changegonnacome

Member-

Posts

2,694 -

Joined

-

Last visited

-

Days Won

7

Content Type

Profiles

Forums

Events

Everything posted by changegonnacome

-

Anyone else sitting on a lot of cash?

changegonnacome replied to Sweet's topic in General Discussion

What I would say that is the sheer brain power dedicated to uncovering value in US equity market is so much higher than in other places.. Finding a 50c dollars is tough when so many are looking for them......your much more likely in US markets to find a 50c dollar that actually turns out to be worth 50c in the end i.e. mis-pricing is more of rarity in US markets......on the flip side.....what can occur in foreign markets, I've found, is kind of the symptom of the same problem/advantage......value can get created in foreign equites but the time it takes to get that value PRICED in that market can actually take a frustratingly long time......and given time matters in terms of opportunity cost such that all things being equal we'd all like to see value converge with price the moment after we buy something.....that tends to be happen pronto in US markets not so much overseas....its both a gift and a curse. -

Anyone else sitting on a lot of cash?

changegonnacome replied to Sweet's topic in General Discussion

Yep thats what the book says.....equities tend to bottom some time after the first rate cut but not before......and rarely the bottom is in after the first rate cut.....its first cut plus some time more cuts before things bottom out. -

Anyone else sitting on a lot of cash?

changegonnacome replied to Sweet's topic in General Discussion

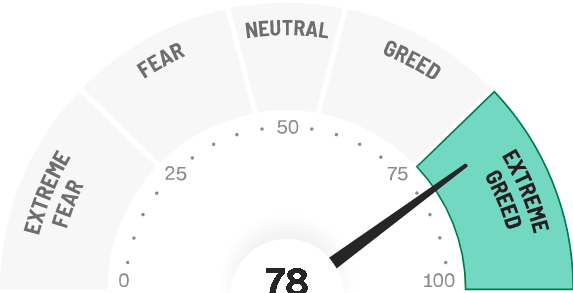

-20% Cash….tbills - Starting to build up a LONG volatility book again via various means which I guess could be achieved by upping cash allocation but don’t like mkt exposure to drop below 80% - tax considerations are clouding one or two holdings ….in a Roth world I’d consider trimming….in the past when I’ve made those types of holding because of tax I’ve regretted it…might be time to evolve here a bit There are one or two more economic data points to come out before a self imposed before September 1st personal positioning deadline- BLS wage data, SuperCore - and if the trend continues i.e. zero weakening progress…..zero supercore progress….which kind of IMO ends any tiny tail possibilities of a soft landings….I’ll get more even more bearish…..a whole swath of institutional guys are IMO coming back in September and gonna take 2023 returns ‘to the bank’ by hedge my out 2023 returns. There are times for being a hero….and now isn’t one….the simple historical market heuristic is be a hero sometime after the 1st rate cut….when the ‘system’ wants stocks to go up, when Joe Sixpack has a shot again at expanding his purchasing power. -

Looks like I've got to get my TSLA puts out again into the EoY...........its funny H2 2023.......has the possibility of being H2 2022 re-run all over again.......its a pity in a sense that the Fed didnt capitalize on the negative sentiment back then and push the envelope on a weakening economy, weakening markets (financial conditions) such that supercore actually budged.......they had the wind at their backs so to speak.....doom and gloom was seeping into the culture meme.......but nope they kind of slow walked the hikes down to 25bps...sounded a little doveish......and let the idea forment that cuts were coming.....Powell really should have jawboned a bit more but he didnt.....and here we are in f-ing July 2023 15 months into this doing more god damn hikes and supercore hasnt budged an inch, unemployment hasnt budged an inch and SPY is at 4400 (having been at 3500 already)!!!.......if your gonna pull a band-aid off......Grandma Change says pull it off quick and in one go and get it done.......this Fed is peeling the band aid in slow motion....in fact they are kind of starting and stopping. Last month's pause....will go down as the "pointless pause".

