LearningMachine

Member-

Posts

1,747 -

Joined

-

Last visited

-

Days Won

6

Content Type

Profiles

Forums

Events

Everything posted by LearningMachine

-

Thanks @Xerxes for sharing. On Alibaba, when Buffett put up the top 20 list of companies, which contained Alibaba, and helped attendees realize that the list won't be the same 30 years from now, to me it felt like an internal conversation that Buffett might have had with Munger as well to not get too excited as we cannot even say with certainty that Alibaba will stay on the top 20 list. I had a similar feeling when he made the audience realize that even if "you had seen a quick glance back in 1903 of all the interstate highways, 290 million vehicles on the road in the United States, everything about it and had realized 'Well, this is pretty easy. It's going to be cars. It can be autos.", investors would have still failed by trying to pick one of the auto-manufacturers or even all of the auto manufacturers in all the excitement. Felt like he must have had a conversation with Munger that even we can see the vision that Chinese economy is going to be much bigger than the U.S. economy, you can still fail by trying to pick one of the Chinese companies at a high multiple based on the assumption that it will stay on the list for a while. It was also interesting to see Buffett talk about Google, Microsoft and Facebook: "So those are the kind of businesses -- they're the best businesses, but they command the best prices too. And there aren't that many of them, and they don't always stay that way." I think Buffett is still opposed to paying best prices for businesses because the high multiple assumes the businesses will stay that way for a while, but "they don't always stay that way."

-

It came up at the Berkshire AGM yesterday that the number of Chinese companies in the top 20 list will probably be higher than 3 thirty years from now. Their valuation will likely be also order(s) of magnitude higher than today's valuations. However, there is good probability that the actual Chinese companies will be different from the ones that are in the top 20 list today. Even though Chinese economy will be much larger than the U.S. economy by then, Buffett thought U.S. companies will still outnumber Chinese companies in the top 20 list then, presumably because of the legal framework and the overall system we have in place in the U.S. To still have some benefit from Chinese growth, wondering if folks have looked into Chinese ETFs from the perspective of expense ratio, composition, securities lending practices, whether they are at risk of ADRs being delisted, whether they have exposure to VIE structure issues, etc. Regarding composition, S&P 500 might work fine for U.S., but I'm wondering if top 50-100 would be better for China because of higher chance of fraudulent accounting with smaller companies. On the other hand, even though the top few companies will probably have the biggest extraction power from the economic value flowing through them, but unlike U.S., Chinese regulators will probably keep them in check most as well to make sure their extraction power is limited. What do folks think would be the best ETF to take a cut of Chinese economic transactions, and grow along with the Chinese economy?

-

Thanks @Spekulatius for sharing. Really helpful in understanding deeper what was said yesterday :-).

-

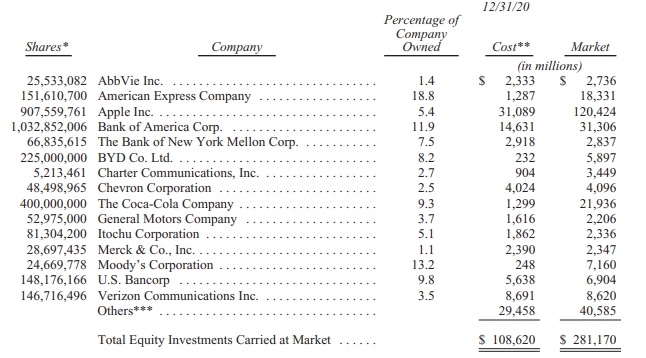

Compared to Dec 31, 2020 Cost basis for Commercial, industrial & other went down from $47.561B to $44.934B, which means that in net, he sold something(s) that he had bought for at least $2.627B in total. Fair value went down from $68.361B to $67.054B, that is, $1.307B - there is probably noise in this from various stock movements but some noise could be removed. Net unrealized gains went up from $20.8B to $22.120B, that is $1.32B - same for noise here. Cost basis for Banks went up a little from $26.312B to $26.730B, which means BRK probably bought at least $418M of some bank stocks Cost basis for Consumer products went up a little from $34.747B to $34.787B, which means BRK probably bought about at least $40M of some consumer products stocks What do folks think he sold that he had bought for at least $2.627B? Looks like it will probably be something in this list with a cost total above $2.627B? Looks like it wasn't AXP, AAPL, BAC or KO.

