-

Posts

3,482 -

Joined

Content Type

Profiles

Forums

Events

Everything posted by Luke

-

IMO the US operates fully in its own interests (contrary to european countries but they dont see that), which by now are not realizable and will lead only to further escalation because Russia would rather blow up than be defeated. They also have little to lose with how much they are pushed into a corner anyway. It is time to call it off and sit down with Putin to discuss forced peace (as much as this goes against the will of the Ukrainians). Much better would be of course, total withdrawal by Putin, some sort of autonomous region in the east and a neutral position with a new government. But I think that deal was realistic 10 years ago, but not anymore

-

Russia has expanded its wealth of natural resources by more than 10%, and there is a lot of value in the eastern region, so I don't think "nothing" was gained here. But as you already said in previous posts, it was not smart at all from Ukraine to lean towards either side and could have existed perfectly fine if it would have run a more "swiss" position with a government that operates more strategically. I agree basically with everything you said in previous post though. Ukraine got into things way bigger than them, and the government didn't think about its position and the willingness of Russia to solidify itself there. Very tragic.

-

Thank you for your detailed answer!

-

There will be a 4%?! buyback tax??

-

Relatively well

-

And i own some tracking stocks, minor positions, some leftover TSMC shares that i will probably never sell.

-

Half in FFH 25% in PRX almost 20% of PDD Rest is in AMR, HCC, IPCO On Margin, I own: Hang Lung Group, WOSG, PETROBRAS 3 very big bets. IB hates me for it and requires ridiculous margin requirements, i have enough liquidity that i can get out of the margin quickly. Sold my Japan stocks for mid teens gain, exited EVO.AB (still think its a good bet), exited some other things which went into the larger positions, for example when PDD crashed. We will see what the future brings, I am young, and I can afford to be concentrated!

-

+1 Just love the set up still at current valuation. Fairfax has lots of room if a recession hits and will do well if it doesnt too. Also, i could not find anything else where i would feel comfortable allocating as much money as this position is and i really dont want to be in cash Maybe buy even more Prosus but i like my current mix.

-

https://qz.com/bill-gates-would-make-the-rich-poorer-1851652364 Back to communism for the US?

-

The thread is called "Is Europe becoming uninvestable"? The answer clearly is: NO! Lots of good stuff!!

-

Folks, I am patiently waiting yet to read ONE comment that speaks out for the need to regulate these mega-caps in their anti-consumer stances. The EU needs to downsize, but the IDEA itself is good. WHY is there this ridiculous iPhone lock-in with their lightning cables, why are the phones unrepairable and software locked etc. Have you ever dealt with this S***?

-

https://www.scmp.com/economy/policy/article/3279153/china-eyes-sci-tech-venture-capital-boost-industrial-upgrade-economic-growth?module=top_story&pgtype=homepage

-

What stocks/assets to own if China/US ties continues to worsen?

Luke replied to sleepydragon's topic in General Discussion

"Reversing globalization would involve a massive derating of US asset prices as sales to foreign buyers are artificially restricted. Effects on GDP could theoretically be contained, but the wealthy would have to become poorer in hopes of bringing low-income folks back into the middle class as investment bankers become process engineers and Uber drivers become factory workers. For a political economy that couldn’t figure out a mechanism to pay-them-off as globalization created immense riches, how likely is it that the immensely rich will willingly stomach becoming significantly poorer?" In that case owning local manufacturing companies that take chinas market will be good! -

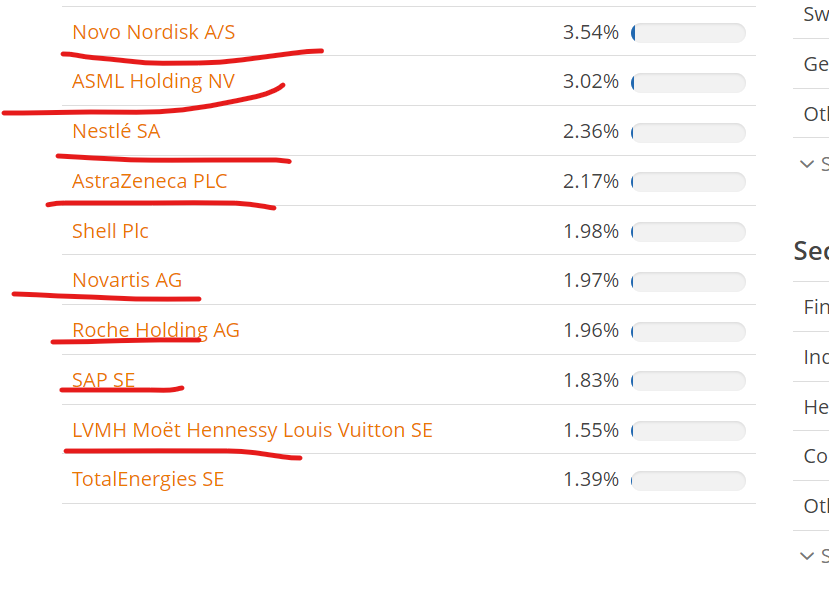

All of these are insanely high quality, there is no shame in not having a trillion or two trillion USD marketcap. I have 0 bias towards any country in the world as long as the price is right and the story

-

Europe and European countries have a heck of a lot of wonderful companies of various sizes. Just because they don't have any tech megacaps doesn't mean they are not innovative. There are thousands of midcap suppliers of semiconductors, robotics, cars, etc. Part of why there are no EU equivalents to US-mega caps is their monopolistic structure. Good luck getting venture investments for a Facebook, Windows, Apple 2.0

-

Which regulations AGAINST big tech by the EU are in YOUR opinion "bad"? Please explain. The golden eggs are tax evasion, lowest corporate taxes ever, anti-repair anti-consumer products, record high dividends and buybacks, and coercing entire countries with their power They are not a good goose! X is a complete mess, you cant contact them about your account, they ban people and you get no feedback why. If you want the data they have about you they dont contact you back. The guy cant do what he wants with a business of that size. We are not in the wild west.

