-

Posts

285 -

Joined

-

Last visited

-

Days Won

2

Content Type

Profiles

Forums

Events

Everything posted by maplevalue

-

Where Does the Global Economy Go From Here?

maplevalue replied to Viking's topic in General Discussion

Well in fairness this is the 2nd year of 'transitory supply chain related inflation' one can forgive investors for thinking this might be persistent (especially if there is no quick solution in Ukraine). You are correct investors are not entitled to real bond yields. With that said real yields serve as inputs into the save vs. spend decision, and the more deeply negative real yields are, the more economic actors are incentivized to pull forward consumption. So if the Fed wants to slow economic activity, it's not enough to just have a higher nominal yield, but real yields matter as well. -

Where Does the Global Economy Go From Here?

maplevalue replied to Viking's topic in General Discussion

Since long rates are what most influences asset prices, and since asset prices are essentially what the Fed is using to affect inflation, if inflation is persistent this will force the all-powerful Fed to make long rates go higher too (faster QT + more hikes). Today's bond market reminds me of what it was like in the mid 2010s. Market kept saying "yields are so ridiculously low, they cannot possibly go any lower". Rates kept grinding lower (including the epic 2014 treasury market flash crash). Believe similar situation at play today where market convinced yields cannot go that much higher, and we will continue to grind higher in yield. -

Where Does the Global Economy Go From Here?

maplevalue replied to Viking's topic in General Discussion

Forget about recession or no recession. The most important consensus in the market right now is that rates can't go up that much. Market thinks Fed can get to neutral at ~2.5%-3% (which at current inflation rates is still one of the most stimulative monetary policies the US has had), real 10y yield at 40bps well below historical norms. All retail investors and real estate investors conditioned on BTFD of the past decade because you get rewarded by ever lower discount rates. Very big pain will occur if consensus shifts to higher rates than what is currently discounted. Not saying it will happen, but macroeconomic uncertainty is super high right now so its a very real possibility. -

Demography - declining birth rates / falling population

maplevalue replied to Sweet's topic in General Discussion

Great trend to consider long term. In the declining population scenario housing is particularly at risk outside of urban centres. Just look at Japan https://www.vice.com/en/article/88nxkx/japan-abandoned-homes-akiya. On the other hand, there is good reason to believe life expectancy could dramatically increase in the years ahead which would soften the effect of declining birthrates (https://www.youtube.com/watch?v=nnnXVUWlTkI). -

There is probably something to be said for the fact that there has been no post in the BABA thread today, on one of its biggest moves in awhile (+15%). Maybe sentiment is just really bad?

-

@Spekulatius I am sympathetic to your view about Xi's vulnerability, but the more I read on it the more I am convinced he is not very vulnerable (many China experts believe his next 5 years a done deal). Xi has essentially purged most of his opposition via anti-corruption campaigns. Plus we are at the beginning of China opening up and he will be able to say "yes it was hard, but I saved millions of lives at the expense of a few percentage points of GDP growth". Good article below (paywall) Rumours that Xi Jinping is losing his grip on power are greatly exaggerated https://www.ft.com/content/5e14bfb2-f0a9-4259-9d4c-a1b0ff607560

-

A House in Canada Now Costs Almost 2X A House in the US

maplevalue replied to Viking's topic in General Discussion

Blackstone targets Canadian real estate, opens office in Toronto Blackstone Inc. is ramping up its Canadian real estate business and opening an office in Toronto as it expands from significant investments in warehouses into new sectors such as commercial and residential properties. https://www.theglobeandmail.com/business/article-blackstone-targets-canadian-real-estate-opens-office-in-toronto/ -

China - Economic Consequences of Zero Covid Policy

maplevalue replied to Viking's topic in General Discussion

Year of Xi's re-election -> desire for 'stability' in China. Chinese hospital system is not great -> keep COVID 0 even in face of Omicron to at least slow spread of COVID amongst population without natural immunity, bad vaccines, and a elderly population that is relatively unvaccinated. This will likely follow the path of Hong Kong where there is a sharp peak, and then it declines. Overall, after this latest amount of lockdowns China probably will have been less locked down on average since 2020 than many Western countries. COVID 0 gets relaxed going forward. -

Where Does the Global Economy Go From Here?

maplevalue replied to Viking's topic in General Discussion

I guess what I am wondering is how much first time homebuyers having a hard time buying their first house is really going to drag on the economy. Inflation is an economy wide phenomenon, and I feel the factors driving inflation (supply chain, govt spending, etc.) are going to far overwhelm the economic impact of some millennials having to continue renting instead of buying a house. -

