gfp

Member-

Posts

5,335 -

Joined

-

Last visited

-

Days Won

10

Content Type

Profiles

Forums

Events

Everything posted by gfp

-

you may be right. They already bought their tank car leasing business and stuck it in UTLX. There are pieces BRK would want at the right price but I don't see them buying the whole thing without new management

-

He was probably commenting specifically on the price of Berkshire at the time of the switch from the zero coupon bond to the very attractively priced BRK.B shares. At that time, 8% was a very conservative projection, which is the only way he would make a public projection for BRK. Berkshire has done well since, but is not at a crazy valuation. With luck, 8-10% is a realistic expectation. But they need to buy something or repurchase shares in size to make it happen.

-

Ferromex or Kansas City Southern might be possibilities for rails. Don't think CSX deal would pass regulators. They are far from tapped out on US utilities and they will continue to attempt to buy utilities if they are available for sensible prices. They will also likely make huge investments in a nationwide high voltage grid. Maybe AEP gets bought? Or the California utility with wildfire liability problems? Any of 3G's projects could come into the wholly owned subsidiary fold for Berkshire. Anyone Byron Trott is working with on the private, family owned side (Pilot Flying J was most recent) could come to BRK at any moment. Auto Dealership groups, more realtors, whatever PCP ends up buying.. The literal next company to close is probably MLMIC, the New York mutual medical malpractice liability insurer. But that was already announced.

-

He's bummed he can't buy anything big. It will be particularly interesting to see his tone and general condition in Monday morning's CNBC interview. Waiting for the cycle to turn in your favor sucks for everyone, but it's especially lame when you're almost 90...

-

The article was in The Nation, and had nothing to do with Rupert Murdoch or the Wall Street Journal / Marketwatch. The article in The Nation was pretty bad. I did not read the other articles summarizing the primary article. Cardboard, it's OK to be anti-Trump. At least half the nation feels that way. For many Americans, he is a national embarrassment - with potentially dangerous ignorance. It's also OK to be anti-Buffett. Not as many Americans feel that Warren Buffett is a national embarrassment, but he's not perfect - as is well understood by people on a board like this one, who follow his statements quite closely.

-

Interesting that "moat" is now equal to "monopoly"... Apparently the United States is not supposed to allow any competitive advantage, brand name or otherwise additionally, the author of the article in "the nation" appears to think Buffett is an investor in TransDigm. News to me.... "Buffett takes full advantage of tax loopholes. He uses Berkshire Hathaway, a valuable tax shelter, for his investments." We should all stash our investments in a C-corp. Way to stick it to the government warren

-

Look through portfolio - Google Sheets with live prices

gfp replied to Dynamic's topic in Berkshire Hathaway

Yeah - I had a chance to look at your sheet and it looks like you are short the following share amounts, which are also owned by Berkshire but reported separately through New England Asset Management: ticker, number of additional shares not included in BRK's 13F: AAPL, 4,217,000 BAC, 21,000,000 DEO, 227,750 GS, 431,063 USG, 4,385,964 USB, 17,386,443 VRSK, 2,954,050 WFC, 24,312,200 It makes sense if you remember that BRK got 700 million BAC shares and hasn't sold any. You are showing 679 million in your sheet. Here is the most recent New England Asset Management filing - all the stocks with "Other Manager 01 02" are Berkshire's https://www.sec.gov/Archives/edgar/data/1004244/000108514618000878/xslForm13F_X01/form13fInfoTable.xml They aren't wrong. They are reflecting the big sale that Berkshire just announced: http://www.berkshirehathaway.com/news/feb1418.pdf -

Look through portfolio - Google Sheets with live prices

gfp replied to Dynamic's topic in Berkshire Hathaway

The difference in USB, AAPL, etc, is probably in New England Asset management, under general re on Edgar- but i’m Away from the office and can’t check if that’s your issue at the moment -

He's been liquidating it for a while now, and mentioned he was still selling in a fairly recent CNBC interview. I'm surprised he sold almost all of it before December 31st, since he had mentioned having high basis and low basis shares and choosing the shares he was selling before and after the new year. I guess he didn't really have many low-basis shares left. I don't think it is about finding something "better" - but rather moving on from a position that did not work out as he originally saw it going. I do like to see the mental flexibility to change his mind, even with the cover of his whole "ideal holding period is forever" and a 4% dividend yield to justify holding. It's amazing how much confidence he has in Apple - that position is getting really big. Far bigger, at cost, than any other stock purchases in his life.

-

If I had to guess it was probably more about FERC and/or DOT regulators that Berkshire Hathaway Energy deals with. It is possible that over 10% they start to consider PSX assets when Berkshire seeks certain approvals. Another possibility is that it was PSX's idea to buy the block, Warren was OK with it, and they used it as an excuse.

