thepupil

Member-

Posts

4,184 -

Joined

-

Days Won

4

Content Type

Profiles

Forums

Events

Everything posted by thepupil

-

I won't ever buy an automaker unless sustainably dividends + buyback give me like 5-7%+ yield. Look at that sexy GM FCF or Earnigns yield and see how much comes back to you. toyota's good for about $6-$9 billion / year....so I'd buy it at maybe $120 billion (-60% from here and 0.5x book...it traded to 0.7x in the depths of the GFC)...I therefore conclude I'll never buy an automaker because i have unrealistic expectations. they're basically non profit entities organized to provide better cars for the world in the form of plowing all earnings into capex.

-

97% voted against divvy in 2014 for a reason (tax inefficiency vs buyback, desire to have WEB retain/reinvest earnings). Berkshire's been close to 100% payout ratio on operating earnings w/ some px sensitivity but $28B in 2021 of buybacks isn't half bad, capital return is robust. buyback is same as divvy, but better tax efficiency now net buyer of equities and balance sheet is significantly less lazy (Y purchase, big energy buys, etc) Berkshire has returned 14.8% / yr over last decade (+0.5% vs SPX), 13.8% over 5 (+0.5%), 16.9% over 3 (+0.5%), 13.6% over 1 (+13%). And you think it's still undervalued so fundamental intrinsic value growth has been even better(assuming you're right). In what world is that a "bad investment"? all seems well.

-

-

Significantly Outperforming a Bear Market

thepupil replied to spartansaver's topic in General Discussion

I know this is going to seem somewhat insane, but I have yet to conclude we are in a protracted bear market. We are experiencing a healthy decline in valuations and some covid retracing, some violent sectoral and factor rotations make it extra fun...but It's still not clear to me we're witnessing a "major regime change" or that the case for owning equities is much less strong today than it was 3,12,24,36,60 months ago. The exorcism of the froth gets me more bullish. I'm just going to buy whatever I like, whether we are in a bull, bear, pig, peacock, or rhinocerous market...I try to buy things that are defensible in a variety of market conditions... -

yea...it's in WSJ, on JP Morgan's website, on bloomberg..."prime"...it equals 4.0% on all of those...i don't have the docs on hand so can't tell you with precision, but whatever you think "prime" is, it's that.

-

Signature federal credit union is aggressiBe on LTV I went to 97% LTV with them on a 2nd mortgage (but not a revolving HELOC) the rate was 5-6% though (I think 5.25%)

-

I have a $150k HELOC with third federal. The rate is Prime for first $50k and prime - 1% for the next $100k. I believe they do up to $200k but that’s there limit which may be less than you’re looking for. its undrawn for now, plan would be to use it in a real dislocation. last dollar of LTV is only 70% since values have gone up, but I think they’d do a little higher. may not be aggressive or enough $$$ for you. I think the terms are very fair (prime is 3.9% and prime -1% is 2.9%) but it did take a long time to get.

-

531127AC2 - Liberty NY Dev Corprev Goldman HQ 05.25% 10/01/2035

thepupil replied to thepupil's topic in General Discussion

Fidelity has $2.7mm ($100K minimum face / $68K at markt value ) offered of the Stanford University 2.25%'s of 2051 at $68 / 4.15%. These were issued @ $96.8 / 2.4% in 2021, nice 28 point loss in year.. They are callable at par after 2031. Some portion of the return will be taxable because of the steep discount (google de minimis rule, OID, etc), but nevertheless this represents an after tax yield in the high 3% (3.8%) range and a TEY for wealthy californian of 6.5%. At high tax rates, the bonds offer a return equivalent to 320 - 740 bps above the treasury rate (depending on when called). I'd assume the 2.25% coupon will be below market for the life of the bond and they'll extend to 2051. Nevertheless a healthy spread of 320 bps to take on the illiquidity/credit risk. Stanford University is a strategic asset of the United States and is a AAA credit sporting a $38 billion endowment, global brand, etc. Won't default. CALIFORNIA EDL FACS AUTH REV BDS 130179TM6 02.25000% 04/01/2051STANFORD UNIV SER. V2 -

