kevin4u2

Member-

Posts

341 -

Joined

-

Last visited

Content Type

Profiles

Forums

Events

Everything posted by kevin4u2

-

Yes it's called unearned revenue.

-

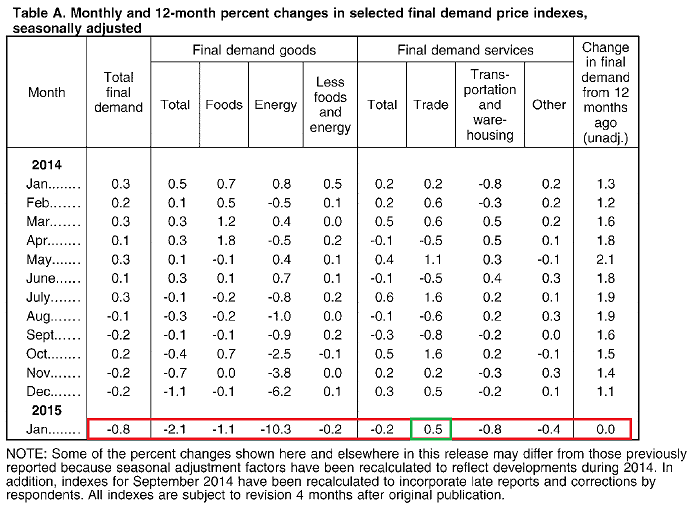

That is a very valid point regarding commodities rising. Regarding the January CPI, deflation was predominately from energy but you can't say it was the only reason. If you look at all items less food and energy, commodities less food & energy commodities, new vehicles, used cars and trucks, medical care commodities were all down in January. Apparel was also down on a non SA basis (-1.1%) but up modestly 0.3 on SA basis. Apparel unadjusted is down 4% YOY. Basically it's fairly safe to say that most all consumer goods in the CPI less food and energy were down in January. Goods only make up 25% of the CPI less food and energy. Services make up the other 75% and shelter makes up a huge portion there. Housing as you know turns on employment and that doesn't seem to be a problem anytime soon. Household formation also appears to have turned the corner. So almost everything in the CPI is flat or declining, including food, energy, and consumer goods in January. The only items supporting CPI is shelter and other services. I also agree with you regarding QE... and to quote buzz lightyear, "To QE infinity and beyond..."

-

Way to early to tell. The latest PPI was down big. That will work its way through the economy. All commodities are down, except a few. Food will fall, we have way too much over capacity. Corn prices today would much lower without ethanol consumption and now with low oil prices ethanol makes little sense. We are awash in oil. Next up to fall will be beef prices. The nature of the industry makes it a longer to turn up or down. Input feed prices have come down a lot and supply is being held back as farmers increase their herds. That will turn shortly, it always does. Too early to say that. If China slows further, deflation will increase. Cheers!

-

That argument doesn't work. Who should decide what is good or not for my body? You? The government? Bill Ackman? This is a major problem today. Most people believe they are responsible for the decisions of other adults. When someone tries to take away another persons ability to choose they are treading on dangerous grounds for me. Personal responsibility is a huge problem in the west. If you don't want to hold individual responsible for their health why are you holding Coke responsible? You can't have it both ways. I would say a lot of harm is done to individuals when the government tells them they are not responsible either. Let me be clear. KO doesn't hold a gun to anybody's head and force them to drink their products, yet you want to hold a gun to KO's head... and claim the moral high ground in doing so. WEB is free to make whatever endorsements he wants. Do you want to hold the proverbial gun to his head too? Ultimately who should decide? It is very freeing when you believe that everyone is free to make their own decision and that they are also free to face the consequences of those decision. The government is in the business of removing consequences, for bankers to Coke. Great discussion... Thanks.

