changegonnacome

Member-

Posts

2,702 -

Joined

-

Last visited

-

Days Won

7

Content Type

Profiles

Forums

Events

Everything posted by changegonnacome

-

HSW

-

For sure what I meant more was that given the volatile nature of inflation that floats around the 1.5% to 2.75% range is fine.......whats not fine is where we are now potentially....which is inflationary volatility that is let's call it 'headline worthy 'and so feeds into inflation psychology and anchoring....this sticky supercore base we have now is dangerous jumping off point to easy vol trips to headline catching 4%+ inflation.......as you say inflation & price stability is where inflation is NOT part of business planning. We are not there yet.

-

Yeah OER nonsense etc makes headline not a great read.....psychologically including it actually doesn't help "fight" inflation.......people walk into wage neg with a CPI figure But again SuperCore....made in America inflation just wont go down......this is just not good IMO.....in and off itself you might be able to live with it where it is.....but as I've said before.....SuperCore where it is becomes the foundation on which trips BACK to 4 or even 5%+ on headline can be achieved You can't get inflation with a 2-handle with supercore where it is......and as I've been consistent on it becomes the basis for trips to 4 or 5%.......inflationn is not good.......what's worse is volatile inflation.

-

Wilshire 5000 market cap / GDP exceeds dot-com peak

changegonnacome replied to RuleNumberOne's topic in General Discussion

Yep one of the biggest mistakes treasury made during the crisis was that they didn’t extend maturities….they should have been issuing 30/50/100yr bonds like maniacs. instead a huge chunk of existing federal debt is going to roll over into higher rates to say nothing about all the incremental ‘new’ issuance…very poor treasury mgmt…and what happens when civil servants and committees run the show. -

Well in an economy with genuine inflation - when somethings price isn't going anywhere for years....its actually going down in real terms...inflation compounds like anything else...rents become more affordable by staying flat while folks get 4% pay increases....before you know it rents in real terms are 8-12% below peak relative to incomes. Take house prices - OK no major house price falls except in frothy markets......but in reality relative to their 2021 peaks and in real terms lots of properties I was looking at have remained flat or slightly down vs. 2021 in nominal terms.......in practise given two years of solid inflation prints their price to me in real terms have actually fallen as they've failed to match inflation (assuming cash purchase, not mortgage obvs!) In some respects the question of affordability in US housing can be fixed with a little time and inflation.....that acts a little like a pull back in housing but has a minor wealth effect as everybody gets to hang on to their nominal ATH so they sleep well at night and still go to Ruth Chris's steakhouse on Friday nights.

-

Cost of living and end of stimmies/student loan seems to be tempting more labor off the sidelines - it’s an impressive number MoM nominal wage increases have moderated too….those numbers if they were stay down where they are would indeed be consistent with 2% inflation…. The only issue being what company have you ever worked that institutes a pay rise in August…..and given the level of worker comp friction/strikes…. it’s clear a wave of inflation catchup wage increases are coming…..likewise EoY performance & comp season is rolling around AGAIN with a super tight labor market backdrop. Pluses and minuses but I think we are headed for an inflation flare up in the next number of months….which is gonna cement the higher for longer thesis

-

Yep good assessment - hedge funds can successfully have large AUMs that underperform all the time vs. SPY or other benchmarks......the question is whether you are selling an investment product that is supposed to be correlated or uncorrelated.....absolute return or something else.....the simplistic view is always what one would have made if they put their whole portfolio with Bridgewater or <insert> fund manager.......but sophisticated institutional & international investment houses.....are attempting to put large clumps of capital into diversified and inversely correlated sub-managers to achieve some higher level portfolio diversification aim.....lots of bridgewaters solutions for these guys are some form of diversification AWAY from SPY. Macro hedge funds do this too.......short shops also....as an institution/family office you dont give 100% of your money to Jim Chanos and hope he outperforms the SPY....he wont....you give him 2% of your AUM....& when SPY is down 20%...he's up and your portfolio has a smoother ride.....he's selling something akin to insurance. The reality is someone like Bill Ackman/Pershing...is what people think of as 'normal' hedge fund......he's predominantly long, US large cap...and he says that by picking superiorly he'll out perform SPY......you go to Ackman to outperform SPY.......you go to Bridgewater et al for something else than simple outperformance....thats not the job to be done so to speak.

