thepupil

Member-

Posts

4,184 -

Joined

-

Days Won

4

Content Type

Profiles

Forums

Events

Everything posted by thepupil

-

yea, I'm not predicting that gets repeated, nor am i incredibly excited about ESS (have about a 4% position). if i thought ESS was going to compound in teens i'd put my entire NW in it and retire lol. it probably goes lower over next few q's maybe years as tech bad news shows up in fundamentals . I think ESS did well because california doesn't build enough housing or raise property taxes and it owns a high barrier to entry irreplaceable portfolio (tech boom also helped of course). I'm not a big "this is the only geography that will do well" guy. I rolled my APTS profits into a Nashville ground-up mixed use development. Can't have a better economic outlook than NAshville, also a market that's bringing on crazy supply. I own a valuable house in suburban DC. I own JOE. I own ESS. I'm a permabull and i want some Cali, some NYC, some Nashville, some FL, some DC....all as long as it's reasonably priced. I don't have a strong view on Realty Income, other than that their model is more dependent on accretive issuance (which is fine and can work)

-

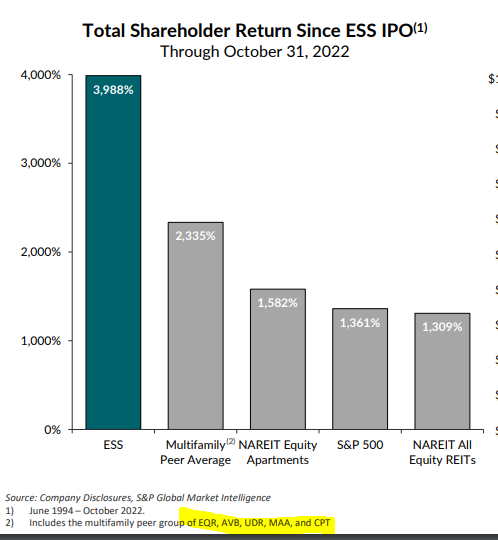

here's the chart you're looking for. The future won't be as good as the past, but long term REITs have provided returns in line with the indices, MF REITs have done better than REITs, and blue chip MF have done better than MF (and ESS has done better than blue chip because you know California). I don't know what next 10 yrs look like, but would be surprised if they can't put up solid and safe high single digit annualized returns (with some optionality to higher IRR's over shorter time frames from re-rating). Nothing crazy, but not a terrible way to preserve and grow one's purchasing power.

-

the publics have nicely staggered debt making this risk pretty manageable. To illustrate let's take ESS. ESS has about $5.3B of bonds outstanding at a 3.1% WA interest rate. $600mm / $5.3B is 2048 and 2050 maturity. that's not all their debt, but I'm just going to use that for simplicity. Below is the WAIR assuming they refi'd the existing bonds at 5% and 7%. Note how it takes a full 8 years to raise ESS's debt cost by 1% if current rates of about 5% on their bonds prevail. this is despite the fact that their wgt average bond maturity is "only" 7.5 years. Each year they have $300-$500mm mature which is about the same as their current $550mm/yr dividend and about 1/2 their FFO. worse comes to worse, just go to be net neutral on shareholder distro (issue stock = dividend) and pay off debt due in a coming year, though that'd be a not great outcome. point is the big publics can handle a huge increase in cost of debt/equity capital. in that scenario, the private market would be in shambles and many owners will be handing back keys. Many MF owners have 70-80% leverage. to put some more numbers behind it, the bonds are about 80% of their debt cost and are about $166mm interest / yr. If you had to refi it all at once at 7%, it'd suck and decrease cash flow by $200mm/yr ($3.1/share vs 2023E FFO of $15) so about 20% . But that's not what will actually happen. I'd also note that increasing rates offer buyback opportunities for the in place debt. The 2.65%'s of 2050 trade for 60% of par right now. At 7% they'd be at $47

-

agreed on all accounts. another important thing for the asset class is the stability and attractiveness of financing. Fannie/Freddie/Ginnie are a large % of the financing (and increase share when banks/insurers/CMBS aren't there), and provide low cost/low spread financing to the market. While the REITs don't take advantage of this and run with very low leverage, it underpins asset pricing and allows the REITs to sell individual assets for good prices to buyers willing to put on more leverage. the low leverage of the MF REITs is a double edged sword in that they can never relaly be that exciting, but it also makes them much easier to average down into as they decline in price. they'll be the last ones standing if shit really hits the fan.

