sholland

Member-

Posts

92 -

Joined

-

Last visited

Content Type

Profiles

Forums

Events

Everything posted by sholland

-

As long as an underwriting profit is achieved, float is more valuable than an equivalent amount of equity (book value)

-

The government owns warrants for 79.9% of Fannie Mae and Freddie Mac which Ackman estimates could be worth $300B over time.

-

FNMA and FMCC preferreds. In search of the elusive 10 bagger.

sholland replied to twacowfca's topic in General Discussion

Some vested interests are calling for Congress to legislate an explicit MBS guarantee, but that will not happen as Congress has shown it has no desire to get involved and would likely require the U.S. government to consolidate the $7.6T MBS of Fannie and Freddie, which would increase the national debt by 20%. In return for Treasury’s 2008 funding commitment, Treasury received from each GSE non voting senior preferred shares, warrants to purchase 79.9% of the GSE’s common stock, and a right to a periodic commitment fee to be determined at a later date (which was never determined). Bill Ackman says the senior preferred shares should be modified to act as a government backstop, providing the same benefits as an explicit guarantee without the negative consequences. Mr. Ackman further states Treasury would be paid a commitment fee in exchange for this support (Pershing Square estimates a 25 bps fee). -

FNMA and FMCC preferreds. In search of the elusive 10 bagger.

sholland replied to twacowfca's topic in General Discussion

The Trump letter indicates that he will order FHFA to release the GSEs from Conservatorship. However, the actual process is quite technical with many potential bureaucratic stumbling blocks. Is an explicit guarantee necessary? If not, is a periodic commitment fee necessary? A periodic commitment fee would increase the g-fees ~10 bps. An explicit guarantee would add several trillion dollars to the national deficit and would require congress. Is the ECRF ok as is? If yes, then FNMA and FMCC both estimate that g-fees will need to be increased 15-35 bps (not including the PCF). FNMA and FMCC both believe they need a 5 year transition period to allow for an adequate mix of higher g-fees in their portfolio to provide adequate returns for investors. Bill Ackman, Tim Howard, and others believe the ratio needs to be reduced to ~2.5%. I estimate that the process of changing the ratio would take almost a year. I believe that the new FHFA director will rewrite the capital rule as it is my experience that when a new sheriff arrives in town anything done by the old sheriff needs to be reworked (as my old boss used to day - not invented here, no f**king good). How will Treasury be compensated? Craig Phillips, Bill Ackman, and the Moelis plan all assume the senior preferred shares will be cancelled. Canceling the senior preferred shares was a nonstarter for Mnuchin. I suspect it will be a nonstarter for Bessent too because he will want the avoid generating newspaper headlines stating that he gave away taxpayer money (the value of the senior preferred shares) to enrich hedge funds. How will the outstanding court cases be settled? -

I Need a Laugh. Tell me a Joke. Keep em PC.

sholland replied to doughishere's topic in General Discussion

I wish I watched this 30+ years ago. I just sent this to my buddy’s college son. Hopefully he will learn, but I am afraid that he will have put his hand in the fire to learn that it is hot. -

Question regarding Constellation / Topicus / Lumine

sholland replied to Tintin's topic in General Discussion

-

I traded in and out in 2008 for a big gain. I traded in and out in 2013ish for a modest gain. Thanks to reading Viking’s posts it’s been a continuous holding since November 2023. While I am at it I want to thank @Viking for posting his book! I enjoyed reading it over the course of 5 days last week, and it prompted me to increase my position. All of my positions started out as 10% positions.

-

FNMA and FMCC preferreds. In search of the elusive 10 bagger.

sholland replied to twacowfca's topic in General Discussion

When (if) Fannie and Freddie are released from Conservatorship then the intrinsic value of the preferred shares will be equal to the liquidation preferences with perhaps a 85%-95% discount similar to what Citigroup shareholders got when their preferred shares were converted to common shares. (They may trade a little differently based on the different dividend rates.) I believe the logic of the 85%-95% discount is that the older preferred shares received a lot of dividends and the newer preferred shares received fewer dividends. This will require a 2/3rd vote of approval from preferred shareholders. I thought the 2/3rds vote applied to all preferred shareholders, but @orthopa said above that not all (I have not read all the preferred stock certificates- only the ones I have owned). -

I don’t have a best idea for 2025. My largest position is cash and cash equivalents. I am waiting for one of those 20 punches that Buffett talks about.

-

Valuation method #3 is novel to me and I was wondering if I could solicit the board to help me process this. So BVPS is a rough proxy for the liquidation value of the business with the float being returned to policyholders. But Fairfax is a high quality insurer that is not being liquidated and the float is stable (steadily growing actually) so one could value the float like the face value of bonds that you continuously reinvest at maturity. Am I missing anything?

