-

Posts

285 -

Joined

-

Last visited

-

Days Won

2

Content Type

Profiles

Forums

Events

Everything posted by maplevalue

-

CAD govt in particular can always lean on increasing immigration. Current target 400k/year; they could just do 500k and voters would probably not care (voters do not really care that they have ratcheted it up to 400k already). Many of these people move to the GTA. Same amount of land + more people = soft landing for real estate.

-

With the Fed about to begin a hiking cycle, I would be curious to hear the community's thoughts on investments that will do well in a higher rate environment. Specifically ideas that would do well if the Fed had to hike significantly faster than what is priced in. Right now Eurodollar futures have the Fed hiking to ~2% by 2024, so I am thinking of what would do well in a scenario where the Fed has to hike to 5% in a similar timeframe (for context the Fed was at 5.25% before the 2008 financial crisis). Rates at 5% could mean GDP growth is good, or GDP growth is bad, so feel free to share ideas for either case. Some 'textbook' ideas include insurers, banks, and commodity producers. Although with many of these breaking out to new highs it would be interesting to hear some more niche names/sectors that could stand to benefit and are less in favour than the aforementioned sectors. For example, a more niche idea is rate reset preferred shares trading at a discount (since they trade at a discount as rates go up their coupon increases more than the rate increase).

-

Is there a value rotation going on today?

maplevalue replied to BG2008's topic in General Discussion

The move over the past few days feels like a bit of a headfake. Classic scenario where market goes into a new year and everyone has read year ahead pieces talking about higher interest rates, tech is overvalued, bull market in commodities, blah blah blah. The market may move that way over time but it feels like it has moved a little too fast this week. -

2021 IRR of 14.02% across whole portfolio; was a decent year considering ~33% of my portfolio is EM. Just looking at my single name stock picks it was 26% (about 1/5 of my portfolio). Was more active this year thanks in part to being part of this great community. Hope to get more active in 2022.

-

Truly amazing to read this book in the context of the massive past, and continuing, government (including the Federal Reserve) intervention in the economy since March 2020. Some summaries/quotes below (from the IEA edition) Pg15 government has no resources of its own, the only way a government can give one person money is to first take it from another person…doing so represents the forcible using of one person, through the tax system, to serves the purposes of another. That is a form of immorality akin to slavery” Pg20 his greatest contribution lay in the discovery of a simple yet profound truth: man does not and cannot know everything, and when he acts as if he does, disaster follows. He recognized that socialism, the collectivist state, and planned economies represent the ultimate form of hubris, for those who plan them attempt – with insufficient knowledge – to redesign the nature of man. Pg35 the more the state plans the more difficult planning becomes for the individual Pg42 when economic power is centralized as an instrument of political power it creates a degree of dependence scarcely distinguishable from slavery Pg49 democratic assemblies cannot function as planning agencies. They cannot produce agreement on everything – the whole direction of the resources of the nation – for the number of possible courses of action will be legion. Pg49 to draw up an economic plan in this fashion is even less possible than, for instance, successfully to plan a military campaign by democratic procedure. Pg54 to make a totalitarian system function efficiently it is not enough that everybody should be forced to work for the ends selected by those in control, it is essential that the people should come to regard those ends as their own. This is brought about by propaganda and the complete control of all sources of information. Pg57 hence the familiar fact that the more the state plans the more difficult planning becomes for the individual Pg59 no difficulty about efficient control and planning were conditions so simple that a single person or board could effectively survey all the facts. But as factors which have to be taken into account become numerous and complex, no one centre can keep track of them….under competition – and under no other economic order – the price system automatically records all the relevant data Pg60 any further growth in economic complexity far from making central direction more necessary, makes it more important than ever that we should use the technique of competition and not depend on conscious control Pg68 with every grant of such security to one group the insecurity of the rest necessarily increases. If you guarantee to some a fixed part of a variable cake, the share left to the rest is bound to fluctuate proportionally more than the size of the whole Pg70 the guiding principle in any attempt to create a world of free men must be this: a policy of freedom for the individual is the only truly progressive policy

-

NTDOY

-

"Bankers know that history is inflationary and that money is the last thing a wise man will hoard." - The Lessons of History by Ariel & Will Durant (one of Dalio's favourite books)

-

+1 (although technically it will be even better than a treasury since it has inflation protection!)

-

Canada opens door to immigrants, adding fuel to hot housing market https://www.reuters.com/markets/us/canada-opens-door-immigrants-adding-fuel-hot-housing-market-2021-12-09/