-

2022: +4.5% Historical: All rough approximations, putting the old stuff from contributions to similar threads like this, it looks something like this My consolidated IBKR accounts have returned: +248% from May 24th 2013 to December 30th 2022. SPY is about 178%. REITS +62%....Account = 13.9% / yr. SPY = 11.2% / yr My consolidated Fidelity accounts have returned +106% from August 12th 2016 to December 30th 2022. SPY is about 96%. REITS +23%. SPY: 11.2% /yr, Account = a bit better than that. My (slight) outperformance has come with much greater volatility and tax drag. 2022: +4.5% 2021: +55% 2020: +2% 2019: +20% 2018: -2% 2017: +15% https://twitter.com/thepupil11/status/1610293154871406593?s=20&t=ljxIAVKsBs5hps4Nrk7LAg

-

right, but they're actually like 1/2 of what the numbers indicated, so you're making an asusmption with bad data. No one is forcing you to look at UHAL, and in the end you can prioritize what you wish, but just think you mischaracterized the biz w/o doing any work (which i sometimes do too, and like when people correct my high level impression w/ data). About 1/2 of gross capex is purchases of rental equipment. If you net this w/ sales of PP&E (which I'm not sure one can do fully, but I think that line is them disposing old trucks), it's more like 1/3. One has a very different view of the capital intensity/maint capex when looking at the company as a self storage company with a truck rental biz. vs just a truck rental biz. Also you seem to assume higher inflation / much higher rates as fact, when in my opinion it is one scenario of many (we've had this discussion multiple times though, so no need to rehash ad nauseum)

-

not to beat a dead horse, but the company went from 153,000 units to 638,000 units (12.5mm to 53mm sf) over the last decade w/o share issuance. gonna go out on a limb and say some of the capex was growth capex.

-

also you may wish to consider their land/building ownership regarding replacing their "fleet". like at least open a financial statement before making a sweeping authoritative statement about the business...

-

how do you know all that was maintenance capex? Uhaul is a low leverage conservatively run self storage business (short leases, small % of customer budget, low maint capex) and the leading DIY truck rental biz (scale buyer, cheapest way move shit, etc). I think it would have many qualities that make it a good LT inflation hedge and that your assumption that all investment is maintenance capex is misguided and runs counter to what I've heard from many long term owners/students of the business. Since '94, UHAL has returned 14%/annum, 10 yr = 18%/yr, 5 yr = 12%/yr I think Berkshire would buy UHAL in a heartbeat if given the chance (as Berkshire has been speculated as a potential LT home for the company).

-

this bond is now at $77 which is +16% in < 1 month and a greater return than the S&P 500's 6.5% over the same time frame. the spread collapsed from 280 to 210 and the 20 yr treasury went from 4.5% to 4.0% yield. Not trying to take a victory lap on an inconsequential position, but just demonstrating that bonds can have upside too.

-

I really wish IBKR did not offer it via Paxos. Everything I read about Paxos seemed okay, but I’d rather IBKR not have any ties to the crypto ecosystem. I take comfort in their ruthless margin/risk mgt, but still don’t like it

-

High Quality Multi-family REITs - EQR, CPT, ESS, AVB

thepupil replied to thepupil's topic in General Discussion

ELS: Recognizing that it's probably best biz model in all of housing and like the best REIT ever, still seems a little rich. EQR/AVB: maybe i should buy those too, but just wanted the pure west coast vehicle. I kind of view all of them as different flavors of the same thing. -

