SafetyinNumbers

Member-

Posts

1,567 -

Joined

-

Last visited

-

Days Won

5

Content Type

Profiles

Forums

Events

Everything posted by SafetyinNumbers

-

Is there a community here interested in discussing Canadian exchange traded debt? I’m mostly interested in the special situations but it’s seem like an inefficient market over time. I have had some success historically.

-

I prefer FFH keeps using the TRS vs buybacks for the enhanced financial flexibility and because it doesn’t shrink the market cap. The larger the market cap, the more likely we have a replay of the 95-98 period and get a more reasonable P/B multiple. Being added to the S&P/TSX 60 seems like a real possibility if FM and/or AQN get removed in the short term which could be a trigger. FFH’s weight is just going to go higher over time so entry into the 60 seems inevitable even if it takes a few years.

-

Either a typo by me or I misread it. Apologies for the confusion.

-

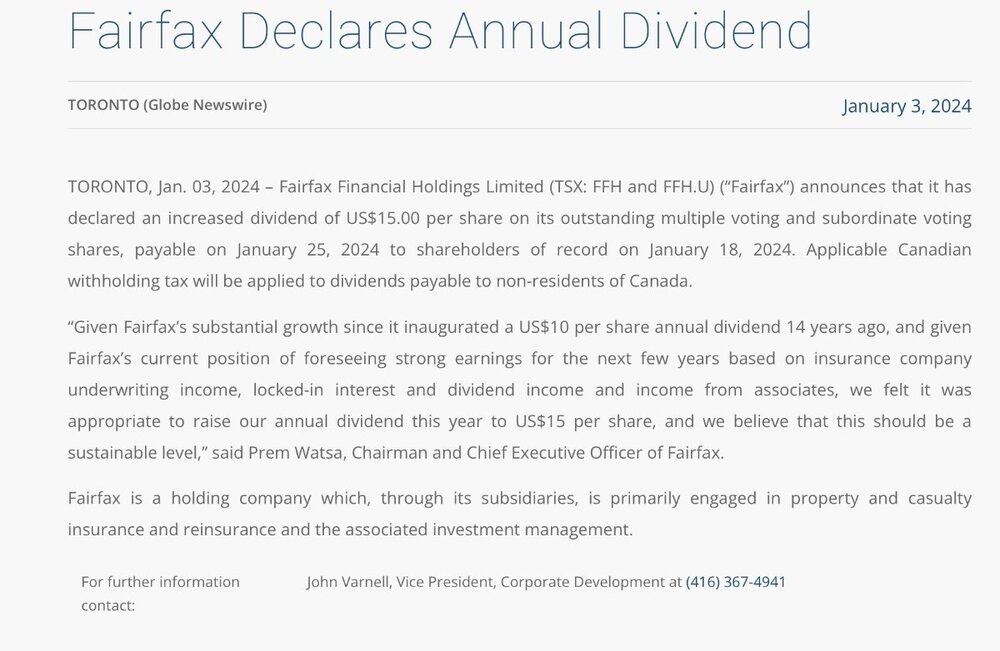

Starting this up so we don’t have a new topic for every press release like this morning’s 50% increase in the dividend.

-

I think the bigger FFH gets in the S&P/TSX Composite (65bp to 91bp last year), the higher the multiple will go as index huggers continue their chase. Once, the multiple starts going up, analysts might start increasing earnings estimates enough to show growth, which will allow quants to buy expanding the multiple even more. We could also get a bigger surprise like FFH being added to the S&P/TSX 60 to replace tiny components like FM or AQN but given it’s a financial, that could take longer.

-

Great analysis as usual Viking! Thank you! FWIW, FIH calculates their CAGR to Sept 30, 2023 on BIAL to be 12.8%.

-

In the most inefficient market I have ever seen, I think an unconstrained investor like FFH has the potential to generate strong absolute returns over a long period of time. It’s what gets me really excited about the right tail. If you want a holdco that owns the index (VOO) and has money invested with the GARP investment style (UNC.TO EVT.TO), you should consider E-L Financial. It trades at a ~50% discount NAV despite its holdings being closer to what most investors prefer i.e. passive or quality.

