kevin4u2

Member-

Posts

341 -

Joined

-

Last visited

Content Type

Profiles

Forums

Events

Everything posted by kevin4u2

-

We are in for a slow growth period until the debt deleveraging cycle is over. Let's face it, much of the growth from the past 20 years has been paid for by increasing debt. That cannot continue forever. The average US citizen is more develeraged than their Canadian counterpart. In Canada we are facing a real estate crisis, falling commodity prices, and an average consumer who is debt up to their eyeballs. I noticed the Fairfax increased their short position by adding the TSX index just recently. I imagine that will grow over time. Before that they were only short the Russel 2000 and another index, I believe. Slow/no growth is a real possibility for at least a couple years. Consumer is tapped out. Canada is in big trouble. I am bullish on U.S. two years out, but until then it will likely be slow growth.

-

Most recent Graham and Doddsville Fall Newsletter 2012

kevin4u2 replied to Evolveus's topic in General Discussion

Interesting Quote from Joel Greenblatt G&D: In class, you talked about how you try to assess how cheap or expensive the market is at any point in time. Can you talk about your views on the market today and how you look at it? JG: Sure. Well we’ve looked bottoms-up at each stock in the Russell 1000 Index, the thousand largest stocks in the U.S. by market cap. We’ve looked at those over history, meaning the market-cap-weighted free cash flow yield of the Russell 1000 on each day over the last twenty years and right now we’re in about the 87th percentile towards cheap, meaning that the market as measured by the Russell 1000 on a free cash flow basis has only been cheaper 13% of the time over the last 23 years. When it has been this cheap, the forward return for the Russell has been about 17% and then about the mid-30’s two years out. That’s not to say that the market’s prospects are better or worse going forward – they’re probably a little below average for the forward period and therefore you could say that perhaps you won’t do quite as well as would be implied by historical returns. But, even in the 50th percentile, you would expect to make 8% or 9% based on the history of the last twenty-something years, so I would just say that if I had a choice between being more long or more short, I’d be more long. It’s a very attractive time to invest in the market, despite the run-ups that we’ve seen in the last year. -

The reason they are printing money is to head off deflation and keep interest rates low. It will only cause inflation if and when those excess bank reserves enter into circulation. Do a search on debt deflation cycle. Ask the Japanese if they have had hyperinflation. Anyway, here is what Bernanke recently said in response to this: With monetary policy being so accommodative now, though, it is not unreasonable to ask whether we are sowing the seeds of future inflation. A related question I sometimes hear--which bears also on the relationship between monetary and fiscal policy, is this: By buying securities, are you "monetizing the debt"--printing money for the government to use--and will that inevitably lead to higher inflation? No, that's not what is happening, and that will not happen. Monetizing the debt means using money creation as a permanent source of financing for government spending. In contrast, we are acquiring Treasury securities on the open market and only on a temporary basis, with the goal of supporting the economic recovery through lower interest rates. At the appropriate time, the Federal Reserve will gradually sell these securities or let them mature, as needed, to return its balance sheet to a more normal size. Moreover, the way the Fed finances its securities purchases is by creating reserves in the banking system. Increased bank reserves held at the Fed don't necessarily translate into more money or cash in circulation, and, indeed, broad measures of the supply of money have not grown especially quickly, on balance, over the past few years.

-

You can't be serious... I'll second that... What are the unintended consequences of the handout policy? I would also recommend The Road to Serfdom by F A Hayek

-

People naturally want to obey authority becuase it allows them to avoid taking responsibility for themselves and their lives. For those who disagree haven't looked at the science, Milgram's experiment.

-

The case for Deflation and FFH's CPI-linked derivatives

kevin4u2 replied to giofranchi's topic in General Discussion

They are certainly very good, however I'm not sure how much of a benefit they got from issuing their shares at a huge premium to book value (it was up to 3x at one point!) -- I think it was quite a bit. Absolutely, and that is a good point. Much better to issue equity when the stock price is high. Crescent Point energy has been playing that game for years, and the income trusts did it for years. CPG issues new shares consistently at 2x book to fund their high dividend. The haven't earned a dime in profits for 10 years. -