here from quicken (top mortgage provider) talking cap… I can also say my Wells Fargo jumbo was structured similarly. this provide one with ability to model the maximum risk which should be manageable anyways think OP should have info to make decision. Adjustable-Rate Mortgage Margin Margin is a percentage point predetermined by your lender that remains the same throughout the life of the loan. It’s used to determine the interest rate for loans. Once the initial fixed-rate term ends on an adjustable-rate mortgage, the interest rate typically adjusts annually, and this new rate is determined by adding the index to the margin. Although this may cause the interest rate to increase, there are caps on how much it can increase. Adjustable Interest Rate Caps Initial cap: The maximum amount that the interest rate can adjust the first time it’s changed after the fixed period. Periodic cap: This puts a limit on the interest rate increase from one adjustment period to the next. The initial cap and the periodic cap may be the same or different. Lifetime cap or ceiling: This puts a limit on the interest rate increase or decrease over the life of the loan, and all adjustable-rate mortgages have a lifetime cap. Although these limits are put in place for rate increases, rates can decrease, too. However, since the margin stays the same throughout the life of the loan and is added to the index to get the interest rate, the rate will never fall below the margin. Adjustable-Rate Mortgage Cap Structure Cap structure is a numerical representation of each cap for the loan. This is presented in a series of three numbers that represent the three caps: initial cap, periodic cap and lifetime cap. For example, a common rate cap is 2/1/5, which breaks down like this: Initial cap: Your initial interest rate can only change by up to 2% the first time it adjusts. Periodic cap: Each change after that is limited to 1% every 6 months. Lifetime cap: Throughout the rest of the loan term, the most the interest rate can increase or decrease is 5% from the fixed rate. So, if your original rate was 3.5%, your interest rate can only go up to 8.5% during the life of your loan.

-

I used 8% because it’s 5% more than the ARM. Many ARM’s have built in caps both in terms of aggregate increase in rate (ie your max rate is 8%) and how much rate can go up in a quarter or year. These have value to the borrower and substantially de-risk the ARM. I don’t know the poster’s precise terms but would be surprised if it’s uncapped

-

I think Buffett gives generally good advice. I also understand the appeal of negatively convex callable 30 year mortgages, but the math is the math is the math. Unless you are highly certain your hold period is 13+ years, the 30 year fixed (with this rate differential) is likely to cost money. it's pretty expensive insurance. if that security is more valuable than the $10's of thousands one will likely forfeit for choosing the fixed, than that's fine, but it's not necessarily "optimal"...also if your mtg is manageable relative ot income/resources the risk is much smaller than perceived.

