changegonnacome

Member-

Posts

2,694 -

Joined

-

Last visited

-

Days Won

7

Content Type

Profiles

Forums

Events

Everything posted by changegonnacome

-

Thats a good word for it .......the likely culprit will come out in time I think......the fact the definitive finger hasn't been pointed at Russia/Putin when it would be so advantageous & frankly politically popular to do so now.....strongly suggests (but of course we cant say for sure) that it certainly wasn't the Kremlin......after that its a means & motives game. Nord Stream AG - a sub of Gazrprom......like I said a Russian pipeline........without even checking......& assuming/pretending under the sanctions regime post-invasion that Nord Stream AG & its assets were seized by Germany it would still not make sense as Russian to blow it up. Why? Clearly in a negotiated settlement a rolling off of all sanctions and a return of seized assets to Russian entities would part of any deal. Again you dont blow up that which is yours.....or that which might be your again in the future. Anyway pure speculation but somewhat of fun mystery.

-

Yes I agree with this too - I’m more familiar with the EU’s regime…which is just way more sensible approach than what SEC/CFTC have done in the US….which is to just say that all the rules on the books for this ‘new’ asset class already exist. The EU kind of knew all the rules were on the books for the asset class already……but they decided to bring clarity to the situation with the MICA wrapper…..and in doing so removed the ‘grey area’ /regulatory arbitrage game which is at the heart of many a crypto project. The ‘Markets in Crypto Assets (MICA)’ regulatory regime in the EU was indeed put in place to finally put to the bed the idea of grey areas or confusion in the EU that many crypto promoters have used as a fig leave behind which they could carry out low cost/low overhead securities offerings etc……the trick in crypto before MICA and up until very recently in the US…….was to get a legal firm to write you a letter stating that what you were proposing to do in their opinion was either (1) not a securities offering under current law or (2) regulation was sufficiently unclear, undeveloped & activity so unique such that the law firm could not apply the rules on the books with certainty to your proposed business plan……….or a mixture of both. How do I know this - I’ve met a bunch of these folks through an acquaintance in the space…….in US terms then…….you effectively created an LLC shield through which this security would be offered…..you then collected these opinion letters from your lawyers & sent them $$$$ in exchange…..one letter for the company…..one letter for you personally as the CFO/CTO etc…….you put them both in your home safe under lock and key…….as a future legal defense.shield if/when things went south…..safe in the knowledge that there was literally thousands and thousands of securities/token just like yours being launched in 2020/2021 anyway so highly unlikely you got singled out for prosecution by SEC. That was/is the game…..Coinbase and the compliant if upheld in the courts kinda ruins that game. However back to MICA……..what the EU did with this legislation is they effectively put a crypto overlay around their existing MIFID/E-Money & payments institutions and AML legislation…the VASP registration is the only technically new “license” that got created…..and even that is really just a light touch AML regime lifted from existing E-money & Payments institutions licensing …the result of MICA is it classified and forced every crypto activity you can think off into an existing regulatory lane, that ultimately saw them fall into a bucket of existing financial services regulation already on the books in the EU. Done….the legit players stayed in the Europe & got license and all the phony/frauds decamped or re-focused on schemes in the US & Asia. Crypto scams in the EU, post-MICA, had their legal jeopardy increased 100 fold……and legit crypto firms saw their governance & compliance costs go through the roof such that many were rendered deeply unprofitable. I’m proud of the EU in this regard…..they didnt bury their head in the sand…..they did what bureaucrats do with some things they don’t really like or believe is legit….. they strangled it in red tape & costs. If TradFi can exist profitably in that regime….it must have an underlying business model that can sustain the compliance costs…….if crypto cant well perhaps the business model, like many others in emperors new clothes FinTech, was really just a game of regulatory arbitrage all along.

-

Isnt the puzzle we are all grappling with more akin to the below title: “New secular bull market- 2023 to 20xx?…or the last thrashes of the 2009 to 2022 bull market? I tend to start at the start - that market cycles are dominated by the credit & economic cycle…..and so I’m interested have we reset such that the median household (Joe Sixpack) has incrementally more money to spend moving forward than they did in the past (more precisely, given inflation, is the basket of goods and services Joe can command increasing relative to the year before) My conclusion is that median US/EU household has both a dis-improving balance sheet & income statement (as measured in purchasing power)…..which is not the base recipe required for a new secular bull market in equities. An improving balance sheet & household income statement - comes after inflation has been brought down below nominal wage increases……and when the yield curve steepens encouraging growing credit…when those two conditions are met Joe Sixpack gets to expand the basket of goods and services he consumes…….as opposed to the contracting or at best stagnant basket of goods and services Joe is getting now. Simples