The case for Deflation and FFH's CPI-linked derivatives

kevin4u2 replied to giofranchi's topic in General Discussion

Frank, you are correct. The use float to generate huge returns. Look at their history, FFH has increased book value by almost 24% for 26 years. That is no fluke. They are very good at what they do. The formula is simple: Float + Strong Value Investing = Cash flow machine! Like others here, after reading every annual letter to shareholders since inception I have invested a significant amount into FFH and plan on leaving it there for a good long time. -

So you would conclude that Americans believe that Obama is muslim from watching late night comedians? These clips are edited for comedic value, and not for accurate sampling. If you spend enough time in Hollywood Boulevard, you can find enough people who will say exactly what you want to say. Especially when the 4S looked exactly like the 4 and Apple hasn't put out a single ad on iPhone 5 yet. Now, the hype question: http://tech.fortune.cnn.com/2012/09/13/what-twitter-had-to-say-about-apples-iphone-5-event/ You think its hyped? Everyone is talking about how boring it is and how Apple is not innovating anymore. Yet, it is going to shatter all records. I hate to break it to you but you have a strong innate bias for apple. You perhaps don't even realize it.

-

-

Just curious. Did Buffett ever sell any AXP shares? Correct me if I'm wrong, but Buffett did sell his AXP shares after the salad oil scandal only to repurchase them later. I plan on holding until BAC reaches fair value. Today that would be around BV. Remember BAC sold for over TBV back when it was recording it's heaviest losses in late 2009 and early 2010. A little better than a year ago the concerns were all about having to raise capital. Today the balance sheet is in much better shape, they are very well reserved, and housing seems to have found a bottom. That said, concerns still linger over litigation and putbacks issues.

-

Given all the politics of late, this video should generate some discussion (or laughs). I don't know how the Democrats allowed a guy like Peter Schiff into the building. I just love the lady right at the end of the video... "You happen to be one of the smartest people I've met since I've been down here." Too funny.

-

Thanks for the notes from the conference. Much appreciated.

