Xerxes

Member-

Posts

4,626 -

Joined

-

Last visited

-

Days Won

6

Content Type

Profiles

Forums

Events

Everything posted by Xerxes

-

This goes without saying: I couldn’t not have done that without you guys. Not that I am trading in or out or anything. I barely bought 3 times this whole year. And with no sell. But i am capturing a lot of value through this forum that eventually becomes seeds for future growth. The seeds of 2023 were placed several years ago as I was reviewing this forum during Covid time.

-

Now that I had chance to run the numbers: 2023 => 24.81% 2022 => -11.48% 2021 => 20.09% 2020 => 11.36% I should add that the numbers are artificially high because of the low base from which we started 2023. The seasonal bounce was fully captured. I don’t remove funds just add to it. These numbers are net of the additions. But not net of the market return of interim additions. Example: start of year $5 end of the year. $10 contribution. $2 therefore, ($10 minus $5 minus $2) divided by $5 is my return. not perfect as I treat an interim in Jan same as Dec

-

Movies and TV shows (general recommendation thread)

Xerxes replied to Liberty's topic in General Discussion

I need to withdraw this recommendation. This show is total garbage. The first season started well but then devolve into “they” the faceless bad guys that are corporate investors in London. It is like watching X-files. second season is all about shifting alliances, without the grace of Game of Thrones. avoid this like the plague -

Movies and TV shows (general recommendation thread)

Xerxes replied to Liberty's topic in General Discussion

absolutely not. he is not a SW guy. Villeneuve’s Dune is great because his style meshes well with the way Frank Herbert set the Dune universe. David Lynch’ did as well but the movie was butchered by the studio. The great news however is not Dune 2 trailer, the great news is that Villeneuve will be making Dune Messiah (the second book) as the closing third chapter of the Dune trilogy. Historically Dune Messiah was always suppose to be part of the first book but in the 60s the book editor forced Herbert to cut it out as a separate book as it was anticlimactic. Spoiler alert: Paul becomes insane and falls from grace. the book editor could not have a story with a sad ending, where Paul Atrides becomes the very thing he had try to destroy. It was too much for a Western audience, where good-bad guys needs to binary. -

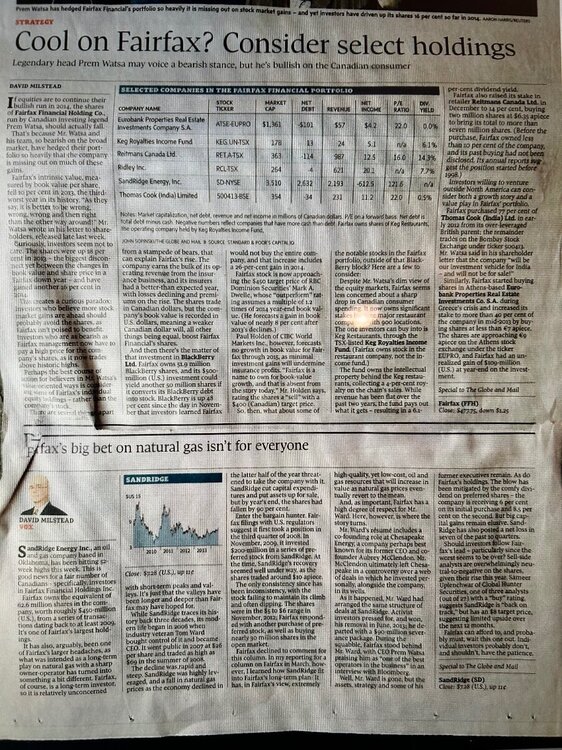

Prem Watsa who !? Never heard of Prem Watsa until I ran into bunch of Globe & Mail articles from 2014 and 2015. Invested an insignificant amount around the time Trump became president in 2016 but only went heavy in 2020-21. I even saved the articles from back in the day. Doesn’t say much but was enough to get me intrigued. And then I found this board, a year or before Covid and joined up later.

-

This is a day early. Year has not ended yet.

-

For clarity, I was not referring to the nuclear attacks against the unlucky twin cities. That was a presidential call. And that made sense. I was referring to the insane firebombing of Tokyo in May 1945 which Lemay planned. War or not. That (using napalm in a city made of papers) was just the too much. Patton, Marshall, Nimitz, Halesay and even the unhinged Mcarthur were real soldiers. Lemay was just the American version of Yamashita. In turn a Japanese could argue that Yamashita’ act in the Philippines were also needed to end the war quickly. Anyways don’t mean to debate on this. Was just clarifying what I meant. We should be thinking about better things so close to the new year. All the best in 2024

-

Public Company Share Repurchase-Cannibals

Xerxes replied to nickenumbers's topic in General Discussion

I may be wrong but I think Morningstar itself (the company) is a capital return story -

agreed my take is Cramer may or may not be a good “stock picker”. That is largely irrelevant. What he is good at is the “business of stock picking” and he has monetized that

-

That matrix table that shows gain/loss, unrealized/realized, fixed-income/stocks was never very clear in terms what goes in the equity portion. A lot of good stuff didn’t make it to the table. ICICI Lombard when it was realized (and that was no even fully owned). That piece of business they sold in Asia pre-Covid. To me a business is a business. Whether there is a liquid secondary market for its shares or not is an irrelevant criteria to have for inclusion to that infamous table.

