-

Posts

5,474 -

Joined

-

Last visited

-

Days Won

14

Content Type

Profiles

Forums

Events

Everything posted by John Hjorth

-

So much for you continuing posting very strenuous posts here on CoBF.

-

@Gmthebeau, Peace. - But in my personal opinion - going forward here on CoBF, I think we all need to think about to be very specific [and careful] about very negative statements [here, in casu, such as yours, like "blown up multiple times" [you haven't posted even evidience here] and the likes], unless you can provide specific evidence and on a very specific level substanciate your findings, naturally according to what you're posting. If you are expressing your personal opinions in writing here on CoBF, it's not a bad idea also just to write about the causes / basis you are opinionated about that particular matter, and your reason behind your why!

-

Well @Gmthebeau, Harris Kupperman is what he is, with his 'corner' at the Praetorian Capital website, his Twitter account, with among other things photos from his finca, and all that, 'finca' in Spanish simpy translates to English by 'property'. Source[s] for the above?

-

Berkshire Hathaway Letters to Shareholders - Warren Buffett & Max Olson

John Hjorth replied to John Hjorth's topic in Books

@Xerxes, I hope you like it and that you are satisfied with the quality, when it arrives, for your personal skeptical inspection and scrutiny. I think I was if I remember correctly for both my orders charged USD 30 per copy plus freight back then some years ago [2016 or 2017?]. I was initially personally highly skeptical towards this 'print on demand' concept used at lulu.com, ['never tried it before' + 'old conservative bugger'] but ended up very surprised - in a positive way! - at delivery of the first one copy-order. -

Well, @nwoodman, -So he is averaging up, also think about what he has not only said, but actually written about allocating capital to your 5th or 10th best ideas in the 1993 Letter, now using basket approach of 5, and now also implementing leverage [J/K, actually! - It all relative ..., among other things to who you are and what you are working / operating with! - Situational flexibility!]

-

Much in line with the last post by @gfp above : Bloomberg - Markets [January 17th 2024] : Sumitomo Clarifies Buffett Comments After Trading House Stocks Jump .

-

Denmark, Sunday : "Connected, commited, for the Kingdom of Denmark!", Russia, Sunday :"Connected, commited, for Putin!". The man does not give a damn about the people of Russia, his people.

-

Reuters [27 November 2023] : Putin approves big military spending hikes for Russia's budget. So a budget shock, and balance based on expections of continued high oil prices. [Not mentioned, but plan B : To tax the hell out of the businesses owned by the oligarchs ! [because there are no money other places] ... wonderful - just wonderfull!]]

-

-

I Need a Laugh. Tell me a Joke. Keep em PC.

John Hjorth replied to doughishere's topic in General Discussion

-

Buffett/Berkshire - general news

John Hjorth replied to fareastwarriors's topic in Berkshire Hathaway

Thanks @gfp, So this ended up exactly according to your expressed and expected playbook, ref. one of your earlier posts here on CoBF about it. All good. -

Ordered this book today, based on that it is mentioned in Howard Marks latest memo : Easy Money in a positive way.