High Quality Multi-family REITs - EQR, CPT, ESS, AVB

thepupil replied to thepupil's topic in General Discussion

today, i purchased a decent sized position in ESS in one go, using some BBB bonds and ALX as funding. Off 35% from pre-covid and 40% from post covid peak and at about the same price as early 2015, ESS has endured a nice drawdown and is trading at a high 5's cap rate. I get EV/Unit of about $360K with low ~$105-$110K/unit of debt all of which is well termed out and at relatively low cost. About 14x 2023E FFO / 4% divvy yield. ESS owns 57,000 (at share, 52K wholly owned then 50% of 10K) mostly suburban California and Washington apartments in LA/SF/Seattle metro areas. They command rents on average of $2500 / month and they own many buildings in ritzy areas where its more like $3.5-$5.0K. This is the cheapest way to buy California housing. No one is able to buy or build at cheaper price than on the stock market through ESS. Further, to assemble this portfolio and at its basis and margin (given the whole prop tax thing in cali) would be impossible. NEar term fundamentals will probably suck. tech layoffs, recession, California exodus. headlines will rage. but it's hard to build, it's the world's fifth largest economy, GDP/Capita in the areas where ESS owns RE is very high. ESS is an advantaged and well capitalized owner should distress arise. I started the year with big NEN and FRPH positions. I've trimmed those by 50% and 25%, respectively. FRPH is up 3% YTD, NEN up 15% YTD. ESS is down 38%. Each of these securities primarily own coastal apartments in DC, Boston, and Cali. that's a big swing and in my view should be taken advantage of. -

Far less different than I’d assumed, guess thats why it’s good to use data rather than gut/stereotype

-

what was Germany's debt/GDP then? (couldn't find on google) it looks like debt to GDP was 30-50%, then. at 125% think we'd have a harder time w/ that high of rates. I will assume our private sector is FAR FAR FAR more levered than 1980's germany also.

-

Let me just say that if the 20 year goes to 7-8%, I will lose a fair bit of money. I completely disagree with the premise (that 20 year should be 7% if FFR = 5%). I'd say 3% is more likely than 7%. but that's just one hare brained dude's opinion.

-

I'm roughly flat YTD but maybe down 15% from peak. having some energy exposure, some buyouts in first part of year. owning conservatively financed off the run RE (like NEN/FRPH) have all led me to outperform this year. I am not in any real pain. have lost a few percent last few days. feel comfortably positioned and have been trying to use luxury of not being down to try to assess everything with new lens, and not get too wedded to any stocks/ideas (my tendendcy) or ideas of NAV/intrinsic value that may be stale....while (contradictorily) allowing for the fact that the world may not have changed...THAT much and things may reverse quickly....been trying to structure life/portfolio to be ready for most things. have built a bond portfolio, HELOC in place, LT fixed mortgage, trimming winners, adding to some losers...just trying to be measured and not overly bearish/bullish. It's very difficult for me to not get more bullish seeing a lot of frothy demons being exorcised from the markets, but I don't find high quality real companies to be incredibly cheap (or expensive). everything seems in realm of reasonableness to me (very US perspective, tons of very cheap stuff abroad, I'm just much more comfortable in US sandbox)....my biggest fear is probably a 10+yr reversal of USD bull market, I don't own enough non USD assets...that's probably what nags me most...like am i gonna hatemyself for not 3-4X'ing some $$$ on a small amount that I could put in china if that works out...i might...might i hate myself for not finding a bunch of great high quality small caps in europe that 3x over next 5 years nad have a currency benefit...yea i might...but i also don't want to be patsy at poker table. in short, no real pain here. i don't think this is really all that bad of a "bear market". only people getting slauhghtered in a real way kind of deserve it in my opinon (like if you'rd down 80% on unprofitable dream of a tech some tech stock...you had the prior decade to make 20%/yr and get your nut...unless you just entered markets in which case you'll be fine because your whole life is ahead of you) this isn't pain. pain is much worse in my opinion. it may come it may not.

-

both i guess. I mean it's more just that I view my royalties as a hedge / "allocation" as opposed to super high returning awesome investments to make 3x+ my money over a short time period (which is what happened), so I think to some extent, I've "overearned" and energy is now 15% of my portfolio which probably a little bit more than i'd like. On the other hand they're unlevered and paying big distros which I'm not reinvesting and there are tax consequences of selling.

-

i sold FRPH completely in 2020. what i bought drastically outperformed FRPH. I bought it back at higher prices than i sold. I think complete exit was probably a mistake last time / a little too cute. but on the margin owning stuff that holds up in downturns should be monetized (in my opinion). I have sold half my NEN this year as its up 15% and all real estate stuff is in the shitter. now where i'm potentially going wrong is that I've generally used proceeds to buy stuff with lower long term return potential (bonds and shit) than FRPH and NEN. I haven't really used it to buy more aggressive stuff, so I'm being a bit defensive, but not like crawl in a cave and don't take risk defensive. i don't know what the hell is going to happen and am trying to prepare the portfolio for a wide range of scenarios. i should probably be trimming my energy royalties...but those distro's yo...