-

I think what he's saying is that the structure makes it less likely that Berkshire will be broken up through the use of tax-free spin offs, which is how many people envision the 'breakup' going. The atypical organizational structure probably benefits Berkshire in several ways directly, but Buffett might also like that it makes it harder for an activist to come in a mess up his painting for a quick pop. A taxable cash sale of BNSF for $100 Billion [uNP's market cap] is a harder sell for the activist folks. BTW, remember when even Buffett loving professors and commentators were lamenting his overpaying at $34 Billion for BNSF? Happy Lundi Gras! Berkshire fans will be happy to know that several stuffed animals thrown at parades yesterday were products of the Oriental Trading Company, Omaha NE... So OTC has successfully entered that lucrative Mardi Gras market.

-

The gist of it is that the subsidiaries tend to be valued at Berkshire's historical cost by the regulators unless the valuation is challenged by regulators for some reason. The zero tangible asset subsidiary in your hypothetical was in reality likely acquired for some price that resulted in goodwill or other intangibles and a book value figure. BNSF is still "valued" at $34 Billion (Berkshire's cost) in statutory capital (possibly adjusted for earnings and distributions, which have been roughly equal since the BNSF acquisition). It means Berkshire has a much larger statutory surplus than the reported number, but it doesn't really matter for practical purposes because their underwriting is limited by opportunity, not capacity, currently and into the foreseeable future. What the extreme overcapitalization does for them is that it gets them approval by regulators to invest in "riskier" assets. Of course, the reality may very well be that long-held, rising dividend paying, equities and wholly owned companies like BNSF are much less "risky" than a huge long duration bond portfolio marked to current prices. There was some discussion a few years ago on this site that I added a (now out of date) NAIC filing to. I'll try to post the link to the thread -> http://www.cornerofberkshireandfairfax.ca/forum/berkshire-hathaway/insider-quarterly-article-on-ajit/msg138629/#msg138629 ----------- edit: Some examples: ("The Company" is NICO in these quotes) "The Company also owns all 1,350.695 outstanding shares of common stock of GEICO Corporation ("GEICO") valued at $20,660,961,730, which is composed of the statutory policyholders' surplus of GEICO's property casualty insurance company's subsidiaries at March 31, 2013 of $12,486,514,157 plus the GAAP equity of all other GEICO subsidiaries at March31, 2013 of $8,144,649,062 and the unamortized intangible goodwill totaling $29,798,511 associated with the shares of GEICO purchased by the Company in 2005 and 2006 from affiliates. Intangible goodwill is amortized under the ten year amortization rule in compliance with SSAP No. 68." "In February, 2010, the Company became the sole member of Burlington Northern Santa Fe, LLC ("BNSF LLC"). The reported cost of BNSF LLC totaled $34,128,543,041, and was equal to the fair value of assets contributed to BNSF LLC in February 2010. SSAP No. 97 requires that dividends or distributions declared in excess of the undistributed accumulated earnings attributable to the investee shall reduce the carrying amount of the investment. As a result, the Company reduced its cost basis in BNSF LLC by $239,000,000 at June 30, 2013. BNSF LLC is reported as an Other Invested Asset and is valued at its June 30, 2013 GAAP equity." Another example shows how they are able to shuffle money in and out of the insurance subs through affiliate loans, inter-company loans, etc... "At June 30, 2013, the Company included in admitted Other Invested Assets affiliated loan balances of $4,455,925,619. This balance is primarily composed of $4,157,688,340 due from BHI. Under the terms of a reciprocal revolving loan agreement, the Company may loan amounts to BHI up to $8 billion with an interest rate per annum equal to the 30-day LIBOR rate. The Company loaned an additional $3.7 billion to BHI on June 6, 2013, and reduced the loan balance by $1 billion for the ordinary dividend declared on June 12, 2013. On October 28, 2011, Amendment No. 8 to the revolving loan agreement, which extended the maturity from December 31, 2011 to December 31, 2013 and made the loan agreement reciprocal in nature, was not disapproved by the NE DOI."

-

Berkshire is willing to use all but 20 Billion of the consolidated cash balances towards investments or repurchases, plus whatever prudent borrowing Warren decides is appropriate for the asset being acquired. It would not be surprising if Berkshire borrowed to fund a portion of a large cash operating business acquisition, as they have in the recent past. Berkshire has a unique ability among insurance companies to invest in common stocks and operating businesses, because so many of Berkshire's wholly owned businesses are actually owned inside of the insurance subsidiaries - and count towards regulatory capital because of that. So Berkshire's insurance companies are enormously overcapitalized and thus afforded permission to invest in "riskier" securities vs the bond portfolios that most insurers stick to for the lion's share of their portfolios. So, long story short, Berkshire doesn't have to dividend cash out of the insurers to buy a large company or make a large investment. Many subs are owned by the insurers. Berkshire could make a $150 billion cash acquisition at this time if they felt like it. A portion would probably be funded with debt guaranteed by the parent, and obviously there are also plenty of liquid securities to sell if something good comes along.