-

Well this is a double digit decline......7.2% + ~5% inflation = -12% real fall But your right the peak to trough ~24% fall in earnings that accompanies a traditional recession is still to play out Earnings going down while SPY goes up = bear market rally The fundamental are disimproving & we still have an inflation problem. How you trade that is up to you. This chart below tells the story about the recent rally of the October lows: Price diverging from earnings.......now you could argue that somehow the market is looking through those earnings.....but if you overlay the inflaiton problem.....they are looking through with way too much optimism....kind of like inflation is done (without unemployment/GDP contraction) delusion

-

https://advantage.factset.com/hubfs/Website/Resources Section/Research Desk/Earnings Insight/EarningsInsight_070723.pdf

-

I think the 10yr/30yr need to move up a bit before bonds genuinely get interesting....they've been creeping there way back into 4's recently but ya know call me when the 10yr has a 5-handle.....but when/if that does happen they would offer both an ok-ish YTM but also some future capital appreciation to go with that nominal yield......like Druckenmiller said recently.....you'd probably like to own some bonds here as hedge but the rates just arent that exciting relative to history......to recent history......they look great......but the bond bubble of 2010 - 2022 is no yardstick by which to calculate absolute value. For now 30 day Tbills work just fine for surplus cash, even IBKR cash interest works out just great. Until stocks or bonds get genuinely interesting in aggregate again.

-

Yep its my base case for later this year. And look at the backdrop.........mortgages firmly back above 7% The 10yr & 30yr treasures are back above 4% There is no such thing as an immaculate disinflation (in a slow productivity growth economy running at 3.6% unemployment)........where company earnings & then labor market don't get run over such that nominal spending growth gets moderated sufficiently......and conditions exist then to take us back to 2% inflation sustainably. Now that journey has taken a little longer than many expected but make no mistake about it.....we haven't got off the 'hike + recession' disinflation end of traditional business cycle highway here......traffic has just been worse than we expected....so our ETA got pushed out.....but our final destination remains the same. I expect next week to see headline CPI drop down to something in the mid-3%'s........its kind of the last easy win CPI dropping all by itself MoM move such that if you wish to believe inflation goes away by itself and is 'done.....I suggest you enjoy these last couple of weeks........cause really what you have then is headline converging with SuperCore.......which really is the oft mentioned transitory inflation rolling off......and what I've referred to as Made in America domestic inflation remaining.....this is the sticky underbelly inflation driven by nominal wage growth feeding into spending growth exceeding productivity growth.....the math of which is only solved by falls in nominal spending which ordinarily occurs in the context of labor market turbulence which follows corporates suffering from their own turbulence .........I expect one last delusionary news cycle where you get Tom Lee, Jeremy Segal et al coming on CNBC and saying that Fed is off its rocker....inflation is coming down....or you get the Truflation.com looneys doing a screen-grab of some proprietary blackbox model that tells you what you want to hear......from a website setup for traffic/clicks and linked to a bunch of crypto people. If you ask me what the optimal outcome is here....an actually realistic landing which isnt soft but isnt terrible either.....is that you'd really like the headline inflation progress we've seen up until now but which is running out of steam to pass the baton on to actual falls in supercore.....as I've explained supercore is only falling meaningfully in response to initially poorer corporate earnings which then precipitates some significant labor market weakness......ideally ideally....you would like to see this labor market weakness become a cultural meme by no later than Q4 2023.....such that it becomes the backdrop for so many 2024 pay negotiations.....done properly and with some luck we might exit 2023 with unemployment heading towards the mid-4's.......a moderate Christmas spending season....and a consumer, with modest pay increases in Q1 2024, really pulling in the spending horns into the new year........and so we'll get genuine contemporaneous MoM progress on headline & supercore...which are about to become kind of the same thing........done right this time next year....the Fed will begin to show rate cuts into H2 2024.....and the spring housing selling season will be by folks with 6-7% mortgages but where they have a high degree of confidence that re-fi time is just around the corner.

-

For some.......the Dollar General customers (or are they food bank customers now? ) would disagree of course........and 5% inflation is a pretty cool way to introduce instability into your society with all the inherent unpredictable results that can ensue.......AOC for President anyone?........5% inflation might be a good way for MSGE to compound at a double digit CAGR (I'm all for it)......but what good is winning that battle.......if you lose the war.......President Bernie Sanders thinks 5% inflation is pretty cool too. Get me?

