-

Posts

15,193 -

Joined

-

Last visited

-

Days Won

38

Content Type

Profiles

Forums

Events

Everything posted by Spekulatius

-

I don’t think that war is over this winter. The sanctions for the most part will stay anyways. Europe does not matter in terms of the outcome all that much, its more the US is supplying the weapons. The EU helps quite a bit to keep the Ukraine’s afloat though with monetary aid. I don't understand the animosity toward Soros.

-

Despite Ukraine, the defense contractors earnings are nothing to write home about: https://finance.yahoo.com/news/lockheed-lowers-2022-revenue-outlook-113815217.html LHX is in the same boat. Ukraine turns out to be classic sell the news story (which i luckily did for the most part) for the defense stocks. FWEIW, my biggest winner in the defense basked was Rheinmetall (RHM.DE) but I sold it as well (~ 3 bagger).

-

I don’t think Russia is bluffing. I put a high likely hood on them turning of the NG to Europe. Once they have done so and Europe is past the winter, they have played their card and I think its unlikely that Russian gas will flow to Europe again. Russian Ng in that scenario will remain stranded for years until they can build infrastructure to move it elsewhere. Europe will go into a recession and I expect some of the basic industries like Steel and Chemical to be hit hard. The rest has to replace the gas with oil in the short term. The power grid will be fine. I have heard expectations of a recession (-1.5% real GDP) but might look worse when compressed in a small time frame. Edit - found and article that looks at the economic impact of NG from Russia going to zero. Italy, Slovakia, Hungria will be hard hit: https://www.welt.de/wirtschaft/article239995319/Gas-Lieferstopp-Diese-Laender-trifft-er-am-haertesten.html

-

This couple was traveling to Music festivals far away and spending like $3k a pop. Resources are finite and you have to make choices. Stick with music festivals closer to home by where you can go by car or spent a night at a Bestwestern and you are closer to $500 for the same thing. Or they can decide to be renter for life and then they can do all these things. For me, the choice would be easy, but its up to them.

-

Actually oil went to $140 in 2008, but only for a New York’s minute. In the past every oil price spike has been followed by a recession : 1990, 2001, 2008 and now likely 2022 which resolved the issue. The US only produces about 10% of the crude (and consumes about the same amount) so it wont solve the issue, at least not in a fee month, but likely not at all. Even if the US increases production by 10%, its just one percent of the total, which matters, but hardly looks like the solution. The solution is demand destruction which is likely happening right now in third and second world countries. These countries have for the most part seen their currencies devalued by 20% or more against the USD, they are seeing a magnified impact of the energy cost surge and can much less afford it. China right now looks like they effectively are already in a recession right now and their construction industry certainly is (a huge energy consumer) so I am guessing that demand is going to be reduced and we know that the price elasticity curve in crude is very steep, with obvious consequences for the clearing price. I actually think another spike in crude prices to the $140/ brl range would accelerate what I think might happen as I expect some third wold countries blow a gasket so to speak like Sri Lanka.

-

I think you can determine that oil prices are high relative to historical prices as well as production costs. So yes, I consider them high.

-

Reduced $CNC as it reached my target valuation.

-

These people are nuts and i think their instinct that the festivals and probably other spending issues are a huge part of their problem is correct. The condo purchase may have been a mistake as well, but it's fixable, I think. They are both young (25 years old) so their income will rise (it has already) and if they keep plugging along, the burden from the condo should progressively get smaller over time. I know it did for me - when I purchased my house, the mortgage was a bit less than 4x my income (5x for this couple) but it was fixed expense (actually went lower because I was able to refinance) while the salary kept increasing. Now if this couple want to continue go to music festivals, they just have to budget and probably visit more local ones where they don't have to spent $3k just for travelling. Nobody ask them to totally abandon what seems to be their hobby, but they got to be a bit smart about it. if they sell their condo, they are going to take a lot of friction cost ($50k?), then they have to rent and that rent will keep going up. They probably end up with a budget problem even if they do sell their condo. I think the underlying problem is that this couple does not know how to budget, it's not the condo purchase per say.

-

I think a housing decline could be a bigger deal than it appears right now. The mortgage payment strike is just symptom and not the root cause of the disease. It have no idea where this goes. I agree that PSBC looks attractive here despite above, I think it’s a way better bet than Alibaba, if yiu feel inclined to invest in China.( I dont have a position).

-

Buying real assets denominated in Euros

Spekulatius replied to Red Lion's topic in General Discussion

I think AKZA (paint) looks interesting and I own some shares. Exor has been mentioned before here. Porsche Holding has an interesting even / unlock as thry want to float Porsche ( as a business). DPW (Deutsche Post) is also very cheap and well run. Then there is Poland where there are a bunch of secular growers that look very cheap. If you drill down to smaller and microcaps , there should be way more opportunities. -

I dont predict anything other than the European leaders having very little influence on the outcome here. Russian gas is done and could be turned off at any moment, so they need to find alternative means to keep home heated the industry going. Lack of power wont be the issue, there is enough spare generation capacity in the grid to keep the light on.