-

@james22 Let me separate the Monopoly 7 from the ARKK stuff.......Monopoly 7 is its own animal........its a hide out for fearful fund managers....but its also to be fair a place where AI & Metaverse dreams can play out (absent anti-trust)......these are at the end of the day finest companies ever to exist with leverage points into adjacent opportunities which are just immense if uncurtailed by competition authorities. The window dressing fund thing possibly has more influence than I think....but not really interested in single digit short term moves in stocks. Not my game.

-

No…..simply because the government as indebted as it’s become post-covid & running outrageous peace time deficits….can only continue to function in a world of inflation….deflation would blow the doors off the fiscal situation…and it won’t be allowed to happen….Dalio and his big debt cycle thesis is correct….we are two crisis deep (GFC & COVID)….each one saw significant levels of debt moved from corporate & household balance sheets to the sovereign….look at the annual deficit & then the debt pile in its totality….then realize that a deflationary bout if it occurred would spell tier 1 trouble for the fiscal authorities in the US and Europe….to the extent that a deflationary cycle happens by ‘accident’….well we figured out how to get inflation back from covid….and it turns out it’s very popular politically….you send people money in the mail and you don’t raise their taxes even though you should. Short version of where we are IMO….is that all risks are skewed to the unexpectedly high inflation side of things….geopolitically….and for the simple reason that it’s in the best interests of the politicians…..and simply you can argue that in some ways it’s in the best interest of us all….the ‘system’ had to get bailed out in 2008 & in 2020…there are no free lunches in life…...and inflating away the debt that we used to stabilize society then by inflating away a chunk of it now is the cowards way out. The alternative….tightening our belt…increasing taxes, reducing conspicuous consumption ….working harder and expanding productivity…is not what happens in wealthy developed societies. Betting on politicians to be cowardly & short term minded….is ordinarily a slam dunk….i think a short term deflationary surprise is possible….but for the reasons above I just don’t expect it to stick around for a hot second.

-

I expect the exact opposite….the ARKK stuff is in trouble again IMO….most likely catalyst is another hike & even more higher for longer talk but more importantly repricing of that reality

-

Yep exactly what I mean - the growth stuff is in for another shalacking IMO. Inflation isn’t just going away….soft landing are fairly tales….and the idea that we may somehow be going back to ZIRP with the inflationary pressures sitting in the background, the decoupling from China & the outrageous government deficits & bond issuances has just completely killed the idea that rates will settle back into a 2010s ballpark….the bond curve has permanently shifted up.