-

Buffett/Berkshire - general news

LearningMachine replied to fareastwarriors's topic in Berkshire Hathaway

Thanks for sharing. It was a good reminder how he realized at such an early age that he had a unique market power to be able to successfully sell more (magazine subscriptions) to his existing well-off customers (who were on Washington Post subscription), compared to others who didn't have that existing positive & direct subscription relationship with well-off customers. -

Buffett/Berkshire - general news

LearningMachine replied to fareastwarriors's topic in Berkshire Hathaway

This is so true! Also true for Apple! Also becoming true for Bank of America! Will probably also become true for Verizon! Of course, Buffett's got a knack for buying good businesses when they are cheap. Then, after Buffett is done building his position, and starts talking about the "why", Mr. Market starts to realize as well how good of a business it is :-). Buffett could literally take a business that is consistently growing cashflow at single digits annual rate, and turn it into a stock that is consistently growing at double digits annual rate, up to some point! Sometimes he screws up like he did with Kraft, where he gets it wrong whether the business will be able to grow cashflow at low-single digits because he missed the loss of pricing power to grocers, but mostly he knocks it out of the park by being able to identify whether the business has economic power to be able to extract single digit growth each year! He has gotten better with age! -

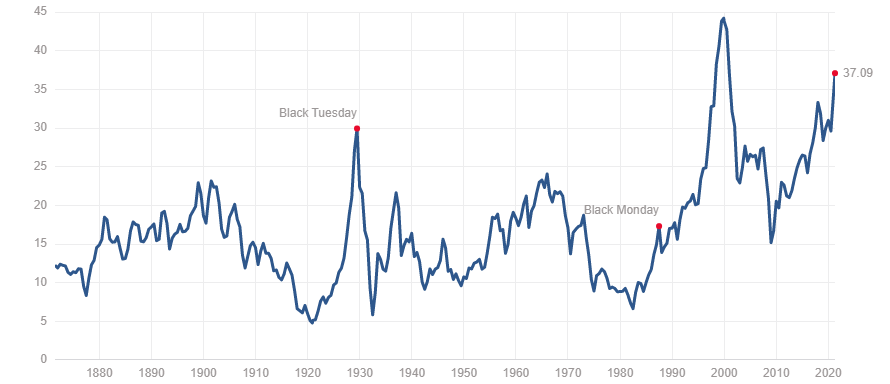

It is hard to predict when the market will crash next. I wonder if it will be easier to predict the range for peak Shiller PE this time? I think we can probably all agree with almost 100% probability that we won't hit Shiller PE of 100. We can probably also agree that probability is high that we won't hit Shiller PE of 50. What about 40 and 45? Above what number will folks start getting some more dry powder ready? Having a range in mind for max Shiller PE might help us be prepared. So far we have went above Shiller PE of 40 less than 2 years in 150 years, i.e. less than 1.3%. Only the 2000 crash started at Shiller PE above 40. All other crashes were at Shiller PE of 30 or below, except the 2020 flash crash. I understand we are in different times with respect to interest rates - if you think these times are different because interest rates are low, it will be great if you could consider that over the past 150 years, we haven't had interest rates low for too long either (https://www.multpl.com/10-year-treasury-rate). Source: https://www.multpl.com/shiller-pe

-

Munger was also a big fan of Tesco at one point to the point of saying "Tesco is God Almighty in England". He led Berkshire into making an investment in Tesco, but it had to be sold at a loss.