-

As someone who is fairly well versed in both investing and the AI field, I am fairly skeptical it will gain much of a toehold in investing. There are two main problems in the application of AI to investing: i) Data Drift - The investing world changes over time, and the drivers of the market today are likely much different than they were in historical data. Most of the AI technology you see hyped in the media works because it has access to huge datasets which are relatively static (i.e. pictures of cats and dogs). Many of these algorithms do not translate into something like investing which have relatively small and changing datasets. ii) Cost of Acquiring Data - In many AI algorithms the variables used to predict an outcome are easily available. For example, in determining whether a picture is a cat or a dog from an image, you have the pixels of an image, and that should be all you need to make a prediction. In investing it is different. For example, maybe you think that a good predictor of returns going forward is normalized operating cash flow per share divided by the price of the stock. So if you want to train a model, with lets say 100 stocks, you need to go an calculate the normalized operating cash flow for each stock for each period going back many years. But it might be nontrivial to find out what these normalized values are (maybe there were idiosyncratic factors, or maybe firms made acquisitions, or maybe a specific sector was in a slump but not anymore, maybe there were regulatory changes). There is a saying in ML 'garbage in garbage out' which basically means if you fail to properly prepare your dataset your predictions will be worthless. Because it is so time consuming to get 'clean' data for a long period of time, and all of the difficulties associated with it, it is unclear how much one's model would outperform a more 'traditional finance approach' to investing. I think if you are interested in learning more about quantitative methods that could be applied to investing you stick with statistics and more basic machine learning methods (i.e. not deep learning).

-

MRG (TSX)

-

A great point about how what the market did defied what many predicted in 2020. With that said the setup for future lockdowns is different. In 2020 we had lockdowns -> deflation -> easy monetary policy. With this go around, and CPI having gone up 6% over the past year, I suspect we would have lockdowns -> inflation -> ?. The ? could very well be monetary policy stands pat (i.e. no incremental stimulus), or potentially a tightening. I am not saying tighter policy in a lockdown scenario is the most likely scenario, but given how big of a negative it would be for markets, it's important to consider the possibility.

-

I would say I am fairly skeptical of us being close to a top given how cheap stocks remain to bonds. With that said today's selloff reiterates to me the potential for a 'doomsday scenario' where we get: more COVID lockdowns -> more fiscal stimulus from governments -> stimulus exacerbates the high inflation we already have -> monetary policy having to tighten in a low growth environment. Not good for asset prices!

-

~1hr discussion between a Bridgewater portfolio strategist and a Harvard geneticist about what the future of aging looks like (I think at some point they mention the first 150yr old is alive today). A very fascinating discussion and thought provoking in terms of investment implications. The geneticist has his critics, but still worth hearing his perspective. Enjoy!

-

Could this mean that the "new series of securities" is not straight equity. Maybe some sort of convertible debt with a high coupon? It would then make the $900mm value not necessarily translate exactly into what the equity of Odyssey is worth.

-

Vintage blow mold Christmas decorations. Gotta be early this year with all the supply chain disruptions going on.

-

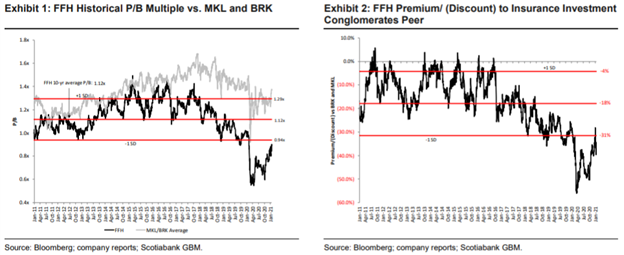

One of the reasons I like the stock. FFH should benefit from a higher rates environment, which is not true of many stocks (particularly tech which has been driving much of the recent gains). You get to own a higher rate hedge at a compelling discount to book.

-

Depends on the market. In emerging markets the index is stuffed full of state owned enterprises who may not necessarily be all that concerned about maximizing shareholder value, so active management is probably advantageous in that scenario. I also am a bit skeptical of indexing given the enormous flows into index tracking products over the past couple of decades. What might happen if that flow reverses (or rates start to rise)?

-

My suggestion was something that is simple, easy to understand, and the poster could just 'set it and forget it'. Hedging the exposure more closely, but more complex, is to sell US 30yr treasury bond futures; added complication is figuring out what the right hedge ratio is and having to roll the contracts every so often.

-

I would strongly recommend against some options strategy on a fixed income ETF, largely because there are fairly simple instruments you can use to directly hedge interest rate exposure without resorting to some complicated option play where it is unclear what the exact relationship between rates and the payoff will be. Probably the easiest hedge to implement is to sell Eurodollar futures (the Canadian equivalent is BAX futures). The price of a Eurodollar future declines 1 cent for every 1 basis point increase in the expected 3m interest rate at some date in the future. For example if you sold Dec 2025 Eurodollar futures you are protecting yourself for a higher overnight interest rate in December 2025 (https://www.cmegroup.com/markets/interest-rates/stirs/eurodollar.quotes.html). In terms of other ways to hedge rates, you could always look at buying bank stocks or low priced Canadian rate-reset preferred shares. Both should probably benefit as rates rise.

-

Really depends on risk preferences. I would lean fixed mainly because the scenario where the government runs a big deficit and you get inflation with little growth -> higher rates, would be so incredibly painful for Canadian economy. In that scenario you really don't want your mortgage payment going up materially.

-

Some interesting comments on China around 13:30

-

https://www.bnnbloomberg.ca/watsa-out-as-head-of-blackberry-compensation-committee-1.1663163

-

NTDOY (adding some comments in the thread)

-

+1 as well. Here is a chart from back in February (P/B even lower now). Sure there are issues, but should P/B be that much lower than pre-COVID...I would say no.