nwoodman

Member-

Posts

1,388 -

Joined

-

Last visited

-

Days Won

8

Content Type

Profiles

Forums

Events

Everything posted by nwoodman

-

This piece in Bloomberg also grabbed my attention An $8.8 Billion IPO Wave Sweeps Across India as Startups Soar “If global investors have to pick an emerging market, the balance is tilting in India’s favor after the regulatory action in the China internet ecosystem,” said Pankaj Naik, executive director and co-head, digital & technology at consultancy, Avendus Capital Pvt. “India may not be as attractive as China in the broader economic sense but it’s looking like a safer bet.”

-

Another article on Digit that provides a bit more colour on the opportunity https://ajuniorvc.com/digit-insurance-lic-unicorn-india-startup-tech-general-acko/

-

And the cash comes rolling in, well kinda. Hope it goes on buybacks https://ir.atlascorporation.com/2021-08-16-Seaspan-to-Redeem-Remaining-Fairfax-Senior-Notes LONDON, Aug. 16, 2021 /CNW/ - Seaspan Corporation, a wholly owned subsidiary of Atlas Corp. ("Atlas") (NYSE: ATCO), today announced its intention to redeem all of its remaining 5.50% senior notes held by certain affiliates of Fairfax Financial Holdings Limited ("Fairfax"), including $250 million of 5.50% senior notes due 2025 (the "2025 Notes") and $50 million of 5.50% senior notes due 2026 (the "2026 Notes" and together with the 2025 Notes, the "Fairfax Notes"), for cash on August 23, 2021 (the "Redemption Date"). The redemption price per Fairfax Note will be equal to $1,000.00 plus all accrued and unpaid interest thereon from and including July 30, 2021 to the Redemption Date. Graham Talbot, CFO of Atlas, commented, "We are very appreciative of our partnership with Fairfax and the strong support they have provided. The investments made by Fairfax have helped to strengthen the company and create the significant momentum in the business that we have today. The redemption of these notes reflects Fairfax's continuing support as we mature and diversify Atlas' global investor base and increase access to capital market opportunities. This is also a further step in our ongoing efforts to simplify and optimize our capital structure."

-

Nice work Glider, I tried my hand at this and couldn’t get the number to reconcile. Should have gone back to the AR as you did

-

Thanks Viking . The market in general seems to be progressively intolerant of any misses etc. That NBF price target of $25 is looking a little optimistic David Patrick, Chief Financial Officer, will be leaving the Company in September 2021 to return to his former employer. The board will be overseeing the search process and Lori Robidoux will act as interim Chief Financial Officer. Ms. Robidoux was the Chief Financial Officer of the Company for approximately six years before retiring a year ago. Wade Barnes, Chief Executive Officer of the Company, said, “I want to thank David for his work and wish him success in his future endeavors. We also welcome Lori back and look forward to working with her during this transition period.”

-

Perhaps it is swings and roundabouts, but noticed that Farmers Edge fell off the cliff today. Don’t follow it at all, any thoughts on why such a massive decline today? Earnings didn’t appear to be much crappier than the IPO docs.

-

Movies and TV shows (general recommendation thread)

nwoodman replied to Liberty's topic in General Discussion

Spent a couple of hours watching the latest offerings from Apple TV+ on yet another night in COVID lockdown . Ted Lasso Season 2 awesome as usual. Mr Corman, quirky and worth a watch. However, Coda, which was the good wife’s pick was a standout. Engaging with enough laugh out loud moments that I would watch it again. -

This article provides a bit more info on the insurance sector in India on the back of the their second COVID-19 wave. While not good news, great to see Kamesh is again their “go to” for the article. https://indianexpress.com/article/business/covid-health-claims-of-rs-10703-cr-pending-before-insurers-despite-hc-irdai-directive-7444822/