-

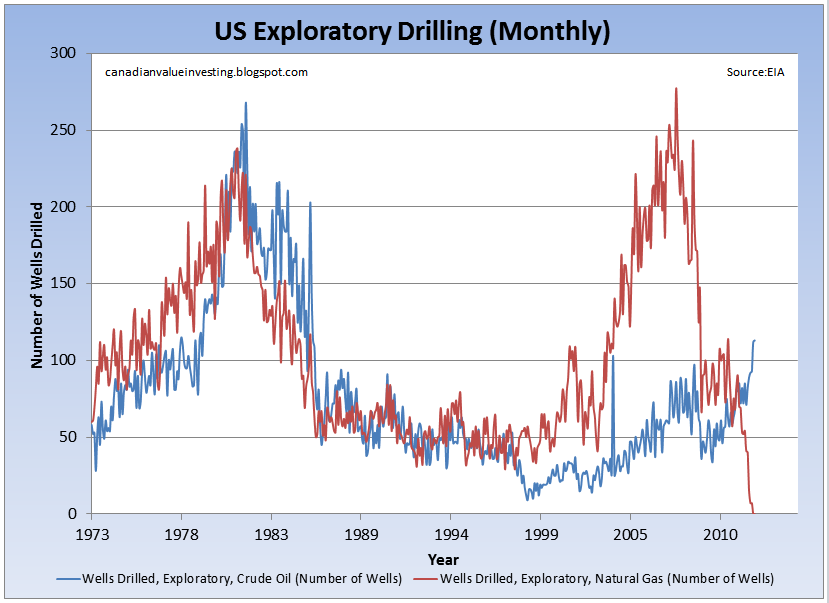

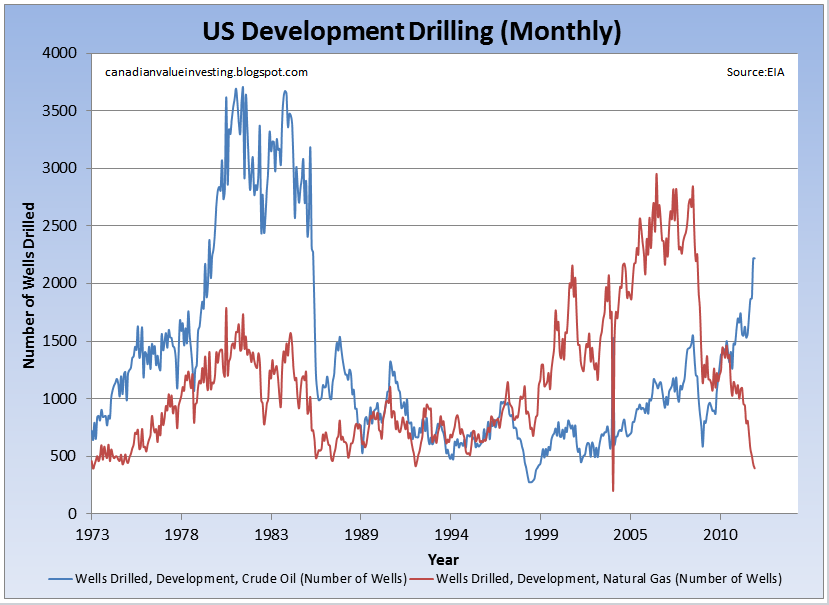

Hi Buddy, you make a number of blanket statements that I hear quite a lot but perhaps I could make a few comments. First, I think you are confusing exploratory with development drilling. I presented both slides above. Exploration has stopped while development continues albeit at decade low numbers. Secondly, I agree much of the drilling is like manufacturing. However up until this year many producers were only doing land retention drilling. That means drill just to retain the land rights. They didn’t care what the gas price was. Lastly, I agree more supply can be brought on but at what gas price and what cost. It’s obviously higher than here given the drilling stats. Many producers are losing money today. The best way to invest in this environment is to own the low cost operators. And you won’t find out who that is from a corporate presentation. Every CEO thinks they are the low cost operator. I own the low cost operator in Canada and they are increasing their drilling right down because of the low service costs. They are also profitable at these NG price levels. Given the drilling response this is a firm bottom.

-

I frequent this board and feel like I should contribute more given how much Parsad puts into this forum. Anyway, it looks like NG drilling has definitely bottomed. Exploratory drilling for NG was zero for May and June in the US. This is remarkable since exploratory drilling is has never been this low. In fact only 14 exploratory wells have been drilled since March of this year. Development drilling for NG was 396 wells in June. This is below the level many believe is needed to sustain current production. It's also the lowest level in decades. It really looks like the bottom for NG has to be near given that companies are realizing that low prices aren't going away unless they take action. In comparison oil exploratory and development drilling are around 25 yr highs. Oil production in the US lower 48 also hit a 23 year high in July. So much for peak oil. I have attached graphs of each.

-

Thanks Farnamstreet. Excellent set of posts. Although much of the first two posts has been discussed on this forum. The idea of linking floats to moats is very interesting.

-

Mohnish Pabrai & Guy Spiers - UC Davis Presentation

kevin4u2 replied to Parsad's topic in General Discussion

I think it was both...Mohnish's mic and Guy's speaker...as there was a delay in the echo. It was funny to watch them fiddle with it, especially when Guy went right up to the screen. Great presentation by two very good speakers...both could be professors! Cheers! This may have been posted here before but here is another interview with Guy Spier. Good discussion of Europe, why US banks are much better, why he didn't invest in Bank of Ireland, and investing in Japanese net nets. Enjoy! -

Windows 8 is likely to only make things worse. At best enterprises will take a wait and see approach. At worst, there will be some shift to Mac OSX. Either scenario is going to hurt them. Doesn't Fairfax own Dell? I don't think you understand the stickiness of Windows. I know at the company I work for, there is no chance of changing operating system. We have too much software that only runs on windows. Changing operating systems is simply not an option. The second reason would be the huge risk this would be for IT departments. The hardware upgrade would be cost prohibitive, especially due the fact that everyone would have to be upgraded at the same time. Thirdly, the sheer amount of training require to make a major change like this is simply not worth the effort. This change could risk data and quality issues. Forth, what you pay for what you get is computing power on a mac isn't going to make cost conscience companies want to make a change. Consumers suffer from herd mentality and social pressures which drives them to Apple. Lastly, the specs on an mac wouldn't cut it for our engineering department. I could be wrong but where I work, and we're not a big company, it switching just isn't an option. Very small companies could likely make the switch. Fairfax owns Dell, and they'll make money on Dell.