-

I would absolutely do the ARM in this instance. Let's say the loan is $500K. In the first 10 years of the fixed ARM period the 3.3% rate loan assuming no extra payments pays $147K of interest. A $500K fixed at 4.1% pays $185K. Over the 10 years one saves $38K of interest or 7.7% of the loan value due to the lower rate on the 10/1. Additionally, the payment is $226/month less, so one could also theoretically use that freed up capital to make investments or additional principal paydown. If I make an apples to apples comparison (same payment / month) and apply the payment savings to the principal then the ARM will save $43K of interest over the first 10 years (8.6% of the principal value). The 3.3% loan payment is $2,190 vs $2,416 for the 4.1% The ARM will be better off in the first 10 years. Thereafter, it may not be, but they typically can go up by only 2% / year and have an absolute cap on how much they can go up (when i took out mine, it could only go up by 5% cumulatively). Typically under a worse case scenario your breakeven will be in year 12-13 (ie you will have paid more interest on the ARM if rates go up a a lot after year 10 and that breakeven point is a couple years after the rates start to go up). The typical american homeowner doesn't stay in their home that long. Even if you think you might, I'd go with the certain savings of the ARM in this instance. plug in your max potential rate on year 10 principal w/ 20 year amortization and see if you could handle that. that's an important risk mitigant. In our $500K example, let's say rate immediately jumps to 8% in year 10. The principal is now $352K / term 20y, rate 8%) your payment would jump from $2,190 to $2,946 and interest / month would go from $~900 to $2,300, so you'd be paying $1,400/month more in interest in year 11....but you saved $38-$43K in the first 10 years so you're still much better off for many more months, so that's 27 more months. At the risk of being repetitive, it's important to note that one will bear the risk of adjustment on a 10/1 on a much lower principal balance. In this case $352K/$500K (70%). If you can't handle the prospect of a big hike in rate on 70% of the mortgage 10+ years out, you may be stretching on house. So I think I can say with a high degree of certainty, even if you never have a chance to refi, the 10/1 will leave you better off in the first 147 months of the loan or 12.25 years (and if i were to see the fine print on your loan and ascertain that the adjustment could only increase by x% / year and is capped at y%) then I may even be able to extend that further. I think when faced with something that will absolutely make you better off for the next 12+ years, but may have some risk of hurting you thereafter, you go with that, rather than paying a large "insurance premium" for the stability of a fixed rate just to potentially save you money in year 13. Go 10/1 ARM I will admit there's a beauty to knowing that your p&i can never go up and I went fixed when i had chance to refi (3.125% 10/1 jumbo--->2.875% 30 yr conforming), but the rational choice is ARM in most cases particularly with such a big gap b/w 10/1 and 30 yr fixed like you are talking.

-

whatever the shoe shine boy is saying, i-bonds can't ever decrease in nominal value so their popularity or lack thereof doesn't matter unless treasury decides to change allowed amount or something. if youre saying inflation fears may be peaking...maybe??? but idk

-

I wouldn’t buy EE’s when the 20 yr zero coupon tsy yields about the same and Is liquid or you can buy 20yr IG bonds for 5%+…but I wouldn’t buy EE’s generally, the payoff profile is just too bizarre, make no money for 19 years then double in year 2…it means you truly must hold for 20 years to reap the above mkt yield…

-

One of the reasons I look at “quality” indexes such as the MSCI Quality or GMO funds or whatever is that historically these are the types of companies which can pass on prices in an inflationary period; honestly I don’t worry too much that Visa, Microsoft are overearning. No company is infallible, things can change (like corporate tax rates) etc, but ultimately I think a lot of the market has pricing power and those companies have fallen in absolute price. everyone is worried about peak margin/peak multiple; you’ve had a nice chopping of the multiple and I haven’t seen mean reversion in margin in the ten years folks have been calling for it and I honestly don’t expect much of it for most high quality companies. I’m partly just throwing some bullish vibes out there to be contrarian…you can’t be complacent, but just don’t want y’all to become too wound up on the “regime change!!! Stagflation!!! “ narrative… with that said my portfolio does kind of look Like big inflation bet and is short on regular way high quality co’s so I’m starting to worry about not having enough of that (normal good companies) vs inflation protection.

-

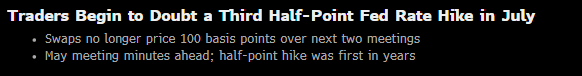

I think assets have cheapened quite nicely (exception: private RE). Your classic 60/40 allocation (Vanguard Wellington) now features high quality ~8-10 yr corporate bonds at 4% and high quality stocks have de rated from mid 20’s to 18-20x (5-6% earnings yield) those 2 numbers were 2.5-3% and 3.5-4% recently. A no effort blended retirement portfolio’s earnings+interest yield has increased by like 30-50%. For the rentiers of the world, an increase of this magnitude feels wonderful (if one can survive the decrease in asset prices that accompanies it). I’m loving it. inflation may continue to weigh upon valuations, but the long term compensation for participating in “the market” has increased substantially. Stocks weren’t that expensive before outside of some frothy demons which have been exorcised via 70-90% drawdowns. If I squint hard enough, even some of that looks more balanced r/r. as the resident Panglossian Permabull Pollyanna (that’s alliteration!) with a decent time horizon. I say buy everything. Megacap tech is reasonable, public RE looks good, bonds offer decent r/r more carry than they have in 10 years, energy is flowing, speculative tech is seeing some forced selling. the top 20% of America dutifully sends their paychecks to 401k’s each month, earnings remain robust and the divvy+buyback yield is decent. buy buy buy !!!

