SafetyinNumbers

Member-

Posts

1,565 -

Joined

-

Last visited

-

Days Won

5

Content Type

Profiles

Forums

Events

Everything posted by SafetyinNumbers

-

The boost in the book value is only for the portion that is sold. Valuations are also surely done by the counterparty to justify the multiple paid. If the prime motivation is to increase book value, it’s not a very effective technique.

-

From the recent Allied World repurchases, it seems like they can buy back the shares at the same P/B multiple they were sold. For Allied World that was 1.3x BV. For Brit, I think it’s 1.55x and for Odyssey I recall 1.9x. If anyone can confirm, please do.

-

-

Does anyone have a list of the minority interests in the insurance companies (Brit, Allied World, Odyssey) that Fairfax is able to repurchase along with the relevant timelines?

-

I assume when they start paying a dividend it will get paid out to the LPs after any related fees but I'm not 100% sure. If they DRIPed it, they would take it private again within a year at these prices

-

SCR management is trying to help! They put out its reserves today and included a 4 page letter to accompany it explaining how quickly and accretively they have grown since Waterous took over in 2017 which is also presumably when FFH made its investment. https://www.strathconaresources.com/wp-content/uploads/2024/03/2023-Reserves-Overview_Final-1.pdf i thought this table was particularly interesting from a comp valuation basis. They show it trading less than half of NAV. I can see this management’s approach to capital allocation and investor communication eventually get a premium multiple.

-

Any sector that doesn’t screen well for quants i.e. not quality, is pretty cheap I think. I like SCR in particular because Waterous is incentivized to get the stock up to do accretive acquisitions. Right now, it’s really hard for heuristic investors to own SCR but If they execute the plan, they start ticking boxes which will increase the number of potential buyers. The share price is just supply and demand after all. The dividend announcement will help in three ways. In energy, investors want debt/cash flow < 1x, they want a capital return policy and they want liquidity. The dividend ticks 1 and 2. The dividend should attract yield investors who don’t mind buying on upticks providing multiple expansion and liquidity. With a higher share price, SCR will be able to make accretive acquisitions and extend the tax shelter beyond 2026. This will also increase liquidity and give SCR a chance to get into the S&P/TSX. That’s the plan from what I can tell but we’ll see if it actually works or if buying shows up in anticipation of the dividend announcement closer to the date. I think six months away is too much for event driven investors. That are a lot of places to put money to work these days.

-

Best to read the disclosure but would seem like mostly private equity type investments where FFH is an LP with a variety of GPs. I think SCR is in the portfolio because they mentioned a mark-to-market loss related Waterous in Q4 on the CC. Waterous owns 91% of SCR via their fund and is the GP. The disclosure in the AR showed that an oil and gas investment declined significantly last year and SCR was listed on the TSX in October via reverse takeover and promptly traded down more than a third from where it was marked. I think there is enough evidence to make a fairly high conviction conclusion that it’s SCR. If you are finding 20% dividend yields on $5b market caps in energy with 7-9% growth and ~30 year reserve lives, maybe SCR isn’t for you but it will probably help FFH get to a 15%+ ROE.

-

SCR.TO is held in the Limited Partnerships bucket but I think it’s about 14.5m shares so just qualifies for the top 20. Probably not worth tracking unless it makes an outsized move.

-

Prem also highlighted the cushioning effect of IFRS17 on earnings. Lower volatility in earnings should make the shares more attractive to quants which helps the multiple. IFC trades north of 2.5x BV with similar ROE expectations. Maybe it will take the S&P/TSX 60 add to get us through all of the value investors that are ready to sell at between 1.2-1.5x BV but that’s where I think we’re going.

-

There was no explicit mention of Strathacona but I think we can deduce from the note on limited partnerships that it’s the third largest investment at $235.3m. Based on SCR.TO ‘s closing price (C$21.43) at the end of 2023, I estimate FFH owns ~14.5m shares or ~6.8% on a look through basis. I think FFH is up $32m on it so far this year. It might be actually more but offset by carry accrued. In 2022 when it was private, the position was valued at $374.8m so it might still be a bargain. I think it’s a pretty interesting event driven special situation but also have thoughts of holding it for the long term. The GP is incentivized to get the shares to fair value. Their plan to rerate the shares is to start returning capital when debt to EBITDA gets to ~1x. That should happen later this year. At $80 WTI, they expect to have C$1b of FCF or a ~20% FCF yield on the current market cap after maintenance and growth capex. Besides quant and passive, the only other buyers on upticks are yield buyers. So it will be interesting if it works given there is a lot of competing yield out there. Management is contemplating a regular dividend with special dividends. Once the shares are rerated, they plan to use equity for M&A. This will allow for accretive growth, increased liquidity and public float. While they don’t state it explicitly, this will help the shares qualify for the S&P/TSX which will bring in passive buyers. That will give institutional shareholders a reason to look at SCR. Currently, no institution has to own it because it’s not in anyone’s benchmark despite being a C$5b company.