-

Yep lets take a step back here........SPY has gone absolutely no where for over two years..........we were at this level back in June 2021.......its never regained its interim high of 4800. Lets also be clear......SPY earnings have fallen during this period......in nominal terms by a descent amount......and in real inflation terms by double digits. This has all occured during a period when the economy & consumer has remained surprisingly resilient....which is to say earnings have been falling in a 'good' economy...no bueno...which is just never a good thing and certainly doesn't IMO presage a new bull market (whatever that means) The index itself in recent years has become heavily skewed by large cap tech as everybody knows.......the mini AI bubble of early 23 + admittedly more robust earnings by what I would call the 'monopoly 7' as opposed to the magnificent 7 is a function of (1) the surprisingly good economy that was way more rate resislant that anybody had forecasted & (2) well they are monopolies they have unlimited pricing power that they can flex on the pricing side & they have to a certain extent untapped OpEx flexibility too.....because well.....they're monopolies. Dont have time to go look at the median stock in the S&P and hows it performed......dont need too....it hasnt been great.....and again when everybody talks about SPY being flat for two year.....yeah great....but thats not the truth....cause in those two years you had nice big chunks of inflation lets call cumulatively perhaps 15%.....so SPY looks flat over two years....but you actually lost 15% of your purchaisng power. Not good.....but it doesn't feel as bad as your account saying your down 15%. Like I've talked about for an extended period on here......the sources of funds for folks are being slowly constrained...much slower than I appreciated given rate insensivitiy....long duration stuff had a rally as it appeared through the final fall off of transitory inflation in the data that somehow inflation was done (minus any pain) and that a soft landing was incoming. That game is over now........inflation is rising again on the volatile stuff (energy/food) the issue is that volatility upwards is sitting on a foundation of core made in america monetary inflation that was hiding out the whole time and didnt budge in response to 500bps of rate rises......it didnt budge for the exact reasons I outlined in earlier threads.....it was monetary inflaiton driven by too much money chasing too few goods in a economy that was growing nominal spending way in excess of productivity growth such that inflation couldnt go down on this core number.......it is more correctly called wage-price-producvity inflation.....rising wages dont push up prices if productivity is rising by a commensurate amount..what we've had is nominal wages rising feeding into nominal spending that is rising far excess in of productivity such that we breach 2%.......that sticky underlying monetary inflation at around 3.5% is now the basis from which we will take unexpected and uninvited trips back up to 4 or even 5%+ on the headline number unless we tackle this core monetary....there is no painless way to tackle this core inflation....falling credit creation solves a tiny fraction of the nominal spending problem....but it isnt the main source of funds in the economy.....the main source of funds that become nominal spend is wages. The setup remains the same as 2022 IMO.......value is the way you play this......not growth.......and given stagflation is looking more and more likely given I see Powell + Fed board beginnnig to chicken out already......I think you play this more & more with hard assets & commodities....that old dog Buffett buying oil & monoploies like Apple is spot on......I've come to appreciate JOE as a bit like OXY......oil in the ground & land in the panhandle will always command a steady percentage of the endeavours of others......the same way an hour with the best doctor in town will always be exchanged for whatever the nominal sum is that would secure about 8hrs of lowly unskilled labor.....that barter relationship remains constant....its just the quoted nominal price of the currency that intermediates that exchange changes over time.

-

Good deal

-

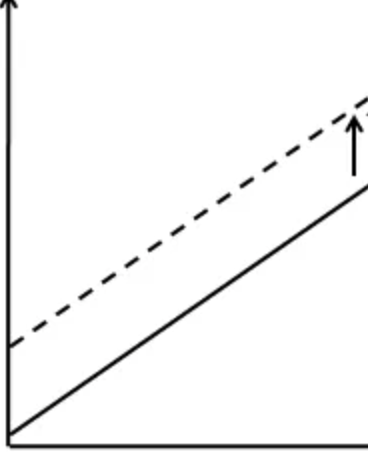

In the same Dimon vein - the whole yield curve is shifting upwards Wasn't about now the time when the Fed was supposed to be cutting rates. The steepening at the long end......or an un-inversion/flattening by another means....is really the most interesting part of this period.........the yield curve shifting permanently upwards and resetting at a higher level is the kicker for assets prices.....a curve that looks something like 2.5% at FF, 4.5% at 10yr & ~5% at 30yr........is just a different world to the one we've been in the 2010's. Reminds me of supply curve shocks in economics.....

-

Interesting graph - the rise of indexing & automatic buying via ETFs is very interesting during this period. Its a great achievement to get so many participating in the market. Perversely I've always thought how if your running a effectively a stock promote.....the best thing that ever happened to you in your life is the day your so called 'company' gets added to the Russell 2000 or similar......you've just achieved the promised land of stock promoters & fraudsters.........at the end of every month a bunch of disengaged price agnostic capital is flowing into your paper. It must be like winning gold in the olympics for these folks. Big picture however getting to 61% participation in the market is a great outcome....and its being done via vehicles (401k's + ETF's) where the worst behaviour of folks is minimized.

-

Forget bonds & equites….get 24ct gold bars this week at Costco…i shit you not just got the notification on my phone and had to look…...takes the treasure hunt aspect of Costco to the next level - $1,979…no idea if that’s good….Costco 14% margin is there for sure…then the Suisse Lady needs to get paid too!!!!