-

Your kind of dancing around the answer it seems. Like any crime its a question of means and motive - and whats the phrase - when you have eliminated the impossible, whatever remains, however improbable, must be the truth. In terms of Russia. Destroying ones own infrastructure……..doesn’t stack up. This is Nordstream…owned and operated by Russian companies…..a piece of infrastructure that had benefited Russia financially in the past….and in a post Ukrainian war/sanctions scenario could benefit Russia financially in the future….….and it’s Russia that is selling the gas in the pipe right? Why blow up something that yours and where you control the flow of the strategic valuable contents going through it anyway?…withholding the gas causes problems for Europe, the pipe is just a pipe…..at the end of the day to stop the gas flowing Russia decides to turn a valve at the other end end. Simple you dont need to blow up anything to deny gas or strangle the EU of energy. Russia has the means to do it but not the motive. As the culprit they dont stack up. Ukrainian operatives…….would certainly have the motive but Id be very surprised if they had the means to do so. It wasn’t, for sure, the European union heading into the winter of 2022 desperately trying to fill up their gas storage tanks. I wonder who else had the means and the motive to blow it up?…….like who has long despised and counseled the EU & lobbied Merkel against Nordstream and ever increasing economic ties with Putin…….who benefits strategically & economically longer term from a severing of the economic & political relationship between the EU/Russia. Who has gas to sell and would benefit from a permanament switch to other suppliers? Who benefits from Russia being economically crippled & isolated over the long. The US had both the means and the motive here. Did they do it - I have no idea. I dont like conspiracy theories…I also dont like admitting that a country I love and admire could do not nice things…..but countries doing not nice things in their own self-interest is like the history of the world…..but for sure you can’t rule out the possibly that the US blew it up. Means and motive fits…..what doesn’t fit of course is that one of the ‘good’ guys could carry out an act of such blatant self-interest…..it doesn’t fit with the good guys and the bad guys world of moral simplification that we like to live in. The fact the investigations and reports are completed yet various European governments sit on the information is a little bit of the tell here…the investigative conclusion dont fit the narrative of the day so they are put in the vault…..…if it was Russia that blew it up the results of the investigation would be all over the news.

-

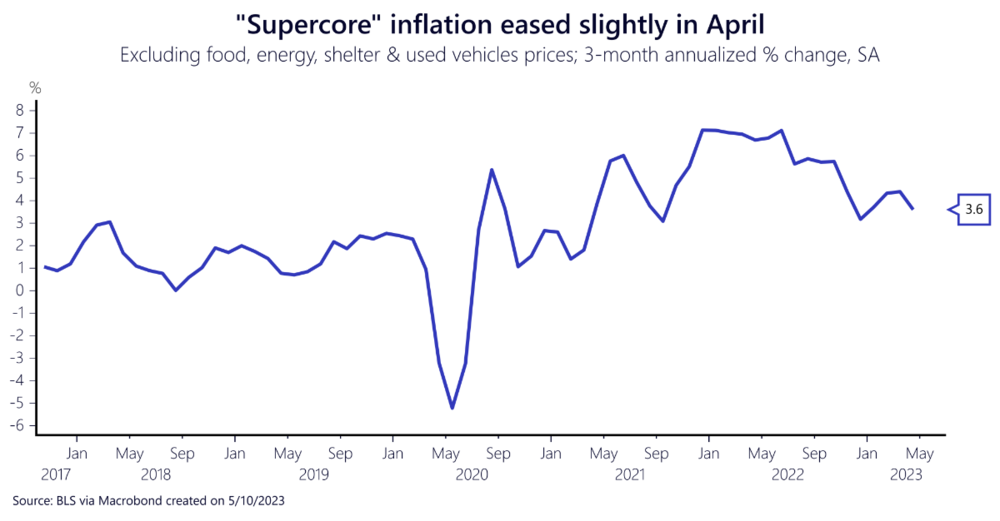

Greg you know thats BS as it pertains to my position - go back to my posts from late 2022/very early 23 in this thread.....and those posts from back then were a back and forth between you and I in the main.......i was talking to you back then about domestic inflation...made in america inflation i called it, occasionally I called it "underlying monetary inflation"......might have used sticky & underbelly too ....and that one needed to ignore foreign goods, supply chain stuff, energy, shipping container stuff as it was destined to disappear & roll-off..........I despise folks moving the goal posts so dont like getting falsely painted with that brush .......I've been 100% consistent on the nature of the inflation problem in the USA....never claimed it was persistent 9%....always guided to mid-4's, maybe 5 at a stretch inflation absent any cracking in the labor market/economy..........anyway I used to call it 'made in america' inflation....till this new supercore inflation name became dejour.......I decided to start using it as folks woke up to the real nub of the issue......about six months after i was talking about it! I'll take a tiny flea sized victory lap on that one.......albeit my expectations around the speed by which the US economy/labor market would detoraite in the face of 500bps in rate hikes has been off by about a country mile and for which I give myself an 'F minus'! Don't steal my 'made in america' inflation victory away