-

My pleasure @thowed. As usual, I’m talking my own book as I own both FISH and MKO and sit on the FISH BOD. I think most investors like the royalty companies for good reason but that also means their starting valuations are generally significantly higher and because of the business model, the operating leverage isn’t as significant. The contrarian move is smaller producers and royalty companies that aren’t yet included in major ETFs like GDXJ but then sizing the positions like options so no one individual name can hurt that much if bad things happen like they sometimes do in mining. FNV found out recently with their Panama royalty.

-

Here is the link. There are webcasts going back years so one can go back and compare the plan to what obstacles that were run into and how they were handled. It’s pretty clear to me the decision making is rational but everyone should be their own judge. Mining is hard and doesn’t screen well which makes it the opposite of quality. Most investors are quality investors and they use heuristics to screen. MKO gets excluded pretty quickly based on all kinds of factors that have nothing to do with FCF. Instead of using heuristics, I use a probabilistic approach and on that basis, I think MKO is particularly compelling. The share float is pretty tight too with Wexford, Akiba and a few high net worth investors with probably close to 65% of the shares. I’m excited to see what kind of returns the FCF can earn and how big a producer Mako could be parlayed into over the next decade.

-

I used to work with Ritchie when I was at UBS. I think I had just joined the prop desk when he joined the sales desk. I enjoyed the interview. Valuations for gold stocks are significantly lower than they were back in 2002 when I first got in the business. For example, I’m on the board of Sailfish Royalty (FISH.V) which has a royalty on its sister company Mako’s (MKO.V). Mako turned its mine on in Q221 and after working through somewhat common start up issues, the mine is really humming. I see it trading at 2.4x 2024E OpCF. In a recent webcast, the CEO, Akiba Leisman laid out that exploration spending yields a 10x return before discounting. Mako’s mine is in Nicaragua so for most people a 1% position is probably enough. They plan to diversify through acquisition and find high return places for FCF from the mine. It’s hard to find a good fit despite the low prices. I think a lot of promoter-led companies are weary of dealing with Wexford Capital which is the largest shareholder of FISH and MKO. Wexford shuts off the grift which is common in this industry. For reference, Wexford Capital, is a multibillion dollar hedge fund and MKO is a way to sidecar invest with them with hopes they can work their magic in gold like they did in energy with Diamondback Energy (FANG.N) since they took it public back in 2012. It’s CAGRed 20%+ since then and has a $32b market cap which will go up significantly when they close their latest acquisition. If anyone wants to chat about either name with me or Akiba, please let me know. The last time MKO raised money was in 2020 and it was done at C$4 or ~66% above the current price. That raise was done assuming the stock would trade at 6x OpCF once in production and perhaps we’ll never get there again. But gold could triple in the next 5 years, in which case OpCF will be bigger than the entire market cap.

-

They also own Strathacona (SCR.TO) based on disclosure on the conference call that there was a mark-to-market loss on a Waterous LP investment. SCR is closer to a 20% FCF yield at $80 oil with capital return expected to start in H2 following debt reduction. Looking forward to seeing the annual report to determine how much they indirectly own. Wouldn't shock me if its a $300m+ position.

-

Great point and the Leap Year added a day to prepare.