-

Yeah I wanna be careful here - what I'm outlining is the US becoming something akin to a banana republic such that AAPL at 40 times earnings makes total sense....which I don't believe.....however owning AAPL even at 30x earnings.....is not a mechanism by which you grow your purchasing power.....and to me in some respects AAPL at 30x represents something more akin to an insurance product....a wealth protection insurance product.......... if held for a five year plus duration untouched. The trick as you and I agree on @Gregmal is to find Apple-esque businesses with the same pricing power/inflation hedge dynamics that are trading at much much lower valuations than AAPL such that they provide purchasing power insurance while at the same time providing the opportunity to expand ones purchasing power over time too. I've seen them referred to as 'secret moat' companies and I think thats exactly right.

-

Not if US fiscal keeps ballooning deficits.......driving inflation up.....and forcing the Fed to hold rates at ever higher and higher levels. In that scenario.........where the dollar in your pocket is shrinking in value.....and where bonds issued in 2020 arent trading at par.......Apple, with their monopoly ecosystem, can sit there and potentially push through with perfect pricing power each inflation tick up......means that Apple at 30x times could be a bargain as mechanism by which you get to PRESERVE purchasing power.. Like I said....I don't believe this......I see just about enough sensible people in D.C. to ensure the US doesn't go banana republic this go round........but my god its getting close.

-

I'm not claiming this for a second.....so take what I'm about to say with a pinch of salt -as I'm about to present a kind of counter view to my own personal opinion.......but.......and its a big but AAPL at 30 times earnings....might not be crazy at all: There is one way to explain super high valuations in the Mega8...but lets call them what they are the Monopoly8.. in the context of Fed funds & bond yields being 5%++ which the 'book' says doesnt make sense- but perhaps it does make sense in a world where Central Banks are having trouble taming inflation...........and in a world where fiscal authorities are up to their tonsils in historical debt...are running annual fiscal deficits in the good times that are unprecenteted and are therefore likely to blow out in a recession....and then you've got POPULISM of the left and the right......which has shown almost ZERO interest in any kind of fiscal restraint.....such that its hard to see either US political party run a balanced budget any time soon if they get into power....and then to top it all off......you've looming and ballooning off-balance sheet entitlements of promises made in the past that not a single political has the kahunas to tackle even though they are crazy.....i.e. even more guaranteed fiscal deficits on top of the ones we are running today in a 3.5% unemployment economy are coming. Put it altogether you've got something akin to slow rolling currency crisis that one might see in South America/Turkey......what happens in those countries might be occurring in US markets.....which is to say nobody wants to own the currency or indeed sovereigns debt......as both are going to be killed.....you want to own hard assets or inflation protected assets such as stocks....as protection against purchasing power destruction.......AAPL might be 30x times earnings..........but its likely a better vehicle to preserve purchasing power than the dollar and/or 10yr/30yr treasury bills.......if and its a big if.......we are staring down the barrel of some kind of come to Jesus moment for the US in terms of monetary & fiscal stuff. Like I said I dont beleive this idea.......I think that there's enough, just enough ADULTS in the room down in D.C still.....to see some modicum of fiscal & monetary policy restraint......however........AAPL mooning to 40 times earnings etc. is exactly what you would expect to see in a world that had lost confidence in the dollar & US fiscal authorities. Its the stuff of crypto, gold bug & doomsday preppers wet dreams.....but you have to ask yourself sometimes when you see something that on surface looks a little nuts how it might not be that nuts after all.

-

Again you've basically proved my point.......when AI 'works' it ceases to be called AI. "a guy who say at his desk and banged out the code" = biological intelligence Automation that replaced "a guy" sitting at a desk = artificial intelligence

-

Thanks for proving my point. Automation is AI that works, AI is automation that doesn't work.......yet.