-

All investments, including assets & businesses, involve purchasing "rights" protected by law: Real estate in law is defined as the "right" to legally exclude others from a well-defined boundary, and certain other rights, e.g. right to build a certain amount, right to use for something specific, etc. Sports team investment is the "right" to legally prevent others from having another team for a defined area and certain other rights. Railroad is the "right" to use a physical pathway and exclude others from using it. Spectrum is the "right" to use a frequency band and exclude others from using it. Pipeline owns the "right" to easement Trademark is the "right" to exclude others from using your name that stands for something. For some of the "rights" above, there is an alternative option, e.g. for Trademark or "sports team" or even real estate or pipeline. For some rights, there is no alternative or alternative is very suboptimal. If a "right" has no alternative, you can make it cashflow higher and higher. How much you can make a right cashflow depends on the alternatives. Ideal investment would be directly owning a "right" that has no alternative and that can cashflow unleveraged at 20+% per year, where there is no other alternative to that "right" for those that need to use it, and where you can take the cash and buy more such "rights" at a price that cashflows unleveraged at 20+% per year. Such an investment is really hard to find. Usually, buying "rights" directly is expensive because other neural nets can easily comprehend what they are buying and are willing to pay a high price for it. So, you cannot buy it at 20% unleveraged cashflow. The next best alternative is buying shares of an entity that owns such "rights". Now, as soon as you put an entity between yourself and the "rights", you take several risks, e.g. agency risk from those employed by the entity taking a big chunk of the cashflows before they let it pass it on to you, leverage risk created by those employed by the entity while not caring about taking the risk for the shareholders, etc. Another option is directly buying rights that might have an alternative also. However, if you are paying a high price for those rights (because other neural nets comprehend the right as an investment also) and those rights have an alternative also, it might not be as good an investment.

-

This is a really hard question to get right. If memory serves right, Snowball mentions Buffett playing this game as well. If we compare his record between his 2000 and 2020 letters, looks like he didn't do too well on this game either: American Express: $8.329B to $18.331B, for annualized return of ~4%, excluding dividends Coca Cola: $12.188B to $21.936B, for annualized return of ~3%, excluding dividends Wells Fargo: $27.844/sh to $30.18/sh, for annualized return of ~0.4%, excluding dividends I'm thinking he probably didn't too well on these because he didn't want to sell as he had to pay 35% tax on capital gains, which would have left only 65% of the capital gains to invest in something else. Selling and reinvesting would have required a higher return to get to the same amount in 2020. Another reason I'm thinking is that looks like he has been investing while worrying about 1970s style inflation kicking in any time and thus has been focusing on Pricing Power and Return on tangible assets/Return on Equity, and so far, high inflation just hasn't kicked in. Also, he probably wasn't able to foresee the impact of GFC and reputation-hit on Wells Fargo. Also, Coca Cola lost some of the pricing power to oligopoly of retailers, which he probably couldn't foresee in 2000. On the other hand, he nailed it with BNSF, where he was able to see it owns rights to scarce physical pathways that are cashflowing well, and that he'll be able to monetize higher not only because of inflation but also because of more and more goods needing to be transferred through those scarce pathways, causing access to be given to highest bidding customers. Looking 15 years from now, I think probability is higher than last 20 years that inflation will finally kick in with minimum wages going up. With high inflation, high probability that interest rates will probably go back up to historical norms. You all know which stock I'm talking about here. We'll see in the May 13F, but I wonder if he is thinking rights to cash-flowing scarce licensed spectrum can also be monetized higher not only due to inflation but also as our economy becomes more and more digital & mobile, with more and more end-points needing access to scarce wireless pathways, which will cashflow best in the right entity's hands, which can give access to highest bidding customers. It is similar to if you could buy a big percentage of the road network before cars became ubiquitous. You all know which stock I'm talking about here. Even though Buffett wasn't super-successful at this game over the last 20 years, I still think he is probably better than any of us at this game as he has been playing it for decades. So, nothing big to share here as you could all see this already in Buffett's annual letters and BRK filings.

