-

Posts

198 -

Joined

-

Last visited

-

Days Won

1

Content Type

Profiles

Forums

Events

Everything posted by giulio

-

Public Company Share Repurchase-Cannibals

giulio replied to nickenumbers's topic in General Discussion

At one point it was trading at less than 0.4 BV, probably 3 years ago. It's the second largest bank in Italy. Higher rates, incredibly low starting valuation and Orcel contributed to a spectacular performance. I am impressed by how prepared he was, he saw a lot of value and has executed flawlessly so far. His words re: capital allocation are reassuring as well. He won't do a deal just for the sake of empire building. At this valuation ucg is buying back 25% of daily volumes. I guess it's one of those Einhorn stocks! -

Public Company Share Repurchase-Cannibals

giulio replied to nickenumbers's topic in General Discussion

UniCredit (UCG) bought back 2.7% of its shares in 6 weeks. An additional €1.5B authorized and I expect more to come in Q3-Q4. It trades at 5.5x this year's expected earnings. -

@Sweet Christopher tsai of tsai capital

-

@gfp you're spot on. 2020-2021 -> he bought overvalued tech (CRM, SPOT, TSLA, SNOW, ZG) and questionable insurance companies (TRUP). we can discuss whether GOOG, AAPL and AMZN were overvalued or not in that time frame. from memory, they were not cheap. no wonder the portfolio crashed in 2022. I am not sure these names were cheap in 2022 either, unless you picked the absolute bottom! Maybe fairly valued? Hard not to be biased now looking at share price movement. Adding to TSLA in 2021 makes 0 sense even if you believe the autonomy story or whatever. It is just cathy-wood-crazy level! CAGR does not lie and I am using gross, not even net (after fees). Gross CAGR is 9% inception to 2023. Nothing great IMO especially if you owned big tech in its huge melt up. 6.5% inception to 2018. 8.1% inception to 2019.

-

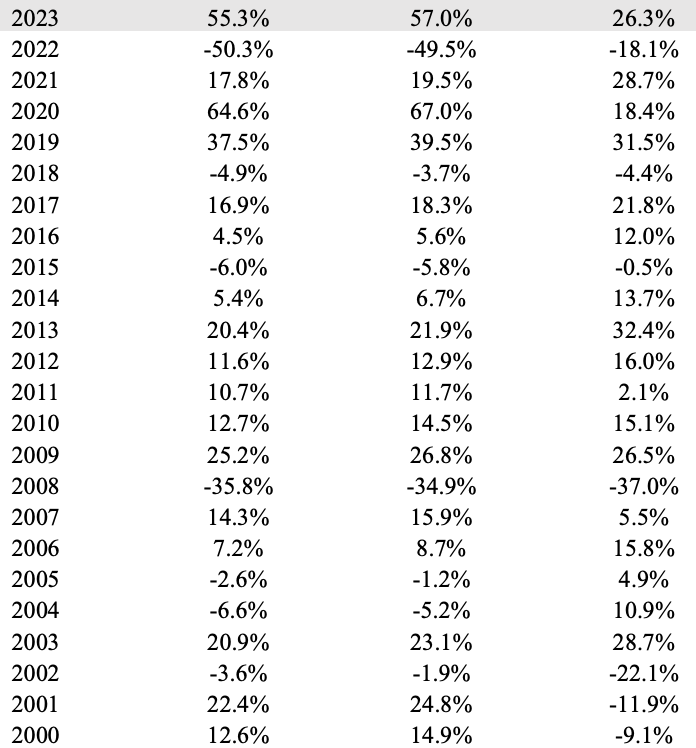

Not sure where to post this. I would like to collect the feedback of the forum members, and maybe provide some food for thought as well. First column is net returns, second is gross, third is S&P500. What would you think of this investor? Does this record stand out? Inception is Jan 1st 2000. I have a ton of doubts about this investor...managing $100M in 2019 not sure now. What I see is a very "convenient" start date to compare yourself against the index huge numbers in 2020, 2021 and 2023, fuck up in 22 -> red flags more or less market performance excluding 2020-2023 and 2000-2003 Yet, I see him presented as "an extraordinarily thoughtful investor", "who’s beaten the S&P 500 over the last 24 years", obviously mentioning Peter Kaufman and Charlie Munger.... If you know his name please don't share it now, do it later.