-

Tariffs on Canadian oil isn’t going to happen for reasons very well articulated in this short video:

-

FNMA and FMCC preferreds. In search of the elusive 10 bagger.

sholland replied to twacowfca's topic in General Discussion

FMNAT dividend = 8.25%, but is less liquid FMNAS dividend = 7.75% FMCKJ dividend = 7.875% https://www.fanniemae.com/sites/g/files/koqyhd191/files/migrated-files/resources/file/ir/pdf/stock-info/series_T_05152008.pdf https://www.fanniemae.com/sites/g/files/koqyhd191/files/migrated-files/resources/file/ir/pdf/stock-info/series_s_12062007.pdf https://www.freddiemac.com/investors/pdf/FtFPrefStock-oc.pdf -

FNMA and FMCC preferreds. In search of the elusive 10 bagger.

sholland replied to twacowfca's topic in General Discussion

http://www.timelessinvestor.com/wp-content/uploads/2019/10/Blueprint-for-Restoring-Safety-and-Soundness-to-the-GSEs-Final-1.pdf @Sunrider here is the latest copy of the Moelis blueprint -

Just to add some color, this is what Peter Clarke had to say about Viking’s assumption #2 during the 3Q24 CC:

-

I believe that I once read that the only reason Fairfax established a dividend is because Prem personally wanted more money, but didn’t think it was fair to shareholders to increase his compensation. The dividend is a way for Prem to get more money while shareholders get the same too.

-

Buffett gets monthly numbers on all the businesses. Buffett and Munger believe that have having honest and able managers and getting out of their way (bureaucracy is like a cancer) is the reason that Berkshire works so well.

-

https://en.wikipedia.org/wiki/List_of_largest_private_non-governmental_companies_by_revenue

-

Definitive Ranking of WEB’s Best Investments?

sholland replied to ElstonG's topic in Berkshire Hathaway

-

My thought also.

-

Does being full-time investors help you getting better return?

sholland replied to alertmeipp's topic in General Discussion

to answer the question posed by the original poster - if you are having any doubts you probably shouldn’t do it. 52 second YouTube video below: -

-

FNMA and FMCC preferreds. In search of the elusive 10 bagger.

sholland replied to twacowfca's topic in General Discussion

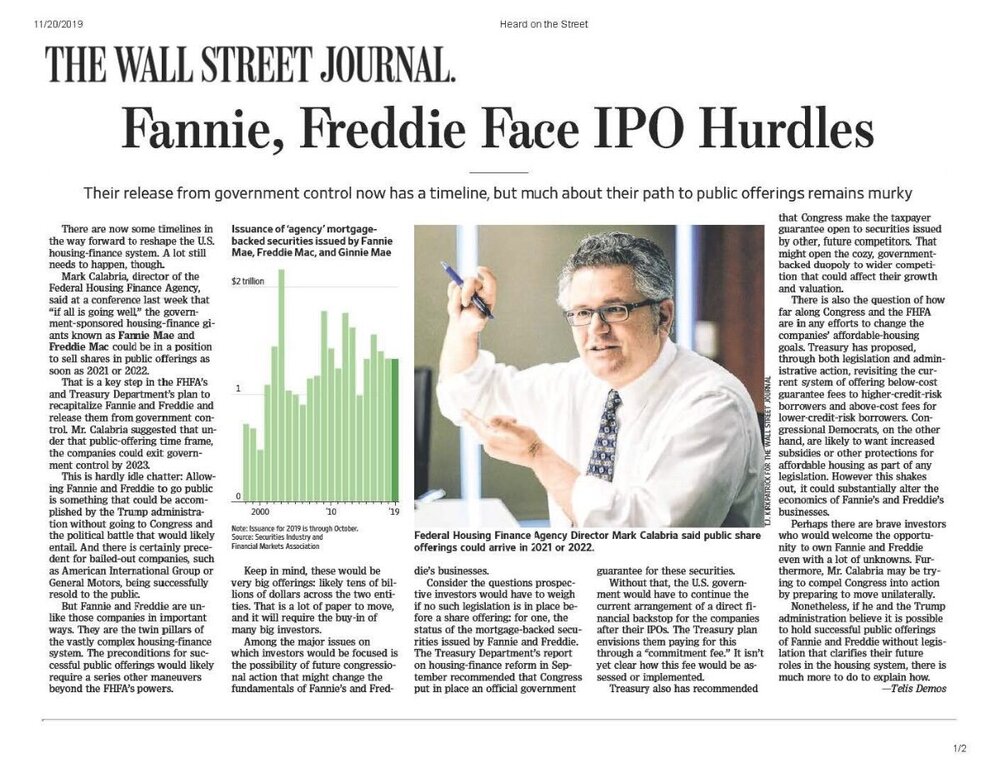

As it says below Mark Calabria’s picture in the 11/19/2019 issue of the WSJ, the plan was to do an IPO in 2021 or 2022. In a recent interview Mark Calabria said w/o the pandemic the GSEs would be out of Conservatorship. https://www.bloomberg.com/news/audio/2024-06-11/calabria-on-fannie-freddie-conservatorships-votes-and-verdicts -

The Wall Street Journal

-

I know this is over a year old, but I assume a similar situation happens every year that pricing is favorable (I don’t know about this year). I believe that were only 4 hurricanes in the last 100 years that would have caused BRK to be on the hook for the entire $15B: Historical examples (source August 2012 Karen Clark report Repeat of 1926 Miami Hurricane is estimated to cost $125B in insured losses Repeat of 1928 Great Okeechobie Hurricane is estimated to cost insurers $65B Repeat of 1947 Fort Lauderdale Hurricane is estimated to cost insurers $50B Repeat of 1992 Hurricane Andrew estimated to cost insurers $50B Pretty good bet to make $7B in the good years and be on the hook for up to $15B in the rare bad years. Total cost to insurers would be spread out to other reinsurers so a $50B industry event probably wouldn’t cost BRK $15B.

-

I agree with JRM. Day-ahead scheduling is not load following. Nuclear reactors need to operate at a steady state because of Xenon poisoning.