-

We've talked about this before - invading, occupying and conquering the whole of Ukraine was never the plan.....how could it have been?.......an army of perhaps 250,000 max was gathered on the borders of Ukraine in Belarus before the invasion. The plan was to topple the Zelensky government........remind the population of Ukraine it lives in the shadow of Russia....get a pro-Russian or at least not pro-Western government.......and get a deal for the Russian-speaking Oblasts in Eastern Ukraine. To try and occupying and conquer the whole of Ukraine, with Russia's limited military capacity, would be just beyond their capability.....Eastern Ukrainians have no interest in being part of Russia, they would be nightmare to try and control......occupying this part of Ukraine would be like trying to swallow a Porcupine (in Mearsheimar words). It's a Western fantasy to think that was the plan.......pro-Russia government, puppet government....for sure.....I think their long term territorial ambitions extended & still only extend to effectively what they occupy today....an area that before the invasion was something like ~40% ethnically Russian & 60% ethnically Ukrainian........the invasion has I'm sure completely upended the demographics and made the Donbas even more Russian than it could have claimed to been before. Short version IMO - Plan A - was to topple Zelensky, in a swift drive to Kyiv......remind (scare) the Ukrainian people that Russia will always and forever be their large neighbour to the East with a military capability that far exceeds theirs........in doing a puppet government or even just a scared Ukrainian centrist wartime coalition government would go to the negotiating table with Putin and hand over the Donbas & sign away Crimea. Plan A clearly failed. The Ukrainians fought like lions and the Russian forces proved inept. The West rallied in a way Putin couldn't believe. Plan B - is to invade, occupy and ultimately conquer the Donbas territories while keeping Crimea and absorb them into Russia proper......what remains of Ukraine....the non-ethnically Russian regions the part IMO Russia has no interest in absorbing/owning..... as they quite rightly believe it would be impossible to permanently control anyway (perhaps 75% of the Ukrainian landmass)......will be sent back to the stone age with artillery fire & bombing till such a time that the Kyiv government comes to Russia with signed assurances around the future of Ukraines neutrality......no nato, no EU, limits even on Ukraine offensive military capabilities........Russia wants to neuter Ukraine........it would prefer it to be Belarus a vassel state....but neutering would work too......until such a time that happens the plan is to just wreck it such that its no good to anyone.....Ukrainian, American, EU or NATO.......Russia never had any plans for this part of Ukraine so destroying it costs them nothing.