-

Stress is caused by not being in alignment with reality. Try controlling reality or people and let me know how that works for you. Understanding boundaries of responsibilities goes a long way to understanding and accepting what you can and cannot control. Stress can be changed and reduce by changing beliefs about reality. What other people think about them is a big cause of stress. Change this belief and it will change your life. If you want stress, try being a short seller. The market continually tells you that you are wrong. You really need a strong internal scorecard to do that. That is why I have utmost respect for Watsa and Chanos. Buffett is very fact based and thus reality based. He allows the facts to lead him where he needs to go. He quickly changes his mind when he makes a mistake. Most people allow others to determine their behavior, especially authority. Since 99% of the population has low self esteem this is no surprise. Numerous experiments in social psychology have confirmed this. Below is a very funny video demonstrating this. They get a random person to "marry a stranger". Most people erroneously believe they wouldn't fall for this but the data suggests otherwise. LOL. Maybe you guys can ask him how can he lead a fairly stress free life while running one of the largest companies in USA and periodically running into near-death corporate situations (Washington Post strike in 70s, SEC investigation in 70s, Salomon Brothers debacle, Gen Re debacle, Net Jets debacle, death of all the "made in America" brands he bought, Lubrizol and Sokol, etc.). I would have killed myself multiple times during his career. "Stress free" my a** ??? ::) :-X :'( :o I don’t agree. I think he is smart enough not to take himself nor Berkshire too seriously. He enjoys what he does very much, and would certainly like to do it as long as possible, as well as possible. But imo he won’t yield to pressures he doesn’t like, simply to add some percentage points to Berkshire’s returns. And that’s basically all that stress is about: the need to yield to something we don’t like to do, think, nor feel. In other words I believe he is in a position to say NO to whoever he wants, to whatever he wants, whenever he wants, and still go on doing what he loves practically undisturbed: and that’s my definition of being stress free! Cheers, Gio

-

http://money.cnn.com/2015/02/26/news/economy/inflation-january-negative/ We now have official confirmation, not from the BLS but from CNN.

-

I was surprised that there was no discussion of the PPI numbers from last week. Tomorrows CPI numbers should be interesting. Attached are the some highlights from the PPI report.

-

Capital account vs income account and business structure

kevin4u2 replied to cloud's topic in General Discussion

Hi Cloud, Let me make a few comments. I can be blunt too so please don't take this personally, but I'm confident you will remember this discussion is a few years. 1) If you are dealing with small sums of money why not trade within a TFSA or RRSP if you have contribution room? If you are using a LOC in a margin account to increase your leverage, you must like paying with fire. I mean a 3x ETF would be less leveraged. 2) If you are paying interest to invest, write it off. Then again if you want to pay more tax on my behalf go right ahead. 3) Being an engineer doesn't make you a god. You are young and have a lot to learn. A BS in any type of engineering does not make you an engineer nor can you claim you are an engineer by law in Canada. I didn't say you are making this claim but it could have been implied. 4) I agree with Scott that this thread is quite scary. The markets have been going in one direction since you have been investing. Wait till the market turns and you'll learn what your really made of. 5) Leverage is great when the market is going the right direction. See point 4. 6) Reading rich dad poor dad is not an investment education. 7) Why not post all your trades for everyone to see? Start a blog. The transparency will be good for your ego. and 8) (I'm serious here) What was your investment rationale for buying COS? -

I would be curious to see the stats for Alberta alone... I think the diversified economy comes mainly from Ontario, Québec and BC.

-

Books You Consider Worth Re-reading (... every year)

kevin4u2 replied to smd123's topic in General Discussion

Born to be worthless - Kevin Solomons The six pillars of self esteem - Nathaniel Branden Investing books are great but these books can change your life. I speak from experience. I have read a dozen books by Branden and learn something new in every one. The Art of Living Consciously is a great follow up to the six pillars. -

And no discussion of the forward strip which doesn't see oil getting back to $100. It is under $70 out to 2024. If you think it's going back to the moon it should be relatively easy to make a killing by speculating on futures. I have also yet to see anyone say the words "permanent loss of capital".