-

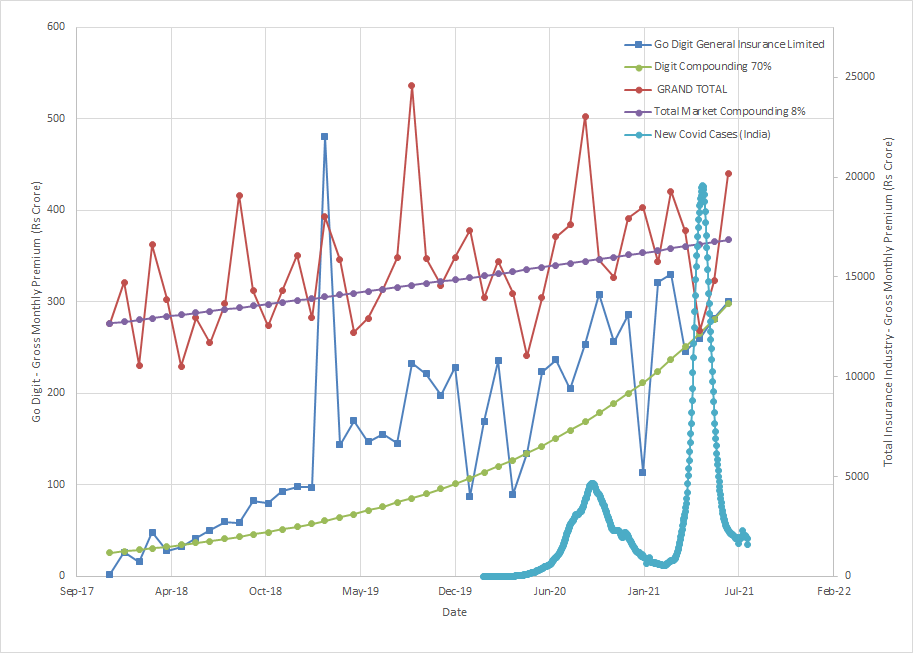

Graph of monthly IRDAI figures for Digit (LHS) vs the Total Insurance Market (RHS). Numbers are pretty volatile and how reliable they are, who knows. Compounding curves are eyeballed, so don't put too much weight on them. Overlaid Covid-19 cases, perhaps a minor correlation. Spectacular growth off a low base but we already knew that. Will be interesting to add in another year or two down the line. The usual caveats on profitable underwriting etc. apply of course. Spreadsheet attached in case you want to play around with the compiled data on a rainy afternoon IRDAI Data.xlsx

-

Not that it matters but I think it was because Sokol was already involved. He was working for Dennis Washington at the investment company level and was sent in to advise on the situation at Seaspan. Our Fears (Hopes) Realized? | Marine Money Seaspan chairman slams Wang and Porter for failing to grab boxship bargains - Splash247 One of the issues that has clouded ATCO has been the APR transaction and the perception of self dealing. Its contribution this quarter, EBITDA of 45.3m hopefully goes some way to mitigating this perception.

-

These guys are executing beautifully. The new CFO’s supplementary spreadsheets are super helpful too https://ir.atlascorporation.com/earning-reports?cat=42. Their core strategy of foregoing short term pricing power for longer term dependable cashflows that in turn drive down the cost of borrowing is Sokol to a tee. All this, before he has even sunk his teeth into a sector he really understands. Exciting times and I just hope Fairfax stays in the background and doesn’t try to do anything cute. Just let Sokol and co do their thing and it will be a $5bn+ position for Fairfax in less than a decade.

-

No disagreement from me. Ops and investments will do well, perhaps surprisingly so. I would be amazed if they don’t have an Ajit replacement in the wings, that even if only 80% as competent, will do well. All things considered there is a valuation that I would sell my shares, I hope it never gets there, and this behemoth just keeps chug, chugging along.