-

It’s hard to argue it’s a big love in when the multiple is 1x BV and IFC and TSU trade closer to 2.5x BV. I appreciate it’s because their earnings have less variability and estimates show consistent growth which quants like. It doesn’t mean they will create more value over the next 5 years and certainly doesn’t guarantee they have better stock performance although anything is possible. I think a lot of FFH investors are scarred from the last decade and are very afraid of drawdowns. There is no consideration for what could go right despite a very strong set up. I think it’s greater than 50-50 odds that ROE is north of 15% for the next 3 years based on the current balance sheet. It could be materially north or it could be lower but ultimately I think the odds of a 20% ROE are higher than a 10% ROE over the next 3 years and thankfully my hurdle is 10% so I’m still happy to own it even if my lofty expectations aren’t met.

-

I think dilution would have been ~1.5% depending on how big the performance fee will end up. I think it’s also fair to say the market was expecting the shares to be issued. Both good reasons for the shares to benefit on Monday at least in the short term. A lot of investors didn’t want to own the shares because of this clause. Despite it not having a material impact on investors since inception, the perspective was understandable. It will be interesting if they reconsider. That pool of investors might be big enough to close the discount materially. That’s how the shares benefit in the long term. This move by Fairfax might generate a lot of Social Value or in FIH’s case, reduce the negative Social Value as Market Value is well below Intrinsic Value. it’s hard to predict what will happen with NAV discounts but the narrative just got easier to sell. The stock is at new 52-week highs and there is nothing macro guys like more than strong technicals and a country bet. India is flexing its strategic importance to every super power in the world. India and Indians own a lot of gold so there is some optionality that the rupee will benefit materially if gold rallies materially. Indian debt is going into the benchmark next year which should lower the cost of capital and also provide another reason for the rupee to strengthen. Oil is cheap and they buy it even cheaper. 2024 brings a few potential meaningful catalysts. The biggest being the IPO of Anchorage which has been taking forever. I assume part of what led to the sale of the additional 10% of BIAL to FIH were the other counterparties was not wanting to wait for a longer process and FIH willing to pay a fair price. CSB Bank is reported to be bidding for a partially state-owned bank that is much bigger. I’m not sure what kind of deal structure is possible but it seems like it could have a lot of upside. CSB is up 64% this year and according to the internet has a P/E of 12. They own a lot of interesting businesses. The public stocks are going up and my bet is the private ones are marked conservatively as a group. I think the l/s hedge funds I sold too in 2003 would have been all over this story but they are all gone and there are too many ideas for those of us that are left. The discount might go back to 40% but book value could still grow pretty fast depending on how the world turns out. i’m going to trade around a core position which probably means I’ll sell too much too early and I’m elated with that outcome vs the alternative where BVPS doesn’t CAGR north of 10% which is always possible but I think unlikely. You may think otherwise.

-

That seems to be the case. I don’t think it impacts the ~43% ownership because these shares were included in the proxy. Does anyone disagree? On a side note, it looks like the FIH AGM is the day before the FFH meeting at the Ritz. Anyone have an idea why?

-

sold a piece to establish Anchorage and get an arms length valuation. They announced this purchase quite a while ago. It’s just closing now.

-

I assume the insurance companies benefit with ratings agencies and clients by having excess capital sit at the subsidiaries. What do you see as the benefit of having cash at the holdco instead besides Social Value?

-

if I understand the IFRS reg correctly, book value would go up by about ~$48m with the balance credited to NCI. Does that look right?

-

Nice timing with the dip in rates. Also it looks like the spread came in about 65bps vs the 10-yr note it’s replacing.

-

See the FT article attached. BIAL is also working on their master plan which they revise every few years. It has some operational details included in the article. https://indianexpress.com/article/cities/bangalore/bengaluru-airport-master-plan-renovation-9049746/

-

FFH does any insurance investments and FIH does everything else so there is no conflict there. FFH has bought shares in the open market and FIH has bought back shares at a big discount. Almost no shares have been issued below NAV and they have bought back significantly more below NAV. We’ll see what they do this year. They might surprise and take it in cash and ideally tender for shares. The parties that really let down minority shareholders were those who negotiated on their behalf i.e. OMERS etc… The agreement incentivized minority shareholders to buy the shares into the measurement period at the end of a performance period but they haven’t shown up.

