thepupil

Member-

Posts

4,184 -

Joined

-

Days Won

4

Content Type

Profiles

Forums

Events

Everything posted by thepupil

-

Where Does the Global Economy Go From Here?

thepupil replied to Viking's topic in General Discussion

i don't disagree with anything you're saying. just have to be mindful at extremes and the choice isn't b/w COST and some shitty company. as of 3/31 the index of high quality US stocks traded at 24x trailing and 21x forward...the likes of COST/WM may be worth a premium....but is it worth 2x the multiple? From what i can tell quality stocks grew EPS by about 8-9%/yr to costs low double digit (i don't have data going too far back) High quality US stocks 12/2013 PE was 18x ish (now 23x) COST 12/2013 PE was 26x (now 43x)...both figures are trailing for ease of comparison. So the COST premium has gone from 44% (26/18) to 95% (43/23) while absolute multiples have gone up. these are the types of setups where stocks can dissapoint for pretty long time frames (even if "eventually" right). you are sized to be okay with that. -

Where Does the Global Economy Go From Here?

thepupil replied to Viking's topic in General Discussion

my only point is that even for those of us with "long time horizon", possible change in multiple matters. If you assume COST reverts to historical multiple over hold period and grows EPS by 10% / yr (this is how much operating income per share has grown over previous decade, NI grew 12%/yr but tax reform impact) 5 year time horizon 8% cost of capital: $411 (25% lower than stock price) 20 year time horizon 8% cost of capital: $756 (36% higher than stock price) EDIT: to clarify, this is what stock worth today under above assumptions so this is why i push back on both you and speculatios. I hardly see COST in Bubble territory. If you think it can grow EPS by 10%/yr for 10 or 20 years and be worth 25x (a "reasonable" multiple for a world class business) it is not expensive; this is why munger badgers buffett for selling and is mr #neversell. But to completely ignore the asymmetry of an elevated multiple (as you do with your "what's wrong with costco's price" omits a big risk of derating over 1,3,5,10 years (the latter 2 of which i'd consider somewhat "long" time horizons. Making no money for that long a time particularly if withdrawing a portion of capital can hurt a fair bit. We actually have a very real example of this. The broader stock market made 0% / year from 2000 - 2010 and Costco only made 5% / year in that time frame. EPS grew by 2.5x. The stock de-rated from 40x (about where it is today) to 23x. I assume you're trying to make more than 5% / year holding COST a high multiple, medium growth security has extreme sensitivty to changes in multiple (duration) over short to medium time horizons...COST has more duration than bonds (but should make a much higher return over long time horizon) -

A House in Canada Now Costs Almost 2X A House in the US

thepupil replied to Viking's topic in General Discussion

For my house, I have 4 cases. bear case: Lot value at 3 years ago land prices -33% from base base case: slight haircut to today, 0.85-0.9x zestimate bull case: zestimate canada case: $2.5mm -

Where Does the Global Economy Go From Here?

thepupil replied to Viking's topic in General Discussion

It does, but no one actually has a 20-30 year horizon for every $1 they invest. -

Where Does the Global Economy Go From Here?

thepupil replied to Viking's topic in General Discussion

Well one could compare relative and absolute valuations of say 5 and 10 years ago and take the view that the big premium now is potentially not deserved. but in the end arguing over valuation is one giant exercise in the below.... -

Where Does the Global Economy Go From Here?

thepupil replied to Viking's topic in General Discussion

this is a bizarre sentiment. if one doesn't own something, one cannot opine on something. that said, I think bubble is a strong word COST Over the last decade COST has gone from 20x to 40x. one would therefore expect fwd returns, ceteris paribus to be lower the next 10 than the prior 10. But earnings a 2.5% earnings yield that grows at well above inflation probably preserves and grows one's purchasing power...though at this price you certainly have risk of a big drawdown in a de-rating (20 yr average PE of 27x and low of 14x). KO KO has rerated to ~27x average PE of 22x...doesn't seem crazy to me. am i a buyer, no? might it derate, yes. is it a "bubble"? not unless there's something amiss w/ the earnings such that they're drastically overearnings or something WM 32x, average of 20x. again same shit. a little heated, yes? vulnerable to de-rating. sure, but it's a TIP w/ greater real yield than one... Would i expect the three to outperform the SPX over next 5,10 years. Probably not. But 30% higher multiple than expected because of flight to actual quality /safety is not a bubble IMO -

