MMM20

Member-

Posts

1,870 -

Joined

-

Last visited

-

Days Won

10

Content Type

Profiles

Forums

Events

Everything posted by MMM20

-

Nah, I maxed out my position a couple days ago. My average cost is ~$2.02.

-

I need to learn more about Bauer, but I'd assumed they had solid pricing power. What self-respecting Canadian or Minnesotan wants to be seen with Temu skates? Only half joking. Is there a legit competitor?

-

same here.

-

-

Can Bauer be Fairfax’s Sees Candy? A wide moat but niche regional brand that prints money without any great internal reinvestment prospects. Too small to really matter to the parent returns, but a symbol of what they’re looking for / why they’re special, and a signal to Canadian business owners that Fairfax is the best long term home when they decide to sell. Thoughts?

-

I’m the guy buying SNDL (but also own PDD). Are you talking about PDD calls?

-

-

@Luke I bet you'll outperform if you keep your head on straight during the inevitable ~80% drawdown.

-

Yeah that's my only other meaningful active public holding and would be top 5 on there. But I treat the whole thing (common, pref, warrants) as a private investment and mark it quarterly-ish b/c it doesn't really trade.

-

-

I am buying SNDL up to a core position. I think it's a fat pitch and looking for pushback.

-

Thanks, I figured it wasn't the first time this was brought up. I'm wondering if Sokol as CEO is one plausible way the stock ends up rerating ~2-3x this decade. Maybe he's got a chip on his shoulder and learned some hard lessons from the way things ended at BRK. Fairfax looks like the ideal platform for him to build on and outdo BRK over the next decade or two. But yeah, he's 68 and I wonder if he'd be up for it. Maybe it's not worth speculating about, but I wonder if anyone has a strong opinion on this and/or a different one than a few years ago.

-

https://www.kaizenreserve.com/capital-allocation/how-ex-berkshire-hathaway-executive-david-sokol-is-building-atlas-corporation-into-a-capital-allocation-compounding-machine What are the chances David Sokol ends up as Fairfax CEO when Prem is done? I wonder if Fairfax has a better version of Greg Abel right there in the wings. Anyone have any real insight on that? He’s only 6 years younger, but maybe they both work til 75 (80?).

-

Devils advocate = “only the paranoid survive” -Andy Grove. The exponent is really the key thing to compounding. I’m still not sure I’m not missing something. The platonic ideal portfolio would be hundreds of high return low risk ideas known equally well, right? Not possible, so Fairfax is still 30%+ which is enough to drive great performance if we’re right but won’t break the bank if some black swan shows up. I think every investor has to go through multiple big drawdowns to know how they’ll manage through it. Many of us haven’t yet. That’s the “personal” part or personal finance and concentration decisions.

-

https://iansbnr.com/industry-cat-loads-are-still-not-high-enough/ "The US 1 in 100 PML is 30% of US surplus. Wow!!! That is a level typically associated with cat reinsurers. Sure, I get a lot of that PML doesn’t sit on US balance sheets due to reinsurance protection, but on a gross basis, the average US diversified insurer looks like a cat reinsurer! At the end of the day, the primaries are paying for this one way or the other. Just because they’re paying it through ceded premium, doesn’t mean the cost isn’t there. This calls into question whether US insurers are truly adequately capitalized to withstand a 1 in 100 event or are we heading towards another post Andrew reckoning where the industry learns it didn’t hold enough capital for cat risk? Just because we have better models now, doesn’t mean we can’t make the same mistakes in new ways! Housing investors had much better tools to assess risk in the 2000s than the 1990s but they made much bigger mistakes."

-

Can you share any insight into why Canadian PMs are such fans of IFC? Does the board agree that there's a reasonable upside scenario for FFH over the next few years in which that preference shifts? Maybe my thinking is too zero-sum and there's room for more than one - but I wonder if when FFH gets into the indexes, the narrative among these PMs will follow price and FFH will similarly get valued on earnings as a high quality compounder => 2x+ rerating (to fair-ish IMHO) from this valuation. So what's different about the IFC shareholder base? Are we talking CSU levels of cult fandom over the border there? Appreciate any insights from the board!

-

I pay ~$300/year for Koyfin and get more value out of it than my old ~$20k/year (?) Bloomberg terminal.

-

The Sleep Country thing makes so much sense now!