-

Today, I purchased 912810SV1 , the 30 yr TIP issued in February 2021. It has fallen to 62% of par (par has grown 13% because of inflaiton). real rates have gone from -0.5% at the time of issuance to +1.8%. I like this bond because of the discount to par value provides a theoretical put in the event of deflation. if deflation occurs over the course of the bond, the bond will return 1.2%/year because TIPS are floored at their original par value. so the nominal return of this bond will be at least 1.2% /yr, even in a disastrous depression, so it has some of the same i-bond like characteristics of being both deflation and inflation hedge. unlike i-bonds, it wil lmake a shit ton if real rates decline (if it immediately went to zero real yield, this would return 65%) and if real rates continue to rise it will lose lots of money. brings me to 17% bonds, and am buying more in 401k every month but taking a pause for now on bonds. About 90% long stocks, 17% long bonds. I guess that makes me a risk partiy investor since i'm levered long both. I also bought more PSH at a 36% discount to NAV. I used FRPH to fund both of the purchases. FRPH is great and has been my largest position all year. It's still a large position. one isn't supposed to cut winners but I think FRPH NAV has declined and it's gotten more expensive relative to alternatives.

-

I think the best thing in short term is i-bonds and CLO AAA ETF offered by Janus JAAA. It's floating rate and yields 6.0% ish, japanese banks are no longer buying and UK pensions are forced sellers and are puking CLO AAA out. Its the AAA tranche of securitized leveraged loans. you need a TON of defaults to get hit. it's a liqudiity / complexity spread more than a credit spread. this is like 1-3 yr floating rate paper yielding 6%...for perspective a year ago more like 1.5% and 3-4% in 2018. I disagree with the general aversion to duration, but if you want a little extra on your short term, i like this (and i-bonds). the JAAA ETF has gone from almost no AUM to $1B+, probably some tinfoil hat tail risks if everyone wanted out at once maybe.

-

it seems like it actually didn't go down 7 points, it just there wasnt a bid and it got marked at the $98 bid...neverthless, I like em at $104.8 / 4.75% where one can buy $55K of them right now at Fidelity (there's $1.25B of them so I'm sure you can get more paper if you need, but just showing what's actionable with one click for the common man here)

-

in january 2021, low quality, highly levered but asset rich pub company Marston's received a buyout for 87p / share, stock traded to 100p. In dollar terms the stock has since declined by 77%. i looked at it a few months back in the 50's (now 33p) and couldn't get a ton of conviction they'd make it through w/o raising substantial dilutive capital...but i also didn't conclude that they were destined for failure. also a writeup on VIC for JDW which is apparently a better run peer, also down 74% in USD so maybe that's the better play. probably better to buy higher quality co's but just noticed these because have a passing interest in british pub real estate (just seems like an enduring asset)

-

i mean i just bought a 1% position in the PM 4 1/4% of 2044 for $66 / 7.4%. in the last 1 year, the spread has gone from 130 to 285 and the rate has gone up a lot, all leading to a fall from $117 ---> $66. there are some PM specific reasons for this and i don't pretend to know what the tobacco market will look like in the future, but even if PM defaulted in 10 years and recovered 50 cents, this would yield a 4.4% IRR. It would break even at a 30 cent recovery. now in no world am i saying PM will default, there's $120 billion of market cap betting it won't, but just illustrating the benefits of the discount. if in 5 years it trades to a 5.6% yield, you'd make an ~11% IRR. 1 year it'd be like 47% but that's probably a bit aggressive. I know i'm always early on this stuff and will lose money before make. i could be years early...but the pricing on high quality long duration tsy and credit has drastically improved (from an admittedly insane level)...just nibbling all the way down...like a lamb to slaughter

-

today, i think some folks are saying that fed is starting to show signs of stlowing tightening which perhaps long end thinks is too early / won't tame inflation...but the move of the last month doesn't fit that narrative. i think it's tough to say WHY anything is happening....