Where Does the Global Economy Go From Here?

maplevalue replied to Viking's topic in General Discussion

For variable rate mortgages my understanding (see here https://www.canadalife.com/investing-saving/mortgages/fixed-vs-variable-mortgages.html#variable-rate) is that if rates go up your payment stays the same its just the interest vs. principal ratio changes over the course the 5 year term. At the end of the 5yr term that is when you could face higher monthly payments. My original point being higher rates are not immediately leading to higher payments for those with variable rate mortgages. -

Where Does the Global Economy Go From Here?

maplevalue replied to Viking's topic in General Discussion

One thing I think about, and can't wrap my head around, is the economic sensitivity to higher rates in Canada. Canada has 5yr mortgages so payments more closely track where short-term rates go than US. However I suspect when all is said and done, and you account for the fact many mortgages are partially paid off, or based on mortgages taken out many years ago (i.e. lower prices), or that mortgages over last two years will not reset for another ~3 years (either because they are fixed, or the fact variable payments remain the same until end of term just the amount interest vs principal changes) the dollar amount that mortgage payments change with higher rates is not very high. Also for credit card debt nobody notices a difference between 20% rates and 22% rates, and for HELOC debt people are sitting on massive MTM gains on their houses so a small change in rates doesn't matter. So do we get a situation where the Canadian economy is on fire (reopening from crazy stringent lockdowns + commodity sector + Libs/NDP spending like crazy until 2024), rates are going up, but the economy doesn't respond? That is a really scary situation for asset prices if the BoC is 'pushing on a string' with its rate increases necessitating they raise rates even higher. -

Where Does the Global Economy Go From Here?

maplevalue replied to Viking's topic in General Discussion

It's true, the proportion of the population that doesn't like inflation represent a huge percentage of the electorate (particularly older people on fixed incomes). This is why today there is a heightened risk that central bank inflation targets get lowered (I think there is a non-negligible chance they get changed to ~0% CPI/PCE inflation). Just think about how popular a "no more inflation" policy would be from one of the candidates in the 2024 election. -

NTDOY

-

Where Does the Global Economy Go From Here?

maplevalue replied to Viking's topic in General Discussion

Hat tip to @crs223 for posting the Dalio video, I think it is worth a watch. @Viking I think you are correct in saying your macro ball is pretty cloudy. We are in a very uncertain environment with respect to the future path of interest rates (another way to look at it is the future path of where the Fed wants asset prices). Fed clearly behind the curve, economy at full employment, inflation at 8%, and likely Republican sweep of government coming by 2024 (remember what happened with long rates in 2016...they skyrocketed after Trump's victory). It is hard to say exactly where the market will go. However given market direction is a combination of fundamentals + positioning, I will offer the following two thoughts. i) The entire financial system is positioned for rates to go up but stay at historically low levels (market pricing overnight rate to go up to just north of 2%). A particularly egregious example of this positioning is in Canadian real estate where prices have become mind boggling on the back of variable rate mortgage rates of ~1%. I saw a tweet the other day of mortgage rates in 2006, where TD's 5yr fixed was ~7%. As a long-term investor, given the current macro environment you cannot rule out the possibility the regime has shifted and we are go back to more 'normal' levels of rates (fun fact if they made the overnight rate 7% today real rates would still be negative), and I think one's portfolio should be insulated against this possibility. ii) Many individuals such as Russell Napier have argued that because government debt loads are so high we are about to enter into an era of financial repression where rates are kept below inflation. While this is completely possible, what is different today is central banks are far more independent from governments than they were in past eras of financial repression, and hence more likely to push back against high inflation. -