531127AC2 - Liberty NY Dev Corprev Goldman HQ 05.25% 10/01/2035

thepupil replied to thepupil's topic in General Discussion

hey, i don't canvas NYC / NY muni bond market and only follow these because they are knid of unique in that it's a corporate credit (and backed by RE) and it is a bullet bond and therefore more convex than typical munis (which often feature callability)...so this has a lot of duration upside....I don't live in NY/NYC so don't follow closely. sorry. -

Japanese Maple indeed! Thanks! All landscaping done by prior owners, play set a bit “vintage” as well.

-

Because I wish to turn this into a thread bragging about my backyard. The prospect of a lousy 20% correction isn’t going to pry my little plot of well located land from me.

-

NFW. t-costs are 9% of asset value and large chunk of equity and i have a 2.875% 29 yr mortgage. my home is "expensive". It's probably at about a 2.8-3.3% cap rate (normalized maintenance/capex is hard to guess) and 3x+ the median US home despite being ~1900sf/80 yrs old....but because I have fixed low cost leverage and t-costs are a very large % of the equity, there's no way I could reinvest the equity at a better return and that's before all the psychic benefits of ownership. also imputed rent on primary doesn't show up on your 1040. this is important consideration. only reason I'd sell is if moving geographies and didn't want to deal w/ being a subscale landlord in a landlord unfriendly jurisdiction.

-

Bonds Today: +0.6% Netflix Today: -34.7% Bonds outperforming Netflix by over 35% today. you heard it here first fellas.

-

here’s one I like. 3.8% to 2035, NYC triple tax free, guaranteed by Goldman Sachs and backed by their HQ. there are others, my flagship state university’s bonds are yielding >4%. I haven’t checked out the levered CEF’s in a while, maybe something to do there.

-

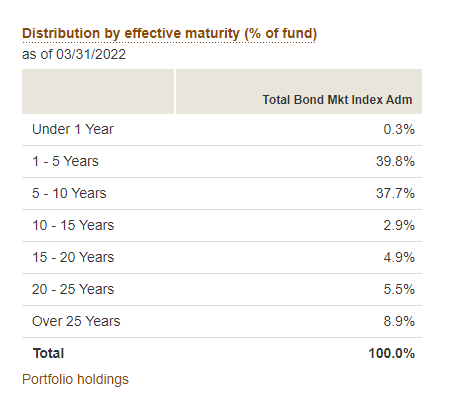

I know there's a thread on i-bonds, but this is about things we can buy more than $10K/social security number of. Plain old bonds, notes, debentures, obligations, etc. For my 401k (where i can only buy indices, ~4% of my investment portfolio), I switched out of stock index to buy the bond index today. I've bought slugs of i-bonds. I bought a AAA county GO today yielding 3-4% YTC/YTM (5-6.5% tax equivalent). Between all those, I've got like 10% of my portfolio in bonds and I'm loving it and looking forward to being way too early and losing more money in them and actually getting paid mid to even high single digits on bonds! This is an exciting time. Muh bonds in total are yielding 5.5% and in total have a duration of about 4 (both numbers heavily subsidized up in yield and down in duration by the slug of i-bonds), but even ignoring that there are good high quality companies out there whose bonds yield 5% (if you take a little duration risk) or 3-4% (taking less). i see some good muni's at high 3% ish yield which gets into the high 6's for high tax bracket folks in terms of tax equivalent. I recognize that inflation is running hot, and that 4-5% yield with inflaiton at 9% is "the same" as 0-1% yield with inflation at 3% (or worse!) but i think that fails to recognize the fact that you're now getting a fair bit of coupon which can be reinvested at higher yields if yields keep going up and really bonds have less duration than most equities unless you go real crazy far out. A 20 year bond w/ a fat coupon isn't that different than assuming some 10 yr out multiple in your DCF. For the first time in a long time, I think bonds are worth owning and a decent diversifier. Buy bonds!