-

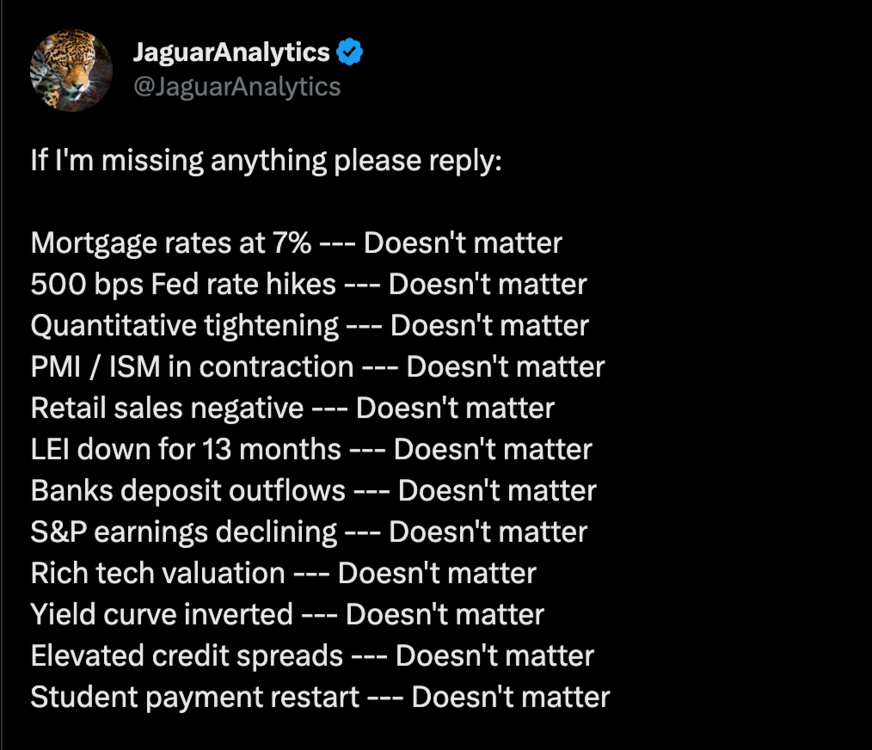

That just isn’t so - with SuperCore sitting where it is and not moving down for months now….headline will find it impossible to get below 4% this year…. Ultimately what I find quite alarming is that once you come to the conclusion I have , from the actual data, that the inflation fight isn’t behind us….and that 500bps of raises has achieved no progress on domestic made in America monetary driven inflation (SuperCore)….& that the disinflation that has occurred to date has pretty much had zero to do with the Fed hikes it was simply late departing transitory inflation that was going away anyway…..and so the sticky persistent inflation underneath that remains has been immune to 500bps of rate hike hikes in 15 months….I find that quite alarming relative to how high rates may need to go given the rate insensitivity of the economy……I genuinely think, a bit like Druckenmiller, that they are some fat pitches to come. Happy to participate in this rally but feels like a great place to bank some gains…..build some liquidity…..and wait and see if Powell is gonna walk the walk late summer, fall…..cause all the inflation data to date is demanding the Fed gets more aggressive. Let’s see maybe the June/early July data on supercore surprises…..if it doesn’t things are gonna get nasty starting ~July 26th……watching the 10yr/30yr heading back towards 4% over the last couple of months shows I’m not the only one concerned that Fed is failing to bring inflation back to target.

-

Really appreciate both your feedback here.....genuinely wrestling with the idea/concept.....but the devil & detail and line that needs to get crossed from just selling a thing to selling an investment contract is a subtle one & I think the SEC has got it about right.....just went through the Coinbase compliant where they run the Howey test rule over some of tokens in question and its hard to disagree with them when you visit the white papers that started these ICO's or ITO's. To be clear I completely agree with you both that BTC & Doge are not securities. In terms of your example @rkbabang isnt the point that the shiny metal beads......can come with promises vs. representations (which are very different) from the seller of the bead around what THEY are going to do post-bead sale to drive up the value of the bead soon to be in your possesion...... so explicit & implied project timelines & milestones and things that they the founders/creators are going to do after the initial sale...the usual stuff about how the promoters are going to increase adoption & the usefulness of the underlying such that metal bead becomes more valuable over time. Put it like this - I've never seen a token sale......where the pitch is here's a token we've created to be sold at 0.000001cents on July 4th......and absolutely nothing is going to happen after you buy it! Zero, zilch, nada. Doge which @TwoCitiesCapital mentioned is an example of this....I 100000% agree......its not a security....no promises to do anything post-creation/sale was implied by anyone.........quite the opposite. Put another way using your example......if you sold me a metal bead.....and told me it would be worth more one day just because you taught so and that was it....and I bought it.......thats bad on me for believing it. Your a huckster or maybe you believe it too who knows. People who sold beanie babies to each other online were these people - no investment contract, no securities just morons. However, and this is the key point >>>>> you made no promises about what YOU personally would do post sale of said bead...to increase the value of the bead I'm about to buy from you. You told me your opinion/believe about the future value of the magic bead in your possession, sold me one & we parted ways. Your future endeavors have nothing to do with the value of the magic bead now in my ownership. So yeah I totally agree in this instance..... no investment contract was created either implied or explicit. It is the sale of a metal bead from a wise man to an idiot....or maybe just between two idiots. However if you sold me a metal bead....but lets be clear in a token project you are being sold a unique type of metal bead not a commodity bead (last time I checked cardano doesnt work in solano slot machines type thing).............and in the sales process to get me to buy YOUR specific metal bead with rkbabang embroidered on it......you told me about your plans that these unique beads with your insignia on it (RKB token)..........will become a right of use token bead inside of software project your currently working on with other genius developers that did X,Y,Z and that if successful & adoption increased of your software project that the magic bead you are selling me today will go up in value because people will need it as gas and after we settle the transaction for the RKB metal bead heres what I'm going to do as soon as you give me your money - action items / timeline/roadmap/business opportunity/value proposition. So after all that ---- you say to me- would you like to buy my rkbabang magic bead now?.......that is fundamentally different transaction than the one above.......one is a sale of thing....opinions may have been shared about its future value but no promises were made.........the other is a creation of an investment contract......and what I just described above is contained in every single 'white paper' document I ever read for an ICO or ITO (except Doge!) As I said above @rkbabang & @TwoCitiesCapital...........send me a token project white paper document (excluding BTC & Doge) that says within it we are launching this token and selling it for 0.0000001cents on July 4th........and absolutely nothing is planned by the authors of the white paper once the token is sold to you.......nothing is built which will go live or nothing is to be built, no portal/website or service will 'go live'...... .......nobody will use this token for anything. Its just a token caveat emptor! That white paper doesn't exist - maybe it does & its just called Doge coin. Cause the authors of white papers and creators of tokens, but lets just call them entrepreneurs & promoters, all make explicit promises in a token sale about what happens next, what will 'go live' and why people will care about it cause it does X,Y,Z faster/better/cheaper ultimately. So maybe I revise my thoughts - what makes an investment contract is not intent to make money at creation.............its the promises & representations around future actions the seller of the token will do post-sale to enhance the value of the underlying thing that they just sold.........its this that changes the nature of the transaction..........its the commitment and representations that the seller will do X,Y,Z post-sale to increase the value of what they just sold you.....this how a 'thing'......gets turned into a security. Somebody sells me a baseball card of Babe Ruth - we just transacted a thing........somebody sells me a baseball card with @TwoCitiesCapital on it but in doing so he promises post-sale that he will be establishing a secondary market in twocitiescapital baseball cards on a website & will then start marketing the card as unique & special to drive attention to these cards........and then after that he'll open up a casino in vegas where only twocitiescapital baseball cards will work in the slot machines and so all going well what I sell you today for 0.000001 will go up if he's succesful ........well done...... you just managed to turn a baseball card into a security & the SEC wants to talk to you about it!

