gfp

Member-

Posts

5,335 -

Joined

-

Last visited

-

Days Won

10

Content Type

Profiles

Forums

Events

Everything posted by gfp

-

Alas, the Social Security trust fund and SS disability trust fund don't own any marketable treasury securities. Only the special issue IOUs of the US gov.

-

At least inside Odyssey Re, the cost basis for UA was $6.994/sh. and the cost basis for VOO was $464.91 / sh. At Odyssey, average price sold for MU was $127.75

-

Posting the Odyssey Re Q2 NAIC filing for those interested. Investment activity is toward the end of the file. 23680.2024.P.Q2.P.O.2.4808959.pdf

-

Is $159.9m after tax and $35m a pre-tax number?

-

Well it is not better, but it could be smart to do both. And don't fret over the price to book value of the mattress retailer - I don't think the book value matters at all and it will be written up to 1x book value once the acquisition goodwill is assigned anyway. Book value is just an accounting construct. Repurchasing shares at a discount is great capital allocation and also shrinks your capital base and earning power. Buying profitable businesses that don't correlate with insurance in order to build out the type of diversified non-insurance income that has benefited Berkshire over time increases your earning power, increases your diversity of earnings, and builds long term strength of the enterprise. Returning capital to shareholders might be great and accretive on a per-share basis for your owners, but it doesn't do a lot to increase the long term strength of the enterprise. It's a return of capital after all.

-

To save us all 28 minutes, what is the Motley Fool saying about the yen carry trade that doesn't square with your understanding of it?

-

Atlas / Poseidon quarterly report for those interested - https://www.sec.gov/Archives/edgar/data/1794846/000162828024036286/atlascorpq220246-k.htm

-

Anchorage is for infrastructure assets like airports and train stations and the like. IDBI will be merged with CSB bank (with IDBI being the surviving brand) if Fairfax is the winning bidder. Plenty of creative structures available to fund the deal with partners. Looking forward to hearing the details!

-

Is that Brett Horn? He's stuck in the past. "we believe disciplined underwriting is a more reliable path to long-term value creation...." - yeah buddy, we all do. You don't have to be good at your job when you have a job like his. Remember - companies miss analysts' figures not the other way around!

-

I feel like it's pretty well nailed down. Market capitalization is a super easy to figure 1 trillion INR. It's not 6000 crore, it's like 100,000 crore.

-

What?? Aren't we talking about IDBI bank here? Almost $12 Billion USD market cap? 51% would be $6 Billion USD

-

I wouldn't be surprised if someone made an offer for CarMax down here around $11 Billion. Offer $100/share and see if they take it? I've thought Berkshire might even do it now that KMX doesn't own any new car dealerships but I'm not sure BRK would be interested in the financing securitizations and they probably don't want to retain a bunch of weaker credit auto loans for reputation issues if nothing else. I'm not going to invest based on that thesis however.

-

Fairfax book value or share price will touch US $ 2000 before 2027 end.

gfp replied to Haryana's topic in Fairfax Financial

Ha! Well, something happened - assigning causation accurately isn't quite that simple. How do excess bank reserves impact the real economy when bank lending is not even close to being constrained by the level of bank reserves? Neutered money only useful as tokens between the largest mega banks. And QE removes highly useful, interest paying, pristine collateral that can be transformed into virtually anything and/or leveraged! -

Fairfax book value or share price will touch US $ 2000 before 2027 end.

gfp replied to Haryana's topic in Fairfax Financial

We'll just have to agree to disagree on the effectiveness of QE / QT. I couldn't disagree more! -

-

Poor Berkshire only owns 70 shares of BHE! Imagine calling the family with the other 6 shares and asking them to pony up their share.

-

It may be one reason they are selling BYD but definitely not Apple. BHE can bankrupt Pacificorp in a worst case. I don’t expect that at all. I expect methodical settlements and plenty of liquidity to pay them. BHE itself is not at risk of bankruptcy. Berkshire not even close

-

I don't know if they sold it right then, but I did just check their NAIC portfolio and MKL doesn't own any Fairfax shares as of 12/31/2023. 13F filings do not require disclosure of over-the-counter (non-exchange listed) stocks or foreign stocks. I don't know why they included it previously but maybe they owned the NYSE-listed Fairfax shares until 2009 and somehow that became FRFHF and they kept up the disclosure out of habit. I will list MKL's foreign stock holdings in case anybody has interest in that - Diageo Pernod Ricard Sony Group ADR AON Accenture Brookfield Reinsurance Ferguson Linde RennaissanceRe Willis Towers Watson Spotify

-

It's hard to tell whether they just stopped listing it on their 13F on that date or actually sold 100% of the position in one quarter.