I thought I would revive this thread to post some interesting commentary on EM I read recently. Obviously there is lots of discussion in the Russia/Ukraine war thread, and in individual investment threads (e.g. BABA), but I thought there would be value in having a place for a slightly more general discussion with respect to EM. This is especially relevant now given the large underperformance of EM over the past year (EEM -21% vs. SPY +7%). FT: Emerging markets: all risk and few rewards? https://on.ft.com/36dg3Gm Larger emerging economies appear to be in less immediate danger. But Ed Parker, head of global sovereign research at Fitch Ratings, a credit-rating agency, talks of “a long tail of weak, fragile frontier markets” that look to be at risk. Investors are particularly concerned about countries such as Ghana, El Salvador and Tunisia — not to mention Ukraine, should Russia invade. “This is not an abstract concept,” warns Parker. “Given the pandemic, many of them are much less able to withstand the shocks that could hit them this year.” Six countries have already defaulted during the pandemic: Argentina, Belize, Ecuador, Lebanon, Suriname (twice) and Zambia. ... The outlook is not wholly bleak, say analysts. Many emerging economies are much better placed today to withstand such difficulties than they were in the past. Previously, persistent and deep current account deficits made countries vulnerable to external shocks and dependent on foreign finance. Now, in aggregate, emerging markets are running a current account surplus. Many, including Brazil, South Africa and India, have substantial reserves of foreign exchange and deep local capital markets, which offer protection from swings in exchange rates and in foreign investors’ appetite for risk. FT: Letter: South and east Asian countries offer the best places to invest https://on.ft.com/3J75un9 It is time the Financial Times grew out of using the generalisation “emerging markets”, a lazy way of covering the majority of the world (Big Read, February 16). Whatever the problems of a few middle-size economies like Turkey and Argentina and a myriad little ones such as Belize and Suriname, just a brief glance at currency rates alone would show continuing sustained levels of confidence in the large majority of south and East Asian countries. Currencies of these mostly externally-oriented economies have been stronger than the euro and the yen over of the past year. The Vietnam and Taiwan currencies have risen against a strong US dollar and the Indian, Indonesian, Thai, Malaysian, Korean and Philippine ones have been roughly stable on trade-weighted terms. Sri Lanka may be in crisis but the vastly bigger Bangladesh economy has been growing, albeit slowly, all through the pandemic. ... Although some economies, notably India and the Philippines, were especially hard hit in 2020, India has led the world with 12 per cent bounceback growth in 2021 and Indonesia’s gross domestic product is back above its 2019 level. Growth is back in Kazakhstan — and never stopped in Uzbekistan, the most populous state in central Asia. The inflationary impact of supply chain problems so far seems greater in rich countries, meanwhile most commodity prices have been buoyant. Future growth will be slowed by demographics everywhere, especially Europe and China, but there is nothing to suggest that well-run younger countries will not remain the best places to invest.

-

https://www.bloomberg.com/news/articles/2022-03-07/fairfax-is-said-to-weigh-selling-stake-in-iifl-wealth-management Fairfax Financial Holdings Ltd., the Canadian investment firm run by Prem Watsa, is exploring the sale of its stake in Indian financial firm IIFL Wealth Management Ltd., according to people familiar with the matter. The Toronto-based firm is in early-stage talks with potential bidders for the stakes, said the people, who asked not to be identified as the information is private. Other major shareholders including General Atlantic could also consider joining Fairfax in selling their own stakes, the people said. IIFL Wealth shares fell 1.2% on Monday, giving the company a market value of around $1.7 billion. A vehicle controlled by Fairfax holds about 13.6% of the firm’s shares, while General Atlantic has a 21% stake, according to data compiled by Bloomberg. Deliberations are ongoing and the investors could decide not to proceed with the sales, the people said. Representatives for General Atlantic and IIFL Wealth declined to comment, while Fairfax didn’t immediately respond to requests for comment outside business hours. Founded in 2008, IIFL Wealth offers solutions for high and ultra-high net worth individuals, family offices and institutional clients, according to its website. The Mumbai-based firm has more than $44 billion in assets under management.

-

You raise very good points about why investing in an authoritarian country like China differs from a more free-market one like the US. With that being said China trades 11.5x forward PE vs US at 19x, partly as a result of sentiment being absolutely terrible towards EM right now. My feeling would be valuation + China easing COVID zero policies + Chinese monetary easing provides a decent setup for Chinese stocks right now.

-

https://www.cicnews.com/2022/02/canada-immigration-levels-plan-2022-2024-0221165.html#gs.p4r2bw The Canadian government has just announced its Immigration Levels Plan 2022-2024. Canada is increasing its immigration targets yet again. It will look to welcome almost 432,000 new immigrants this year instead of its initial plan to welcome 411,000 newcomers. The announcement came today at approximately 3:35 PM Eastern Standard Time. Over the coming three years, Canada will target the following number of new immigrant landings: 2022: 431,645 permanent residents 2023: 447,055 permanent residents 2024: 451,000 permanent residents Also a reminder that over the past 12 months the MLS Housing Price index is up 26.6% (https://www.crea.ca/housing-market-stats/mls-home-price-index/hpi-tool/).

-

Here it is

-

I think I heard on Bloomberg Radio that the full interview gets released tonight at some point.

