SafetyinNumbers

Member-

Posts

1,565 -

Joined

-

Last visited

-

Days Won

5

Content Type

Profiles

Forums

Events

Everything posted by SafetyinNumbers

-

2024 AGM Meeting poll - are you attending

SafetyinNumbers replied to This2ShallPass's topic in Fairfax Financial

Everyone is very friendly at all of the events. I’m sure you will feel very welcome. If you want to grab a coffee before the C’est What event on the 9th, let me know. -

The most likely explanation is correct. Just more incompetence at Morningstar.

-

someone on Twitter pointed out that Morningstar system probably wasn’t able to read underlined words. I guess it’s rare to see them in press releases.

-

I agree. I sent an email to the company. Hopefully, they follow up. I dismissed the Morningstar conspiracy theories but now I wonder.

-

2024 AGM Meeting poll - are you attending

SafetyinNumbers replied to This2ShallPass's topic in Fairfax Financial

I think the events on here are worth checking out. https://www.stingyinvestor.com/FairfaxWeek2024.html When are you getting into the city? -

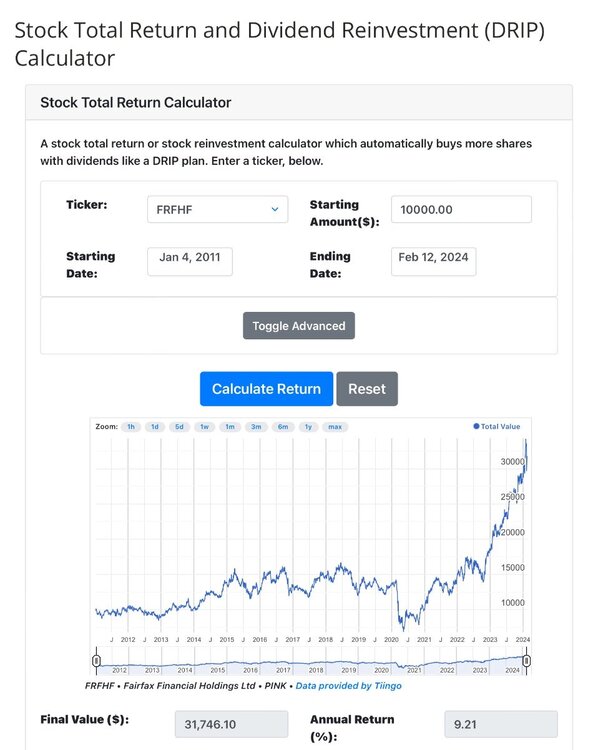

I live in CAD so that’s what I posted. It’s weakened a lot since then apparently. Including dividends it’s 9.21% in USD according to this website at least.

-

Makes me think that’s just the CAGR to the end of Q3, which makes sense if they didn’t want to release financial information early.

-

They know their arguments don’t hold any water so of course they didn’t. It’s a very good business model for those without integrity.

-

You’re welcome and congratulations. If an 11% CAGR is your worst return “by miles” since 2011, you should just keep doing what you’re doing.

-

It was in 1990 as a result of Markel and Fairfax separating. You can read all about it in the annual report. https://www.fairfax.ca/wp-content/uploads/AR1990.pdf

-

FFH bought its initial position in GIG in 2010. Given it was a ~40%+ stake, they used equity accounting. Every year, their share of earnings less dividends increased the carrying value. When they closed the deal to buy the additional ~47% from Kipco, they revalued at the higher price. Over that time, the company went from ~$420m in premiums to ~$3b. That might be worth 2.4x BV. But the multiple they actually paid should be adjusted lower because they deferred payments by way of annual instalments. Money is more expensive now so the discount rate is probably 9%. Is that helpful?

-

Most investors don’t bother to model out the earnings power and look at historical results expecting mean reversion. The quants have had a great influence over how the average investor invests.

-

The last three years, BV has CAGRed more than 15% and the odds are better than 50-50 the next three years BV will also CAGR more than 15%. The major reasons, interest rates have normalized and the equity portfolio is mostly just as undervalued as FFH.

-

I appreciate all of the good analysis on the board today. Thank you. I spent time with a few PMs today that were buying positions for the first time so they certainly saw it as an opportunity. I tweeted about the MW IFRS 17 proposed haircut and the work is incredibly sloppy. If you disagree, please let me know.

-

I think all of the equity issuances that were well north of book value probably created a lot more value. The most important might have been for Allied World at 1.3x BV in the midst of the zero interest rate era. It really put a damper on ROE and an overhang on the stock which they took advantage of with the moves you noted. Prem's painting quite a masterpiece, it will make for a good book some day!

-

Thanks for sharing Glider! Was a good listen. Overall, the commentary on culture was very interesting and encouraging. I think the most disappointing parts to me were that they think markets are efficient and they manage money the same way they did at Schroders. I think FFH best chance for significant absolute returns is not acting like everyone else and taking advantage where others have constraints that FFH doesn’t.

-

Why 2009-10? The stock wasn’t particularly cheap then from what I can tell.

-

FFH has for the most part traded their stock brilliantly including issue equity well above book value on many occasions. It’s a part of BVPS growth that gets ignored for the most part since with the exception of the TRS, it doesn’t flow through the PnL.

-

I’m not sure but I think with these agreements they buy back at the same multiple they sold at which in Odyssey’s case was 1.9x BV.