-

Howard Mark's latest memo has a bit about bond investing vs. stocks....how it's what Ben Graham called a negative art......in bonds as long as you can avoid the losers in a specific credit risk pool...the YTM you saw on the day you bought them is what you end up getting......your job is to weed out the losers........the beauty in the bond market ( at certain credit risk strata) is there are so few outright losers anyway......and so it takes in some respect LESS skill to assemble a portfolio where the anticipated YTM on Day 1 gets delivered upon maturity.....and conversely, cause they are so few outright losers, only a modest amount of diversification is required to get you close to the 'advertised' return even if you end up with a loser or two i.e. the delta between your anticipated & actual returns is highly highly likely to be minimal.....which is to say your probabilistic expected & risk adjusted returns are high on a relative basis.....not as high on an absolute basis as the potential in stocks but then you know that already. @thepupil is right the predictably of payoff & risk of nominal loss in the bond market with the yields where they are now is very interesting......and I'd argue we are in a curious time.......I think Buffett said once that when bonds become attractive as investments..... it's highly likely you should be buying stocks.....the curious thing today is that certain bonds do now offer attractive risk adjusted returns here.....equity like in their profile.......yet stocks haven't become attractively cheap IMO in response & it somewhat breaks Buffett's heuristic. Link to Howard Mark's memo below....I find his writing style kind of tedious so recommend the audio/podcast version of these things that Oaktree has started putting out at the same time: Audio - https://www.oaktreecapital.com/insights/memo-podcast/fewer-losers-or-more-winners Memo - https://www.oaktreecapital.com/insights/memo/fewer-losers-or-more-winners

-

Public Company Share Repurchase-Cannibals

changegonnacome replied to nickenumbers's topic in General Discussion

Cutting your shares outstanding by 50% in six years is pretty impressive for LBTYK....now not a perfect buyback....in the sense that they liquitated big chunks of the FCF in the business in sales.......so the s/o shrinking against stable or growing FCF base started to occur around 2019......so they've dropped s/o by about 30% on the stabilized/growing FCF business in the last three years -

Joe Sixpack buying a six pack..or a carton of milk...isnt looking for finality of settlement & censorship resistance.....he's looking for ubiquitous acceptance, low friction & speed....and if/when his payment method (phone/card) is stolen...or a merchant scams him.....he's looking for chargebacks and theft protection. The value proposition where a lightning network beats M & V's value prop above is embarrassingly small..surprise surprose again....the TAM extends to paying for illicit goods and services. . The network simply didnt work in El Salvador........it was a disaster....an implementation flop. Scaling & driving acceptance when you cant support at best a few thousand merchants/customers in your pilot market does not bode well. The technical deficiencies of lightning are stark.......first that any lightning network/layer2 payments solution.....is contrary to crypto ideal.....see the more you want it to actually work.....it requires that layer2 solution to get very centralized very fast....payments at scale are hard....and like every decentralization project I've reviewed trying hard things....its starts to get centralized (in practise) very quickly. There is the age old problem....that is as the complexity of a problem grows so too does required effective centralization & concentrated control required to ensure its continued successful functioning & improvements.......its analogous to anyone that has worked on college group project or on a company project.......every successful project begins somewhat decentralized and shared across the group.....very soon as folks go around in circles getting nowhere a natural and needed centralization occurs...a natural hierarchy of responsibility & control....the crypto decentralization dream....that complex problems in the economy can be replaced by decentralized autonomous blockchain solutions is the deluded dream of mainly solo computer programmers who work always on their own in their basement or folks who never really had to deliver a truly complex robust solution at scale to the public.

-

Yep - inflation expectations are still the big thing....they remain anchored through this whole thing which is really a big win in an age where so many have lost faith in institutions.........lots of the recent pay disputes are somewhat about restoring purchasing power back to 2019 levels.....the danger as always broadly is that. (1) consumer inflation expectations move up such that wage disputes start to become about front running future inflation & (2) more importantly for investing that the long end of the curve begins to incorporate higher long run inflation expectations from the bond market and you get the 10yr/30yr moving up.

