LearningMachine

Member-

Posts

1,707 -

Joined

-

Last visited

-

Days Won

6

Content Type

Profiles

Forums

Events

Everything posted by LearningMachine

-

@bargainman, agreed. That is exactly what I was implying. Yes, testing still needs human trial, but effectively "duplicating" carbon-based human research-scientists onto silicon-based intelligence will make it way more efficient to find new drugs, and simulations should help pick those drugs that will pass human trials so that more of human trials would result in success. Also, a competitor doesn't have to wait until another competitor's human trial is done to start their trial if they have truly found something better within next 6 months because of increased productivity. So, if both competitors pass human trial, first one gets exclusivity only for 6 months. Also, it is not an all or nothing benefit. I think we should be able to see some incremental improvement in this direction over time. Thanks for sharing. You will get lots of heads up on oil. If 100% of 15M car sales in the US were electric today, it will take 18-19 years to replace all of 283M cars in the US on the road today. Even if Level 5 automation came today, it will take time for transportation as a service to take off fully. I understand it has started in SF and Phoenix, but we are no-where near level 5 automation yet. Also, 99% of the population in the world wants to live like the top 1%, i.e. have big mansions with great oil-based flooring, walls, roofs, carpets, oil based furniture, materials mined using oil, heated homes, heated water, cooking gas, etc. They also want asphalt paved roads, and want those roads to be cleaned using oil-based machinery. Even if all cars were electric today, to give bottom 99% of the population same life as that top 1% have after labor is not bottleneck, you need multiple times more oil just for petrochemicals. Vicki Hollub claims oil supply will go down before oil demand would. I think what she means is that you will get so much heads up on demand coming down that oil companies will stop investing more capex to keep production flat, and production will start falling, while leaving more cash for shareholders in the end game - cash that would have otherwise gone into capex.

-

I think LLMs is only one of the benefits of AI. For short-term for LLMs, moat is in data and existing user experiences that carbon based neural nets (humans) are trained on already. Tech itself will spread around with good engineers getting high bids from those who have the moat. META has already benefited from it in increasing relevance of its ads. Nvidia's customer base are companies with big pockets and when those customers are paying 10s of billions of dollars, they can easily spend a few billion dollars each to continue to invest to try to create their own AI chips. Will one of them be successful eventually? Time will tell. I think probability is significant that at least one of them will be successful eventually. Next huge value-add won't be in increasing relevance of ads, but it will be in another scenario. One of those will be to reduce # of hours of high-hourly rate knowledge workers. If you can save 50% of hours of 10M workers getting paid $100K per year, you have created $500B in value, and that is per year. At 10-20X multiple, that is worth $5-10 Trillion. To enable this scenario, you need access to data that those knowledge workers are consuming and producing already. You can deduce from there, who has access to that data and who already owns the user experience that these knowledge workers have been trained on. Longer term, who all will benefit is a little like trying to predict which 3 car manufacturers will be winner out of 1000s of car manufacturers in 1900, where almost all went bankrupt. LLMs is only a start. Another big industry to be disrupted is biotech, in discovery of new treatments and drugs. Counterintuitively, I think value of drug exclusivity rights will actually go down if innovation starts to happen at such rapid pace that a better drug is found by someone else that doesn't infringe an existing drug's exclusivity rights. Autonomous driving has been talked about a lot, but when level 5 really arrives, it will cause a sea change. Entertainment is ripe for disruption with AI generated short-videos, movies and even games. Longer term, innovation will continue to happen. Some assets will be bottlenecks and will continue to get valued higher, e.g. energy, and even commodities that have a monopoly controlling the limited supply, e.g. oil. The demand for these commodities could rise to unthinkable levels in terms of multiples of today as commodities will still be needed by the remaining 99% to increase their standard of living to match top 1% of today, when labor is no longer bottleneck. But, the value will only accrue to those commodities that have a monopoly over controlling supply.

-

I think this is true. I think we'll overestimate what AI could provide in the short-term, but will underestimate what AI could provide in the long term. Before industrial revolution, people couldn't have imagined all the things we take for granted today that take energy. Similarly here, imagine human desires were not bottlenecked by availability of human labor. For example, think about all the things that people in top 1 percentile can afford with human labor today, e.g. concierge to take kids around, help to keep home clean, human labor to rebuild a house on the lake and another cottage in woods, repair roads, build more roads, build more housing, jets to fly around the world, etc. Now, imagine all these things were not bottlenecked by availability of human labor for the remaining 99% of humans. All that would need more and more energy over time, and it is possible that growth rate in energy use will go up when we are not bottlenecked by human labor needed today to fulfill a lot of the human needs that top 1 percentile are able to satisfy today.