-

Everyone else has summed this up well. All things being equal, a conservative 8% CAGR is a high probability, a market hiccup of “non central bank intervention regression to the mean” in the next five years may see this rise to 10-12%. The inevitable demise of one, then both of the most talented didactic business brains, we will see in our lifetimes might create some short term opportunities. This company is indeed set up to reward the long term, rational investor. It Is the only asset that I own, that I am happy to margin against. This creates some good opportunities over time as you start playing with the unrealised tax owing on your holding. The benefit of the slightly lower but predictable compounder is not to be underestimated.

-

https://www.berkshirehathaway.com/news/aug0721.pdf https://www.berkshirehathaway.com/qtrly/2ndqtr21.pdf

-

Absolutely, if you want a laugh you should check out their quarterly earnings report. Despite previous comparisons it is the first time I have glanced at it. If I was ever to do a pairs trade, Long FFH short LMND would be it.

-

Just for reference, current market cap for LMND is 5bn ($80/share after hours) Lemonade (NYSE:LMND) stock drops 8.8% after the digital-forward insurance company after the tech-driven insurer still has no date for launching its auto insurance product, the "timing of which is hard to tie down," the company said. Q2 GAAP loss per share of $0.90 matches the consensus estimate. Boosts guidance for full-year revenue to $123M-125M, up from its previous range of $117M-120M; consensus estimate is $118.9M. Sees in-force premium at Dec. 31 of $380M-384M, up from $376M-382M it expected previously. Still sees year adjusted EBITDA loss of $169M-173M. For Q3 2021, Lemonade (LMND) expects in-force premium at Sept. 30 of $336.0M-339.0M; compares with $296.8M at June 30, 2021. Sees Q3 revenue of $32.5M-33.5M vs. consensus of $32.2M. Expects Q3 gross earned premium of $76.5M-77.5M; compares with $66.9M in Q2. For Q2 2021, premium per customer of $246 increases from $229 in Q1. Q2 adjusted EBITDA loss of $40.4M widened from a loss of $18.2M in Q2 2020. Q2 total revenue of $28.2M beats the average analyst estimate of $26.8M and declined from $29.9M in the year-ago quarter. Net loss ratio of 80% rose from 70% a year ago.

-

No ceiling as far as I know. Fairfax could conceivably be given a Fintech multiple by the market (I wish). Can’t speak for others but I consider fair value to be 1.2-1.3x’s as it stands. That has worked OK for me in the past. My preference would be that they compound a believable book value at 15% and forever trade at 1x’s book

-

at the upper end of the P/B range for the last 10 years too. Longer term graph shown for comparative purposes

-

Another possible data point. Not even an an insurer just an aggregator https://techcrunch.com/2021/08/01/indian-online-insurer-policybazaar-files-for-ipo-seeks-to-raise-over-800-million/ In papers submitted to the market regulator in India, PolicyBazaar said it is looking to raise $504 million by issuing new shares while the rest will be driven by sale of shares by existing investors. Local media reports said the startup is looking to raise at a valuation of up to $6 billion.

-

I am quite bullish on Digit but a $200m raise that in turn gives a $3.5bn mark is still price discovery lite. I remember seeing an interview with Kamesh Goyal, where he indicated the first raise (that got them to unicorn status) was about price discovery. The second raise of $200m, is certainly a little more material but not by much . I don’t recall if the actual % amount that was purchased for 200m was disclosed. Based on the note in the quarterly, and comments in the CC it looks like Fairfax has at least attempted to discount the valuation of the raise a little, which is welcome. “During June 2021, the company's associate Go Digit Infoworks Services Private Limited ("Digit") entered into agreements with certain third party investors whereby its general insurance subsidiary Go Digit Insurance Limited ("Digit Insurance") will raise approximately $200 (14.9 billion Indian rupees) of new equity shares, valuing Digit Insurance at approximately $3.5 billion (259.5 billion Indian rupees) (the "transaction fair value"). The transactions are subject to customary closing conditions and regulatory approval, and are expected to close in the third quarter of 2021. The company estimated the fair value of Digit at June 30, 2021 using a probability weighted valuation model, attributing 60% weighting to the fair value determined through an internal discounted cash flow analysis and 40% weighting to the risk-adjusted transaction fair value, which resulted in the company recording a net unrealized gain of $425.0 (inclusive of foreign exchange losses of $13.7) on its investment in Digit compulsory convertible preferred shares. Increasing (decreasing) the weighting of the transaction fair value by 5% would increase (decrease) the net unrealized gain by $54.4 ($54.4). The company also holds a 49.0% equity accounted interest in Digit as described in note 6.” It is still only the 1st innings for Digit, while it is looking good I can understand the market’s reticence. Then again you pay a high price for a cheery consensus as WEB would say.