-

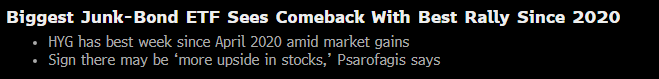

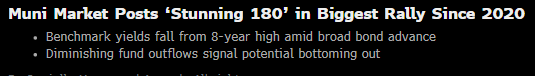

this has been a good (stupidly short term) market call so far. bonds are flat as the drive up in rates stalled, US / Global stocks down 11% and nasdaq down 16%...the problem is i like stocks so much i'm tempted to just sell my bonds buy more stocks lol...but 11% market timing move on a very small portion of portfolio isn't why i did this...staying the course... the vanguard bond index yields 3.4% and is 2/3 treasuries & government MBS...hoping i actually start losing money here and bonds become a bit more rela of an alternative (though I fear the effects of that on the rest of the portfolio.

-

Haha I’m still long and strong, just suffering from endowment bias / twiddling thumbs

-

Adult diapers

-

Better start prepping…housing is collapsing in Suburban DC mortgage rates were 4.7% at the time of listing.

-

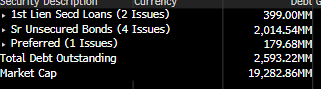

I am generally adverse to preferreds for a number of reasons. 1) negative convexity. preferreds (and munis, and MBS) all have callability that i don't like because i want the full benefit of capital appreciation if rates go down 2) fewer rights 3) worse capital treatment by regulators so demand from something like an insurance company won't ever be the same as a big sexy IG rated bond 4) generally owned by procyclical retail yield pigs...weak hands to be taken advantage of in times of stress with that said, this one seems interesting in that it doesn't appear to be callable, it's a corporate issuer and therefore would qualify for qualified dividends, it's very small so the incentive to screw it over in some extractive way is not really there, seems pretty interesting to me tbh it's a clear liquidity discount in that this only trades $125K / day...I'd be a little wary of that...maybe require a bit more extra yield relative tot he 2028's at 6.1% (though they don't have the punch of the duration)