-

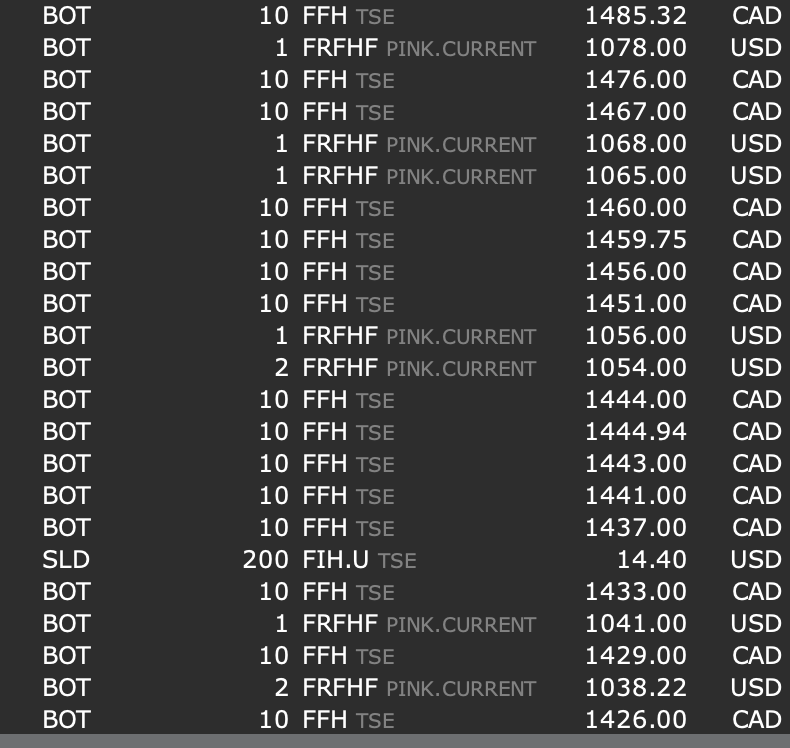

I just had some orders filled at 1064 USD and 1468 CAD. Happy to have it continue lower

-

Berkshire doesn't own any Fairfax stock. I've never checked if Markel does - it wouldn't be on the 13F so you would have to check the NAIC filings for several of MKL's insurance subs to find out. Watsa family has been pretty clear that Fairfax is not for sale. They are painting their own painting.

-

For those that like more detail, here are the BHE and BNSF 10-Qs BHE: https://www.sec.gov/ix?doc=/Archives/edgar/data/1081316/000108131624000016/bhe-20240630.htm BNSF: https://www.sec.gov/ix?doc=/Archives/edgar/data/934612/000093461224000012/bni-20240630.htm

-

Don't worry about Mr. Buffett. He knows what he is doing. He has sold fixed rate corporate bonds in JPY. He has locked in the very low rates that he pays for the duration of each bond. The bonds serve as a natural currency hedge to the Japanese equities he bought. The Japanese equities yield more than the (tax deductible) interest on the JPY debt. This is "positive carry" so yes technically it is some version of the "Yen Carry Trade." But unlike most Yen borrowers, who want to borrow JPY to buy higher yielding assets in other countries and are exposed to swap spreads and changes in holding costs of their trade, Buffett is borrowing JPY fixed rate and investing the proceeds in Japan. Berkshire has no problem if refinancing JPY bonds becomes less attractive because Berkshire can just own the Japanese stocks funded with equity, or better yet, negative cost float. If he expands his insurance business in Japan, he could even conceivably fund the Japanese equities with JPY denominated negative cost float.

-

Remember the good old days, when news of Mars buying up Kellanova's Cheez-its would involve a call to Omaha and a nice bespoke preferred stock deal? What would the rate be on something like that today - 8% plus some redemption premium?