-

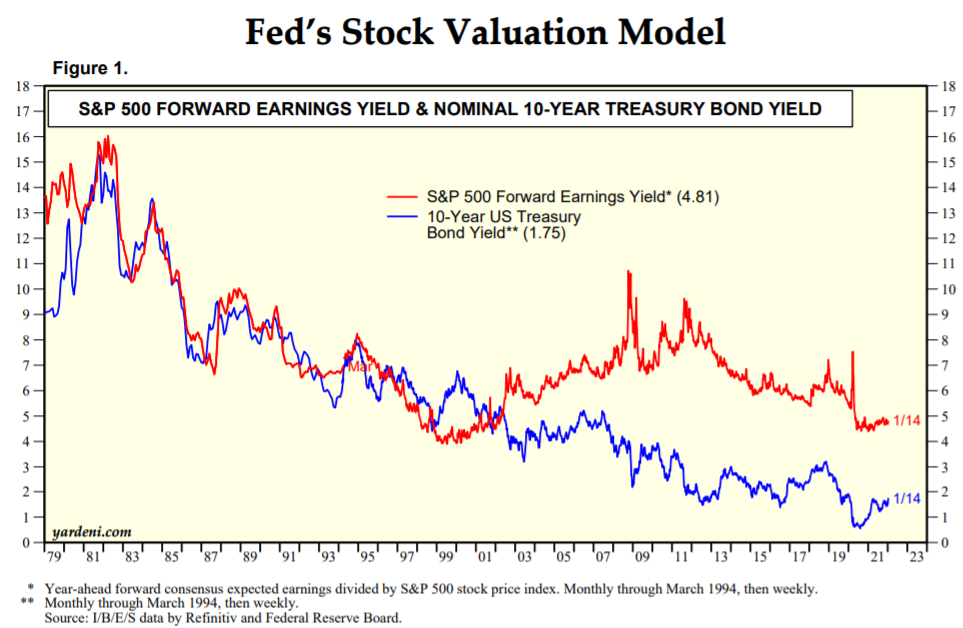

Well obviously if you get a 10yr yield at 10% stocks will probably be lower. However, it would seem from the history that US 10yr yields could go up another 300bps to 5% (this would truly be an enormous move, and I doubt the economy could really handle it -> inflation wouldn't be a problem) and stocks could still do ok.

-

Whenever I get nervous I just look at this chart. Sure the Fed tightening is helping inspire a selloff, but at the end of the day stocks still look good relative to the alternatives out there. https://www.yardeni.com/pub/valuationfed.pdf

-

Investments Benefitting from Higher Interest Rates

maplevalue replied to maplevalue's topic in General Discussion

Thank you for all of the terrific suggestions. It has given me a lot to think about. One that hasn't been mentioned that has piqued my interest is BDCs. They all differ, but they tend to provide floating rate financing to mid-market companies. So as rates go up your income is protected. Here is an article which talks about them https://www.kiplinger.com/investing/stocks/dividend-stocks/602058/need-yield-try-these-5-best-bdcs-for-2021. I need to do more work since many of them are externally managed (general negative), and of the internally managed ones many trade at rather high P/B ratios (MAIN trades ~1.85 PB). -

Never said immigration would create more per capita wealth or would inflate wages. What immigration does do is make more people compete for the same amount of land, bidding the price up. In places like the GTA there are a host of restrictions on building new houses, so the only way to build is up, which makes existing houses (i.e. ones with a backyard) more expensive.

-

Next Thirty Years - Real Estate or Equities?

maplevalue replied to valueinvestor's topic in General Discussion

I would agree on the comments of it depending on your expected future cash flow. If you have a stable-ish job, and expect to be paid uninterrupted for a decade or so, and are happy living in the same place it probably makes sense to own real estate. In Canada the first 5 years you will have a mortgage of 2%, and inflation will be 2%, so you are effectively borrowing 'for free'. There would be two other considerations I might point out taking money from equities to real estate. i) Future taxation - In Canada I just cannot see how real estate does not get taxed more heavily in the future, especially at the high end (what could be more politically appealing in a left leaning country like Canada than a mansion tax!). Governments are massively in debt and have to pay for baby boomer healthcare somehow. One of the things higher prices have done is increase the proportion of renters in society, particularly in the GTA, so the political opposition to increased property taxes is probably less than in the past. ii) Correlation with the 'everything bubble': At least with equities, particularly if you take a value approach, you can construct a portfolio that can perform decently even in adverse market/economic conditions. With real estate you are praying that the QE induced asset price inflation we have seen over the past decade continues into the future. In the event that monetary policy is forced to becomes more significantly more restrictive the value of your real estate will become exceptionally sensitive to the whims of a bunch of PhD bureaucrats at the Fed/BoC. So you want to make a determination how comfortable you are with that.