-

Started reading the docs. I understand that the convertible notes are still an issue. They have not been converted and Fairfax is working on a solution. Fairfax will own 68.65% max when (if) conversion happens. Something to ask on the next cc.

-

He is the guy from compounding quality. He essentially recited this article and a bunch of other staff. Zero original thoughts. https://www.fool.com/investing/2024/03/18/new-clues-confidential-stock-warren-buffett-buying/ I find him and Christohper Tsai highly overvalued at the moment

-

almost a 4x in 5 years...I hope he's buying a Gulfstream or a big yacht 620K+ shares repurchased ytd, that's the important one to me!

-

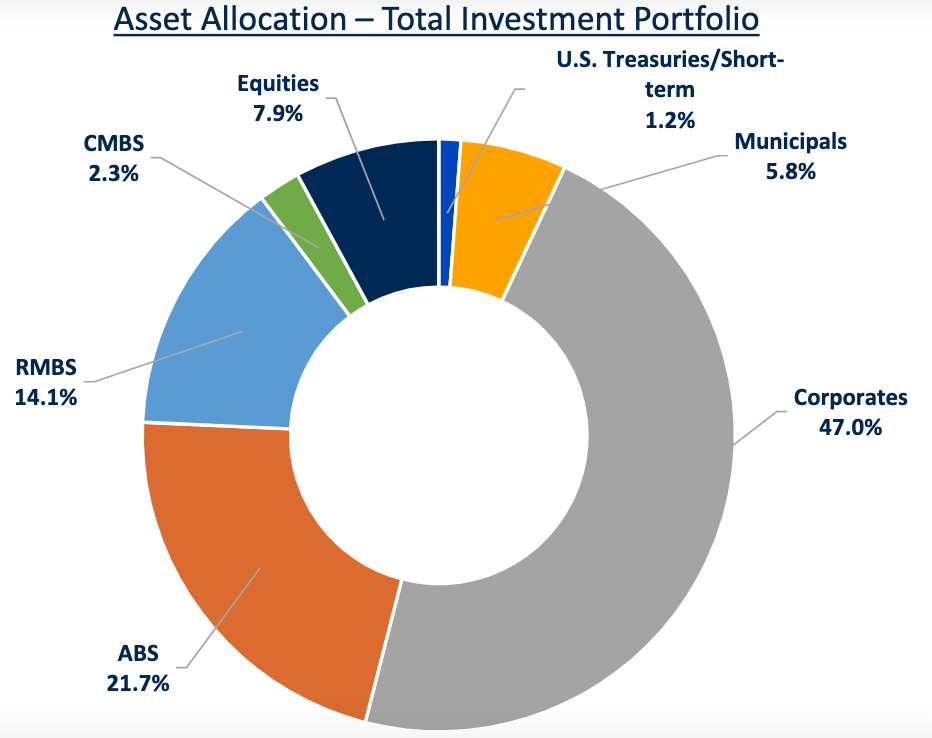

Hi @Hamburg Investor, I appreciate your response. First, let me stress the fact that this is a very high-level, simplistic view of FFH. I basically assume that their uw profits make them break even on all other costs, so you are left with the portfolio returns. That said, you are right there is certainly upside if their uw profits >> than overhead, interests on debt ecc. FFH cash taxes are lower than the cad rate; I have them @ 16% . Could you clarify your comment on growth? I am not sure how to interpret your question. Are you referring to some kind of operating leverage? On the bonds yield, this is what FFH reported in the AR 2023 The 10% you mention, I think it refers to the IRR they expect to earn on the KW/PacWest loans, i.e. an example of their opportunism. Corporates are not yielding 10%. Anyway, you can play around with the numbers. I just wanted to show that if Watsa can display a 18%+ CAGR it's not just leverage or uw profits. The equity portfolio, in a lumpy manner, has certainly contributed! On the last part, I did not get your point. The insurance segment provides the capital for the investment team to put to work. Only part of it can go to equities. During the last segment of the AGM, Watsa talked about the "transformed" FFH and the "stability" of the interest income achieved. He alluded to the possibility of tilting more capital towards equities in the future, but I guess that will depend on the premiums level and regulatory capital. G

-

It would be great to see them post this again!