-

Companies -truly long term focused not managing to quarter results?

gfp replied to Nell-e's topic in General Discussion

I would add Texas Pacific Land Trust, TPL, to the list. They are "going out of business"... It's just taking them a while. Returns are awfully good. http://www.businessinsider.com/texas-pacific-land-trust-2014-8 -

That's a lot of premium Mike - good trade. Is that you, all 5 contracts of open interest!? I wrote March 9 185-strike puts. Averaged around $3 per share for them. I had planned on writing some 52-strike BK puts but got busy and never got the order in before the price went back up.

-

Exact same thing here. Constant texts and calls from financially unsophisticated folks for two straight weeks right at the recent top.

-

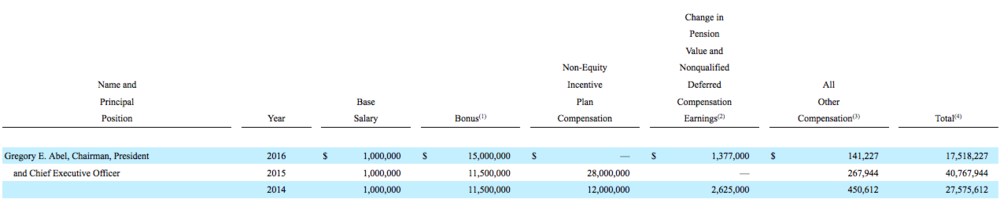

I believe Abel's previous compensation has been detailed in BHE's filings but I don't have them in front of me. Certainly they did end up disclosing that he holds something like $400 million of BHE shares that can be converted into BRK stock at his option. Much - if not all - of that was transferred from Sokol, so I'm sure there was a loan involved and it slowly vested to him over time. There may still be a loan behind it. And on Doo's chart, Buffett's compensation is mostly security services as he famously takes the same $100k a year as Charlie. Charlie usually reimburses Berkshire something like $50k a year for 'personal use of postage' and other personal stuff like secretarial time. edit - added graphic showing BHE comp

-

Bloomberg with a reminder that Berkshire's reported earnings are going to include unrealized investment fluctuations going forward -> https://www.bloomberg.com/news/articles/2018-01-17/buffett-s-nightmare-begins-as-earnings-include-stock-swings

-

Yeah - I was referring to the post above mine: It doesn't really solve the "currently slightly overvalued" issue to wait until someone dies.

-

not to discourage someone giving him several millions dollars but his basis would still be his dad's basis

-

Not sure if this all got figured out already, but TNP was Texas National Petroleum. It was a merger arbitrage I think. See pages 93 and 94 of James Altucher's book "trade like warren buffett" back to this train wreck of a saints game///

-

How a running toilet can lead to financial RUIN!

gfp replied to DTEJD1997's topic in General Discussion

Of course it's not the water you are paying for - it is the maintenance of the aging infrastructure coupled with a smaller population. Just like in New Orleans, where our water comes from the Mississippi river (near the end! YUCK!) - we aren't paying for the water - we are paying for decades of deferred maintenance, subsidence, mismanagement, etc... Rumor is that there are still hollow wood water pipes active in the New Orleans Sewerage and Water Board system. Water leaks, which cause sinkholes, are everywhere and remain unaddressed for months. All the resources are spent putting out fires so there never seems to be a plan for comprehensive updating of the infrastructure. We have boil water alerts regularly because water main breaks cause pressure to drop to some level that requires boil water advisories. New Orleans' population is growing now, but shrunk for decades previously - and, of course, halved overnight in 2005. -

I've had two used cars appreciate on me. One was my wife's old 98 toyota tacoma trd, manual transmission. She tried to sell it years ago for $6500 and nobody bought it. Today she still has it and it is worth about $9,000 unbelievably. Scarcity of low mileage, small pickup trucks with manual transmissions made them more desirable as new trucks got huge and very expensive. The second one was a 1956 Porsche 356A super coupe purchased for $19,000 in 2001. I remember a Merrill Lynch broker telling me I was making a big mistake selling some General Electric stock to "buy a Porsche"... so irresponsible they said. Fired the broker, sold the GE.

-

How a running toilet can lead to financial RUIN!

gfp replied to DTEJD1997's topic in General Discussion

That’s for a single family 2 bath 900 Square foot new construction house. He didn’t pay it. (I should add it’s a one month bill) Wow for some context roughly how many units does your friend own. I thought my water bill for properties were high maybe not.. -

How a running toilet can lead to financial RUIN!

gfp replied to DTEJD1997's topic in General Discussion

My friend in New Orleans has this water bill framed in his guest bathroom. Automatic bank drafts can be dangerous!