-

Buying real assets denominated in Euros

Spekulatius replied to Red Lion's topic in General Discussion

European stocks are very cheap right now and many have sizable business in the rest of the world. They also benefit from low Euro if they export in the US. I think there are great opportunities investing in Europe right now, similar to the Greek debt crisis back on the day. The risk of recession is real but a lot this is priced in. I would look at exporters and those with world wide business as well as some local champions. -

I haven’t listened to this episode (and wont), but if the couple spent on ~28% of their income on housing, thats about what I spent when I bought my first house. I think it is highly likely that purchasing the condo isn’t the problem, they go broke because they spent too much on other stuff. Festivals for example are hideously expensive and over priced nowadays. Thats where I would start cutting back.

-

Just one mans opinion:

-

@StevieV I showed the iron ore chart just to show how closely correlated the direction of equity prices is with the underlying commodity. Its not because I think it should trade like this. Same seem is true for energy, to some extend, although I think there are more confounding factors. I agree I have a myoptic view of these sectors. I have invested in energy and commodity stocks longer than many are alive here and have had more misses than hits. In particular l, I have lost money when I was wrong about the price or the underlying commodity almost EVERY SINGLE TIME. I gave up on commodities in 2014 when oil prices started to decline and really haven’t done anything in this sector there since. This has nothing to do with ESG but more that I found it impossible to predict the direction of commodity prices and every time things looked certain it turned out that it wasn’t though. People here thing that we cant add supply but I disagree. If prices stay high I think some stuff will happen that nobody here accounts for. Just to add one possibility, do you guys think that the US is the only location with shale deposits? Why would that be? Europe has shale deposits for sure, but they may wont use then am although I am not sure that countries like Poland etc may get to that point. Argentina has a huge shale deposits (Vaca Muerta) that rivals the largest US deposits and is just about starting to get exploited . There are likely dozens of deposits like this that nobody knows yet about. These bulk of these countries doesn’t care much about ESG either. Then there is Venezuela which is coming back (even with the government morons in place) and if you have s change all of a sudden a fee million barrack of supply will come on in a relatively short period of timeframe. I would go so far to say that one political decision in or about Venezuela could kill your oil bull thesis right there, because think this country alone could lift as much oil than Russia potentially. that would be a disaster for prices most likely because Russia really hasn’t reduced their oil exports yet, just the destination has changed.

-

Movies and TV shows (general recommendation thread)

Spekulatius replied to Liberty's topic in General Discussion

@Blugolds11 Great list. My simple rule that every western with Clint Eastwood is good. I disagree on the True Grit remake, I liked that one a lot. Some newer westerns one that I really like are: “ Hell and high water” and I also think that “No country for old men” could count as a contemporary western. Then we got the “ Power of the Dog” (probably not everyone’s taste, but a great movie). I really enjoyed the “ Ballad of Buster Scruggs” novellas, but then again I am huge Coen Brothers fanboy (hence my liking of True Grit). -

Why would there be a shift in attitudes? The ESG folks are still growing and if you listen to the younger generation, they are not going to go back to the old days. Some of the other investors like me don’t buy commodity stocks when the commodity is high, they have seen it all. Many don’t buy commodity stocks because they have been burned several times over. I don’t think there that many incremental buyers actually. The only thing you can rely on are capital returns. In that respect, the miners like RIO, BHP seems to be ahead of the oil stocks here. You want to see a clear capital return framework with cash dividends, not buybacks. Buybacks are nonsense, because they only occur at high share prices when the companies are flush. If you dont believe me, look at how many oil companies bought back stock in 2020, there are virtually none. Buybacks are always buy expensive, buy nothing when cheap. If companies would just concentrate on paying dividend per formula on excess cash flow, it would be way better for investors. Thats why I like PBR, despite the political issues. If SU and CNQ starts to do the same thing and just issues double digit yielding dividend per formula from their earnings (lets say 60% of their net earnings), I would be a whole lot more interested and put some in my tax deferred accounts. Right now, there is virtually no oil stocks that provides a better distribution yield than my ORI holding for example.

-

XOP contains crappier companies than XLE so what I imagine happens is that in every downturn (2015, 2020) , some go bankrupt or in dilution hell, so the equity in those is toast. There is no recovery from your equity being toast and only partially from dilution at the bottom. That is why I imagine those ETF undercover m the underlying equity. The other reason is that while equities follow directionally spot prices, its not (and should not be) a one to one correlation. Equities should rationally trade based on LT cash flows, not on spot prices. LT cash flows depend on the prices in the future and the expect stunk for those are reflected in the crude future a few years out. Right now a quick loom shows that crude futures for Dec 2025 futures trades for ~$70/brl and that is why E&P companies are valued as if crude trades at around these values. I have no view whether these assumptions are correct. If you do think these prices a will rise, you should think about trading specific crude futures rather than oil stocks, imo, .