-

Yea we’ll find out if there’s folks who have requested / been granted confidential information for sake of diligence / offer in the next few days. got a little lotto ticket riding in this but expect it to be a tax writeoff

-

While i think it's highly likely to go to Berkshire, I have not seen an announcement regarding the results of the go shop (which should come tomorrow or Monday). Right?

-

iSavings bonds yielding 7.12% currently

thepupil replied to Spekulatius's topic in General Discussion

Most recent print has me buying the full amount (I procrastinated a little bit) for 2022. Probably won’t hold but currently accreting 31% of my mortgage interest in I-bonds despite only owning 8% of my mortgage principal in them…love It. -

i'll am i the only nut job who likes the idea of owning all this land? at least to start. like I'd rather go from land rich , asset heavy to asset lite than to buy the asset lite. Lennar had $8.1 billion of Land and Land Under Development as of 11/2019. They've since sold a bunch of homes and added some and now have $7.5 billion, but the point is a good bit of that $7.5 billion is from pre-covid. they were also a buyer of whole companies (Cal Atlantic $5.7 billion in 2017) and WCI 2017 ($640 million). t o summarize, most of the land on the balance sheet (and in unconsolidated entities) is likely well before the covid housing boom and underwritten under pre-covid assumptions. If you could go back in time, knowing that housing prices have mooned and buy billions of dollars of land (not to mention even more billions of finished inventory) at pre-covid prices, would you? I would. and have in very small tiptoe-ish size. tha'ts big picture why i find the idea of buying homebuilders <book right now interesting...I don't have time/bandwidth to llook at all of em though

-

If you think mtg rates should be that high you’re effectively saying where the 10yshould trade(5-7% to get mtg’s of 7-9%) and taking a low probability view thereon. id recommend futures options or bond etf options to express this view. I’m not trying to dismiss the risk just saying that mtg’s and tsy’s are inextricably linked and that fixed income investors are not entitled to a real return

-

umm if we're talking homebuilders it was a 90% peak to trough drawdown in the S&P 500 homebuilders GICS subsector and the 2005 peak was not reached until 2017. I am more bullishly inclined of the homebuilders than most, i like em. they're in far greater shape now than back then (several went BK and i don't see any major homebuilder coming close, they all have giant backlogs such that they may not even lose any $$$ even in a pretty big downturn), but 30% mark to market is not at all what the experience of the GFC was in homebuilding. if we're talking RE value declines, yea, it was about 30% asset level, but that's a huge % of equity.

-

It's extremely low still. INVH is the biggest and owns 80,000 homes. there are 84 million single family homes in the US. the largest institutional SFR landlord has 9 basis points of market share. this is not to dismiss your concern and there is a big "stock vs flow" dynamic here. Investors are a much larger percent of purchases.

-

I don't think we're in a housing "bubble" in the 2005 sense of the word at all. I think we're in a period of elevated and rising housing prices. I want to be long homebuilders. I'll probably start w/ a low conviction basket approach XHB ETF calls ~1% (these are nice for me because i don't have to preclear ETF's) NVR #Neversell you can buy the dip all the way down, 1-2% to start LEN/B Event driven/spin-off play, 3-4% for now i'm thumbsucking. I think it's ridiculous that LEN/B is at 1.1x TVPS (0.9x book) vs its 10 yr average of 1.3x and 8/2021 valuation of 1.8x, the quarter before it spins off a decent portion of its asset base, after 2 years of tremendous deleveraging (2018 ND = ~$8.5B, now about $3.5B). I know this is the whole sector but I'm a sucker for that discounted supervoting share to capture a lot of the spin. On the whole "land bank vs non land bank", I actually don't mind a hefty land bank and like Lennar in that you are going from an asset intensive model to something less so, rather than NVR which is already asset lite / beloved. LEN has plans (albeit seemingly vague ones) to become more of an asset mgr and sell down/manage its land bank for a fee. this seems attractive. we're probably early and there's could be a knee jerk reaction to rates from home buyers that causes everyone to pause and potentially more of a panic.