-

I cannot claim to be an expert in the field so any input is appreciated, here is my 2c: An insurer would need to write @85% CR or below to achieve those results without a strong performance on the investment side. Some lines of insurance could allow you to achieve that CR. Or a combination of niche expertise and strong technology (i.e. low loss ratio and low expense ratio). For example, Kinsale has a "standard" $3b portfolio but excels on the uw side. I am not sure if an insurer can scale and still maintain such a CR. Another example would be Francis Chou at Wintaii: both strong uw and investment expertise, but he write $50M in premium on $150M of equity. @Parsad correct me if I am wrong here. What does Watsa mean when he says that to achieve 15% ROE FFH needs a 95% CR and a 7% return on investment portfolio? The math is simple: a 7% ROI (both interests, dividends and gains realized and unrealized) translates to 5.1% after tax (26.5% Canadian rate). At 3x leverage (thanks to float and some debt) this equals 15% ROE. UW profits would more than cover FFH other expenses (overhead, interests, run off). Now 75% of the portfolio is fixed income in nature (A) and 25% is equities (B). If (A) earns 4% and (B) 16% you get 7% ROI. This is my extremely simplistic view and the way I would look at an insurer with demonstrated uw discipline and a focus on investment performance. It is not easy to find both these elements. It is even more rare to find an investment team that aims for superior returns in BOTH equities and bonds! Most insurers just park float in bonds and match liabilities. At FFH we benefit from an incredible astute team that looks for bargains even in bonds. Do not underestimate this. I think the above equation completely melts down in a world of 0-2% return on bonds and an equity portfolio "drowned" in hedges, shorts and some bad investments. Still, Over the last 10 years, FFH BV has compounded at 10%. I remain optimistic about the future and believe that they will achieve their stated goals. G

-

FFH did not need higher interest rates to work out well as an investment in 2020-2021. If you held everything the same, the stock was easily worth 2x. When I was building my position the market cap was around $10B and I thought that in 5 years time FFH's shares of Atlas + Digit + FIH could easily be worth $5B. I was able to get ALL the rest for $5B. IT WAS A NO BRAINER. The subsequent outperformance was surely due to not just one factor but multiple ones working in the same direction: no more shorts,/hedges fih investments surfacing value equities portfolio recovering from covid better uw results hard market buybacks higher interest on fixed income portfolio and I am sure I am missing others. 4-5% rates are not an anomaly. 0-1% was! My assumption in 2021 was rates would go back to 2019 levels, 2% at best. Still, FFH was so undervalued. To say that FFH worked out as an investment ONLY because JPow hiked rates is UNFAIR to the great work done by Watsa and the team. G

-

Thanks for sharing. Interesting because Odyseey is providing the loan, not fih. I guess fih will subscribe their portion of the rights issue.

-

What stood out to me: Their expertise in India and how well the bial team is executing Buffett and Jain tried to set up an insurance operation in India and gave up. I am sure they tried to invest there and found out it was too difficult. This is of course from 2010, before Modi. I would say that Watsa has been highly successful instead and it does get enough credit for this. He saw the opportunity and positioned fairfax to succeed. Bial becoming a hub for airlines in the south of India is a great accomplishment Sokol made me jump from my chair: I was not expecting that kind of growth from Atlas "we don't forecast, we react and we are fast": great line and great example with the $1B issuance not being possible today The fact that FFH might be less dependent on investment gains going forward and their improved ability to absorb cat losses: I liked that whole segment. I don't think we are there already but it is a promising start especially if they tilt their investment strategy in that direction G

-

I got the same impression wrt Anchorage which is strange because 1) they said that Anchorage will own the entire bial stake eventually, 2) if they are going to bid when other infrastructure assets get privatized they should have a structure in place. Iirc they should list bial by September 25, but given their partner in Anchorage I guess they can renegotiate that. On the sib. Watsa said "we are buying shares in the market" numerous time. Truth is they haven't bought any in 2024 (while ffh has been more active). Last purchase was in November. They are preserving cash, maybe something good will happen in H2.