-

I would suggest that certain, mass hysterias come along like beanie babies that become trading sardines with profit expectations.....the toy company that created beanie babies had no intent around them becoming a speculative vehicle with a profit expectation after they were purchased......their intent was to sell them, as many as they could...... in a transaction that started and stopped at the cash register.......it was a fluke, the profit expectation was created not by the sellers of beanie babies but by the minds of the buyers of beanie babies. Its subtle but hugely important difference here. Diametrically opposed to the above every crypto token project on Day Zero begins with the principle that the tokens value will go up over time...that the token transaction doesn't start & end at the cash register......see they are creating a 'thing' with a profit expectation from its very moment of inception. THEN because these tokens & architecture, press & PR don't will themselves into existence autonomously (they aren't base commodities)......it means the tokens very creation & existence depends on the endeavors of others to create them.....it means they have founders & promoters. Sure sounds like a security to me. The commodity argument barely holds weight - there is no entrepreneur/founder of true base commodities...... bronze, gold or wood......these things just EXIST.........the founder/entrepreneur who created commodities is GOD/the Universe (if you believe in that sort of thing )........a token ALWAYS has a founder or a group of founders.....it is ALWAYS willed from non-existence into existence by the endeavors of other human beings......it ALWAYS has baked within in its DNA, its very creation a profit expectation. There is a difference between beanie babies, commodities & this token stuff - and it boils down to intent at (1) the very moment before its creation i.e. a profit or no-profit expectation built into the DNA of the 'thing' being created & (2) because these things aren't base commodities, they don't EXIST..... they require a creator/founder/promoter to create them which satisfies the second leg of the SEC's argument the ' endeavors of others'. & (3) because the transaction doesn't start & stop at the cash register for the token it has an explicit or implicit contract baked within it....it sure starts to look like an investment contract.

-

Im tourist in this space so dont want to suggest I have strong convictions on what I'm about to say - however - every token I ever looked at that seemed vaguely interesting.........clearly had a profit expectation.......and then when you looked into the 'project' itself....all the promotion of the project was very much centered around who the bunch of individuals were who had (a) started/founded the project & (b) the on-going success of the 'project' very much depended on their endeavours cause they were geniuses or had done X,Y,Z before etc.. The classic project pitch was the folks involved in this new endeavour were founding members of Etherium etc. and/or were very close friends of Vitalik Buterin etc. and that this was Ethereum except it would scale better. Literally every 'pitch' I ever saw....had these two elements in it. Profit participation through the endeavours of others......sounds very much like a security to me.....albeit with various somewhat distracting ambiguity which felt like a purposeful distraction to make the token not seem like a security.......usually that the token itself was also both the reward mechanism while simuntasouly being the voucher required to make the service work i.e. 'gas'.......... the supposed project was being run by a DAO etc......yet the decentralized org.....had a press department that constantly and consistently pumped out press releases........and all the attention around the project was centered cult like on 3 to 4 individuals in the project....which looked pretty much like an exec management/leadership/founders team to me. Walks like a duck, quacks like a duck.