-

@LearningMachine - OPEC only controls about 37% of the crude supply and they have not shown any ability to control the prices - otherwise the crude prices would not be that volatile. https://www.statista.com/topics/1830/opec/#dossierContents__outerWrapper Iron ore has 3 large producers VALE, RIO and BHP and the largest customer is China (but end consumers are elsewhere because a lot of the iron from China gets re-exported as goods). I think Iron ore has a price floor around $75/ton at which point anyone except the big three does not make any money. That's what I like about iron ore - it is more a natural resource based commodity than a political one. It's also relatively cheap now (iron ore trading around $100-105) historically while energy is quite expensive. I also don't like with energy that the low cost producer (Aramco) is not investible for me.

-

I have stated in the past that in order to be successful investing (or speculate) in commodity stocks, you need to be right about the direction of the underlying commodity. Sure there are company idiosyncratic issues, but for the most part, it is the direction of the underlying commodity that determines the outcome. Here is an example I pulled together from an another sector - mining. RIO is a miner but predominantly , their most important commodity is iron ore(roughly 75% of their cash flow). Now if you create a chart of the underlying commodity and the RIO share price, you will find that they correlate quite well: The conclusion seems simple - you need to buy RIO (or Iron ore futures) when Iron or is cheap. RIO is pretty good because they are a low cost producer with BHP and Vale so nobody really can underbid them at the low points without taking heavy losses. So RIO is unlikely to go out of business. I think pretty much the same applies to all other commodity stocks. The only way to relatively sure way to win is to buy when the commodity is cheap. if you own a low cost producer that can't go out of business, there is almost no way you can lose money short of an exogenous event (nationalization, fraud, severe operational issues with mines etc). I also think that it makes little sense that a miner with long life resources trades up so much with iron or spot prices, but I can't argue with Mr Market and I don't make the rules. Anyways, make of this what your want. I think it applies well to energy and oil stocks as well. but there are other factors at play here, as the market structure seems to be a bit foggier than with iron ore. For once with Oil, the low cost producer is Aramco and other Gulf states, not the ones the people typically buy. Aramco can be bought, but has political risk and trades also based on that. FWIW, I think RIO is starting to look attractive here.

-

Bought some USB.

-

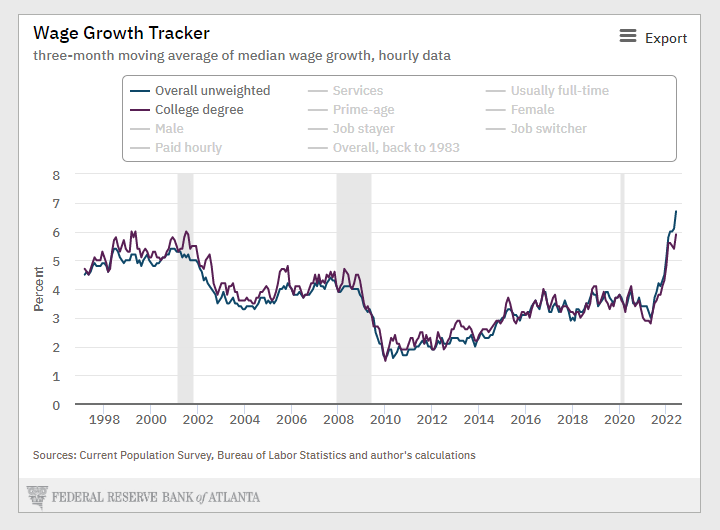

Yep, current wage of wage increases is 5.5-6% overall, which trails inflation of 9% YoY. That's a 3-3.5% loss in purchasing power on average. Stimi checks (which did not count towards wages too) are gone as well . So the vast majority of people probably has 3.5-6% less income (counting the stimi checks last year towards income). With the consumer spending being 70% of the economy, how can we avoid a recession here? I don't see it. Now the consumer is flush and has some excess cash which is going to be spent (we know what it is because the savings rate is pretty much at a record low) but that only last that long and is probably gone for the lower 50% at that point.

-

The Bundesbank (as long as the DM existed) had the Single Mandate of price stability as well. This is not the case any more with the ECB now in charge of the Euro. I like the single mandate better because I do not really think that central banks can fix structural issues in the economy like unemployment. My sense is that if you try to do this, eventually you destroy the money and still haven’t fixed the structural ailment. We are seeing the extreme of this in Turkey where Erdogan seems to be hell bent to run both his currency (Turkish Lira) as well as his economy into the ground with his unconventional central bank policy. In practice, even the Bundesbank was beholden to politics back in the day but their independence did serve as a counterweight to populist policies affecting the stability of the currency. As for the Canadian dollar, I suspect it doesn’t move against the USD because the Fed will decide on a similar 0.75% move or perhaps even a 1% move on their next meeting. Just a reminder that back in 1980, we had a 5% move at some point.

-

Core inflation does contain inflation, rents, lot's of services etc. Let's play the guessing game - assume inflation cools off, but core inflation sticks around at 5-6% the remainder of this year. Bullish or bearish? I think it's the latter. What is the Fed is going to do in this case?

-

It's possible, but I think the Fed may have to do more. My guess is we have seen the peak in CPI but the sticky components (or core inflation) may not back down. That could be a disaster too. Just check the 70's if you think that's the playbook. Inflation was not consistently high - it varied quite a but, but tended to surprise people on the upside and that's not a good thing. Just putting it out there. I don't think I am smart enough to predict what is going to happen.