-

Here are my notes on the 2024 FIH agm that just finished: Something worth keeping in mind -> in 2023 they bought back 2.9M shares, the share price was up 24%; yet, $14.9 is exactly the same price at which they completed a SIB back in 2021. A lot has happened in 3 years... slide 28 is a nice summary of the impact of fees on returns BIAL will see "explosive" growth in the next years huge number of aircraft ordered by indian airlines (1200?) number of operating airports expected to roughly 2x to. 250 (?) Air India established its 2nd HUB in BIAL -> increase in international flights (EU/US) + other flights from other parts of India Watsa said that there are lots of structure that you can set up to raise money for big opportunities; seemed very confident that money will not be a problem for FIH Sold NSE because valuation was too high and they saw downside risk given that NSE makes a lot of profit from options trading IIFL gold loans issues -> founder said there were minor "lapses", IIFL was used to set an example for others. He said they addressed all the issues raised by RBI and hope that RBI audit will confirm this (April 12th start) no fraud, no money laundering Lots of emphasis on the financial sector opportunity -> 7% real growth, 12% nominal, financials should grow at 1.5-2x the nominal = 18% I am not sure I got this correctly but Watsa said something like "we are targeting 20% rate of return, not 10-15%, need to offset some fx risk" Sanmar had a terrible year with PVC prices down 30-60% improved efficiency in Egypt focus on specialty PVC growth ahead -> China has similar population to India and uses 20M tonnes per year vs India's 4M tonnes per year Maxop and Jaynix -> "unlimited growth", their only constraint is capacity and they are expanding, huge demand Anchorage still stuck in regulatory approval, nothing will move before the election (I would expect nothing before 2025) Privatization opportunities will unlock after the election all in all, great enthusiasm as always. focused on integrity. Deepak Parekh (founder of HDFC) is their consultant for everything and this is a HUGE plus in my view. Curious if any of the guys who attended in person were able to gain other insights. G

-

Will he give up when Digit goes public? The COBF should make a bet with him wrt Digit value/valuation.

-

still at it. Looks like mw is on a crusade now against Watsa.

-

https://www.business-standard.com/markets/capital-market-news/iifl-finance-spurts-17-in-five-days-to-acquire-minority-stake-in-nse-124040500746_1.html Small consolation. I still have mixed feelings about FIH selling their NSE stake. I hope they can put the money to work in even better opportunities.

-

Since I updated my FFH valuation, I'll share it here just in case someone wants to add anything. I use 3 methods to value FFH Investments + capitalized underwriting profit Starting from the investments portfolio ($65B), I subtract debt (excluding debt @ consolidated equities), preferred shares and NCI I capitalized avg uw profit @ 14x (7%) NAV = $2500 Look-through earnings excluding run-off this part relies on more work, estimates and assumptions (e.g. earnings yield on MTM equities of 6%, cash tax rate rather than statutory one, excluding investment gains, ecc) for 2023 I get $5B of EBIT, $4.3B of EBT and $3.2B of net income (a 25% increase YoY) ROE of 16.7% in 2022, 15% in 2023 @ P/E of 14x the shares are worth $2000 I think 2023 numbers represent a fair, conservative estimate of earning power over the next 4 years (lots of moving parts but they should balance out) P/B if FFH can earn 13-15% on book value, an investor buying @ 1.5 P/B would be paying roughly 12-10x earnings for the company everyone fair multiple would be different but 12x would not strike me as expensive @ 1.5 P/B shares are worth $1500 Overall, I think FFH intrinsic value is closer to $2000 per share and I hope this will prove conservative thanks to strong uw discipline and good capital allocation in the next 4 years. Book value is probably understated as well. G