-

I don’t think they will take FIH private. With OMERS stake, they can never own more 90% but they could buy every other share back over time. There is no ownership limit, it just doesn’t allow FFH to elect shares for payment of the performance fee if it means FFH would own more than 49% of FIH. They should hit that by the next performance fee period end in 2026 assuming continued buybacks or big enough performance fee given they are at ~43% now. I don’t think institutions want to own it because it’s not in their benchmark more so than the liquidity. It seems pretty easy to buy most days and I know a small cap manager that recently bought some for his fund. I do think it’s interesting how no one wants to buy the shares that actually closes the discount which makes sense as it’s mostly active value investors that are looking. That sort of buying comes from quants and passive these days. FIH won’t ever have that kind of buying. Kind of like ELF in that way. One positive aspect of FIH, that doesn’t get mentioned a lot is the cheap leverage. $500m note that doesn’t mature until 2028 at 5% is a pretty cheap cost of capital. As you have pointed out often recently, Viking. FFH is pretty good at managing debt. Issuing 7 year 5% paper when the 10-yr was ~1.5% in 2021, was another stroke of genius. Buying FIH at these prices is ~2 to 1 leverage which is a lot better than an India ETF and that’s probably the switch trade investors should be making but no one on this board likely buys India ETFs as a long term investment. I think it’s impossible to know when the discount will ever close enough to realize the return but I’m invested anyway. I appreciate that people have better alternatives in what I believe is a very inefficient market.

-

Very good points TwoCities. I think the sentiment is the impact of passive and quants on ownership of a company that’s not in anyone’s benchmark and has no earnings estimates. Add to that a much more inefficient market and active investors think and probably do have better risk/rewards with much quicker payoffs. It’s hard to find the marginal buyer besides the company and FFH. Maybe that changes with the Anchorage IPO as it will dramatically increase the marked-to-market portion of the portfolio and potentially give FIH a vehicle to grow with that has a low cost of capital in India. Also as I believe @glider3834 pointed out, once Fairfax is at 49%, they can no longer accept payment of performance fees in shares so this performance period is the last one for which that gripe matters. Despite all of the consternation it hasn’t mattered for the first two performance periods for two reasons. First, the stock was close to NAV for the first performance fee period and the performance fee was only ~500k shares for the second period. Second, they have bought back way more stock cheaper before and since those fees were paid. If they choose to take stock this time then almost certainly if they want more they will have to buy them in the market and I’m guessing they will. Hopefully not too opportunistically but that has to be the expectation. Buying near the floor of the discount seems like a good risk/reward. I guess we’ll find out.

-

It doesn’t fit with what I understand Prem to be all about. Do most people agree with Stubble?

-

Prem seems to be saying never https://financialpost.com/executive/capitalist-manifesto-how-capitalism-and-canada-made-prem-watsa

-

I thought it was clear I was discussing FFH. Sorry for the misunderstanding. And no I don’t think he would ever take Fairfax private even if he had the resources to do so. I’m surprised you think that he would. Do you think Buffett would do the same to Berkshire?

-

I think you make great points which contributes to the moat. Another feature of Fairfax is that you know your optionality on the stock doesn’t get impaired by an opportunistic take-private bid from management. Arguably, the market gives Fairfax a discount for this feature as its participants are more interested in short term gratification.

-

At the time the hedges were put on there was real concern about negative interest rates. What’s float worth if interest rates are hugely negative? I think that’s what they were hedging so they could keep growing premiums.

-

Q. So you would pay a premium for any leverage or is this leverage more valuable because of its characteristics? A. Yes, in principle. Leverage from taking out a big loan would be worth a lot less than safe uncallable leverage from a steady self-renewing source of float like Fairfax's insurance business. Given the fact that float represents $28b at Fairfax, and equity is $26b (including non-controlling interests), and Fairfax is trading at only 1.1x book, you might say that Mr Market is giving very little value to that float, but I think it deserves a much more healthy premium. A huge loan that you never have to pay back is worth something. Sounds like a moat.