-

There is a committee (4 people from S&P & 3 from TMX) that decides. Generally the TSX 60 (XIU) tries to mimic the sector weights of the TSX Composite (XIC) while also trying to beat it. Historically, they have replaced components when they go under 20bp but I don’t think it’s a rule. Financials are already overweight in XIU vs XIC so that might make the hurdle higher for FFH to get in. IFC took a long time to go in for that very reason. When IFC was announced in to XIU in March 2022, its weight at the end of Feb was 104bp and it was the 25th biggest company in the XIC. It was almost inevitable that IFC was going to get into XIU given its above average growth. Now its weight is ~124bp and it’s the 20th biggest weight in the XIU. They would have been better off putting it in sooner. I would argue FFH is a good analog for what happened with IFC. Given the high certainty of near term earnings, FFH’s weight in XIC is only going to increase. Today, I estimate, it jumped from 29th to 27th biggest passing GIB and TRI. Its weight is probably close to 101bp. At the end of 2022, FFH was #41 and 65bp. It’s like a freight train and if the committee can see that, they may want to get it in soon so they don’t lose ground to XIC. I estimate, AQN is only ~21bp in XIU after today’s trading so it’s flirting with the historical replacement precedent of 20bp. Please correct me if I’m wrong but I believe they will use Feb 29 as the measurement date. Presumably, it will be a live every quarter going forward or if a member of XIU is acquired. Recently ABX was rumoured to be interested in FM. If that transaction was consummated, it would open up a spot for FFH as well. Of course, they could always skip FFH and go to TFII but it’s less than half the weight. The biggest impact of Scotia and now NBF socializing the idea of FFH going in XIU is that shareholders who really want to take profits for risk management or because they are afraid of a drawdown might hold on instead. This is important, because most buying is institutional and it’s usually done on a % of volume. It’s a constraint placed by investors on asset managers to protect against them manipulating share prices. The side effect of that is, sellers set the price. Knowing there is likely a significant amount of buying coming sometime in the next year at a time when the company is growing incredibly fast might decide to at least lift their offers. Some shareholders might even hold on and see if they can get a better price when there is an indiscriminate time constrained buyer and reported BV is likely somewhat higher. The float in FFH is relatively tight and underowned by Canadian institutions who are benchmarked to XIC. If shareholders start believing what NBF is telling them, the multiple expansion could be significant. P/B could get out of hand. It’s happened before from 95-98, a period when FFH put up 20%+ ROE for 4 years in a row. Maybe 2023 was year 1. P/B went over 3 back then before coming back to earth. It seems more likely to happen in this kind of market (meme stocks etc..) but it might take analysts starting to believe FFH can grow earnings consistently as some quants also set prices. Morningstar coming around would be a huge signal. I don’t expect that to happen but it’s possible.

-

It’s a really good note. Hopefully makes it harder for those funds underweight vs the benchmark to ignore!

-

Canadian exchange traded debt

SafetyinNumbers replied to SafetyinNumbers's topic in General Discussion

The strategic review that ECN announced is what peaked my interest. SKY ended up doing the private placement and apparently wants to buy Triad but wants nothing to do with RV/Marine. Everything ECN has done since is to try and clean itself up for SKY. Ultimately, they still have to execute though. The ACD bonds don’t seem very interesting to me. Like you pointed out, the reward is much higher in the equity. -

He provides the earnings estimates and the moat rating. The quant machine spits out the target price. But he’s especially bad at estimating forward earnings. They don’t make any sense. Ironically, his earnings estimates make other quants want to avoid the stock because they show high variability in earnings estimates and show earnings declining. Things that are not generally associated with quality and what quants prefer.

-

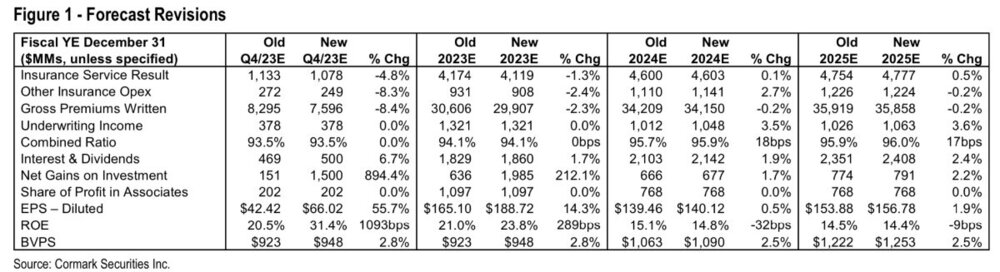

Pretty much the only reason, I think FFH has stayed cheap is because of quants. Volatile earnings streams are by definition not quality. Earnings growth modeled by analysts is also a necessity for most quants to get involved. This rules based approach has worked on a portfolio basis so they won’t make exceptions to over rule the model. Will analysts finally start modeling in earnings growth as the multiple expands, we’ll have to wait and see. Even Cormark with their US$66/sh estimate for Q423, still has them earning only US$140 in 2024. There is no point being a hero when the stock trades at ~ 7x conservative estimates.

-

Canadian exchange traded debt

SafetyinNumbers replied to SafetyinNumbers's topic in General Discussion

Thanks. A big part of the ECN trade is its event driven nature. If they sell the business which is pretty much what they are telling us they are going to do, then ECN.DB.B gets 104.875 + interest until the end of 2024. The sooner a deal is done the better and of course they actually have to do it. I disagree that the goodwill/intangibles aren’t worth anything. Most value/debt investors don’t want to pay for them but origination is valuable because with the right structure it can create significant ROE. I assume that’s why SKY was willing to invest new equity above TBV. On a related note, it will be interesting how much CHW and ACD trade for when they are sold. If you haven’t looked at ACD, it trades at close to half TBV and I think they have every reason to go private given the current conditions. Agreed on the DRT. I like that one of major equity backstops for the rights issue also owns a lot of bonds. I think the rights issue was a clever way of getting a larger stake in the company while ensuring the debentures get paid off but they have to execute too. Equity holders have a lot more faith than the debt holders! Thanks for taking a look.