-

Does being full-time investors help you getting better return?

MMM20 replied to alertmeipp's topic in General Discussion

I'm in my mid-30s and "retired" 5 years ago, giving up a $300-500K/year job that wasn't worth it b/c the opportunity cost was too high. I've had health scares so I’m probably more aware of my own mortality than the average mid-30s guy. That was part of it. I also didn't fit in in the corporate world so I knew pretty early on that I was prob on the ~8-10 year plan. I'm convinced I wouldn't have had the ability or conviction to identify and buy/hold a couple of big winners and compound at ~25-30% (with a lot of luck!) since then if I still had that job. But I have little kids and spend most of my time with them so I guess that's not "full time investing" anyway. It can be hard but a better kind of hard. It works for me. Find what works for you. -

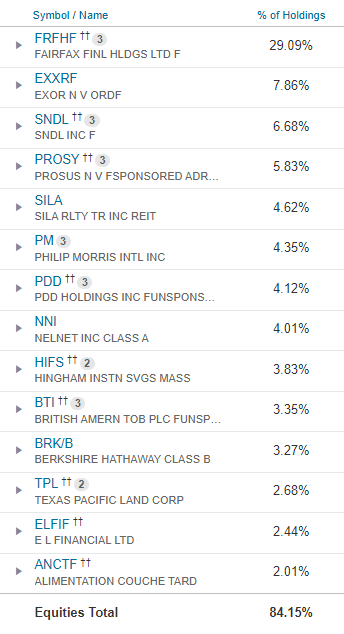

I wanted to close the loop. I sold ~10% of my FRFHF around ~$1,200 to close the margin from buying HIFS then (and to buy SILA now which looks like a fat pitch to me). FRFHF remains my biggest position by ~3x, and I'd keep a large core position at ~$2,500 if it went there overnight. This still looks like the best thing out there, but I'm probably too conservative with sizing and it's a risk management decision that I hope I'll regret.

-

Interview with Sumeet Nagar of Malabar Investments https://economictimes.indiatimes.com/markets/expert-view/go-digit-to-be-a-great-compounding-story-for-next-10-15-years-sumeet-nagar/articleshow/112674261.cms?from=mdr Q: Let us talk about Go Digit. Now it is a manufacturer. It is manufacturing insurance. I am just bringing it for our viewers, but it is selling that product digitally, that is the difference. But insurance is a brutally competitive space. And if I look at, let us say, the general insurance space, I understand a bit, there are about 20 players and only top five players are making money. How can a small player, which is only selling insurance online can actually make money? A: So, the Go Digit name may be somewhat misleading. So, while they are using technology very well and their internal backbone is all on new tech, it is very-very digital. The selling of insurance in India, if you want to be mainstream, has to be done through agents. But again, technology can allow you to do that a lot more effectively. So, from that perspective, they are like any other traditional player, but just technology is allowing them to do everything far more effectively. So, their ability to come up with new policies, new designs, that is better than everybody else because of the technology benefit, their ability to provide flexibility to agents on pricing, for example, is far better than other insurance companies and because the company was built during this new tech stack, it is far more efficient compared to the others and that is why despite the size, they have been profitable for quite some time. And I think there, the important thing is to look at the IFRS accounting because the GAAP accounting actually does not do a good justice to insurance companies where you are investing or getting customers for many years, but you expense that upfront. So, it sort of depresses your profitability. They have been the fastest growing insurance company. Insurance is a business that is still very under-penetrated in India, has a long runway for growth. It has a huge TAM and within that, you have one of the fastest growing players. So, we think this is a great compounding story for the next 5, 10, 15 years and that is the reason why I had invested while the company was private. We added more into the IPO and then post that.

-

Yes. I passed around $2-3 a few years ago and it’s looking like a pretty bad error of omission. There’s a good amount of research floating around out there. I think I heard of it from Dave Kim at Scuttleblurb.

-

-

This probably comes out to something like ~11-13% total returns if the stock derates to ~1x BV over those ~15 years, depending on how much capital they return to shareholders (and how). My expectation (ok, wild guess) is that sort of return would still end up at least a few percentage points ahead of global indexes. Maybe ~2x BV or mid-high teens on earnings is fairer right now across scenarios. Someone tell the robots!

-

Interesting to see S&P 500 index fund now at ~4% of their 13-F portfolio. Anyone know what's going on there?