-

Google and Meta are potentially coming to put a bid under CRE.....both dropping the hammer in the last few days in company memos tightening up their remote policies moving forward.....senior exec management but especially middle management needs/wants bodies back in the office.......leverage has been the only thing missing up until now to achieve that & it seems Meta and Google felt the scales are tipping in their favor in the last month or so such that the time had come to drive the herd back into their hotdesks and cubicles. There's a price for everything and lots of this CRE stuff needs to come back to reality........but like lots of trends it will get over baked at a certain point.......I like this thread CRE soon, if not already, will become the most hated asset class out there. https://www.washingtonpost.com/business/2023/06/08/google-salesforce-return-to-office/

-

Whats the bull case for COIN from here - outside of BTC trading.........effectively every other token on the platform/exchange has been deemed to be a security..didn't COIN business shrink by orders of magnitude?...assuming COIN gets even a broker-dealer license......what percentage of these tokens/projects economics would sustain a US/EU securities registration and public company disclosure requirements....never mind the exec management teams or leadership teams signing sarbanes oxley etc. My guess is not many and 95% will just choose to trade offshore in El Salvador with convoluted backdoors into the USA. So whats left - BTC broker/custodian.......isnt that commoditized now......fees are compressing and the SEC just shut down your adjacent market opportunities to trade other exciting tokens.

-

I totally agree. This Ukrainian / Russian conflict is the new Vietnam/ Afghanistan….both those involved the US spending blood and treasure….so far in Ukraine it’s ‘just’ treasure….the real cost however should be measured in its strategic cost. Russia’s ever closer alliance/dependence with and on China which is not good….but importantly the lack of focus on where the US’s focus should be which is in Asia, not Eastern Europe. The real winner inside this mess is Did you watch the Jake Sullivan video I linked too - implied in the section that begins at 6m40secs….is, let’s call it the administrations pipe dream, that the Ukrainian counter-offensive will be so successful that it will force the Russian’s to the negotiating table later this year for talks and where Ukraine inside those talks would be dealing from a position of strength such that a deal could be done that would be acceptable to the Ukrainian people but more importantly acceptable to the Ukrainian hard-right which Zelensky has to cow-tow too. To have the US national security advisor even imply such things in an interview must warm the Kremlins heart - the US administration is already fantasizing about an exit.

-

Yeah when I heard it though the “counter-offensive / year end negotiations with Russia” it sounded like he misspoke….but I haven’t been listening to US talking points recently….is that the party line? I mean you can’t help but hear that the US would really love to ramp down support and involvement in Ukraine in Q4….as I said though…the idea the US could ramp down involvement now is the most laughable part of that this thing is gonna end at the negotiating table so soon.

-

Saw this interview on Sunday with Jake Sullivan - it jumped out at me then and I went back to re-watch it now and it's as I remembered it. 6 minutes 40 secs in you get to the meat of it........you hear a US administration turning its attention away from Ukraine and towards the 2024 presidential campaign..........if your Ukrainian listening to this, the subtext is clear........you've been backed to hilt to date and you've got one more push with the US's unadulterated support.....make it good one, make it count cause its the last.....in late 2023 support will be backing off and we'll be suggesting intensified diplomatic engagement with Russia........i.e. make the counter-offensive good so you've something to barter at the negotiating table.......cause Jake Sullivan and the Biden crew wants this conflict out of the headlines & out of the congressional budget heading into 2024. Its kind of naive in some respects to think the US could get out of this boondoggle this early.....the reality is the USA has got itself involved in what’s very likely to be a multi-year if not decade long conflict….that SUCCESSIVE presidential administrations will curse ..........but Jake Sullivan’s word soup is music to Russia's ears.......like all its foreign conflicts in far flung places America is a tourist in the region & a fair weather friend.....it thinks in weeks and months.......Russia isn't going anywhere, it cant, its stuck there in the region damned by geography....it thinks in years,decades and centuries.......it will forever and always be neighboring Ukraine & it will always have deeply ingrained stake in its Western borders where East truly meets 'the West'.... nothing except Belarus and Ukraines neutrality at a minimum is acceptable to them ..for the folks that think that Ukraine, with the Wests help, can 'beat' Russia who do you think exactly has the greater resolve here? Russia or the US led West? Especially now that the conflict has descended into a World War One-esque war of attrition? Skin in the game and resolve win wars like this…. Not quickly….but in the end…. just ask the Taliban. Russia and Ukraine have equal resolve in this matter and equal skin in the game….The only issue is Russia’s war effort is, in the main, being sustained by Russia itself with its own captive war machine…it’s economy isn’t in great shape but at least it has an economy as compared to Ukraine….Ukraine’s war effort & very economy is being sustained by foreign aid payments and its war machine isn’t in its control….it’s artillery & weapons capability is outsourced to the West and based on their success in lobbying other nations to send/gift them the equipment they desperately need. One nation in this bilateral conflict is in control of its own destiny, the other is relying on the kindness of strangers. I know what strategic position I’d rather be in.

