changegonnacome

Member-

Posts

2,702 -

Joined

-

Last visited

-

Days Won

7

Content Type

Profiles

Forums

Events

Everything posted by changegonnacome

-

“Keep your eye on one thing and one thing only, how much government is spending. Because that’s the true tax. Every budget is balanced. There is no such thing as an unbalanced federal budget. You’re paying for it. If you’re not paying for it in the form of explicit taxes, you’re paying for it indirectly in the form of inflation or in the form of borrowing. The thing you should keep your eye on is what government spends. And the real problem is to hold down government spending as a fraction of our income. And if you do that, you can stop worrying about the debt.” - Milton Friedman Stolen from top of Wedgewood letter - https://imonkey-files.s3-us-west-1.amazonaws.com/WP_3Q202_-Client_LetterFedUp.pdf I think its about right - at this point......the last mile in terms of inflation and the final landing we have all been waiting for wont occur until fiscal spending by hook or by crook is reigned in. Fiscal is fighting the Fed..and fiscal has won until now levitating the economy...the last mile of inflation 3% to 2% is difficult to close using interest rates with 7-8% budget deficits.......the price the fiscal authorities are going to pay for this largesse is the incremental debt itself, sure....but the real cost is buried and is in the amount of debt that is going to roll over into this higher for longer period that didnt need to happen........higher for longer BECAUSE the authorities wont stop fiscally stimulating an economy at full capacity......forcing the Fed to raise the short end....while scaring the holders of the long end. This period of government borrowing relative to the set of cards for the US economy that drove that borrowing (full employment/debt to GDP ratio+ inflationary backdrop) is by far away the most reckless its ever undertaken.

-

The nature of tightening cycles is that the Central Bank is too late to the party and then stays too long. The current inflation numbers unfortunately don't provide a green light for rate cuts & the federal government's deficit spending is contributing to continued nominal spending growth exceeding productivity growth in a way that is ultimately counterproductive and doesnt allow the Fed to cut. Ironically the federal government, not the Fed, will be responsible this time for not delivering a soft landing. It's a pity I suspect if 8% deficit spending wasn't occurring we might have drifted down to 2-ish% inflation with minimal labor market turbulence just based on the progress to date............which is there but not quite there in terms of getting us back to 2%.....nearly never won the race.......and thats kind of where we've landed I think....close to something approximating a soft landing (see Target CEO above on consumers moderating)....but not quite enough because the federal government is running recessionary like deficits with full employment....usually at this point in the cycle (the end!) you'd expect fiscal surpluses or at least balanced budgets......instead we have 8% deficits....which should be reserved for the beginning of the business cycle not now. It's inverse and perverse keynesianism. We are a year out from the November 2024 elections......nothing meaningful is happening with fiscal spending in the months to come.......a mess of tough & some forced decisions await the new federal administration in 2025. Grandpa Joe must praying that he's shoved enough fiscal adrenaline into the economy to keep it limping on for another few months.

-

Got it thanks for the broad update - yep both sides seem to be spinning their wheels while they destroy huge amounts of resources....which is to say nothing off the human death and casualities.... The Ukrainians from what I can see continue to outperform expectations.....especially expectations around casualty exchange ratios for an offensive party versus a defensive one....as well the same metric for equipment. It seems the Russian army is /was in a poorer state than anybody could have imagined.......all the more reason to double efforts now to support Ukraine.......the Russian army is a shambles......but the reality of any standing army is that battle experience (assuming the resources to continue to support them) improves over time....Congress needs to stop dilly dallying on support.....there will be dimishing returns to aid provided in 2024/2025 as the Red Army gets its act together. https://www.csis.org/analysis/seizing-initiative-ukraine-waging-war-defense-dominant-world

-

Havent been following the situation in Ukraine closely for the last couple of months. As we head for winter in Europe - what is the general take on the Ukrainian counter-offensive.....broadly it seems clear there has been very very little territorial advancement around recapturing lands that Russia has annexed. Article below however talks about a more subtle take which is underlying strategic victoires that bode well for the future: https://foreignpolicy.com/2023/10/20/ukraine-crimea-black-sea-counteroffensive-russia-fleet-navy-drones-war/ My only quibble with the above article which makes me think things arent going quite so well is when the author leans on the victories against the black sea fleet as signs of Ukraine's progress.......this is not a naval war.....its very much a land war.....Ukraine can do what it wishes to the black sea fleet it will have little to no bearing on taking back the Donbas for example.