-

I don't think the size of a company or several companies is an indication of a prosperous country. It's also not necessarily a sign of a "good" company. It's increasingly concerning how monopoly-like US mega-caps have become, and they face almost no regulatory consequences except for the EU. Bashing the EU for regulating these monopolies makes sense since you are likely all shareholders of such companies, and you want them to abuse their monopoly-like position as much as they can, but I like a lot of things the EU does to make these companies ACTUALLY better (hello USB-C apple). There is a lot of noise by such companies because they prefer 0 regulation but i don't have to tell you where that leads.

-

https://asiatimes.com/2024/09/biden-nato-effectively-declaring-war-on-russia/

-

After securing investments from prominent Western financial institutions, it channeled these funds through offshore companies located in tax havens like Cyprus and the Cayman Islands and into joint ventures with local firms to take over the land.72 The firm faces accusations of unlawful land acquisition, tax evasion, and illicit financial activity.73 NCH Capital played a key role in pushing for land reform in Ukraine: In 2015, its founder and CEO George Rohr was part of the high-level meetings involving the Ukrainian President and the US Secretary of Commerce that led Ukraine to agree on an IMF reform plan, as a condition for two US$1 billion loan guarantees from the US government.74 Those seem like nice guys! The best system in the world! Slava Ukraini!

-

Never going to happen-->The end of the war should be the moment and opportunity for just the opposite, i.e. the redesign of an economic model no longer dominated by oligarchy and corruption, but where land and resources are controlled by and benefit all Ukrainians. This could form the basis for the transformation of the agricultural sector to make it more democratic and environmentally and socially sustainable. International policy and financial support should be geared towards this transformation, to benefit people and farmers rather than oligarchs and foreign financial interests. You simply don't get any Western dollars or euros for free!

-

And of course, as a western financial institution you would want your assets to be protected by the peaceful NATO and get into the EU for trading benefits!

-

Meanwhile everyone in the western world and media cheering for further war Selensky does a firesales to western investors and prepares Ukraine to be completely privatized and neoliberalized to foreign investors. Its so disgusting IMO that you hear absolutely nothing about these developements but only that the war needs to go on. Such a hypocrisy, ukraine gets empathy as long as they defend future investors assets. Its all about money and power again and nobody actually really gives a shit about the dead Ukrainian farmers etc takeover-ukraine-agricultural-land.pdf

-

At a time of tremendous suffering and displacement, wherein countless lives have been lost and massive financial resources spent for the control of Ukraine, this report raises major concerns about the future of land and food production in the country, which is likely to become more consolidated and controlled by oligarchs and foreign interests. These concerns are exacerbated by Ukraine’s staggering and growing foreign debt, contracted at the expense of the population’s living conditions as a result of the measures required under the structural adjustment program. Ukraine is now the world’s third-largest debtor to the International Monetary Fund (IMF)17 and its crippling debt burden will likely result in additional pressure from its creditors, bondholders, and international financial institutions on how post-war reconstruction – estimated to cost US$750 billion – should happen.18 These powerful actors have already been explicit that they will use their leverage to further privatize the country’s public sector and liberalize its agriculture.19 What the IMF wants: https://www.bloomberg.com/news/articles/2024-09-04/ukraine-braces-for-imf-pressure-to-devalue-currency-cut-rates

-

The report details how Western aid has been conditioned to a drastic structural adjustment program, which includes austerity measures, cuts in social safety nets, and the privatization of key sectors of the economy. A central condition has been the creation of a land market, put into law in 2020 under President Zelenskyy, despite opposition from a majority of Ukrainians fearing that it will exacerbate corruption in the agricultural sector and reinforce its control by powerful interests. The findings of the report validate this concern, showing that the creation of a land market will likely further increase the amount of agricultural land in the hands of oligarchs and large agribusiness firms. The latter have already started expanding their access to land. Kernel has announced plans to increase its land bank to 700,000 hectares – up from 506,000 hectares in 2021.10 Similarly, MHP, which currently controls 360,000 hectares of land, seeks to expand its holdings to 550,000 hectares.11 MHP is also reportedly circumventing restrictions on the purchase of land by asking its employees to buy land and lease it to the company.12 By contrast, small scale farmers in Ukraine demonstrate resilience and a great potential for leading the expansion of a different production model based on agroecology, environmental sustainability, and the production of healthy food.14 It is Ukraine’s small and medium-sized farmers who guarantee the country’s food security whereas large agribusinesses are geared towards export markets Today, thousands of rural boys and girls, farmers, are fighting and dying in the war. They have lost everything. The processes of free land sale and purchase are increasingly liberalized and advertised. This really threatens the rights of Ukrainians to their land, for which they give their lives.”16 FIRE SALE IN UKRAINE!!: https://privatization.gov.ua/en/product-category/mala-pryvatyzatsiya-en/