-

Recent lecture from Mearsheimar - he definitely says things that are non-consensus…..and certainly not what the BBC, CNN or Fox likes to hear from the usual ‘experts’. I listen to Mearsheimar because his opinions are so unpopular for a western audience to hear……that you’ve got admire but more importantly listen to a guy who in the middle of Zelensky beatification on western tv and social media channels turns around and says he’s a jackass to poke the Russian bear instead of doubling down on the Minsk agreement and making concessions around the Donbas. With Ukraine in ruins and likely to get even more ruined over time….Minsk had alternative route in it….having some Ukrainian but Russian speaking majority Oblasts in Eastern Ukraine in a kind of joint administration/ power sharing zone with Russia….relative to what we have now….it would have been a blue sky alternative reality.

-

-

My base case is they tumble from here......the ones that are economically sensitive and exposed to a hard landing for sure. This feels like a wonderful and surprisingly elongated bear market rally. In some ways the length of the bear market rally is a function of how long its been since we actually had a bear market (08/09)......the Pavlovian response of buying the dip has been taught to the dog for 14 years...its hard to undo deeply ingrained neural pathways.......you could argue the training has been in place since 1981 when long term bond yields started their four decade long secular fall.......literally a whole career in equity investing could have passed with the long term bond yielding less and less over time.....what a wonderful tailwind. Certainly feels like H2 is going to get very choppy for markets I think as either (a) the Fed gets what it wants and things start to deteriorate with the economy from a fundamental basis or (b) things don't deteriorate..........and the Fed is forced to get surprisingly aggressive with an incremental wave of hikes. Either way the 'no landing' dream goes out the window.......and what emerges are questions around the severity of the coming recession. I remain convinced that 4.5% inflation can only be brought back to 2% with a fundamental weakening of the economy something in the vicinity of ~5% unemployment rate (but more likely 5.5% just given Sahm rule) & negative GDP. The only question I have left is given the demonstrated rate insensitivity of the US economy has the Fed done enough at 5% FF or does surprisingly high to get the labor market to roll over. I'm leaning towards higher and 6% FF.......50bps in July as little excercise in shock and awe....and if the data doesnt start to weaken in late summer/fall in response then another 25bps in September & October. The FF rate isnt the point.....the point is they are determined & a little surprised by the resilience of the US economy to date......and as a central banker it must be quite alarming to be almost a year and half into this.......and to realize that underlying domestic made in America inflation (SuperCore) has not shifted one little bit after 500bps of hikes! One thing is clear.......unlike the Chinese consumer........the American consumer spends like a drunken sailer on shore leave......when you think about putting your economy into a central bank induced coma you've got to worry about your ability to bring the patient back to consciousness i.e. spending again.......there should be no such worries here.......in Europe it can be very hard to get the patient to wake up after a spending coma......and I think the Chinese live in fear of their savings rate spiking & domestic consumption plummeting.

-

Assuming these said appliances got on shipping containers and I’m sure they did - you might remember me saying six months ago that Made in China/S.E Asia inflation was going away (Goods) but made in America inflation (services & domestically produced goods I.e. SuperCore) was not. Ultimately that’s exactly where we’ve ended up….complete non-movement on SuperCore inflation happening contemporaneously MoM…. The reality of which is pointing to the Fed to resume rate hikes beginning in July, or even as early as June. SuperCore will go away too - don’t get me wrong - but you won’t like what’s happening in the real economy & to US equity indexes while it does.

-

Sticky in respect that its removal will require force…..non-sticky inflation just goes away on its own. Immaculate disinflation or the soft landing camp. The 9% to 5% inflation journey was a cakewalk…it was immaculate & soft…however that portion was transitory inflation, it was “non-sticky”….5% to 2% inflation however…is sticky in the sense that the backdrop to this portion of the disinflation journey requires falling nominal spend, rising unemployment and negative GDP. Mainly because this portion of inflation is being driven by an over-heating domestic economy…operating beyond its natural equilibrium and constrained by demographic & labor force realities….in essence growing nominal spend substantially quicker than its growing real goods but mainly services. So guess we are saying the same thing - when I say sticky….I don’t mean it’s never go away but rather it’s not going away with zero pain.