-

I have tossed around the same question. What is a $70 billion dollar loan, at a 0% interest rate, for an indefinite term, non callable, really worth? Better yet, what is the value of that loan in the hands of Warren Buffett? I estimated it's value at $70 billion. Obviously Buffett feels it is worth more than $70 billion.

-

Sometimes I really wish people would explain to me what they mean by "The Downfall of MSFT". Is it just because they're not Apple and they don't have the Iphone? Well, nobody can make that claim! For the moment being Apple is in a league of its own. But all the talk about MSFT's downfall (or a lost decade like the guy in this article) just baffles me. Here's a quick review of what that lost decade (from 2003 to present) and the downfall looked like from where I stand: Revenues went from $32.1B to $70B+ this year. Revenues per share from $3 to $8.35 Net income went from $10.5B to $23.1B EPS from 97 cents to $2.7 Return on equity averaged about 34% Dividends per share increased tenfold from 8 cents in 2003 to 80 cents this year They bought back and retired about 2.4 billion shares in that period and they have about $60 billion in cash right now. If this is what is now called a downfall I know many companies that would love to suffer this kind of downfall. AZ your exactly right. The problem is that they started with a nose bleed P/E ratio of over 50x back in 2000, now they trade for 9x 2012 earnings (net of cash). They also generate over $2 billion a month is free cash. The problem is the average investor only looks at the chart and not the underlying business fundamentals. I must say though, I am thankful for those who use a ten year chart to determine value.

-

ECA has also been mentioned by some folks as a low cost NA nat gas producer. Peyto is the lowest cost operator in Canada, and is lower than many US companies listed above. They just announced earnings that were quite good given the low AECO gas prices. I didn't expect profits to be that strong. Even at the lowpoint of the cycle they are selling for 22 times annualized Q1 earnings. That's right, they were profitable in Q1. If you haven't ever taken a look, it's worth it. They have excellent management focused on maximizing ROI. One of the highest total returns on the TSX for the past decade.

-

Interesting. I was also thinking CLD Cloud Peak Energy that is the lowest cost thermal coal miner. It is not like coal is going to disappear, there are huge legacy costs. It's interesting that Jim chanos thinks you should short coal since the economics for coal will never be the same. Isn't that more important than legacy cost?

-

How much time do you put into each case before buying it?

kevin4u2 replied to anders's topic in General Discussion

If I could add one more comment. I would stick to the facts and less on the opinions. You can read/scan countless blogs, newspapers, and web articles that are overflowing with opinions and often have little to no hard facts. This will impact your decisions. If you don't believe this you are self deluded. Now by facts I mean financial analysis, looking at the numbers. You can't ignore the soft factors like management and industry, but the financials will tell you a lot about them too. As for the discussion on people who over analyze things, this can be very difficult. Many people are highly conscientious by personality so they can't help but over analyze the facts. Many of these people are engineers who like to refining and refining. If you have that type of personality it will inevitably be difficult to make a decision. Some people on the other hand are fast thinkers and overconfident in their abilities. These people run the risk of moving too fast on an idea before all of the analysis is complete. The key is understanding yourself, your natural tendencies, and thinking critically to overcome your innate shortcomings. Balance is the key. -

Compilation of Fairfax shareholder letters

kevin4u2 replied to ageofsocrates's topic in General Discussion

You can download all of the shareholder letters here: http://dl.dropbox.com/u/42759926/FFH%20Shareholder%20Letters%201985-2010.pdf I have read them all and highly recommend ever value investor to read them too. After I finished reading them I was amazed how far the company has come despite all the problems and mistakes they have made. Perhaps Prem is far more humble than most other CEO's as he prefers to be honest about mistakes and learn from them. A important sign of a outstanding leader and a very good critical thinker. I also created a condensed version of every market call (including bubbles) Prem has ever made since 1985. Quite amazing to see his patience and stubborness to wait out market bubbles. His accuracy on large market calls is second to none. People who ignore him do so at great risk. You can download that pdf here: http://dl.dropbox.com/u/42759926/FFH_Financial%20Bubbles.pdf Enjoy, Kevin -