-

-

https://www.thefp.com/p/israel-and-america-have-no-choice-but-to-act Interesting read - its really a time for American diplomacy and coalition building to be at the top of its game.....the world has become a much more complicated place

-

B-REIT gets its way future grandpa & grandma six pack......will be only able to afford a two pack in retirement cause they'll need to make the rent at the end of the month. Your spot on - the social contract for the middle class was kind of work hard, buy a home, save for retirement, social security....have the mortgage paid off by 60-ish.......live rent/mortgage free thereafter.......and where your retirement savings + social security gave you a nice-ish life for your last 15-20yrs on earth where you didnt worry about day to day expenses. The math above completely breaks down if your paying rent in your 70's.

-

Growing at the fastest in two years.....like there's an election or something coming up soon Ideally as politician you'd like this Q's GDP headlines to have landed sometime in mid-2024......will be interesting to see if Grandpa Biden has prematurely stimulated.....which is what I hear can happen as you get older

-

Si Senior One can think of these sell side reports as the consensus...or lets call it the consensus opinion being built.....most of the real money made in markets, the apha, is having a non-consensus view and being proved right......so hope that answers your question @John Hjorth

-

Great if someone with access could share the JPM report mentioned above.

-

https://www.marketwatch.com/story/junk-food-is-as-addictive-as-alcohol-and-cigarettes-report-92aebe6e "Junk food is as addictive as alcohol and cigarettes - new report" In some respects it's a great triumph of food science to modify a product so much that it gets to be as addictive as alcohol & cigarettes.......and given the statistics on health outcomes.....the medical costs to society over time of being addicted to doritos is perhaps worse in aggregate than the smaller number of those being addicted to cigarettes.......cigarette use is falling and the users of cigarettes get 'taken out' early and often......Doritos "users" not so much......junk food addicts tend to set themselves up for a lifetime of myriad health problems - numerous and debilitating..........with trickle down & follow-on health issues that come out of insulin insensitivity & various metabolic syndromes. Dr.Peter Attia spoke recently around a number of drugs similar to the GLP-1 class that are currently in trial and that have been shown to be even better at preserving lean tissue inside a calories deficit than Ozempic. I'm curious if anyone here knows what drugs they might be and by what companies. The data I've seen on Ozempic does show significant reductions in weight - which for some is just a slam dunk outcome - but I've also seen how much of that weight is also coming from lean tissue. https://fortune.com/well/2023/09/27/weight-loss-drugs-ozempic-wegovy-risks-for-people-over-65/ This sub-group trial showing the participants losing nearly equal weight fat & muscle is not a great outcome period....but even more so in older adults where loss of lean tissue sets one up frailty, mobility and falls in older age.

-

Yep quite a consequential election cycle coming up for fwd SPY earnings. Very very hard to see the Trump era corporate tax cuts getting renewed/extended when you think about the budgetary arithmetic.

-

Good point - the US is engaged in effectively a very large debt funded economic stimulus program......a stimulus program inside an economy operating at already full capacity. Not very clever.....you usually save your high single digit % deficits for a rainy day like a recession or economic crisis. What's also true is that there is a very good correlation between government deficits and corporate profits/margins......which is to say corporates do significantly better when the government is running large deficits......and vice versa. Perhaps another thesis/explanation on the mystery of sustained profits margins through this cycle - which is to say that contracting household purchasing power via inflation has been supported or 'filled in' by expanding fiscal deficits.

-

So the S&P peaked intraday at 4,790 on Dec 30, 2021 in today's money inflation adjusted upwards from Dec 2021 to today......using the BLS inflation calcualtor https://data.bls.gov/cgi-bin/cpicalc.pl........that would require SPY to be at 5,228 such that one could say that they are flat, in real inflation adjusted terms, from the 2021 peak (exlc. dividends) SPY as you say closed at 4,224 In real terms SPY is down 19.2% from its ATH on Dec 30 2021 to today. As I've said before - there is a correction occuring in asset prices......perhaps not large enough in nominal terms to draw headlines......but enough in real terms to be meaningful.