-

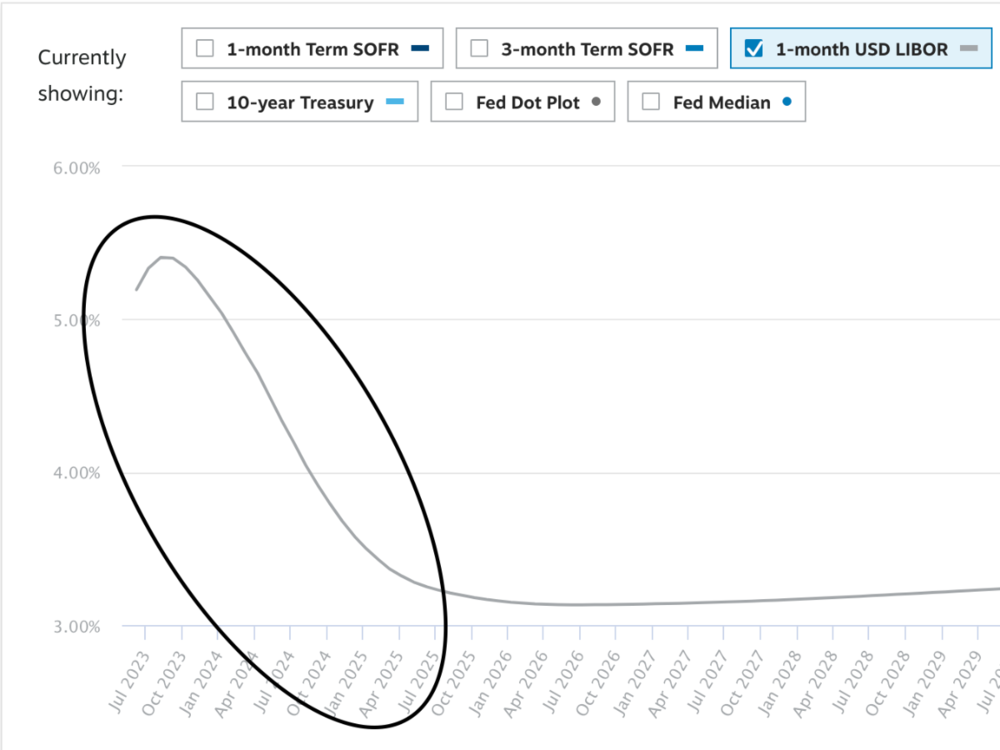

I look out the front window too...5-year break even is half the story........the question from the 5-year break even is why is the bond market so confident inflation is going back to normal?.......I suppose there's those who think employment doesn't break and we've no or an ultra mild recession & we magically get back to two. The immaculate disinflation camp. The only problem is your 5-year break even that your taking comfort in....is imputed by the same bond market participants that create the LIBOR/SOFR forward curve (below)...........if you believe in one, you should believe in the other......the forward curve is sign-posting a recession and not a mild one......mild recessions don't force the Fed to cut as aggressively as the forward curve implies. The bond market is saying that this inflationary bout doesn't end in a whimper, it ends in a scream.

-

Another little counter to the "sea change" argument as regards post inflationary period interest rates returning to ZIRP like levels......is the below R-star model that the NY Fed's John C Williams has just restarted post-COVID craziness: Speech: https://www.newyorkfed.org/newsevents/speeches/2023/wil230519 R-star Forecast - https://www.newyorkfed.org/research/policy/rstar Listen crap in, crap out models have problems......but if the RStar model is to be believed....once inflation is 'fixed'.....there isn't anything in the model right now to suggest that we need substantially structurally higher interest rates on the far side of this inflationary bout. Guess you could add the productivity miracle that LLM's might spur and you've got strong disinflationary forces supporting a return to ZIRP. Driving inflation & structurally higher interest rates in response you've got the slow moving 're-shoring' trend............ & the energy transition which will require gobs and gobs of capital to complete.

-

Larry saying what I've been saying for months - take the 9% inflation rate peak.......and the mistake folks are making is that about 50% of that peak rate was indeed transitory it just took longer than some expected to roll off....but it did....we've enjoyed a nice linear journey from 9% down to 5%......folks are extrapolating the progress from 9 to 5 as indicative of the ease by which we will travel from 5 to 2....the issue is the other 50% of that 9% inflation rate (the underlying inflation) is not transitory......the rubber is hitting the road now as we start to hit this sticky inflation......sticky because its been driven by nominal wage increases that are feeding into nominal spending growth that is exceeding productivity growth. Its clear to effect the equation which is driving this 4% sticky underlying inflation that hasn't moved a jot in months that the labor market will need to get hit. So the question isn't if this will happen, the Fed can through its ability to set the most important number in the economy slow it....the question is rather when. The easy inflation progress 9% to 4.5% is about to run out of steam very soon....4.5% to 2% is gonna be a bitch.......don't see many talking about rate cuts in September anymore.....quite the opposite....another raise is coming in July (if not June).

-

-

Oops @TwoCitiesCapital you nailed it while i was typing similar - spot on......its something that works, until it doesnt work....you dont want to be around when it stops working!