-

we will add this to list of things we disagree with. This is nothing more than Tehran’ attempt to broadly raise the “cost of doing business” in the region. A geopolitical bargaining chip, if you will. Nothing to do with the specific machination to raise the selling price of crude for the sake national budget. Thanks to the Americans in their attempt to crush the Iranians for the past 40 years anyway they could, Iranian economy is not a o&g concentrated economy as it was in the 70s or as it is now with the Saudi Arabia.

-

Aswath Damodaran's investment picks and returns?

Xerxes replied to schin's topic in General Discussion

I have not seen. just my thoughts: The professor cannot be compared in any way to Cramer. Not even in the same zip code. I got nothing against Cramer. But he is what he is. A product of multi-decade low interest rate filled with lots of charisma and evergreen optimism. His program is no different than HGTV for those who like houses. Just a TV show to spice things up. The professor however is a real stock picker with workable framework. You can disagree on his framework but you cannot deny that there is well thought out framework somewhere in his mind. -

^^^^ @SharperDingaan I would say that there are two major “geopolitical premiums” as it relates to crude oil coming out of the Persian Gulf region. The macro geopolitical premium is no longer there thanks to American ingenuity to unlock the shale formations. And the restructuring of the flow of crude out of the middle eastern basin into Asia. That macro premium is largely gone. The flow of oil through Straight of Hormuz and around there is just not as important. That premium has been in a long term bear market. However it does not surprise me to see Western observers still allude to it as they remember the Gulf Wars and the Saudi embargo in the 70s. Now that said, you may have a “micro” premium now and then. (Circa 2023) But that will always be “non sticky”. The players involved don’t shoot ships with an explicit purpose to raise price of oil. When you are under sanctions you cannot exactly reap those benefits. For Tehran, it is about moving barrels at whatever price. Its main buyer (government of Bejing) is not going to be paying a “geopolitical premium” that you are alluding to. It is a volume game for Tehran not price. The real winners are the insurance companies I think.

-

https://www.nytimes.com/interactive/2023/12/17/world/putin-companies-economy-boycott-elites-benefit-ukraine-war.html Looks like that as major stock market indices took a plunge in 2022, as Russian tanks rolled into Ukraine to confiscate Nazi WMDs, it was in fact Putin and his pals that truly “bought the dip”.

-

How many of U.S. military personal were surprised after the fact, that almost everything coming out of Colin Powell mouth at the U.N. circa 2003, was mostly all made up stuff and lies. It was so bad that even Colin Powell didn’t know as he was being thrown under the bus by his “colleagues”. Soldiers follow orders. Just as the top brass does. It is that or treason. Only when one side has overwhelming won, can the other side setup courts to determine if the other side’ military top brass was following illegal orders. And it will all matter of interpretation, politics and the usual bullshit. Had Japan won the Second World War, there would be tribunal of the war criminals, and on top of the list would be: General Lemay

-

-

Happy Holidays everyone, all the best. Rest well for another round in 2024 !!

-

https://podcasts.apple.com/ca/podcast/defense-aerospace-report/id1228868129?i=1000639121637 Great end of the year discussion for us, watching from the peanut gallery

-

wrong. It is value investors that like and need perpetual instability and volatility. Not warlords. warlords, despite the “war” in their surname, like “controlled” stability with “controlled” flareups. 2022-23 had been anything but controlled for them. Both Feb 2022 and Oct 2023 largely spun out of control. None of those events were foreseen by the “warlords” who started it. Yes they may adapt (and survive in some cases), but the “journey” was not planned beforehand.

-

@ourkid8 thanks for resurrecting the thread. great closure and well done.

-

How about ETH. I thought you were holding that for a long time. I am thinking while BTC has the “halving” catalyst going for it in 2024, maybe ETH has more crypto-beta in the tank and might overshoot

-

@Dinar @Spekulatius Based on previous posts. you gents seem to be into luxury liquor related investments.

-

Folks need to revisit 2020 letter, where Buffett painstakingly describes the four pillars of Berkshire, some which are fully/majority owned while some are partial non-controlling ownership. These four pillars are: Apple, BSNF, BHE and the insurance outfits with its equity portfolio. With that in mind why is Apple even being discussed here, in the context of stock investment. The only difference in Buffett mind between Apple and other three entities is that there is a very liquid secondary market for shares of Apple. And none exists for the other three.

-

Buffett put nearly $40 billion to work in the last two months of Q1 2022. After few years of not significant equity purchases. If Greg was in charge he would be have been second guessed for using nearly a third of the cash pile in two months. That he would know he would be second guessed, might also play a role in him being an effective capital allocator. He would need to do his job and fight off public misperception.