-

Voice assistants…..dictation with 99% accuracy rate….smart homes….Google search for christs sake is a marvel of AI…..L2 & L3 autonomy in commercially available vehicles….the L4/5 systems driving around SF & Phoenix without any driver….zero cost trading…Waze..all the automation/AI that goes into ANYTHING you do on a banking app on your phone….you do realize in 1996 that needed to be done in-person and for a given financial task performed it involved swathes of people in your bank & the counterparty bank to get it done? During my brief career whole back office finance teams of 100’s of people in companies I’ve worked in have already been replaced by AI….but like I said by the time AI eliminates jobs….the solution doing it is called RPA/STP/automation/ML system…..or just a systems refresh…never AI but that’s exactly what it is.

-

Not true - a very simple heuristic is that what people class now as machine learning or automation tech is actually what used to be historically classed as AI…and stuff that we can’t quite get to work YET…..and remains to be fully solved…..is called AI. Short version - Automation is AI that ‘works’, AI is automation that doesn’t ‘work’ yet. See once AI starts to work on something it very quickly gets classed as ‘just’ straight through processing(STP), machine learning, RPA or just automation…..there has been an immense amount of THIS progress since 1996….so much so that technologists from 1996 would class much of what you seem to take for granted today as really really immense achievements in the field that likely exceeded their best predictions. Eaten bread is soon forgotten….appreciation of AI progress follows the same principle.

-

NYC, IMO, is a bet on continued & growing concentrated global affluence........or put another way......it's a bet on continued wealth/wage inequality driven by technology innovation......which is a great bet IMO given ChatGPT etc. and the trend in the future for companies being able to produce more & more 'stuff'/value while being staffed with fewer but higher skilled labor.......in an increasingly technologically advanced economy requiring less labor....more and more $$$ accrues to fewer and fewer people over time which equals what we have now - an emerging 'super' W2+++ elite collecting x10 the median salary........if your truly wealthy or a high earner......in say the top 0.5% nationally.......there are not many better places to live anywhere on planet earth to deploy that $$$ in unique and novel ways where you just know you're living your "best life".......& certainly if your a very wealthy person who's a culture vulture/foodie/likes to travel.......NYC has Tier 1 live music, art, theatre, restaurants, global/domestic connectivity (JFK/EWR/LGA).........as a bundled package of 'amenities' all conveniently located within a 20 minute UberLux car ride from your Manhattan luxury condo.......it's kind of unparalleled across quality, convenience & selection.........& if your in the top 0.5% of earners you can insulate yourself against the worst of NYC for sure. You've got other global playgrounds for the well heeled- Dubai, Singapore, Miami, London, Rome - but you know you take the say five or six criteria I just laid out.....and I think you'll find it hard to find a place that measures up to NYC across all those criteria simultaneously.....certain places hit 3 or 4 out of 5....but are found wanting in other areas. Very very wealthy people suffer from FOMO, they are type A...they want to live in a place with ZERO comprises on anything. I sometimes think of cities by business functions too: Front Office - NYC/SF Middle Office - Charlotte Back Office - Jacksonville AI, ML, ChatGPT automation & technology more broadly is likely going to to rip through the back and middle office first in the coming decades. Leaving a kind of narrow 'super' elite running SPY & QQQ companies. NYC wins if that happens. Put more succinctly - if Bernard Arnould at LVMH could acquire a city........NYC would top of his list.

-

"June 30 (Reuters) - The U.S. Securities and Exchange Commission (SEC) has said recent applications by asset managers to launch spot bitcoin exchange-traded funds (ETFs) were not sufficiently clear and comprehensive, a source familiar with the matter said." Of course the ETF proposals arent clear.....the BTC market is a muddy mess its hard to get around that in a S1 disclosure document where your legally required to disclose the reality truthfully.........and there's no way they can put in place comprehensive surveillance structures - how could they be - the underlying spot market is opaque at best.....a vipers nest at worst.....there's no amount of fancy surveillance structures you could put in place to have any comfort level around a free and fair market in BTC. The whole market structure would need to be torn down and re-built as per my earlier posts. The problem for the crypto industry is its got its often requested regulatory clarity.........it was there previously for anyone paying attention........this most recent enforcement against Coin/Binance just put that clarity right under everyones noses in the industry with no where left to hide....basically...crypto got its regulatory clarity.......it didn't like answer...........so they've unleashed the PR flying monkeys to attempt to dress up the last few years of illegal securities offerings as some kind of regulatory fog of war stuff. Its hilarious to watch & nobody even the supposed 'good guys' (Coin/Gemini/kraken) are coming out of this looking good. They all couldn't keep their grubby fingers away from getting into the ilegal securities offerings game......and they all tarnished themselves in doing so.