Has anyone mentioned the biggest headwind SHLD faces, namely the unfair advantage amazon and other e-retailers have on SHLD? Sales tax laws are killing the company. Why buy the big screen from Sears when you can get it 5-10% cheaper online (tax savings). It's a huge disadvantage and unless it changes, SHLD is toast. If you look at the big picture retail sales have been strong, so I take the above disadvantage as the reason why. Here is what Lampert said in his 2010 letter to shareholders: The two leaders in online commerce are Amazon.com and eBay. Despite operating no physical stores of their own, these two companies have built tremendous businesses over the last decade serving millions of customers every day in a broad number of categories. They have taken significant market share from traditional retailers by providing convenience, service, and competitive prices. One has to give each of these companies tremendous credit for their foresight, persistence, and execution through the collapse of the internet bubble, early skepticism, and competition against larger and more established retailers. There remains, however, one advantage that the major online retailers retain that is both unfair and problematic, for competition and for communities and jobs as well. For customers in many states, Amazon and other online retailers are not required to collect sales taxes on purchases made by their customers. Since the 1992 Quill Supreme Court decision, businesses without a local “nexus” have sold goods through the mail or online without being required to charge and collect the related sales or use tax. Amazon, in particular, has argued that when it doesn’t have a physical presence in a state or local jurisdiction, it is not benefiting from police, fire protection, and other local services and therefore shouldn’t be forced to pay for them. Analyses by others suggest that the real issue is competitive advantage, more than other explanations put forward in the past.1 The real story here is that it is not the payment of taxes or the charging of taxes that is at issue. It is the collection of taxes on behalf of local governments from purchasers of goods and services from stores in a locality or for use in such locality. It is the latter fact that is often ignored. A person who buys products from Amazon.com is required by law to pay sales or use tax to their local jurisdiction. In practice, almost nobody does so. The cost and unpopularity of enforcing such laws has allowed customers to avoid paying sales or use taxes, even though they are required in many states and localities. If you buy a work of art or piece of jewelry in NYC, for example, and have it shipped to New Jersey or California, the seller does not collect sales tax on that purchase but the buyer would be required to pay sales or use tax on the purchase where they receive the merchandise and use the merchandise. So, a piece of jewelry shipped to California would require the buyer to pay California sales or use tax. Amazon’s domestic business has grown to $12.8 billion in revenues for the year just ended. If you were to apply a 6% sales tax to this revenue (reflecting a rough average of sales taxes across multiple jurisdictions), that would amount to almost $800 million in sales and use taxes owed to state and local governments that is likely not being paid. The good news is that it is $800 million that remains in the hands of the purchasers of products from Amazon, but at the cost of jobs and new fees and taxes required to make up for lost revenue. Having delayed a level playing field for as long as they have already, Amazon has been able to build relationships with many customers that give it an advantage, even playing under the same rules as those it competes against. I would propose that there be a leveling of the playing field for e-commerce merchants. Either we all collect taxes or nobody collects taxes. If state and local governments are going to require retailers like Sears and Kmart to collect sales taxes and not retailers like Amazon.com, they should recognize that over time their sales tax base will erode significantly and that they place companies who have chosen to locate stores locally at a competitive disadvantage. This will lead to a loss of revenues, the closing of local businesses, the loss of tax revenue, and ultimately to the increase in other types of taxes to compensate for the lost jobs and revenues. Alaska, Delaware, Montana, New Hampshire, and Oregon are states that currently charge no sales tax at all. Let me be clear, we have no issue with continuing our current practice of collecting tax on behalf of state and local governments. We just don’t believe that the current set of rules is sustainable without severe competitive and community damage over time.

-

As BAC stock continues to fall, interesting perspective

kevin4u2 replied to Munger's topic in General Discussion

If it did, it would volunteer to use MTM accounting despite FASB's favors They are being trusted with marking assets (FASB suspended MTM). Think they're doing an honest job? This isn't true statements. FASB 157 never eliminated MTM accounting. MTM has to be used where there is a liquid market. It allows other option for assets that do not have a liquid market. Secondly, why do you think the banks are recording increased earnings due to credit spread adjustments? MTM accounting. Media was all over this saying is all "accounting tricks" inflating earnings. Anyone else notice the inconsistency with the arguments? Banks get attacked if they use MTM or if they don't,... Which way does the analyst want it? The analyst loses all credibility with such statements as highlighted above... Next. Regards, Kevin