-

531127AC2 - Liberty NY Dev Corprev Goldman HQ 05.25% 10/01/2035

thepupil replied to thepupil's topic in General Discussion

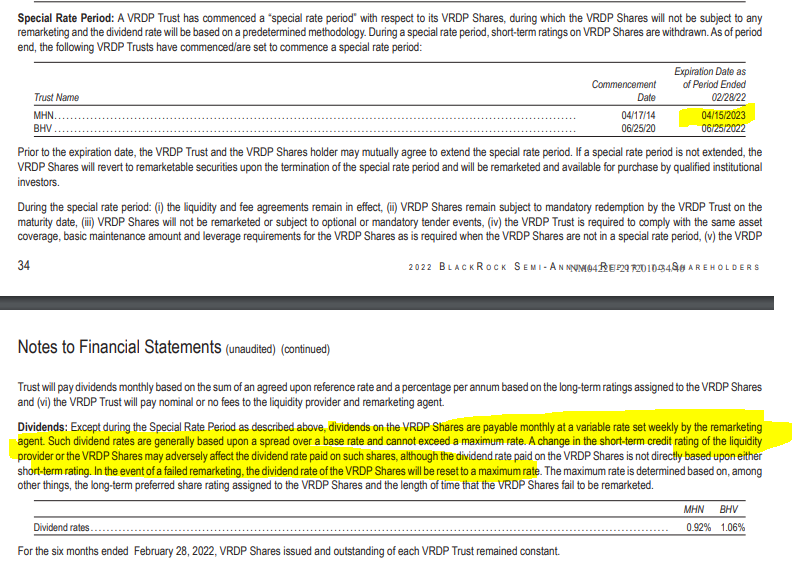

so that's quite interesting....i've looked into these a few times and always get a little scared of the idea of levering high duration securities with floating rate and redeemable/callable debt. I find TOB / VRDP language a little dense, but i think the short of it is "cheap mark to market floating rate leverage" not unlike what mREITs do with mortgage backed securities. managed with position size, this may be an acceptable risk/reward and the muni's now yield WELL above the cost of financing even pro forma for a few hikes. One thing to look out for is there seems to be some kind of teaser period with the bulk of the leverage that expires in 4/2023 after which it becomes floating... I also don't love the idea of paying about 1% / year of equity to own bonds. 1% is a substantial amount of the return...in some ways you're levering up to earn a spread and then paying that to the blackrock. i'll also say that muni CEF and bond mutual funds of all kinds will often manipulate the aggregate yield figures by owning a sliver of very high risk stuff that jacks up the portfolio wgt average YTM...bond averages always make me suspicious...like this says portfolio YTW is 4.66% and YTM is a 6 handle...try to go find a few well rated NY munis that have that...if you can, I'd probably just buy the individual issues. I actually find those stats hard to beleive or maybe they include the benefit of leverage. For example, Puerto Rico bonds (post restructuring) yield 4.5% and those are on the high end (because its PR)...so I don't understand how this whole portfolio would yield 4-6% unless that is an already levered number here's everything they own https://www.blackrock.com/us/individual/literature/investor-education/selected-cefs-holdings.pdf obviously the ETF has benefits of portoflio scale/diversity/ease of tradeability. -

no. the reason one gets a K-1 is because an MLP is a partnership that passes through revenue/expenses etc to its holders. the k-1 shows you your share of all that stuff. bonds are just bonds regardless if the borrower happens to be a partnership.

-

A House in Canada Now Costs Almost 2X A House in the US

thepupil replied to Viking's topic in General Discussion

As are 38 states in the United States...IIRC we've discussed this before. The US is mostly recourse. https://www.legalmatch.com/law-library/article/what-is-a-recourse-state.html -

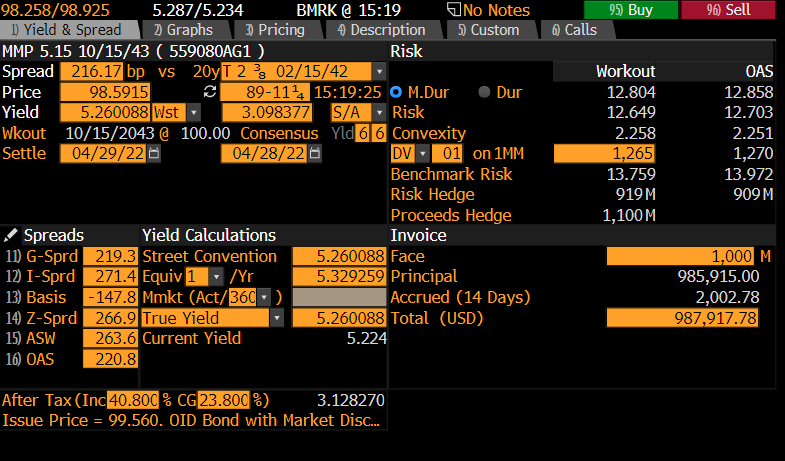

here's an example, Magellan 5.15% of 2043. 33% LTV, ~3.5x levered, BBB (edge of IG)...just traded below its MArch 2020 price and is down about 30 points from the highs on both rate backup and spread widening. this is in my opinion a pretty safe bond. and it offers a 5.25% return. buy $50K of this stuff at 5% in your IRA, buy $50K of i-bonds at floating 9% and you have $100K of paper yielding 7% with duration of 6. that's not half bad. inflation slows and your i-bond yield sinks your probably printing money on your MMP long bonds. inflation keeps up and rates rise and you're reinvesting at rates not seen for a decade.