-

Well 50yr and 100yr bonds sure maybe. The reality is being smart about it didn't require reinventing the wheel and creating new types of bonds......20/30yr bonds would have worked very well for extending the avg. maturity of the aggregate Federal debt pile. Christ even 10yr notes would have been good! Instead what we have is the below: https://research.stlouisfed.org/publications/economic-synopses/2023/06/02/assessing-the-costs-of-rolling-over-government-debt Like I said - if you were CFO of a corporate during ZIRP but especially during 2020/2021......and your companies debt stack looked like this i.e. most of the debt is gonna roll in the next three years......your CEO/board would fire you. It is criminal how much federal debt has to roll into 5% paper. The graph above should be sloping the other way given where we've come from. In some respects whats occuring at the long end of the curve is a response to the reality above....USA LLC. has a debt maturity profile that when rolled into higher rates at maturity will begin to consume larger and larger proportions of the govs net income (tax revenue).

-

Yep it's a standoff - super low inventory is allowing homes to transact at affordability levels that are nose bleed. Cant move, wont move versus have to/need to buy is levitating nominal house prices for now. Investors aren't stepping into this mess.....it's forced sellers, selling to somewhat forced buyers (or buyers with means who are betting on rate cuts soon or have no need for financing at all). Underneath the surface - in the markets i look at - inflation adjusted home prices are indeed falling vs. 2021 peak.....staying flat is the new price fall......and affordability can be restored slowly over time via a kind of monetary illusion....a few years of stagflation will for sure restore some affordability. What happens next is the great puzzle - pressure is building behind the supply dam for sure......folks have postponed retirement and downsizing sales.....each deferred sale....is a future supplier of inventory......but so too is demand....the rent vs. buy math in the markets I follow doesn't require 3% rates to make sense.........5% would do the trick....such is the short squeeze in the rental market. The high level math seems clear - housing is undersupplied.....a temporary dislocation in pricing if it occurs...will be just that

-

Probably the greatest missed opportunity in a generation.......one of the great sins of omission of our time - as measured by the dollar amount over a 30yr period......and for which no public servant at treasury will ever lose his or her job over!

-

Yep we're headed for stagflation in the current standoff......Joe Sixpack cant expand his purchasing power YoY right now....the median russell 2000 stock hasnt a chance to rally with that backdrop....and the Fed cant cut cause labor markets & by extension inflation haven't slackened sufficiently....Buffett the old dog can smell stagflation coming and is buying oil in the ground.

-

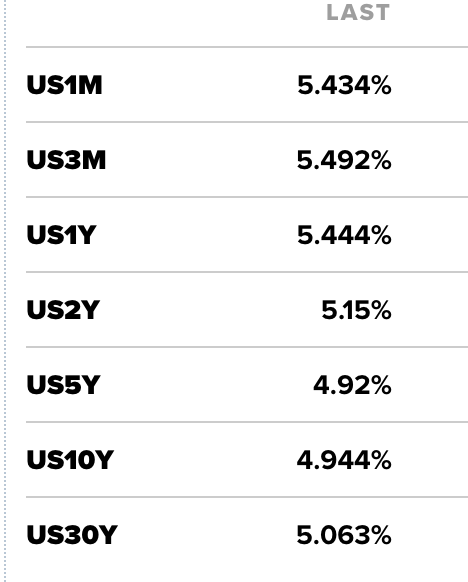

Yeah I think your right - the range of outcomes for upward movement in headline long term rates specifically are capped.....the fiscal debt situation & daily growing entitlement spending makes it so that rates moving much much higher from here is a math problem no politician can solve and no electorate will vote for. You wanna kill inflation & the economy - just do reverse helicopter money.....cut gov spending and raise taxes. Never gonna happen. The upward move on the long end of the curve recently is just that......it's effectively the bond market cutting government spending in real time. The budgetary math is starting to break. Nearly 5% across the curve bingo today: The treasury did a horrible job on duration during 2020/2021......while the rest of America was re-financing their mortgages into 30yr paper at 3%......the treasury did close to diddly squat......we should have got the guy who came up with the Austrian 100yr bond...thats my type of treasury secretary....selling that paper into the 2021 bond bull market. Genuis. Anyway seems to be that absent a recession that kills inflation and allows the Fed to ease........some version of yield curve control is the way out here......fiscal authorities get to extend and pretend.......the curve gets re-inverted....and continue to hope that that inversion drives nominal spending contraction in the household sector via the credit channel.