-

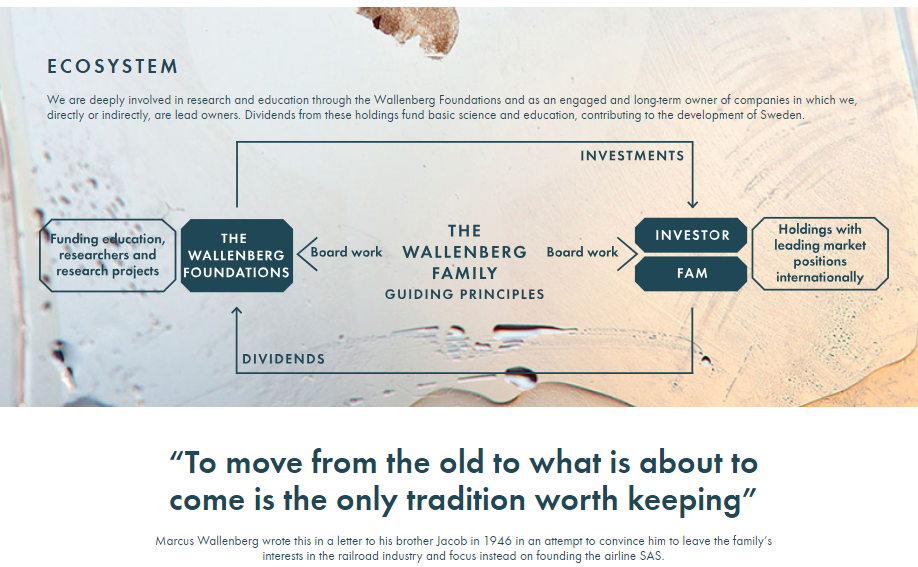

Thank you, @Luca, It was actually not so much - here, in this context - about Investor AB as such, but more about the overall mindset at Investor for how to choose [pick], invest in and run businesses. As shown by me above, the particular mindset was first crystalized in writing in 1946 at Investor AB, and still saturates everything there. Another way to phrase it conceptually is the following : "Stagnation is not stagnation - stagnation is regression" "'Good' is the worst enemy of the great company" Long term it is more about quality and growth than price [paid], @Spekulatius wrote in a post upstream. I don't think anyone here on CoBF would disagree with that. It is about a business simply breaking the 'usual business life cycle' to stay alive and also prosper and staying relevant going forward, no matter its age, instead of it to die. On the rim, it's about staying relevant due to innovation and development by investments in the future. Such businesses actually aren't few, nor seldom. They're just about everywhere. The World is actually stuffed with them. We just need to find them and pick them, carefully, to our best [not easy!] avoiding loosers and laggards. Mr. Buffett in his 50 years anniversary Berkshire letter from 2014 calls such a good company 'sprawling', and calls Berkshire sprawling, too, in that letter. Personally, It think we have quite some fairly young CoBF members by now who have the potential to take this really far for themselves, if they early on get it right and don't become subscription paying members of the foolish crowd by avoiding and stearing clear of serious and material mistakes early on, ref. the basics of compounding.

-

Thank you, @Spekulatius, This is to me personally just such an awesome post of yours, - as already mentioned, in my personal opinion. It basically isen't about names & tickers, but more about principles, basic criterias and considerations from which to specifically allocate capital to names, companies & groups, based on their respective modus operandis. And we should discuss exactly that in this topic in stead of, picking names or tickers with no reason or overall rationale mentioned to supporting it. For Investor AB [, Sweden] : English : Swedish : The Wallenberg family isen't wealthy as such in private, because pretty much all fortunes built over time has gradually been given to foundations, while the mantra for the family is - it's obsessed with it : "To move from the old to what is about to come is the only tradition worth keeping."

-

Berkshire Hathaway Annual Meeting 2024

John Hjorth replied to good-investing's topic in Berkshire Hathaway

Tilman [ @ebdem ], Just shoot Sanjeev [ @Parsad ] a PM or an e-mail. - He can make almost everything happen -

POLL - Likelihood of Taiwan Invasion by China before 2030

John Hjorth replied to Luke's topic in General Discussion

@Cevian, #metoo. I have moved all that trash / breadcrumbs for a few family members to a taxable account of mine personally, containing such stuff, to avoid *noise* intrafamily. Luckily all minors, not much above trackers. What still strikes me is, that these losses are caused by sanctions imposed by the West, not Putin & Co. in his ongoing doings related to warfare. *sigh*. No PTSD over the loss, though. Just move on, and something learned. -

POLL - Likelihood of Taiwan Invasion by China before 2030

John Hjorth replied to Luke's topic in General Discussion

@Luca, Are you able to add it? -

@RedLion, this one is almost killing me! - Here you have the palmes for the post of this week :

-

POLL - Likelihood of Taiwan Invasion by China before 2030

John Hjorth replied to Luke's topic in General Discussion

@Luca, In my opinion the option : "Unopinionated" is missing. Happy New Year to you. -

Berkshire Hathaway Annual Meeting 2024

John Hjorth replied to good-investing's topic in Berkshire Hathaway

Thank you for sharing, Tilman [ @ebdem ] ! -

Buffett/Berkshire - general news

John Hjorth replied to fareastwarriors's topic in Berkshire Hathaway

Thanks, @longterminvestor, There exists a world outside the US. And there is a lot money to be made there. -

I Need a Laugh. Tell me a Joke. Keep em PC.

John Hjorth replied to doughishere's topic in General Discussion

@formthirteen, It's not even a joke [, naturally depending on ones actual mood]. - - - o 0 o - - - Next thing is that I'll have to dig up the story behind the phrase 'Die dumme Dänen'. -

Buffett/Berkshire - general news

John Hjorth replied to fareastwarriors's topic in Berkshire Hathaway

@longterminvestor, What is your geographical scope and / or basis for your considerations above? -

Fourteenth annual letter to owners of Fundsmith Equity Fund

John Hjorth replied to formthirteen's topic in General Discussion

Terry Smiths track record is indeed quite impressive. Almost by coincidence a few years ago [likely by looking at Dataroma, I think], I found out, that I had a sweet tooth for the same things as Mr. Smith. One can read his stuff on and on. [Personally I'm still doing it.] But no matter how you process his stuff and think about it, my observations are as follows : 1. Never any specific talk about new additions, untill they already are built to wanted /desired size, & 2. No tangible and / or specific comments related to what may have gotten the boot out of the boat [<- I'm not totally sure about the 'No' [ever] here, it may be incorrect, or just inaccurate.] - - - o 0 o - - - No matter how ones modus operandi or ones investment style, stock picking isen't an easy, nor trivial, thing. Mr. Smith appears to have found his way forward. He has so far been damn good at doing what he says he's doing. [This label is certainly available for every money manager, for a variety of reasons.] -

Now I'll stop derailing this topic from its purpose by intent of the topic starter [Greg [ @Gregmal ]], and start brewing on a new topic about the major Canadian banks, for separate discussion of them there.