-

Totally agree. It ends up being that trees paying you $12 and ponds producing $15 go on sale only once in a while, and so you have to concentrate when the sale is going on. I was reacting to how folks on another thread might be thinking S&P 500 would be safer than diversifying across a handful of trees and ponds. So, I was trying to use an analogy with rocks to help land the point in a simpler way that keeps other non-essential things out, but I might not be landing it well.

-

Imagine you could buy a rock for $100 that has SPY or RSP written on it, and imagine that rock gave you $1.36 per year for SPY and $1.67 for RSP, and the rock has a history of increasing earnings at a mere 3% annually over long periods adjusted for inflation, as far out as since 1870 or since 1970 or since 2000 that took advantage of productivity increases from the Internet. See https://www.multpl.com/ . Who would be willing to buy that rock? Even if you were to stretch your imagination to imagine that $3.56 in so-called earnings within rock labeled SPY and $5.53 within rock labeled RSP were FCF and distributed to owners of rocks in terms of dividends or buybacks, would you still be willing to buy it?

-

And, people think they are diversifying when buying Mag 7 and S&P 500, when they all share a high severity & medium probability common risk of high growth expectations and P/E multiple, which when it materializes, some will call it a black swan event even though it is clear ahead of time that it is a common shared risk. You'd be safer to be in a handful of lower probability and lower severity independent risks that all won't materialize at the same time than Mag 7 & S&P 500 that are exposed to a common risk that when materializes will impact a lot of them.

-

Buffett/Berkshire - general news

LearningMachine replied to fareastwarriors's topic in Berkshire Hathaway

@Cigarbutt, I think here too, Mr. Buffett doesn't want to risk losing 500-1000% of the investment in a specific utility due to uncapped jury damages, which could put mothership at risk. He wants statutes on the books to cap those damages for him to invest. -

Buffett/Berkshire - general news

LearningMachine replied to fareastwarriors's topic in Berkshire Hathaway

@yesman182, yes, he could do that and I've mentioned that earlier as well. With the recent purchase, OXY has already indicated they are going to divest certain assets - remains to be seen if they shed the riskier ones. Given Buffet is involved, they probably would. -

Buffett/Berkshire - general news

LearningMachine replied to fareastwarriors's topic in Berkshire Hathaway

The risk here is not about just losing 30% if only 30% is owned, but the risk here is about losing 500 to 1000% of the investment if 100% is owned. If BRK owns OXY as a subsidiary fully, in case of a deep oil spill, courts can pierce the corporate veil to reach BRK assets like they did in case of BP subsidiary to reach BP parent's assets. So, full $58B OXY purchase can create a $250B liability. Ajit explained how they make insurance bets at a recent annual meeting that they are willing to risk a certain percent of their capital. I think he said risking somewhere around 5% of capital on a bet. Risking $250B liability would be too much for BRK. When justifying BRK's purchase of BNSF, Buffett and Munger once explained how they looked at the highest damages that a BNSF accident had ever caused in the past, and had decided that they could live with that. However, they can't live with the highest damage that a deep water oil spill can cause. -

Buffett/Berkshire - general news

LearningMachine replied to fareastwarriors's topic in Berkshire Hathaway

Because owning it fully exposes to potentially severe liability risk, e.g. a spill in the deep water operations of Gulf of Mexico. I've mentioned this a few times before. Remember the BP oil spill. Buffett wouldn't want to expose the mothership to that type of liability risk even if it is low probability. -

I remember some of the cable investors have mentioned in the past how laying fiber doesn't make economic sense in today's high interest rate environment. The core message I took away from that discussion was that fiber pays at best only about mid-single digit unleveraged yield, and that doesn't make sense when interest rates are higher than that. @Spekulatius, if memory serves right, I think you might have been one of the participants in that discussion. I see people buying NNI and BOC where they are allocating capital towards fiber install. Can we jointly figure out what is the unleveraged FCF yield range on laying out fiber?

-

I agree you don't want to make macro guesses about economy and make investments based on those guesses. I also agree you want to keep on reading SEC filings & transcripts until you find attractive investments. However, that doesn't stop you from also doing risk management by making sure your investments will do reasonably ok in case any reasonable probability macro events were to happen, e.g. before Mr. Market realized interest rate risk, folks could have questioned what would happen to an investment candidate if inflation or interest rates were to hit 10%. In case of real estate, there is reflexivity and stickiness that humans are susceptible to. Thinking purely from a cash perspective under the hypothetical that whatever you buy, you have to hold forever, and can't sell to anyone. #1. If you bought a property yielding 6% unleveraged and locked in 2.5% interest rate for 30 years, you can calculate how much cash will come to you. #2. If you buy a property yielding 6% unleveraged now and lock in 7% interest rate for 30 years, you can calculate how much cash will leave you. You can now make an assumption that rents will keep on rising, and calculate which year you will start getting cash instead of giving cash You can also try to speculate that interest rates will come down, etc., but that would be hopeful speculation. If you were to calculate amount of cash you will get for #1 vs. #2 in next 10 years, there will be a HUGE difference, as much as 10X to 100X to 1000X to even 1000,000X depending on situation. However, when people in #1 scenario don't want to sell, it makes real estate prices seem sticky and reflexivity of real estate prices causes some humans to miss how HUGE the difference is between two items above, and they irrationally start doing #2. However, if prices fall a little that causes people to start questioning stickiness and reflexivity, and narrative starts spreading through social media and traditional media on how starkly different #1 and #2 are, it can cause people to stop doing #2. Whether and when this narrative spread could happen is hard to predict, but you could always try to calculate probability of this happening and watch metrics, SEC filings & transcripts that indicate probability increasing/decreasing, and be aware how your housing-related stocks would be impacted if that happened, and you could also be prepared to take advantage of it happening. In no way I'm saying you wait for that. You continue reading your SEC filings & transcripts and finding other investments, while keeping it at the back of your mind that this narrative spread might happen and an opportunity might come.

-

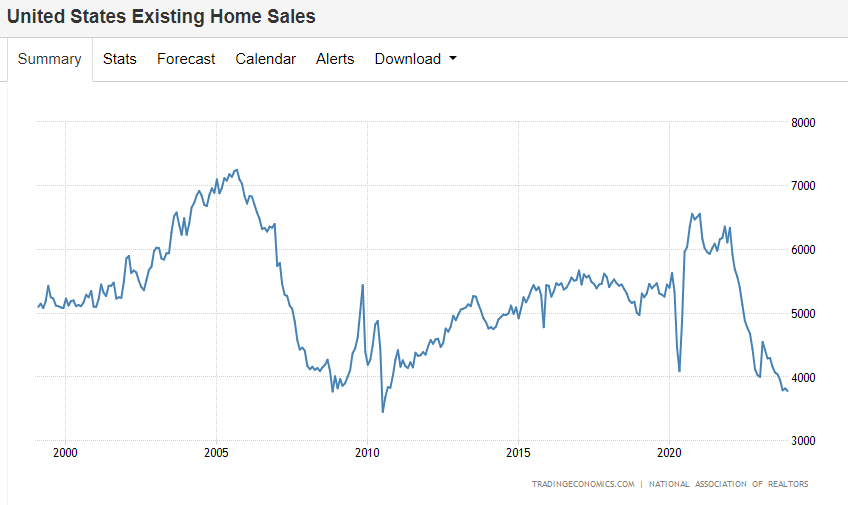

I've been reading transcripts of the builders as well, and waiting to see when existing home sales are below 2009, when would it start impacting them also. Same thing happened in 2009. First existing home sales started falling, then new home inventory started piling up, then builders stopped building, and then, unemployment started going up. So, these things take time. We need to patiently keep an eye for the domino effect to unfold. I think causation has pretty high probability at each stage, i.e. much higher interest rates had high probability of impacting existing home sales and boat sales, and that we are seeing already. Next step in the causation chain is the existing home sales being below 2009, also starting to show up in new home sales starting to fall. I think the probability is high for this causation link also. One thing that is different this time is that people are willing to move far away from their jobs, and so there is a chance, new construction continues, but if that happens, housing supply will go up a lot over time. Anyway, keeping an eye. I think probability still high that this causation link will materialize.

-

Surprised no-one is talking about this, but the signals of impact of higher interest rates are starting to show up in the real economy in home & boat sales but not in the stock market yet. Malibu Boat sales fell 37% year over year because buyers are going on the "sidelines". See https://malibuboatsinc.com/investor-information/events-presentations/default.aspx. Wonder how many construction & other workers will continue to be needed to build more homes, boats and other interest rate sensitive items. How long before it starts to show up in profits of more companies, and Mr. Market starts to notice? Source: https://tradingeconomics.com/united-states/existing-home-sales Source: https://fred.stlouisfed.org/series/MSACSRNSA Source: https://fred.stlouisfed.org/series/NHFSEPT

-

Fast Growers - What Are Your Top 5 Picks Today?

LearningMachine replied to Viking's topic in General Discussion

Sorry, I disagree. I think it would be easy to build a company to compete with Grab, Uber and Lyft. With Uber, you have to give Lyft and other entrants some more time. The reason it is easy is because product is homogenous, and a significant percentage of customers compare price. Proof based on induction would be that if you have a competitor start with 1% market share and slightly better value prop, e.g. better price, would some customers pick it? In marketplaces where the product is homogenous, some customers will end up picking it, causing the marketshare to grow from 1% to 2%, and so on. So, I believe moat of Grab, Uber and Lyft is weak, and subject to new entrants coming in. -

Fast Growers - What Are Your Top 5 Picks Today?

LearningMachine replied to Viking's topic in General Discussion

With Grab, if a competitor came up and had only 5% market share but a better price, do you think some customers would be willing to use the competitor on their homogenous product? If so, where is the barrier to entry and moat? Similar with Sea to some extent. -

Fast Growers - What Are Your Top 5 Picks Today?

LearningMachine replied to Viking's topic in General Discussion

With MarineMax, I was surprised to see they are somehow getting higher gross margin than other players in the boating industry value chain. However, their cash is getting sucked into working capital ($813M for Inventories in 2023 10K, up from $454M in 2022 10K) and PP&E ($528M in 2023, up from $246M in 2022), leaving no cash available for shareholders. -

At a 51B GBP Market cap yesterday, if you took out $16B ITC stake, you're paying 35B GBP for the company. Management has publicly committed to 40B FCF over next 5 years. So, you get your money back in 4.375 years, that is 22.8% FCF yield. Even if you assume US menthol ban happens, you get your money back in 5 years for a 20% FCF yield, instead of 4.375 years. Few companies like this where management also has some direct control over pricing and margins. I might still change weighting, and get out and in at different times. Also, took a small stake in WBA last week, where management currently doesn't have much control over re-imbursement rates, but revenues keep going up over years, and owner-led management is now building a business that will have some control over loss rates with primary care, adherence & specialty pharmacy that insurers would be willing to pay for.

-

Bought BTI yesterday. My biggest position in any stock. Ever.

-

VSCO: took a big position today. My biggest position in any stock, ever!

-

You can listen to the presentation here:

-

Another talk with Arjun Murti: https://www.youtube.com/watch?v=oqCsZuJfCm0&list=PLtt4Fntz3tuvRPlel5NlFuiPq5A6U2igu&index=109 . Found him to be a more rational thinker than Jeff Currie. Arjun Murti doesn't seem to get carried away by some dogma or agenda to sell a narrative, and instead looks at issues from multiple perspectives, and doesn't take extreme positions.

-

Buyology: Truth and Lies About Why We Buy - Martin Lindstrom

LearningMachine posted a topic in Books

I stumbled into this book when looking deeper into Buffet's quote that "It’s share of mind. It’s not share of market. It’s share of mind that counts." Buffett and Munger would love reading this book. Reminds me of Munger's Psychology of Human Misjudgment. Really loved the concept of "Somatic Markers", that is, bookmarks in brains that brands try to put. -

Timely lessons from Buffett's 1999 Fortune article

LearningMachine replied to LearningMachine's topic in Berkshire Hathaway

Looking backwards, it is easy to say in hindsight which companies compounded equity at 20% a year for decades. Looking forward, much harder to do. Even where the general consensus is that the company will compound equity at 20% a year for decades and is reflected in price, I think neural nets are getting persuaded by the story telling around the company by others more than actually figuring out that certainty is high, and a lot of times, they are going to be disappointed. Any companies that you think will compound equity at 20% a year for decades? -

Timely lessons from Buffett's 1999 Fortune article

LearningMachine replied to LearningMachine's topic in Berkshire Hathaway

@Viking, right on, psychology is the biggest one. Buffett is such a genius and so generous at sharing his learnings. Loved how he explained that after no increase from 1964 to 1981, 10X increase from 1981 to 1998 was not just due to interest rates going down and corporate profits' share of GDP going up, but also due to "market psychology": "Once a bull market gets under way, and once you reach the point where everybody has made money no matter what system he or she followed, a crowd is attracted into the game that is responding not to interest rates and profits but simply to the fact that it seems a mistake to be out of stocks. In effect, these people superimpose an I-can't-miss-the-party factor on top of the fundamental factors that drive the market. Like Pavlov's dog, these "investors" learn that when the bell rings--in this case, the one that opens the New York Stock Exchange at 9:30 a.m.--they get fed. Through this daily reinforcement, they become convinced that there is a God and that He wants them to get rich." Indeed some other things have changed since 1999. "Helpers" have invented new ways of taking a cut of transactions, e.g. SPACs, traffic-routing, options trading, hedge funds, IPOs, acquisition fees, spin-off fees, etc. Wall street has to stay fed. Buffett was not able to imagine corporate profits going above 6% of GDP to 10% of GDP without causing political issues. He was still right on S&P 500 not doing too well from annual growth rate perspective in subsequent 17 years, and political issues cropping up, for example, some folks getting so fed up at not getting their economic share without understanding what's going on that they are getting drawn to conspiracists & demagogues, and ok with putting democracy at risk, and pushing for continued money printing.