-

This just aint so - I wish it was. We've got a domestic services inflation problem.....this excludes housing/OER....that domestic inflation problem assures we aren't getting back anywhere near to 2%.....the US is "stuck" at 3%+ inflation.....and its got nothing to do with housing. It appears to me that we are AGAIN heading into year end wage comp discussions with almost ZERO weakness in the labor market.....which assures, most likely a re-acceleration or an underpinning of high core inflation in early 2024, as nominal wage increases turn into nominal spending increases that exceed the meager productivity growth of the US economy. This says nothing about the risks skewed to the upside to external supply shocks of energy etc. tumbling out of global macro (middle east etc.) Given the rate insensitivity of the consumer to monetary policy.........it appears to me that the bond market, acting rationally, and spotting this insensitivity is beginning to incorporate higher inflation expectations plus higher for longer Fed rates........in doing so....so called bond 'vigilantes' are going to do what Powell has failed to do to the lowly consumer.......they are going to force the fiscal authorities hands to shrink their nominal spending......debt servicing costs are going to start overwhelm federal and state budgets.....forcing spending cuts and/or tax increases on political leadership....this is going to be the transmission mechanism this time that effects the consumer in way that is meaningful enough. We saw post-GFC and the fight against deflation.....the weakness inherent in monetary policy to affect nominal spend in the real economy.......interest rates and even QE are weaker sauce than we realized....they effect very well financial instruments/asset prices.....but Wall St. is not the economy....what we discovered during COVID is the inherent power of fiscal stimulus over the monetary kind.....this is money that actually circulates in the real economy and flows into real goods and services...not the financial economy. Seems to me that this current 'landing' question gets resolved one of two ways.......the first is an outbreak of enforced or voluntary federal/state fiscal tightening in the face of rising debt servicing costs......or number two.......a fiscal financial crisis is engineered whereby the Fed is forced to buy treasury issuance directly.....i.e. fiscal debt get's monetized directly by the Fed..........it would be a crossing of the rubicon to a certain extent..........and the final FU to those holding US gov paper especially overseas given what this would do to the dollar......effectively the US authorities will play its trump card as the reserve currency....and it will rug pull the global monetary system. Interesting times. The game, so to speak continues into 2024 I think, the voluntary fiscal restraint is only going to occur post-Nov 2024......the car crash fiscal restraint is of course government shutdowns etc.

-

Is Europe becoming uninvestable?

changegonnacome replied to lnofeisone's topic in General Discussion

Tech gremlins it seems- https://www.reuters.com/world/uk/lse-says-investigating-incident-some-shares-not-trading-2023-10-19/ -

My sense now too - he is a war time leader for now....but once a moments breath can be had by the Israeli people i expect them to throw him out of power.....not only for the fact that Israeli intelligence seemed completely blind to this attack (which would be enough to warrant his resignation) but also because dividing a nation against itself when your surrounded by real enemies & threats is the lowest form & most cynical political calculation a nation's leader can engage in.

-

Is Europe becoming uninvestable?

changegonnacome replied to lnofeisone's topic in General Discussion

Fear no more - the windfall tax has already happened - and it's a nothing burger. Bank of Ireland will have PBT of about €2.15bn this year ((Mkt Cap €10bn)......the Irish Minister for Finance (who owns a majority stake in AIB and PTSB) decided to hit the THREE domestic banks with the dreaded windfall tax by increasing the bank levy (FDIC type insurance).....a grand total of an extra 120m between them all..........BOI on the hook for max €50m ....so now its 2023 profts will be €2.1bn! Everybody wins......Government can say they went after greedy banks.......electorate doesn't really understand quantum of windfall taxes realtive to bank earnings or uplift since rate rises....the irish exchequer doesn't need the money, they are drowning in money.....and theyre the largest shareholders in the bloody banks anyway (excluding BOI). Political theatre at its best https://byrnemccall.ie/2023/10/11/banking-levy-increased-in-budget-2024/#:~:text=Ireland will revise how it,Minister Michael McGrath said today. -

Is Europe becoming uninvestable?

changegonnacome replied to lnofeisone's topic in General Discussion

Irish stock's trade at times with their UK counterparts...especially those with dual listings on the ISEQ & LSE....the divergence between the economies from a macro perspective is just night and day. Irish homebuilders for example are facing a completely different set of circumstances versus their UK peers.....yet Glenveagh Properties moves with Taylor Wimpy & Persimmon.