-

The wealth transfer scheme is hiding in plain sight @Gregmal - no conspiracy theory, short sellers or men behind the current required: 5% Inflation + 3% Fixed Rate Mortgages on million dollar homes = negative real interest rates….financed against inflation hedged hard assets! now add in the folks behind these million dollar 3% mortgages: They’ve the skillsets, occupations & the educational backgrounds that can command inflation matching pay increases no matter what inflation does. Then at the bottom of the wealth/income distribution there’s your prototypical 2022 dollar general shopper….like a frog.......getting boiled in inflation hot water. There is your wealth transfer scam & its irefutable. Dont get me wrong.......I say this as someone who is benefitting right now in a 5% inflation economy that’s “doing great”: I own hard assets - financed with debt with a negative real interest rate's. Just took on another mortgage at 5.15%.....preferably l'd like inflation to go back up to 6%....so this new 2023 mortgage can go negative real rate too! That would be awesome for me. People who do my job and with my background successfully extract inflation or inflation adjacent pay increases annually. Five percent inflation suits me just fine......like I said 6% would work better for me actually if I think about.....….it’s a nothing burger as you would say….in fact I’d call it a double cheeseburger with bell peppers….it works kinda great my end. Now go check out the Dollar General folks…..like i said earlier….they are trading down……trading down to food banks. There's a scam going on alright and i just laid it out for you.

-

Yeah listen on one hand it’s good news…..but on the other it’s just isn’t from a taming inflation point of view …..as you put rightly above the nasty redistributive effects of inflation continue……from those without a pot to piss in……to those with 2.95% 30yr fixed rate million dollar mortgages…..

-

yeah exactly maybe hours worked is enough to pull down aggregate nominal wage increases....which via that fall + maybe slightly increased recessionary behaviors leading to increased savings......is enough that nominal spending growth cools sufficiently and we get back to 2%. Thats the dream type thing and I dont rule it out.....2020 - 2022 was a very unusual period for obvious reasons. I think the soft landing camp is definitely something like a credit contraction + hours worked slipping, + JOLTS falling + a profit recessions driven by margin compression.......the problem is really that wages are just the largest source of funds in the economy.....and it would be very unusual to get inflation from 4.5% down to 2%........without driving a bus right through the heart of Downtown Employment.......and the basic NAIRU math says you gotta drive unemployment up to ~4.5-5% to have no inflation.......its brutal stuff.....that would be a few million folks made unemployed. Hours worked slipping does not get you to something functionally equivalent to a few million folks not getting a paycheck.....its a big difference.