-

When you get a chance to start the separate CNSL thread, it will be good to understand your reasoning on how you are trusting CNSL to act in your best interests so much to lock in your money for 15 years when it has a history of diluting your holdings by obscene amounts in the middle of the pandemic when it was supposedly at a low price to get in. See https://lufax.q4cdn.com/131964560/files/doc_financials/2020/ar/2020-CNSL-Annual-Report-10K-Shareholder-Ltr-color-final.pdf, Page 29:

-

Indeed, it can make sense for someone like Buffett accumulating shares as it probably lets him keep low percentage of trading volume he is buying in order to not ring up the price. From my perspective, I see two issues with selling puts: #1. Good businesses don't go on sale at good prices all the time. If you only sell puts, and don't get put on, you might miss the opportunity of acquiring an amazing business at an amazing price. #2. Another great business might go on sale during your put duration. If you already have your cash earmarked for being put on, during the period of your put duration, you might miss an opportunity of acquiring another amazing business at an amazing price.

-

The higher capital requirements also provide higher buffer for absorbing losses. You have to decide for yourself if you want to be leveraged 10x or 15-20x. The latter might give you higher ROE but also arguably at higher risk of loss of capital. That said, leverage is not the only risk. There are also other big risks, e.g. what assets banks have, what other risky activities they are exposing themselves to, interest-rate risk, credit quality risk, etc.. So, you could still have a big bank with high risk. Overall, I'd rather play it safe with low leverage and also lower other risks, especially when risk/reward will be multiplied by 10-20x.

-

Buffett/Berkshire - general news

LearningMachine replied to fareastwarriors's topic in Berkshire Hathaway

I remember watching it in slow motion. BNSF was cash-flowing well its rights to scarce physical pathways across U.S. After learning about Bill Gates' railroad purchase, I had started following it before Berkshire bought it. I started paying more attention as Berkshire started buying shares. As the # of shares purchased kept on going up, I remember realizing that Berkshire is probably looking to purchase it outright. My memory is a little faint, but I think Buffett tried to hide the purchase of shares on that also a little bit. During the big recession, I remember when price was around $70 per share, I was waiting for it to fall further, and then Berkshire snapped up the remaining shares at $100 per share. Now, I see VZ with its cash-flowing rights to scarce spectrum across U.S. in similar situation and wonder if it might be too big to swallow, or if there is a probability that it might be a way to pick up BRK shares for cheap. In inflationary times, VZ's rights also don't need as much higher maintenance as would BNSF's rolling stock. Wonder how the ratio of VZ's Market Cap of $230B to Cashflow from operations of $41.8B compares to BNSF's valuation in Buffett's mind. That $41.8B annual cashflow from operations ideally belongs in Buffett's hands to invest further as he will likely be able to make better investments with it than arguably VZ has been. I remember writing a lot of puts on BNI, from around 60-strike all the way up to 90-strike in 2008-2009. It was like an ATM spitting out cash. I've written some 55- and 56-strike puts on VZ, but at an order of magnitude smaller volume for now than I was doing with BNI. Way to go! If I remember correctly, Berkshire also picked up some BNI shares by writing puts perhaps in an attempt buy shares without raising the price. Did your puts end up getting exercised? In hindsight, did you make more money by selling puts than you would have made by buying BNI shares at the time to get BRK shares for cheap? Just so that I understand, is your volume with writing VZ puts lower than it was for BNI because you like to be more diversified now or because you're not as sure yet if BRK will acquire VZ as you were with BNI? If the April 13F shows a lot more VZ share purchases, would that change your mind? I responded yesterday, but now I don’t see my response. So, I’ll try again! I did get put to on BNI and I would turn around and sell covered calls. I never looked at whether I would have been better off just purchasing BNI and waiting for the deal to close. I like writing puts to play these risk arbitrage situations because I set the date for the close rather than buying the stock and not knowing when, or if, the deal will close. Also, I was writing so many puts on BNI I would have been heavily on margin if I had just bought the stock. Yes, I could have gotten heavily on margin if I was put to on everything, but I was staggering in price and time throughout 2009. The best thing about the BRK’s purchase of BNI was the introduction of the B shares. As soon as there were B shares, I started writing puts and accumulating BRKB by being put to. I have gotten to 80% of my portfolio being BRKB, so I am really concentrated. I am keeping my volume of VZ puts low because I am essentially fully invested and don’t want to end up on margin. I was already interested in BNI pre-Buffett. So, I was confident ramping up my put volume. VZ only came on my radar because of BRK’s purchases so I am being more cautious. Thanks boilermaker for sharing. Feels like comrades sharing stories from the trenches :-). Hopefully, we'll get to tell the VZ story some day :-). -