-

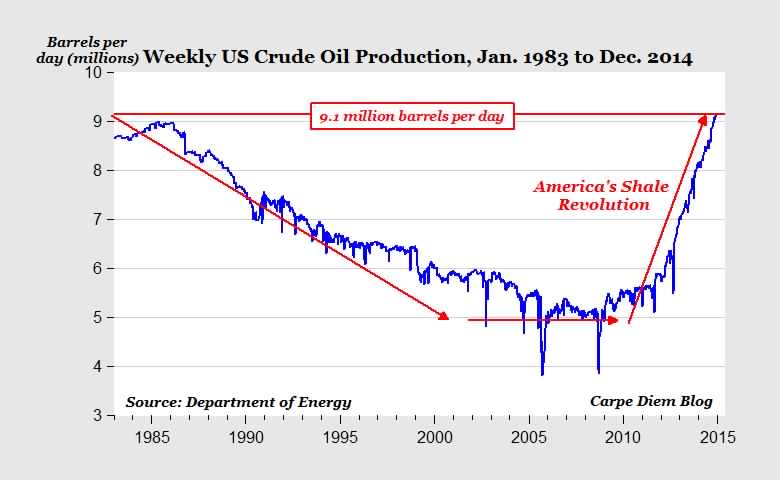

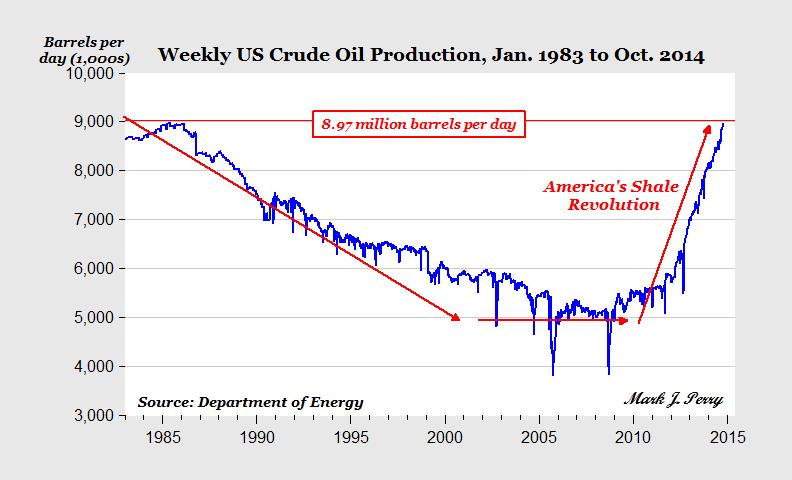

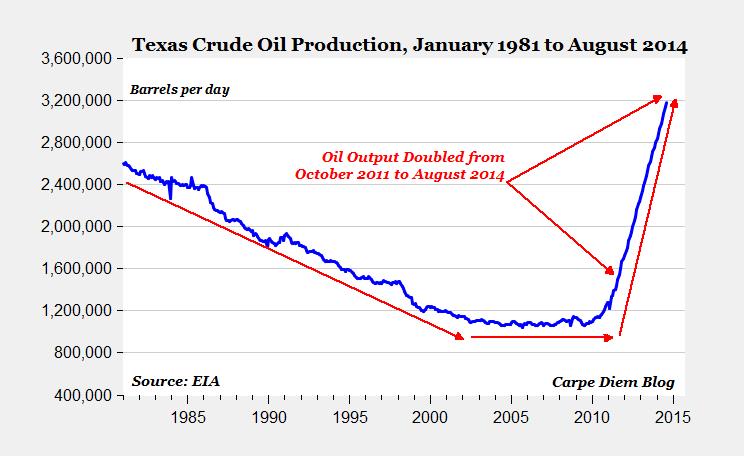

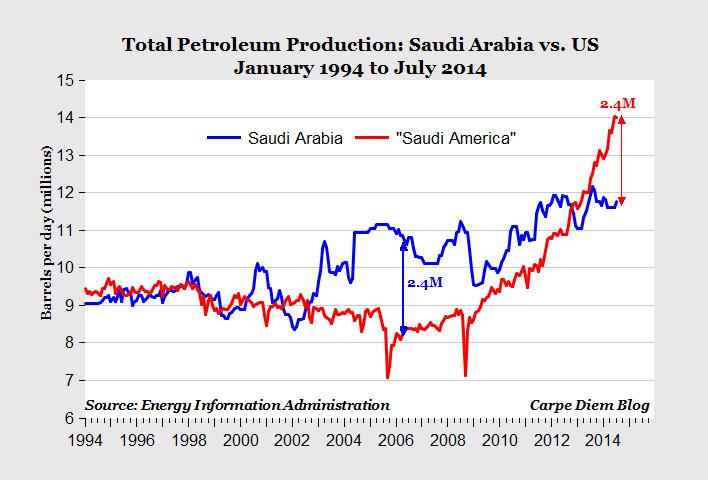

If I could add one thing to Schwab711's excellent reply. It is the attached chart. US crude oil production just topped Feb 1986 levels. Things have radically changed in terms of US oil production since 2008-2010. New technology has revolutionized the industry and until this trend breaks, get out of the way of the supply bus. I discussed this chart on my blog over a year ago. I would venture to say that we are in the top of the first inning of the shale oil revolution. What will happen as this technology is exported all over the world? The way this is playing out is nearly the same as the shale gas revolution that begun 5 years prior to the oil supply shift in the US. It took more than a year for almost everyone, myself included, to eventually throw in the towel, walk away, and admit we were wrong. Now look at NG, new 52 week low last week. The current NG price is well below the marginal cost in Alberta, and it has been there for years.

-

There is no such thing as a value trap. There is reality and fantasy. When reality doesn't align to your estimate of value, your value was wrong. Try again next time.