-

Here are a couple of things that came to mind while reading your post @Viking. While I agree with parts of it but not all of them, I certainly enjoy the discussion! Looking at average ROE, ROIC, ROTCE is a way to measure quality. It's important to understand the normalized earning power over a cycle; more important is ROIIC, that's where the compounding happens. To answer these questions an investor needs a deep understanding of qualitative aspects (competitive advantage) that cannot be found in reported numbers or excel spreadsheets. This is at the business level. What happens at the "investment level" depends on the price you pay. Here I agree with you and particularly liked the Howard Marks quote. Overall, I would say that FFH has done better by identifying cheap opportunities (low price) in so-so companies (not great, high-quality companies). FIH on the other hand, was able to invest in better companies (i.e. NSE, BIAL, IIFL finance, companies that can earn 15%+ ROE and grow long term). When I look at FFH top holdings table and the comments from the AR, it does not flash "quality": BDT might be a great relationship to have, but the return from 2009 are sub par. FFH could have easily made 4-5x its money by investing elsewhere (15 years time frame, starting from a low point); ShawKwei 12% is not bad at all if they can achieve it consistently; Poseidon is probably ok? Double-digit ROE but it takes a lot of debt to get there; it reminds me of BRK investments in utilities (no homeruns but ok profile with contractual cash flows); Eurobank, like all banks, may be a good investment if they do business conservatively and don't need to be recapitalized when the next crisis happens. Maybe their scale and the small number of big banks left in Greece is an advantage. This a perfect example of what I said earlier: by paying a very low price FFH might come out fine with a good CAGR; EXCO and Stelco are cyclical and probably enjoyed the good part of their industry cycle, I have no expertise in the area. I recognize Stelco's CEO as a good capital allocator and their lowest cost advantage might help them better navigate a bad industry overall. CONCLUSION The question I ask myself more often is how is money going to be invested going forward? FFH will have a huge amount of capital at its disposal. Higher than any point in the past: 1986 to 2022 they received roughly 15B in interest and dividends. over the next 4 years they will receive c. 8B, i.e. more than half of what they got over 36 years! the same goes for profit of associates/gains on investment. Buffett taught us that it's easier to invest bigger amounts of capital in high-quality companies and don't touch them. When fishing in a lower-quality pool you NEED a low entry price and you must NEVER forget that at some point you must exit the position. You cannot stay indefinitely, or risk doing a round trip with your gains. This is easier with small positions, way harder if you invest big money and your position is large (% of ownership not portfolio weight). There is a lot to like in the way FFH manages its equities portfolio, e.g. the international exposure, their expertise in foreign markets, strong local relationships, their opportunism in tough times (Templeton's heritage I suppose). We'll see what happens next, will they tweak their style a bit and adapt? Will they reduce capital via buybacks and higher dividends? G

-

https://www.joincolossus.com/episodes/83022007/hansen-the-long-short-of-investing interesting discussion on India, around min 50. It shows the advantages FIH has by being on the ground.

-

Swapped some MO shares for BTI.

-

@SafetyinNumbers this is what I understood from last year AR. The amount is fixed, like debt. If you keep the P/B unchanged and the insurance subs increase BV then FFH would have to pay a higher price. The call option allows FFH to repay the same amount they received instead. If BV increases they record a gain on the value of the option. This is what happened last year with Allied and Eurolife purchases. I am halfway through this year AR and I'll write an update when I am done. Hope this helps. G

-

Do you think that's a risk? Could you explain why? Also, why are you mentioning corruption? I thought this was a lack of control problem. A couple of years ago rbi banned hdfc bank from issuing credit cards. The issue was resolved in 9 months. I am trying to understand the extent of the issue here. Worst case scenario, fih completely misjudged the founder profile which would be bad. Thanks G