Buffett/Berkshire - general news

LearningMachine replied to fareastwarriors's topic in Berkshire Hathaway

I remember watching it in slow motion. BNSF was cash-flowing well its rights to scarce physical pathways across U.S. After learning about Bill Gates' railroad purchase, I had started following it before Berkshire bought it. I started paying more attention as Berkshire started buying shares. As the # of shares purchased kept on going up, I remember realizing that Berkshire is probably looking to purchase it outright. My memory is a little faint, but I think Buffett tried to hide the purchase of shares on that also a little bit. During the big recession, I remember when price was around $70 per share, I was waiting for it to fall further, and then Berkshire snapped up the remaining shares at $100 per share. Now, I see VZ with its cash-flowing rights to scarce spectrum across U.S. in similar situation and wonder if it might be too big to swallow, or if there is a probability that it might be a way to pick up BRK shares for cheap. In inflationary times, VZ's rights also don't need as much higher maintenance as would BNSF's rolling stock. Wonder how the ratio of VZ's Market Cap of $230B to Cashflow from operations of $41.8B compares to BNSF's valuation in Buffett's mind. That $41.8B annual cashflow from operations ideally belongs in Buffett's hands to invest further as he will likely be able to make better investments with it than arguably VZ has been. I remember writing a lot of puts on BNI, from around 60-strike all the way up to 90-strike in 2008-2009. It was like an ATM spitting out cash. I've written some 55- and 56-strike puts on VZ, but at an order of magnitude smaller volume for now than I was doing with BNI. Way to go! If I remember correctly, Berkshire also picked up some BNI shares by writing puts perhaps in an attempt buy shares without raising the price. Did your puts end up getting exercised? In hindsight, did you make more money by selling puts than you would have made by buying BNI shares at the time to get BRK shares for cheap? Just so that I understand, is your volume with writing VZ puts lower than it was for BNI because you like to be more diversified now or because you're not as sure yet if BRK will acquire VZ as you were with BNI? If the April 13F shows a lot more VZ share purchases, would that change your mind? -

Buffett/Berkshire - general news

LearningMachine replied to fareastwarriors's topic in Berkshire Hathaway

I remember watching it in slow motion. BNSF was cash-flowing well its rights to scarce physical pathways across U.S. After learning about Bill Gates' railroad purchase, I had started following it before Berkshire bought it. I started paying more attention as Berkshire started buying shares. As the # of shares purchased kept on going up, I remember realizing that Berkshire is probably looking to purchase it outright. My memory is a little faint, but I think Buffett tried to hide the purchase of shares on that also a little bit. During the big recession, I remember when price was around $70 per share, I was waiting for it to fall further, and then Berkshire snapped up the remaining shares at $100 per share. Now, I see VZ with its cash-flowing rights to scarce spectrum across U.S. in similar situation and wonder if it might be too big to swallow, or if there is a probability that it might be a way to pick up BRK shares for cheap. In inflationary times, VZ's rights also don't need as much higher maintenance as would BNSF's rolling stock. Wonder how the ratio of VZ's Market Cap of $230B to Cashflow from operations of $41.8B compares to BNSF's valuation in Buffett's mind. That $41.8B annual cashflow from operations ideally belongs in Buffett's hands to invest further as he will likely be able to make better investments with it than arguably VZ has been. -