-

Yep.....especially economists of the left heading into a presidential cycle. You can call inflation data bullshit...it for sure has flaws....but the reality is the best inflation indicator is do people notice inflation in their daily lives or do they not.....and how much they care about it. The reality is contemporaneous political polling speaks to the inflation problem better than CPI....Core or SuperCore ever could....inflation isnt over when its sit as the the No.1 political issue (above healthcare!!!!) when pollsters speak to voters:

-

Listen it’s time to accept Bitcoin as a future method of payment beside Mastercard & visa rails for digital payment dream is over….layer2 protocols and the lightning networks chance to shine was in El Salvador….apart from the fact that layer2 protocols break the religion of crypto decentrlaization (cause it turns out to run an instant payment method that hopes to have V/M level transactions it actually requires a lot V/M centralization to pull it off). So now you’ve built something that looks like Visa Mastercard…a centralized-esque layer2 solution…with inherently less consumer protection/chargebacks/disputes such that it’s less consumer friendly…ok maybe it’s cheaper….but driving adoption for payments via cheaper interchange fees has failed….debit carrys tiny fees/discover has tried to undercut fees at times…merchants god bless them can’t get people to use them instead of CC’s…..the consumer is in the driving seat here…..but to top all that business dynamics & competition setup off….whatever layer2 protocol built on BTC has one MASSIVE problem….it ultimately has to phone home to BTC’s crippling slow spreadsheet to update….a spreadsheet that would make an oracle database solution from 1985 look like it was designed by aliens from another planet given its relative ability to process database changes. Gold is never going to be a currency it’s a store of value BTC’s last hope isn’t global payments enabled by layer2 nonsense built on it…..it’s a digital gold….a more portable virtual lives in your mind version of gold. This it has a shot at….id advise those in space….get down to business and make that dream come through….and don’t waste your time with this payments pipe dream.

-

Yep agree with this...and as expected from my point view and flagged a number of months ago......the problem for the inflation is toast folks.......is that during this whole time as the headline mathematically fell MoM in a kind of super late transitory COVID inflation rollover glide.....what didn't go away, in fact hasn't budged nearly at all in response to 500bps of monetary tightening is a very unpleasant fact....stuff that doesnt get on shipping containers in China but is rather produced domestically here in the US.........services......which account for 'only' about 70% of GDP......have been bubbling away consistently under the headline inflation is falling narrative at around 4% annualized....in the best month over month readings so more contemporaneously in mid/late-3's. The issue at hand as the Fed knows all too well........is that those types of numbers create an inflationary floor of 3%-3.5% for the US.....what I would call a fair weather floor.......on top of which inflationary surprises known (energy, commodities) and unknown move you up very unpleasantly, surprisingly & quickly into the 4 or 5% ranges. It will be interesting to see what happens next.......Fed Funds relative to inflation today.....has created 200bps of genuine monetary tightness......that tightness has emerged only recently and in response incremental modest rate rises (the last few 25bps rate rises) twinned to genuine falling in inflation. The big mystery is whom is actually feeling that tightness and is it enough to drive down aggregate nominal spending growth sufficiently...its not quite showing up.......corporates & a great many households fixed significant debt during ZIRP.......higher for longer has always been my base case......but its starting to feel like some more tightning might be required to end this inflationary cycle.......Fed funds perhaps needs to go higher at the short end.....but in fact the tightening may come from other sources....and that's an un-inversion of the yield curve in a way that folks haven't been predicting and that's an universion driven by the long end.

-

Exactly - to us the NATO expansion is of course innocent “we” would never be the aggressor….NATO is a purely defensive organization with benign aims*..…an opposing power however, Russia in this case, must assume the worst of NATO….paranoia is both the natural order of the international system but ultimately the correct posture. As great power the US has this exactly correct with the Monroe doctrine…..not a single piece of foreign military hardware can be placed anywhere in the Western Hemisphere. End of story. The cost of assuming the best of intentions from your enemy and getting it wrong - is that you don’t get to exist anymore. *lets be clear however it’s well understood and accepted….NATO was a mechanism by which the USA post-WWII got to contain the USSR as a peer global competitor