-

How Are You Thinking Bout The Drop In Oil Prices?

kevin4u2 replied to Viking's topic in General Discussion

When oil prices stay where they are for a longer period of time you will probably lose money in oil stocks, because they act like call options on oil. When you then buy call options on these call options you will not make money if oil moves only up a bit, only when it goes back up to above 90$. I don`t know how high implied volatility on oil is, but i suspect its a lot lower than on oil stocks. But that is not my main point. My main point is why speculate? I don`t see this as value investing, because most stocks are now more expensive than 3 month ago at oil prices of 90$. Some o&g stocks are worthless now but still trade at market prices above 0$. And i doubt that oil prices will rebound meaningfull without a big supply contraction first. I completely agree some are worthless. Buying an oil stock today is speculation on the oil price, plain and simple. Before the crash, buying an oil stock was speculation on the price of oil. I have been looking for a "value investment" and have yet to find one. Many Canadian companies are still priced for $90 WTI even considering the recent stock price declines. Most people had no idea that they were all grossly overvalued before. They were priced off their Ponzi dividend schemes. There may be a day when these become value investments. It will be when everyone gives up on oil and when investors blame the reserve auditors for the over estimating reserves. Oil reserves are very price sensitive. The reserve and asset write downs are going to be nasty in Q4. Anyway, there are numerous other sectors to make money. I avoid commodity companies for two reasons. First you are completely unable to predict future cashflows (it takes intellectual honestly to concede the point). Second, they are among the most unprofitable sectors in Canada. Oil and Gas is just above the mining industry for the lowest returns on invested capital in Canada. Nearly all other sectors earn 2-3 times the return on capital compared to O&G/Mining. -

How Are You Thinking Bout The Drop In Oil Prices?

kevin4u2 replied to Viking's topic in General Discussion

Why don`t you just buy calls or futures on oil when you want to speculate on that to pop? :) Why not buy oil stocks if you want to speculate on oil prices? -

It just feels like a great depression for those who own oil stocks.

-

How do you calculate nav ex goodwill? Never heard of it before.

-

Murray Edwards from CNRL sees oil at $30US. http://business.financialpost.com/2014/11/28/canadian-natural-resources-chairman-sees-oil-touching-us35-a-barrel/?__lsa=7b2d-df74 If Edwards is right, there is still a lot of time to wait. Add in tax loss selling over the next month, asset write-downs in Q4, loan covenants being broken, bankers will be nervous... things will get volatile. Most everyone will throw in the towel eventually. What is amazing is how fast equity prices have fallen in a week.

-

Wow, some serious carnage on bay street. Looks like breaking the $70 oil handle was the last straw for some people. Time to buy or more carnage to come? Wait for the first bankruptcy, and watch the fear spike? I am getting trigger happy.

-

Your exactly right. The market neither knows nor cares what is required for anyone's budget. If someone said they needed their investments to double next year in order to meet their "budget" and survive, we would consider that person to be delusional. Other people turn around and then apply the same logic to oil prices and consider it rational. Go figure. This is what I consider the term "circle of competence" to mean. It is the ability to separate facts from wishful thinking. Our minds are not constrained by reality, which causes so much harm in this world but is also a valuable tool (i.e. creativity). When you think about it, almost every time you are "mad" it is because what you believe "should happen" and "reality" are in conflict. Don't fight reality and you will live a much happier life. Wishful thinking is simply trying to force reality to conform to what we feel it "should be".

-

Do you think the U.S. will drill itself into an oil glut?

kevin4u2 replied to JAllen's topic in General Discussion

And Natural Gas. Today, very few NG producers in Canada make money. I stuck my head in the sand for a long time when the shale gas revolution started. Unwilling to accept reality. All the same arguments here are being repeated. High marginal costs, high treadmill, costs are going up, and on and on. Here is an interesting video from the EIA on shale drilling productivity. I like the graphs at 1:47 that show shale gas productivity per well is up 8x and shale oil productivity per will is up 11x in the past 6 years. To compare this to baseball, we are still in the top of the first inning. Didn't they say the same thing about gold? -

Skate to where the puck is going, not where it is today. I just look at the big picture and think about what has happened in such a short time. I have attached some pictures graphs of US and Texas oil production. Texas has added a million barrels of oil in 2 years. It has added 1.6 million barrels a day in 34 months. Most people have absolutely no appreciation of the magnitude of that increase over such a short time period. Since 2011, Texas has had 40 consecutive quarters of over 20% growth in oil production. This has completely reversed the decades old decline in production. These are the hockey stick graphs that the climate scientists dream about. What's going to happen when shale technology is taken elsewhere? The US production has been coming from predominately Texas and North Dakota. The technology is 4 years old. If this isn't a paradigm shift I don't know what is.