-

Yeah my view is that supply chain stuff in conjunction with monetary/printing kind of was the spark for the inflation fire we have now. The problem with inflation is thats its kind of a perpetual motion machine once its established.............as I've laid out.....nominal wage increases feeding into nominal spending growth far in excess of REAL productivity growth.......is the functional equivalent of a company printing new shares & diluting existing shareholders.....anybody who knows anything about stocks.....goes first to the accounts to see the quantum of REAL goods and services being sold and at what margin .......then they look at shares outstanding x price........the intrinsic value of a company increases when its sells more and more REAL stuff.....not when it prints more and more stock certificates. The economy (& purchasing power via fiat currency) is the same........we as a society only get to consume what we produce.....we divide up access to those goods and services via currency kinda like little stock certificates....they are claims on those goods and services..........and those claims mainly come in the form of wages (but also credit)........however you cannot grow wages far in excess of the real goods/services you produce......money/wages are just bit of papers....more money/wages does not create more good & services........more goods and services creates more goods and services. No company can increase its true intrinsic value by printing more shares........and no economy or individual inside that economy can get to consume more goods and services by simply printing more wage increases. The US is the process of modestly growing the amount of real stuff it makes each year....maybe by 1%.....but across the economy in tiny little bilateral wage negotiations workers are leveraging the macro backdrop with employers to give them nominal pay increases that far exceed the underlying REAL gains in national domestic productivity......now this always happens......remember we target 2% inflation......which crudely means we choose to create 2% more money in excess of the real goods and service we produce each year......but whats occurring now is really an undesirable level of monetary dilution against a very modest real increase in the intrinsic real level of goods and services being produced in the US. See I know folks are always what about the little guy......he's finally getting wage increases.......but you know the little guy is running to standstill.......you cant eat money & you certainly dont get to consume more than the economy in aggregate can produce........you use money as a mechanism by which to secure REAL things.......if REAL things are only increasing by 1% a year........yet the quantity of funny money via wage increases is increasing 5%.......you've got a math/consumption problem called inflation. There's nuances here....the little guy could theoretically win, if, they begin to secure pay increases in excess of inflation but to actually actually win somebody else in the economy......but lets call them "fat cats" for fun.....need to be securing wages increases or even pay cuts which FAIL to match inflation.......this would be a mechanism by which the little guys piece of the REAL goods and services are increasing....while the 'fat cats' share is decreasing. Basically for somebody to win a greater share of the goods and services somebody has to lose......of course the other way is you need to grow the pie.....but as we know the pie just isnt growing that fast. The problem with the above - is that its just never the way it really plays out in inflationary cycles......those at the upper end of the income spectrum via bargaining power/scacity gets to secure adequate pay increases to maintain their purchasing power....and those at the lower end, in aggregate, fail to do so. Buffett's remedy to inflation & purchasing power is 100% correct......be the the best doctor in town.....or the best lawyer...you'll always secure your fair share of the American goods and services pie regardless of what inflation is doing at any point in time...thats the ultimate inflation hedge....your skills command it & the scarcity of those skills command it........what Buffett doesn't say of course is the way to not get your fair share of the American goods and services pie in an inflationary environment is to be a worker amongst many workers available with an undifferentiated skills set. Its a recipe for what we have now playing out for all those to see in THIS inflationary economy....the little guy with an undifferentiated skill set loosing his grip on his previous share of the American goods and services pie.....one day your shopping at Dollar General and the next year your in a line at a Food Bank.....and you can't quite figure out why........cause ya know you taught you were a shareholder of "USA Inc" listed on the Nasdaq and you keep hearing about how well USA Inc. is doing............but when you look into it a bit more........turns out the sons of bitches at corporate printed too many shares......& your at the Food Bank cause you got diluted bro! Its the stuff of revolutions if let get out of hand. I joke buts its basically the reality of an inflationary economy in action.

-

True! But the wealth effect of housing prices on spending is powerful.......we all know people who do nothing but keep a weekly tally of how much they think their house is worth now.......goods weeks they go get a steak on Friday......a bad week of comps and their cancelling their vacation to Jamaica and heading for Sam's Club

-

Yeah its really higher for longer........until the labor market cracks.........but I'm firm on the concept that something has to crack to get us back to 2% inflation.......there is no such thing as immaculate disinflation...its an equation with variables I've laid out many times.........so the status quo (3.5% unemployment/SPY earnings this ballpark/ 1-2% GDP growth) dont get us back to 2%. The small possibility of a soft landing exists.......but the softest version I can envisage is a situation where corporate profits and by extension the index are the things that get taken to woodshed and that is sufficient to push inflation down to 2%....without significant rise in unemployment or negative GDP.

-

Yep all in good fun & its a great puzzle - @Gregmal is my permabear therapist.....without him I would be up in the mountain somewhere with beans and rice......Greg I should be sending you cheques in the mail........your 100% right in the sense that spending too much on macro is crazy..........but I think as @Parsad pointed out.....sometimes and very rarely is the macro kind of screaming in your face to pay attention........I obviously believe that now is one of those times when you need to pay attention.......and i think Howard Mark's with his "Sea Change" comments and Druckenmiller comments if I needed any confirmation bias (& I dont!) are kind of echoing that idea.........make no mistake about it exiting COVID with all the fiscal and monetary largese has catapulted into a kind post-WWI era......there's a kind of re-ordering and re=pricing occurring in the economy now that doesn't feel done yet to me.