Things that are scarce that are necessary for people or almost necessary for people, and can cashflow at higher prices. Even better if you can buy it in today's dollars and pay back in deflated dollars in the future, while locking in low long-term rates. Ability to lock in long-term rates is key - a lot of companies either don't have that ability or don't care enough about shareholders to use that ability because they would rather show higher income now and hide the risk under the rug. Price you pay matters too! Companies holding such scarce things. Even better if they have price-insensitive customers where they don't have to have a praying session before increasing prices by a cent, and where they have the ability to lock in long-term debt at low rates. Just do the analysis assuming what would happen to the company if inflation hit 10%. No matter what anyone says, don't miss doing the analysis what would happen to the company if interest rates also hit 10%. You want to be covered for that risk even if some say it is low risk or will never happen. It is your money. Vast majority of companies will fail this test. Also, look at what went up in 1970s to consider. Also, figure out why they went up in 1970s. Same things may not go up this time - also matters what entity that thing is held in this time. Also, consider that impact of 10% inflation in higher earnings will show over years & decades, while impact of 10% interest rates will show immediately, creating buying opportunities. So, have cash ready to pounce like 1974 if it happens again this time because you will find that vast majority of companies won't meet the bar above currently. They are probably still good businesses but have to priced fairly much lower in 10% interest rate and/or 10% inflation rate environment.

-

One obvious one is banks/insurers. The KBW Bank Index only recently exceeded its pre-GFC high (chart below https://finance.yahoo.com/quote/%5Ebkx/) Not all banks are equal. Some have exposure to low-FICO customers, CRE debt, long-term bonds, etc. I'd recommend listening to BAC earnings calls. Almost looks like Brian Moynihan has been getting trained by the GOAT over years. Sometimes, both Moynihan and GOAT let little anecdotes slip through of them talking with each other. BAC is soaking in the money supply, while keeping it with Fed or short-term govt guaranteed securities, while waiting to deploy in higher interest rate environment. Because your equity in bank is leveraged about 10x, its wise to go with highest quality as little mistakes can make 10x the impact, and so can some wise decisions.

-

Wonder which areas the orders are from, and if overall new home orders across all builders are gaining momentum from those areas?

-

This is exactly what concerns me--that inflation will not be something that occurs gradually, but in a highly nonlinear fashion that is "unpredictable", black swan like. A lot of economic phenomena occur like this thanks to lots of interconnectedness and feedback loops existing in our modern system. I say it's better to prepare for it than to ignore the risk due to extreme asset price sensitivity to rates at these levels. It's good to have a checklist item to consider what would happen to the entity that you're considering if inflation and interest rates both went to 10-15% at the most unfortunate time for the entity anytime during the next 10 years or so and stayed there for a while, e.g. before bond/mortgage renewals. You end up realizing that a lot of entities would not do well in that scenario. Only rare ones do.

-

Thanks wabuffo, that is a great point that changing of the peg itself can trigger inflation. Playing devil's advocate, not having a peg at all could also mean there is no limit to how much you can devalue the currency, creating potential of ushering in even more inflation, and entering a viscous cycle that causes people to question even more their faith in the currency, in turn causing more inflation, in turn causing more loss in faith. It might not happen, but probability is non-zero, and we cannot ignore the probability of it happening to some small extent.

-

Thanks wabuffo, that is my understanding as well, and I've been following CET1 and other capital requirements closely. I had brought up the issue about reserves to counter your earlier arguments about "reserves circulate in the Federal Reserve accounts but never leave the Federal Reserve" but looks like we are now more on the same page than I thought. Thanks wabuffo for clarifying your position. We are now more on the same page. Earlier, I had thought that you were making that correlation because your tone sounded very certain to me when in response to inflation thread, you said "reserves circulate in the Federal Reserve accounts but never leave the Federal Reserve". Great exchange to understand each other deeper and realizing we are more on the same page than I had thought earlier.

-

Thanks wabuffo for the link. I understand your perspective is that the money that is tied up in Fed reserves cannot be used for making loans. However, banks can still use the portion of increased money supply that is held up in reserves to enable transactions valued at higher prices, right? I'd also like to get re-confirmation of your perspective on my question earlier: