gfp

Member-

Posts

5,335 -

Joined

-

Last visited

-

Days Won

10

Content Type

Profiles

Forums

Events

Everything posted by gfp

-

The Production Tax credits for those years were: 2016: USD 398 million 2015: USD 291 m 2014: USD 258 m 2.3 cents per kilowatt hour for a ten year period. source is BHE's own 10K. There are also Investment tax credits, which are utilized on projects not claiming the production tax credits. Investment tax credits are deferred and amortized over the estimated useful life of the asset. This is one of the reasons (along with huge bonus depreciation and other routine depreciation and amortization) that BHE, which reports about $2.5 billion in annual net income is actually able to bring in over $6 Billion in cash and make almost $6 Billion in new investments each year without cash inflows from Berkshire and the minority owners (Walter Scott & Greg Abel). Here are some of the numbers concerning BHE's investments in these areas. These are large investments and the planned large wind investments extend at least to 2019 --> The Company's historical and forecast capital expenditures consisted mainly of the following: • Wind generation includes the following: ◦ Construction of wind-powered generating facilities at MidAmerican Energy totaling $943 million for 2016, $931 million for 2015 and $767 million for 2014. MidAmerican Energy placed in-service 600 MW (nominal ratings) during 2016, 608 MW (nominal ratings) during 2015 and 511 MW (nominal ratings) during 2014. In August 2016, the IUB issued an order approving ratemaking principles related to MidAmerican Energy's construction of up to 2,000 MW (nominal ratings) of additional wind-powered generating facilities expected to be placed in-service in 2017 through 2019. MidAmerican Energy expects to spend $826 million in 2017, $853 million in 2018 and $1.4 billion in 2019 for these additional wind-powered generating facilities. The ratemaking principles establish a cost cap of $3.6 billion, including AFUDC, and a fixed rate of return on equity of 11.0% over the proposed 40-year useful lives of those facilities in any future Iowa rate proceeding. The cost cap ensures that as long as total costs are below the cap, the investment will be deemed prudent in any future Iowa rate proceeding. Additionally, the ratemaking principles modify the revenue sharing mechanism currently in effect. The revised sharing mechanism will be effective in 2018 and will be triggered each year by actual equity returns if they are above the weighted average return on equity for MidAmerican Energy calculated annually. Pursuant to the change in revenue sharing, MidAmerican Energy will share 100% of the revenue in excess of this trigger with customers. Such revenue sharing will reduce coal and nuclear generation rate base, which is intended to mitigate future base rate increases. MidAmerican Energy expects all of these wind-powered generating facilities to qualify for 100% of federal production tax credits available. ◦ Construction of wind-powered generating facilities at BHE Renewables totaling $456 million for 2016, $246 million for 2015, and $286 million for 2014. The Marshall Wind Project with a total capacity of 72 MW achieved commercial operation in April 2016 and the Grande Prairie Wind Project with a total capacity of 400 MW achieved commercial operation in November 2016. The Jumbo Road Project with a total capacity of 300 MW achieved commercial operation in April 2015. ◦ Equipment purchases totaling $324 million in 2016 for the purposes of repowering certain existing wind-powered generating facilities at PacifiCorp and MidAmerican Energy and the construction of new wind-powered generating facilities at PacifiCorp and BHE Renewables. The repowering projects entail the replacement of significant components of older turbines. Planned spending for the repowered and new wind-powered generating facilities totals $323 million in 2017, $313 million in 2018 and $740 million in 2019. The energy production from the repowered and the new facilities is expected to qualify for 100% of the federal renewable electricity production tax credits available for ten years once the equipment is placed in-service. • Solar generation includes the following: ◦ BHE Solar acquired the 110-MW Alamo 6 project located in Texas in January 2017 for approximately $385 million. ◦ BHE Solar spent $56 million in 2016 and $3 million in 2015 for construction of the community solar gardens in Minnesota and expects to spend an additional $153 million in 2017 and $6 million in 2018. The completed project will be comprised of 28 locations with a nominal facilities capacity of 96 MW. ◦ Construction of the Solar Star Projects totaling $10 million for 2016, $689 million for 2015 and $1.1 billion for 2014. Both projects declared July 1, 2015 as the commercial operation date in accordance with the power purchase agreements. Final completion under the engineering, procurement and construction agreements occurred November 30, 2015 and project completion was achieved under the financing documents on December 15, 2015. ◦ Construction of the Topaz Project totaling $49 million for 2015 and $814 million for 2014. Final completion under the engineering, procurement and construction agreement occurred February 28, 2015, and project completion was achieved under the financing documents on March 30, 2015.

-

Buffett on CNBC - Stocks Still Cheap

gfp replied to Ballinvarosig Investors's topic in Berkshire Hathaway

He's a large net buyer of stocks (AAPL, Airlines, etc) and has spent enormous sums on acquisitions like Precision Castparts. Insurance float growth brings in free cash flow that shows up as cash and cash from operations is higher than reported net earnings. Also, a few people payed him back - like Mars for one. randomep, Both, but primarily cash flow from operations in the subs. -

Probably best to keep to their interests when selecting a business. If they hate gardening, a nursery is a bad choice; if they despise food service, a restaurant franchise is probably a poor choice, etc... In my town, New Orleans, we have this lady who brokers a lot of businesses. Your region likely has similar specialists - they are a lot like realtors and many of them will list their stuff on the national websites like mentioned above. http://www.capitalbbw.com/business/broker/Louisiana/Michelle_Seiler/18/ Like another poster mentioned, these are people self selecting to get the hell OUT of the given business - so buyer beware. Franchise conventions / fairs will have all the usual suspects for that route. And there is always the motel and convenience/corner store industry, always popular with immigrants. One of my friends here in town immigrated from Venezuela after meeting her man, a jazz musician in town. They purchased a small bar (less than 700 sq. feet but with outdoor seating as well), with the real estate included (commercial condo technically) for less than $400,000 - most of which was eligible for a commercial mortgage. The business consistently turns out $250,000 per year in cash owner earnings to the husband-wife principals every year, and they have no landlord looking to raise the rent to share in the success. A good deal for sure, but it just shows that opportunities come around and they don't have to be multi million dollar investments to put off a nice comfortable income stream for the family.

-

In other news, QBE, the large Australian Insurance company, issued a press release that indicates that Berkshire could see a $900 million payout on a reinsurance contract that Ajit wrote for QBE. QBE exhausted the reinsurance coverage and then some, so BRK could be on the hook for the entire $900 million. Along with the AIG deal amortization and the GEICO numbers, this would almost certainly mean the first full year underwriting loss in quite a while.

-

Could be $8 Billion valuation for the whole thing. Not sure. Sales will be much higher than market cap for a company in that business. It probably makes at least $500 million net each year, but I don't have a source for accurate numbers.

-

It may be 5 or 6 Billion dollars for the entire company. 38% could be $2.25 Billion, the eventual 80% $5 Billion or so. With few other acquisitions this quarter and what I assume to be a quick closing with Byron as the investment banker and one of the sellers, we will probably find out what Berkshire paid in the annual report cash flow statement.

-

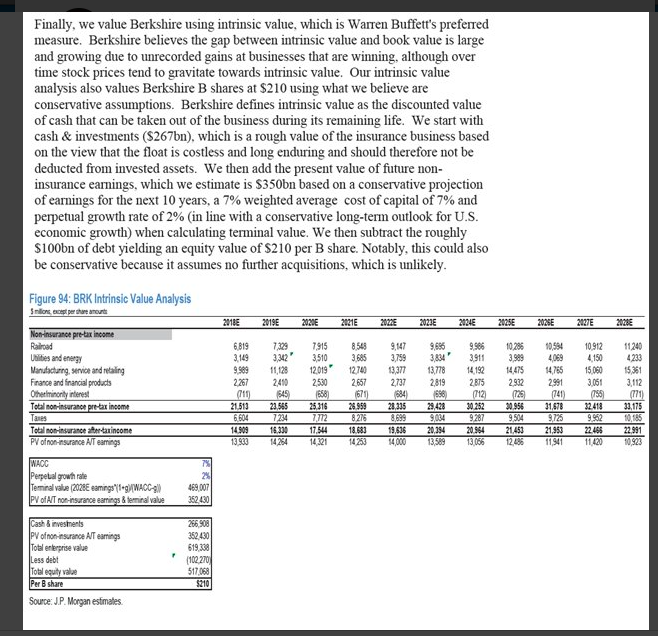

Here are some small pieces of the report, which I found on twitter. I do not have access to the report but I follow the company close enough that I don't think Ms. DeWitt has a ton to add. Always interesting to read anything on Berkshire but this is not groundbreaking stuff. Turns out Berkshire is a valuable enterprise designed to compound the per share net worth of the company... Oh- and Greg Abel might be the next CEO. Or it could be Ajit. But probably Greg. Or someone else...

-

Totally off topic, but for a short time Howie will be the Sheriff in his hometown. (he has been undersheriff for a while) https://www.bloomberg.com/news/articles/2017-09-15/there-s-a-new-sheriff-in-town-and-he-s-warren-buffett-s-son

-

Its not that he took equity out of his house and invested in Berkshire or any other stock, rather that he used a traditional mortgage at the time of purchase and so the 2nd home purchase took up less of his capital. Money is fungible, etc etc..

-

A fairly big acquisition for HomeServices - http://www.loudountimes.com/news/article/berkshire_hathaways_homeservices_acquires_chantilly-based_long_foster http://www.businesswire.com/news/home/20170907006469/en/HomeServices-America®-Acquires-Long-Foster-Companies update: recently acquired Long & Foster as made an acquisition of its own 5 days into HomeServices ownership - https://www.washingtonpost.com/news/where-we-live/wp/2017/09/13/long-foster-acquires-d-c-area-real-estate-brokerage-firm/?utm_term=.e4789c6d99f4

-

Hurricane Losses and Forward Looking Insurance Premiums

gfp replied to TwoCitiesCapital's topic in General Discussion

Insurance Insider has a brief note on Reinsurers with Florida exposure. If I had to bet, this storm is going to track east and make landfall up the east coast in South Carolina or thereabouts. Florida could still receive a direct hit but my bet it turns north sooner. From Ins. Insider: ------------ Nephila and Everest biggest Florida cat treaty writers Fiona Robertson Nephila, Everest Re and RenaissanceRe were among the leading reinsurers of some of the top Florida insurers last year, according to data collated by sister publication Trading Risk. Reinsurers of the biggest Floridian cedants will bear the brunt of the loss from Hurricane Irma, which looks increasingly likely to make landfall in the Sunshine State as a major storm. Nephila cut back its exposure compared to 2015, but the Bermudian asset manager still captured just over $200mn of premium ceded by 10 leading Florida insurers last year (see chart). This gave it a roughly 8 percent share of the $2.51bn of total premiums ceded by the peer group, including premiums written by Nephila's fronting partner Allianz Risk Transfer. Everest Re was close behind, assuming $196mn of premiums. The study covered 10 top standalone writers of personal and commercial residential insurance business within Florida last year, according to Florida Office of Insurance Regulation (FLOIR) data. These were: Universal Property & Casualty, Citizens Property Insurance, Heritage Property & Casualty, Federated National, Homeowners Choice Property & Casualty, Security First, United Property & Casualty, People's Trust, First Protective and American Integrity. The peer group did not include nationwide player USAA and State Farm, which is known to be a large writer in Florida but no longer discloses market share data to the FLOIR. RenaissanceRe-managed entities, including its DaVinci Re sidecar and Lloyd's syndicate, were a more distant fourth behind the leading reinsurers, on $65mn of assumed premium. This put it behind investors in the various Everglades Re cat bonds, although the insurance-linked securities instruments that were on risk last year have since expired. Clustering above $50mn of premiums were PartnerRe, Aeolus, Validus entities including its AlphaCat platform and fronting carrier Tokio Millennium. Other top-15 writers included Sompo International and its Blue Water platform, Markel, MS Amlin and Chubb Tempest Re. Both Swiss Re and Munich Re were underweight, with the former assuming $30.0mn of premiums from the top 10 cedants and the latter just $1.1mn. Hannover Re was also underweight compared to its broader market share in the cat market with $23.1mn of assumed premiums. -

Hurricane Losses and Forward Looking Insurance Premiums

gfp replied to TwoCitiesCapital's topic in General Discussion

There are a few private options but I'm not sure how the pricing compares to NFIP/FEMA. Brokers offer flood policies through Lloyds of London syndicates as well as AIG. http://www.privatemarketflood.com http://www.lexingtoninsurance.com/insights-innovations/current-product-releases/private-market-flood-insurance The National Flood Insurance Program will only cover a residence for a maximum of $250k building and $100k contents. It is important to note that most the insurance policies that most businesses purchase do usually cover flood, in addition to business interruption and other claims. So auto and commercial insurance generally pay out on flood events. Buffett talks about it a bit here: . Basically the people who want the insurance are likely to be flooded so it doesn't really work as a financial product. At some point I guess you're just just paying the same amount of the house. If you had a $500k house I'd insure it for $500k, but that doesn't help you much. -

Well, I'm sure they won't do as well appreciation-wise as Warren did with his modest purchases of seaside real estate in California before a generation of repricing that made virtually every owner of oceanfront property in California a multi millionaire on paper. I know some old hippy college professors that got just as "lucky." Of course, to spend it they have to move away from the beach, which is sad. Should high profile entertainers buy trophy properties in L.A.? Who knows, I would say if it helps them unload the disaster of Tidal then it will probably pay for itself. It's worth noting that the asking price was something above $120 million and they paid in the $80's so there is that. But of course you can ask whatever the hell you want for a property. As far as the mortgage goes - they both earn their incomes predominantly in very high-tax ways (like a professional athlete). Beyonce made over $100 million last year with Lemonade, Formation tour and an endorsement operation that has a lot of room to expand if she chooses. As long as that Goldman Sachs mortgage interest remains fully tax deductible, the cost to them is a lot less than the 4% headline rate. It's probably the most reasonable leverage available to them when you factor in the tax subsidy. Should they instead have invested in 10% cap rate income producing real estate using the same access to leverage for lifetime income for several generations? It's a personal decision. His Champagne company does seem to be doing well, and the Live Nation JV, sports management startup, etc - all seem to be very successful. I'm a fan of both and still listen to DJ Danger Mouse's remixes of Jay's Black Album with the Beatles White Album - the "grey album" as well as another DJ's remix of the Black Album with Radiohead called "Jaydiohead." Great stuff those two. "I check cheddar like a food inspector" ... And Lemonade was pretty phenomenal, even without the New Orleans connections. Almost all the tracks on that album are really great. (I don't care for the 'I ain't sorry' track but all the rest are A++)

-

Buffett interview links on his 87th birthday 20170830

gfp replied to kiwing100's topic in Berkshire Hathaway

He also did a fox business interview with Liz Claman from the same restaurant - http://www.foxbusiness.com/markets/2017/08/30/warren-buffett-id-do-it-for-president-trump.html Maybe I missed it - did anyone ask him about Oncor? Pretty surprising that he flat out said Mondelez isn't going to get an offer from KHC. Not so much that they aren't interested at these prices, just that he was so open and matter of fact about it being a "no." -

Happy 87th birthday to W.E.B!

-

as expected, BRK exchanges preferred and warrants for common in BAC. Wonder if it will have to pass through the income statement for the quarter (no tax due of course) http://investor.bankofamerica.com/phoenix.zhtml?c=71595&p=irol-newsArticle&ID=2297215#fbid=XOIEhKq6Vrz

-

Interesting investor, but I believe his fund is too small to be followed by this method. As far as I know he is not required to file quarterly reports of his holdings, so he is only forced to disclose 5%+ positions. I believe he has raised less than $30 million, although AUM is probably quite a bit higher given the impressive performance record.

-

Christopher Davis: Davis Selected Advisors: 0001036325 Davis NY Venture Fund: : 0000071701 Clipper: 0000736978 Mairs & Power: 0001070134 Abrams Capital management: 0001358706 Nelson Peltz / Trian Fund Management: 0001345471 Bill Nasgovitz / Heartland Select Value: 0000809586 David Katz / Matrix: 0000720498 Tom Russo / Gardner Russo & Gardner: 0000860643

-

I always wondered how one is supposed to merge into the interstate if self driving platoons of road trains are following closer than would be safe if humans were driving. As for BRK, by the time this materially impacts BNSF, BNSF will be a much smaller percentage of BRK. It's just the nature of the compounding machine. And we really don't know what these road trains will be asked to pay for their use of the public infrastructure, vs BNSF's privately maintained infrastructure. What if 20 years from now autonomous lorries are a thing and $1.5 trillion market value Berkshire Hathaway (or a per-share equivalent gain in shareholder wealth through repurchases) is only reporting $400 million a quarter in profit from BNSF, instead of a billion. Is that a disaster?

-

Yeah, I'm not saying that everything with 'manager code 4' in a 13f is warren's personal account. Just that when a form 4 says these securities are owned directly by Warren E Buffett and the CFO confirms as such then we have the answer. Even on Wells the 'code 4' line doesn't match his personal share count.

-

Not sure what happened to Jurgis's post, but this is from Marc Hamburg: "The shares referenced in your e-mail below are Warren’s are personal holdings and are not held by Berkshire."

-

It's pretty clear in the link: "1. These securities are owned directly by Warren E. Buffett, who is a reporting person hereunder."

-

Barron's is reporting that since BRK's deal for EFH was never officially approved (I guess by the BK judge), BRK will not receive the $270m break fee. Not sure if that is accurate, but that's what they are reporting. Oh well. Let's see what the regulators say. http://www.barrons.com/articles/berkshire-hathaway-even-when-it-loses-it-wins-1503410341

-

It's easy enough to see his direct ownership of WFC. It is 2,009,000 shares https://www.sec.gov/Archives/edgar/data/72971/000120919117026722/xslF345X03/doc4.xml Why do you think he owns WFC in his personal account? I've seen that stated many times. It would probably take some work for me to find any sources as everything I am recalling was some time ago, (5-15 years?).

-

I do think it is amusing to Warren and Charlie that Berkshire isn't able to attain the AAA rating anymore. I remember it being something like, "they hold their cash in treasuries and the USA isn't AAA anymore, so we can't count on the cash being good at the AAA level anymore." Interesting that it looks like Microsoft, JnJ and Exxon Mobil are still triple A? Is that out of date or are those the only non financial AAA issuers these days? I feel like Berkshire's diversification of income streams makes them less likely to default on their debt than the three above. Maybe no corporates should be rated AAA.