-

Thanks again Glider, I have added the IRDAI monthly non-life GWP numbers link to this thread, to make it easier (for me) to find https://www.irdai.gov.in/ADMINCMS/cms/frmGeneral_List.aspx?DF=MBFN&mid=3.2.8 under Home >> Insurers >> General >> Monthly business figures

-

Investment gains to one side, the insurance results were stellar, Good stuff Fairfax. Agree with Crip, hopefully they have been able to pull the trigger on more share repurchases in July

-

Thanks for this and all the other posters Greg, Speke, Eric etc. that challenge and provide a contrarian/anti-group think perspective . Equal thanks to Sanj, Viking, Daphnee etc. At the end of the day we will draw our own conclusions but Sanjeev you must be proud to have cultivated this culture. Still superior to ML/AI as far as I am concerned . Looking forward to the earnings release

-

Market Disconnect is One of the Craziest I've Seen in 23 Years!

nwoodman replied to Parsad's topic in Fairfax Financial

This is key. From the 2018 AR "I mentioned to you last year that we are focused on buying back our shares over the next ten years as and when we get the opportunity to do so at attractive prices. Henry Singleton from Teledyne was our hero as he reduced shares outstanding from approximately 88 million to 12 million over about 15 years. We began that process by buying back 1.1 million shares since we began in the fourth quarter of 2017 up until early 2019 – about half for cancellation and half for various long term incentive plans we have across our company. This was after we increased our ownership of Brit to 89% from 73% while having the funds ready to increase our ownership of Eurolife from 50% to 80% in August 2019" The next couple of quarters will be key in terms of whether this is just more platitudes. All things considered, I cannot think of when Fairfax's share price has been more attractive. Sure last year was cheaper on a P/B basis but on a relative basis compared to other opportunities it was cheapish. Now compared to other opportunities I think it is a screaming buy. Viking's comments are spot on, "You can't see the future through a rearview mirror". However, managements actions, given the circumstances, will be key for me. Given they were hamstrung last year, the TRS play was a very good start -

Looks like the IPO market is running hot in India despite the many challenges. Hopefully augers well for Chemplast Sanmar and Anchorage Zomato Soars 80% in Debut of India’s New Tech Generation Zomato’s first-day performance will serve as a barometer for India’s budding tech scene of unprofitable unicorns, which has produced a coterie of up-and-coming giants from Ant Group Co.-backed Paytm to Walmart Inc.’s Flipkart Online Services Pvt. Also backed by Jack Ma’s Ant, Zomato’s debut comes amid investor concern that India’s markets are a bubble waiting to burst and valuations have outstripped fundamentals. Optimism about India is tempered by one of the worst coronavirus outbreaks in the world, which threatens to erode decades of economic gains. Investors also have to contend with political risks, with Narendra Modi’s government clamping down on foreign retailers, social media giants and streaming companies. For many others, the potential outweighs the downsides. With almost half its 1.3 billion people accessing the internet via smartphones, a bet on Zomato represents optimism that India’s tech upstarts could go the way of the U.S. or China, particularly as India’s internet infrastructure remains nascent and consumers are just getting used to buying online. “This is how it is supposed to work. Nine out of 10 will fail,” Goyal, who is barred from commenting in the run-up to the listing, said in an earlier interview. “But the one that thrives will be a spectacular success.”