-

Numerous companies started fracking at $50 oil. If it was economic then, why isn't it now, especially given the improved efficiency? You will be amazed how quickly the marginal cost drops when prices fall. The industry is naturally very loose with cash when it doesn't matter. Bull markets die hard. I see absolutely no reason for oil prices to rise given the huge supply glut. The same argument about high decline rates was also made with respect to NG shale production a few years back. That obviously wasn't true.

-

I changed my mind in 3 months based on data that was critically analyzed, and not accepted at face value from management. The person who copied and pasted from the company press releases you need to throw it in the trash, and do your own analysis. Proved F&D was over $70, just do the math. I will add that the reserves got a boost of 5% due to commodity prices used. They aren't getting a boost this year. Given the very short reserve life, it will be a significant hit. Probable reserves are worthless if the company cannot capitalize on the proven reserves. Proven reserves have the lowest risk, and must have a high probability threshold. As for missing the run up, you are correct, I missed the speculation up to $9 bucks and because it was not grounded in reality, it came back down to earth. I regularly miss out on speculative runs and it doesn't bother me for 5 minutes. I can't predict such things, I don't gamble I value invest, and I don't like to rely on the kindness of strangers. Why is this a fantastic buy when the equity value simply is not supported. Next, the long term F&D is not 25 or whatever was said. The company has lost half a billion dollars over its existence. A company with a long term recycle ratio of 2 or better makes money. I am also not saying that the assets do not have value. I'm arguing that the assets accrue little to no value to the equity holder. Net out liabilities and there is nothing left. Not even 9 months, he changed mind after the March report. So it's more than 2 months. He missed the run up to 9 bucks, but he also missed this massive selling. :'( I was hoping asset sales with such good metrics would provide a floor to LTS's share price. How wrong I am.

-

Hi Biaggio, Here is the rest of the information. I recommended the stock back in January this year, it started the year at $5.9ish. At the time (looking back at 2012) they had spent just over $320 million in capital, added net proved reserves of 27 mmboe, and the cost looked very reasonable at around $12 per BOE. Netbacks were much much higher than this, so a decent recycle ratio. If you do a quick and dirty 1P NPV-10 BT you come up with a rough NAV of about $9. This has been the NAV for a while, ever since I said it was crap on my blog back in 2010 (there are several other posts on there about PBN & PBG, If you want some fun reading... do a search as I had some interesting debates on the topic with a few guys). http://canadianvalueinvesting.blogspot.ca/2011/04/petrobakken-2010-annual-review.html Despite recommending it, I should add that I never purchased it because management is pathetic. I also know a few things about the company from people who work in the field, and all I will say is it wasn't good. Anyway, then as the reserve report and annual financials were released in late march/april and became clear LTS was still crap. First of all they spent $719 million in CAPEX in 2013, and had a net reserve add of 12.3 mmboe for a F&D cost of over $70/boe. That was the start. Obviously they spent a pile of cash and generated NO value. This can clearly be seen in the annual report where they wrote off the $1.4 billion in goodwill they were carrying. I also realized how they justified the carrying amount to the auditors as the report said this... "In addition to discounted cash flows, the Company also considered a range of market metrics in assessing fair value less cost to sell for certain CGUs. Market metric information was obtained from recent transactions involving similar assets." Oh so they use "market metrics" to justify the fair value, not the reserve report which is as close to reality as you can get given the assumptions. Basically you take the production profile and multiply by the forecasted price, reduce it by costs, and discount it back to today. Anybody looking to acquire the property would do the same analysis and also adjust for drilling opportunities. Market metrics is exactly what most of the people who invest in oil and gas do to justify the value of properties. In reality every property has different cost and netbacks so blanket metrics do not work well. Basically they had a pile of technical revisions to their reserves and it really made you question the competency of the company. Next if you do a quick and dirty NAV it comes out to approx. $3.8/shr. My conservative quant model gives a sub $2/share NAV (down from $6, and it takes into account other assets and liabilities). So basically the company destroyed 60-70% of value with a terrible return on a huge capex. It's gone, the company is nearly worthless for equity holders. This was also in a time of high oil prices. For those who own this I wish you well but these are the facts. The company is just as terrible as many other O&G companies at generating a profit. Hope this helps. I am just wondering how you go about looking at these reserve reports?