-

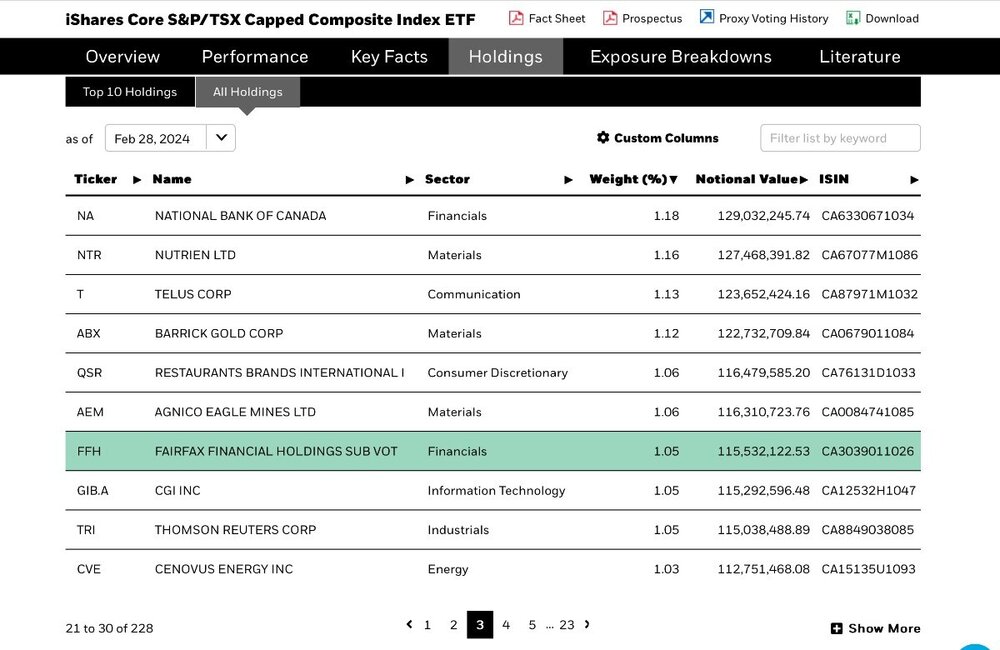

Rebalancing occurs every quarter in March, June, September, December which makes Feb 29, the measurement date. The rebalance occurs on the third Friday of the month and they give two weeks notice via press release so that’s why I think we’re live tonight. I think the odds are under 25% though given the historical precedent of 20bps threshold in the 60 for kicking a constituent out.

-

I think it’s #26 at the end of February which is the measurement date. If it’s going in on March 15, they will announce it tomorrow after the close. It would be an easy call if AQN was under 20bps in the 60 but it’s 22bp. <20 bps is a historical rule of thumb for deletions. I’m not sure if FFH being ~6x bigger than influences their decision to move now. The other reason Bay Street doesn’t think it goes in is because Financials are bigger in the Composite than the 60. The committee is supposed to have the 60 represent the Composite so adding another Financial would make it worse. Some mitigating factors are that when combined with real estate the gap is tighter and FFH isn’t very correlated with XFN. It’s just a matter of time until a constituent gets too small or gets taken out and maybe we are better off it happens at a much higher multiple and book value but it could happen tomorrow night.

-

Does that mean they paid back in 2009 or just before they made the first post?

-

They might still be short a few shares and probably had some poorly run long/short funds follow them in but I think the strategy is about the Day 1 decline. That’s why they can charge such high performance fees. The post Day 1 theatre is for the regulators.

-

They are alternative trading systems or alternative exchanges in Canada. FFH looks like it trades around 60-70% of its Canadian volume on the TSX. The rest trades on these alternative venues.

-

You are correct FFH.U doesn’t trade much but if one uses the FFH bid/ask and converts to USD to place an order an arb will likely provide a fill. I do think people use the FRFHF quote when discussing the price (and its usually close enough) but taking the FFH price and converting to USD at the posted rate is probably more accurate.

-

FFH, FRFHF and FFH.U are all the same shares. FFH.U is simply the USD listing on the TSX. FIH.U is the Fairfax India ticker and it trades in USD too. FIH doesn’t have a C$ ticker on the TSX although it could if they wanted to pay for it.

-

I am curious what percentage CoBF owns of Fairfax. It could be a material number!

-

3. Q2 and Q3 results (May and August) - Each will likely increase BV 3-5% having a direct impact on IV. Consistent earnings helped by the smoothing of IFRS 17 might increase SV as well. 4. Digit IPO (H124) - The Digit IPO should allow for recognition of an additional gain in BV assuming its higher than the current mark which seems more likely than not. This would increase IV directly but also offset some of the doubt caused by the MW report thus helping SV as well. It’s not out of the question to think Digit could be bigger than FFH some day given the growth profile, perhaps the IPO, will put that in perspective. 5. S&P/TSX 60 add (anytime) - Passive ownership is one of the biggest drivers of SV. After all stock prices are just supply and demand. A spot might open up because of M&A or the committee decides, they don’t want to remain short FFH vs the Composite as its weight continue to increase. March and June are both live. 6. ?