic, see below. Something changed in China this year. The steel picture looks the same. Food prices just saw there biggest one month drop according to the UN. Every commodity seems to be in free fall, not just oil.

-

Peyto’s low cost is their really operating costs and secondly their F&D costs. G&A is also low relative to competitors. This is misleading. A well with a 50 year life is much more predictable and thus should deserve less of a discount factor all else kept equal. There are many deep basis wells that have long life production. There are also lots of wells that have been on production for 50 years, so it might not be so optimistic. Decline curves are only one method that has to be used in conjunction with the volume of the reservoir to determine the actual reserves. Peyto's reserves are much easier to predict because they are not sour and don't water out. I would love for you to tell this to Don’s face... Anyway, which metrics were not important? I am curious. I would have to disagree here too. Call Darren and ask him about the reserves. Secondly, every year Peyto provides the following in their annual reserve report news release. Please tell me ONE other company that provides this level of disclosure to their shareholders? Our guiding principle at Peyto is “to tell you the business facts that we would want to know if our positions were reversed.” Therefore, each year Peyto analyzes the reserve evaluation in order to answer the most important questions for shareholders: 1. Base Reserves - How did the “base reserves” that were on production at the time of the last reserve report perform during the year, and how did any change in commodity price forecast affect their value? 2. Value Creation - How much value did the 2014 capital investments create, both in current producing reserves and in undeveloped potential? 3. Growth and Income - Are the projected cash flows capable of funding the growing number of undeveloped opportunities and a sustainable dividend stream to shareholders without sacrificing Peyto’s financial flexibility? 4. Risk Assessment – What are the risks associated with the assessment of Peyto’s reserves and the risk of recovering future cashflows from the forecast production streams? Last year the base reserves were within 1.3% of previous estimates. Please explain why you seem to think that Peyto’s reserves are overly optimistic? They are not just good operators, they are laser focused capital allocators. What did they do to capital spending in 2008 after terrible efficiencies in 2007? They slashed capital spending, production fell for several years, and when capital efficiencies improved in 2009 they began to increase capex again.

-

Actually only 11% of the notional CPI derivatives require less than 0.5% inflation to pay out. The rest require outright deflation to pay out. So wisdom please make the case of how they get in the money pretty quick. What kind of recession do you need for that to happen? How do we get that kind of a recession given current conditions? Up to now your argument is basically that the deflation hedges will pay out because you say so. The people working at AIG had the same mentality. They too never thought they would never have payout on the CDS they wrote. For the most part they were right but unfortunately on a mark to market basis they were bankrupt in the meantime, despite many of the contracts expiring worthless. So no, you do not need deflation for the hedges to pay out. It is no different than making money on out of the money stock options or warrants. The underlying value of the contract has value depending on market perceptions. FFH didn't hold their CDS position to maturity either. If they had, they majority of them would have expired worthless too. They sold the majority of their CDS positions during the meltdown, long before maturity and for a huge profit. The remaining 5.9 billion notional effectively expired worthless. They do not need to hold the deflation hedges to maturity either. It wouldn't take much of a recession at this time for deflation expectations to change big time.

-

China is doing a great job of keeping their economy from unraveling.